Featured Napkin

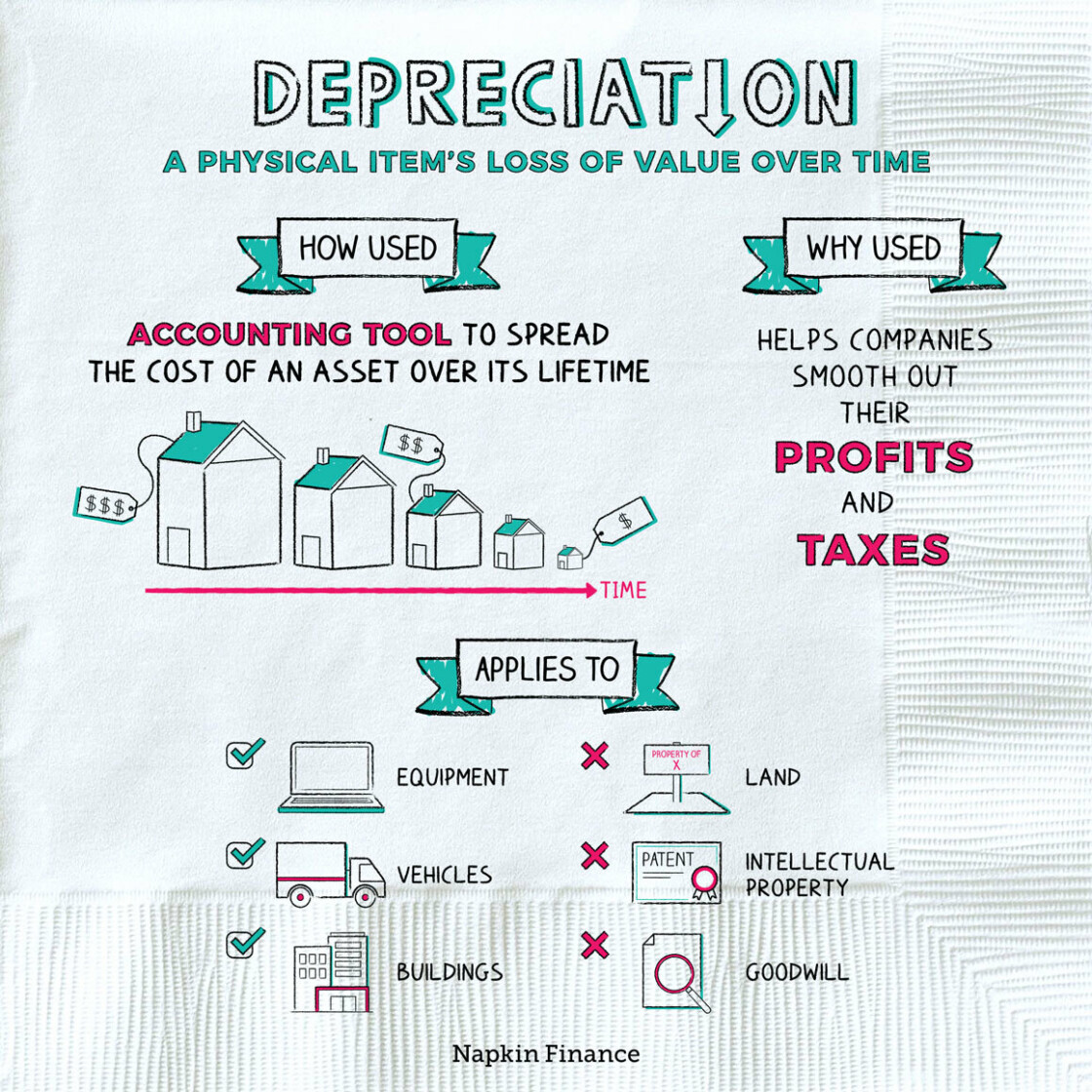

Depreciation

Wear and Tear

Depreciation is a physical asset’s loss of value over time. Just as your once new car is worth less today than it was when you bought it (even if you’ve kept it in perfect condition), lots of physical assets lose value over time due to wear and tear and age....

Learn moreMore investing Napkins...

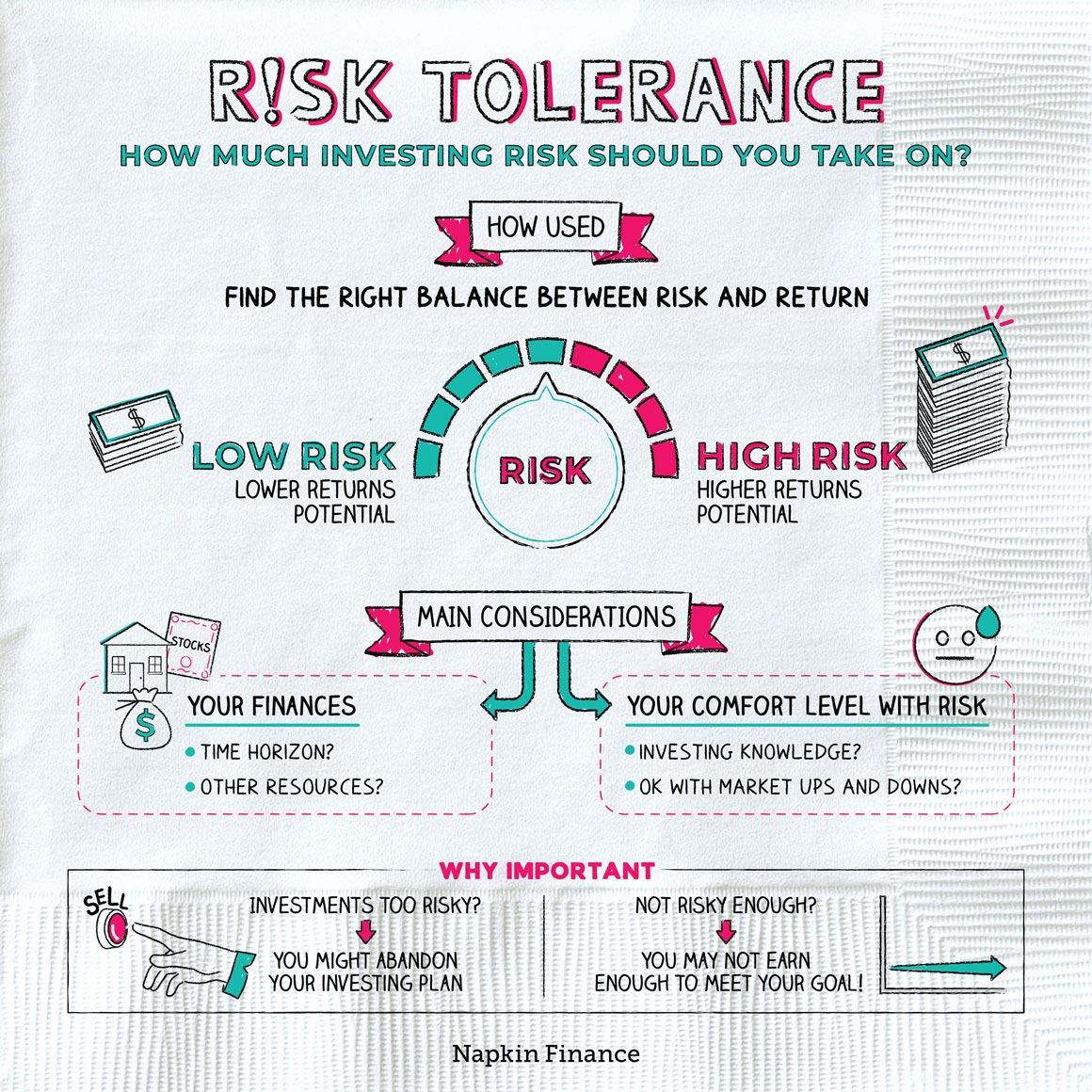

Risk Tolerance

Appetite for Destruction

Risk tolerance describes how much risk you can (or should) be taking on with your investments. Investing...

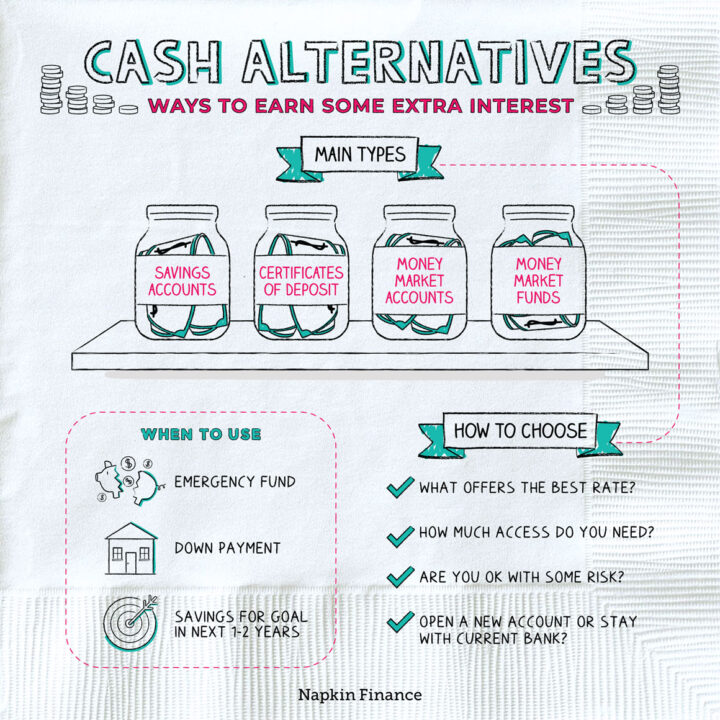

Learn moreCash Alternatives

Cash In

Cash alternatives are investment types that you can consider as alternatives to simply holding money in your...

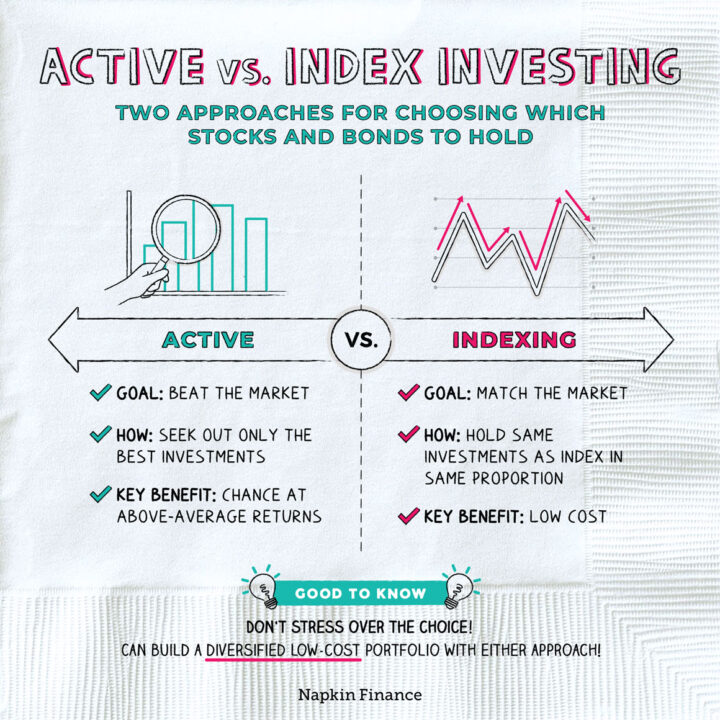

Learn moreActive vs. Index Investing

Pick Sides

Active and index investing are two different ways of choosing individual investments. With active investing, investors try...

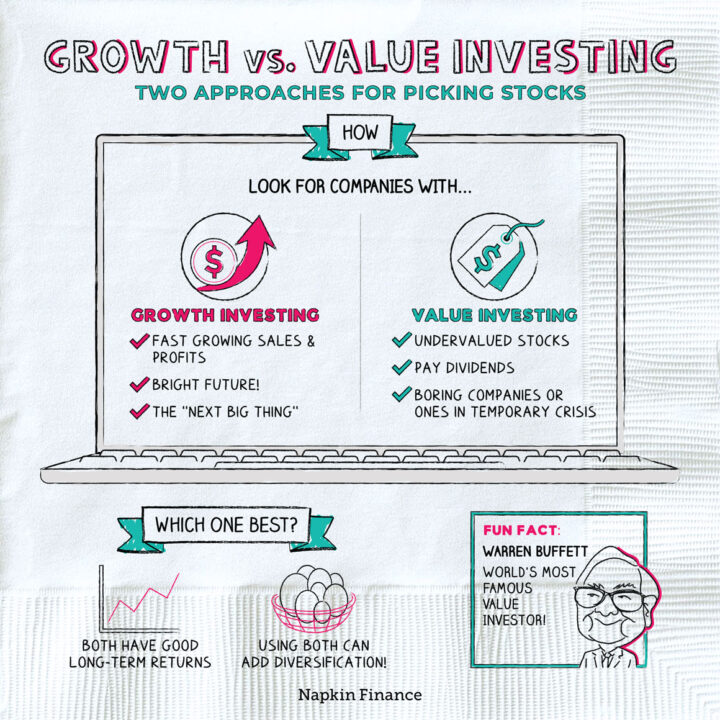

Learn moreGrowth vs. Value Investing

Moves Like Buffett

Growth and value investing are two different approaches to investing in stocks. Growth investors aim to invest...

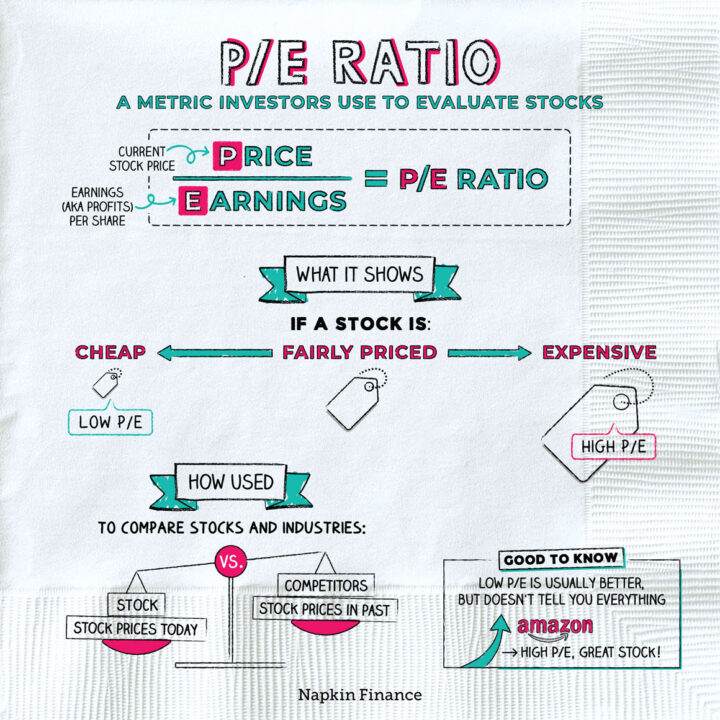

Learn moreP/E Ratio

At Any Price

The price-to-earnings ratio (or P/E ratio) is a way to evaluate whether a company’s stock is cheap,...

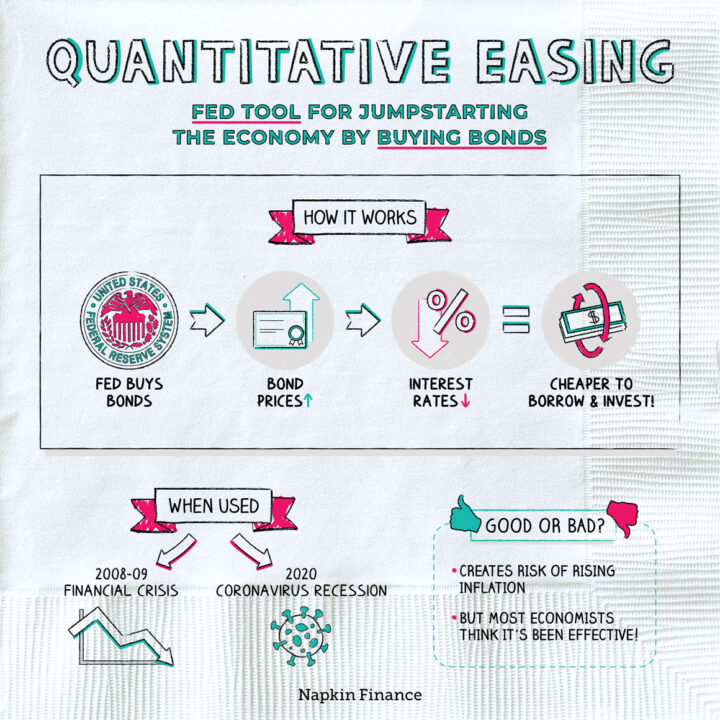

Learn moreQuantitative Easing

Easy Money

Quantitative easing is when the Fed (or another country’s central bank) buys up large amounts of bonds....

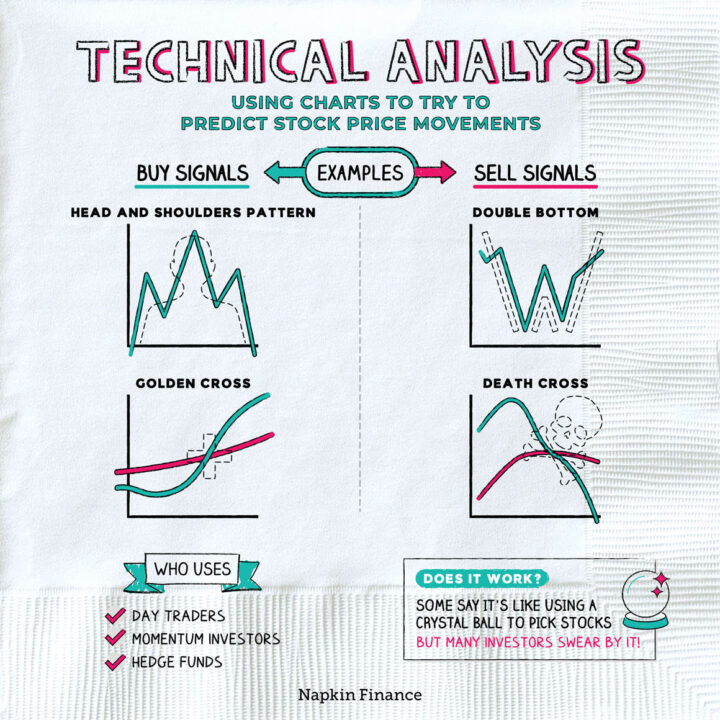

Learn moreTechnical Analysis

Off the Charts

Technical analysis means using stock price charts to try to predict future stock price movements. It involves...

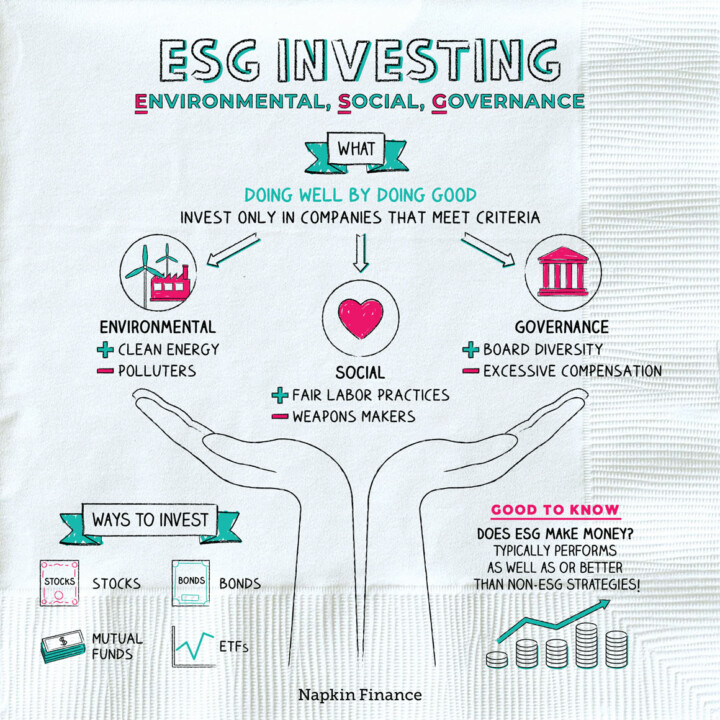

Learn moreESG Investing

Do the Right Thing

ESG investing means investing in companies that do good (or at least don’t actively do harm). With...

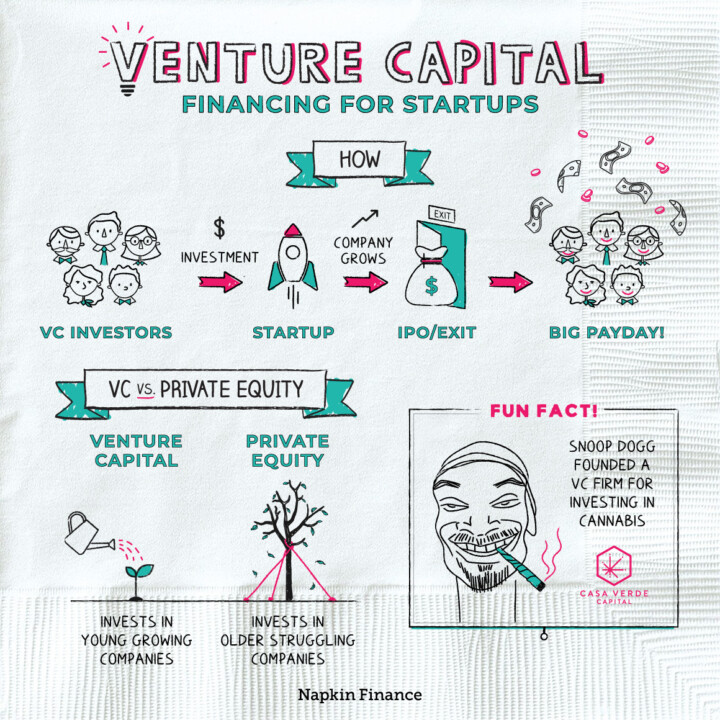

Learn moreVenture Capital

Nothing Ventured, Nothing Gained

Venture capital (or “VC” for short) is a type of financing for startup companies. Venture capitalists invest...

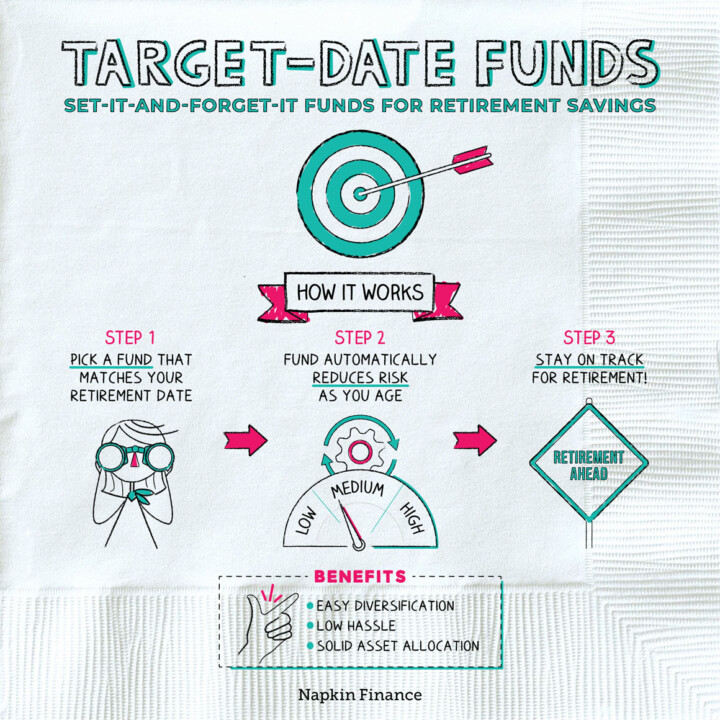

Learn moreTarget-Date Funds

Bullseye on Retirement

A target-date fund is an investment fund that’s based on your expected retirement date. These mutual funds...

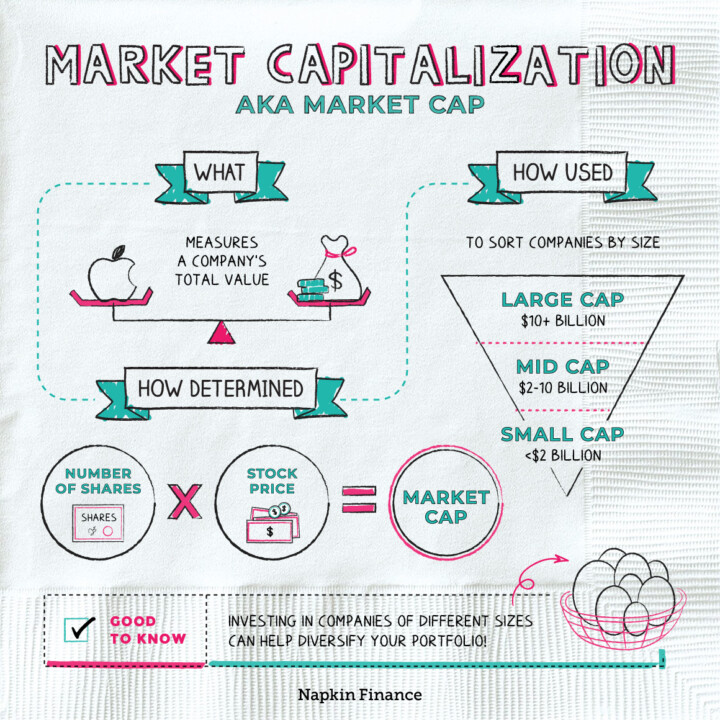

Learn moreMarket Capitalization

Size it Up

Market capitalization (or just “market cap”) is a measure of a company’s total value. If you ever...

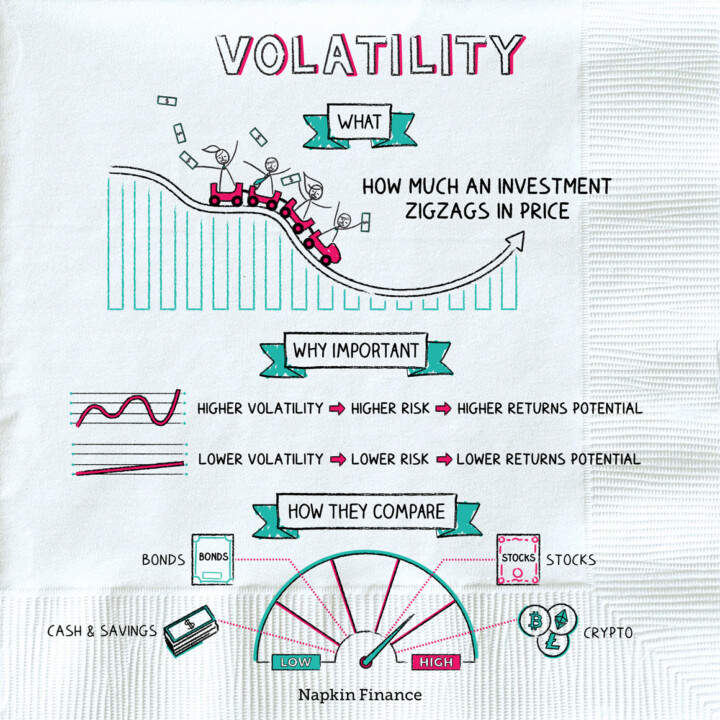

Learn moreVolatility

Rocky Road

Volatility describes how much an investment bounces around in price. More volatile investments zigzag in price more...

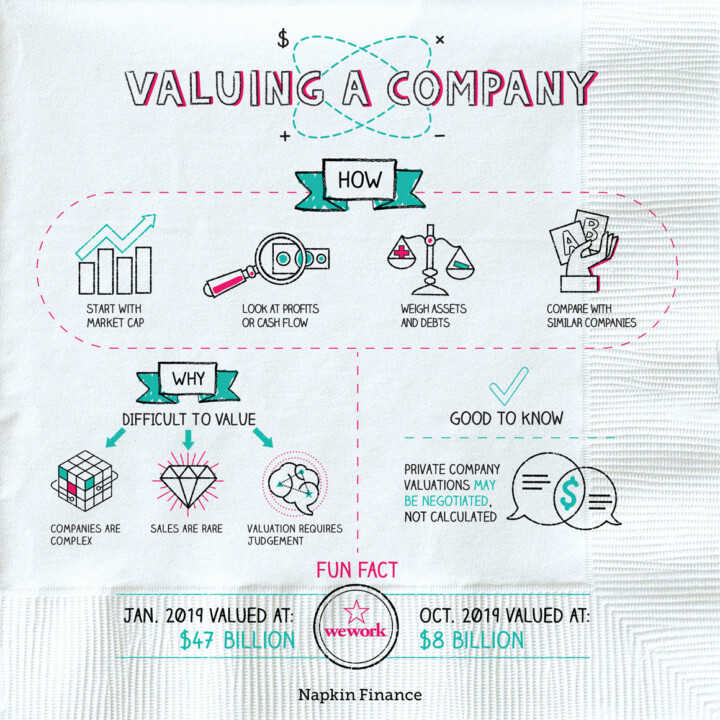

Learn moreValuing a Company

What’s it Worth?

A company’s value is the dollar figure that it might sell for if a person or another...

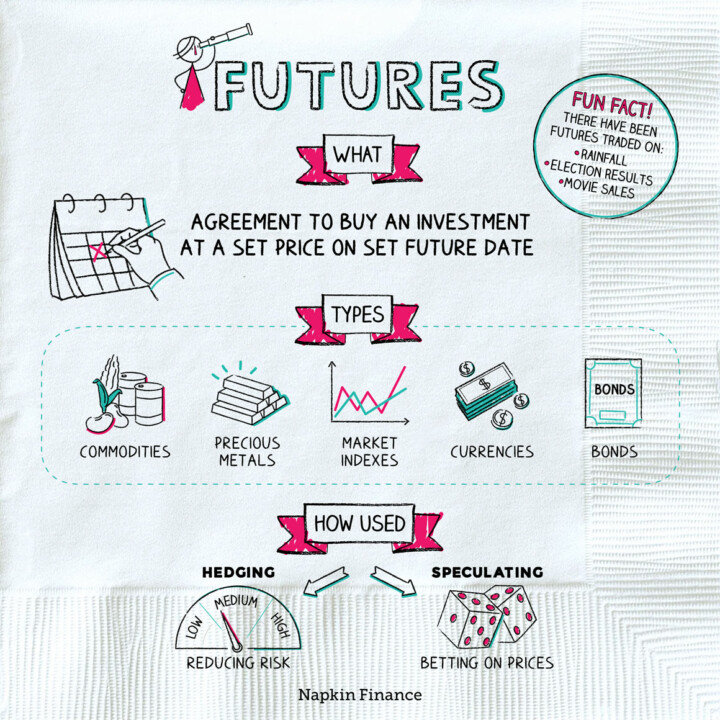

Learn moreFutures

Looking Ahead

A futures contract is an agreement to buy a specific investment at an agreed-upon price on an...

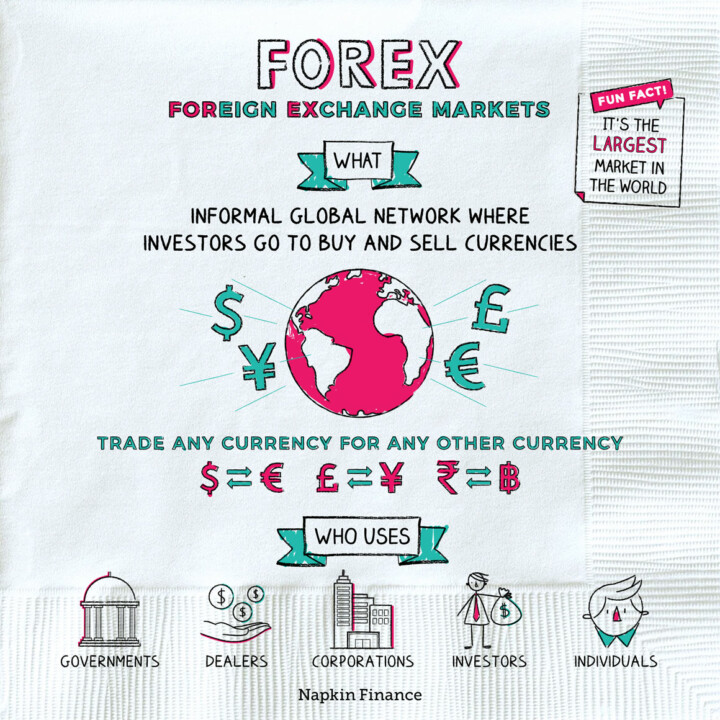

Learn moreForex

Hard Currency

The foreign exchange, or forex, markets are where investors go to buy and sell currencies. Unlike the...

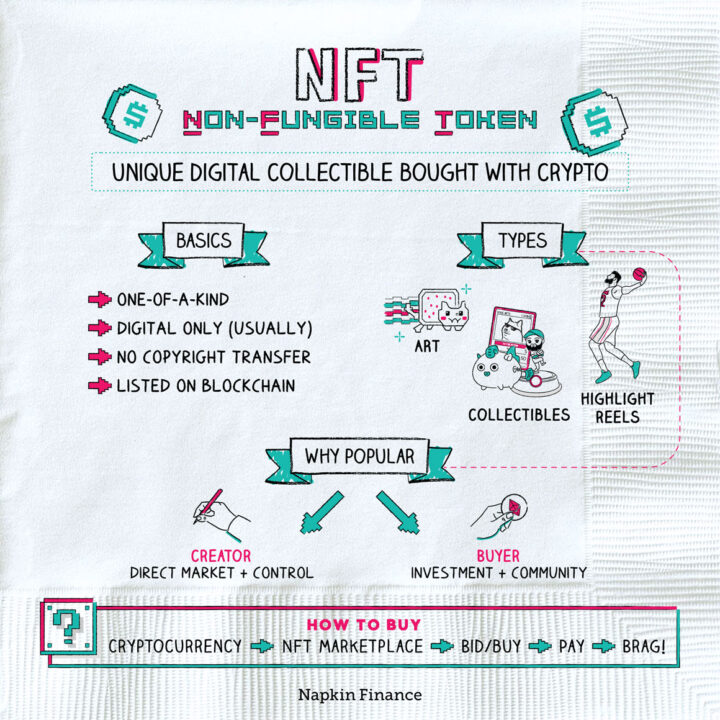

Learn moreNFTs

(Not So) Real World

An NFT, or non-fungible token, is a code that says you own a unique digital item.

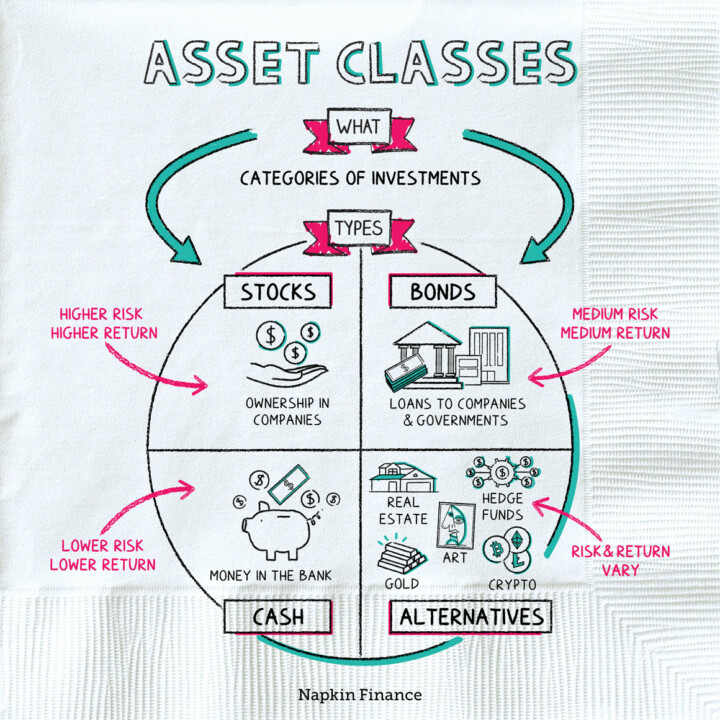

Learn moreAsset Classes

Building Blocks

An asset class is a group of similar kinds of investments. It’s a generalization, not a detailed...

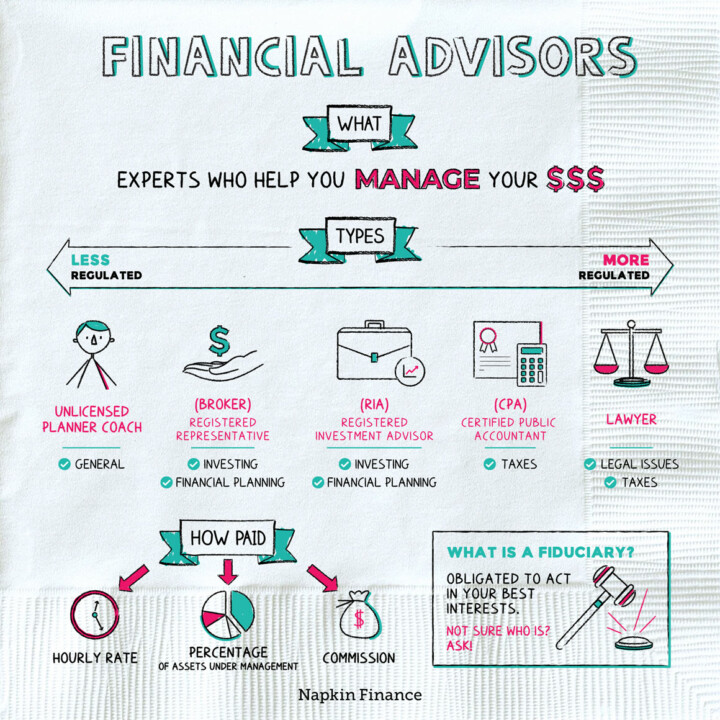

Learn moreFinancial Advisors

Get Some Help

Financial advisors are experts who can provide financial advice and help you manage your money. Some people...

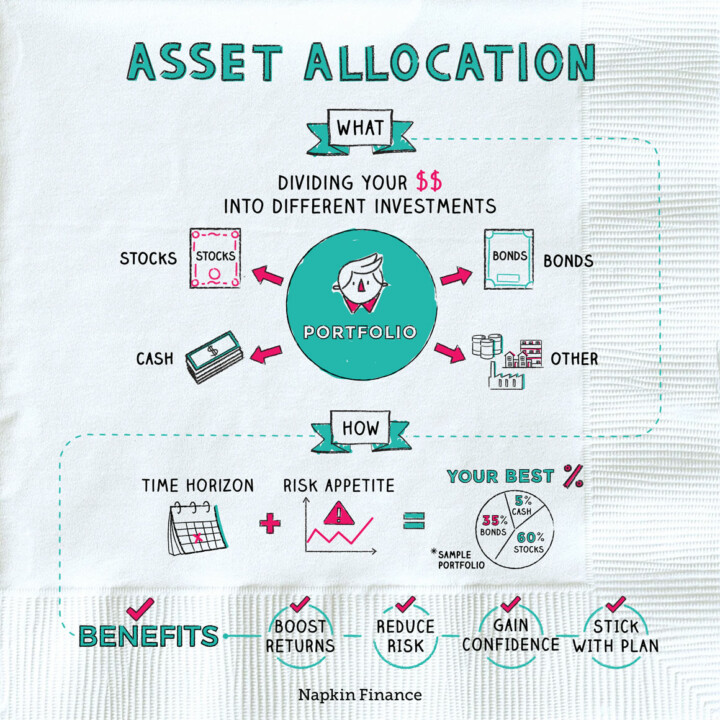

Learn moreAsset Allocation

Divide and Conquer

“Asset allocation” is a way of describing what you own in percentage terms. If you’ve got $1,000...

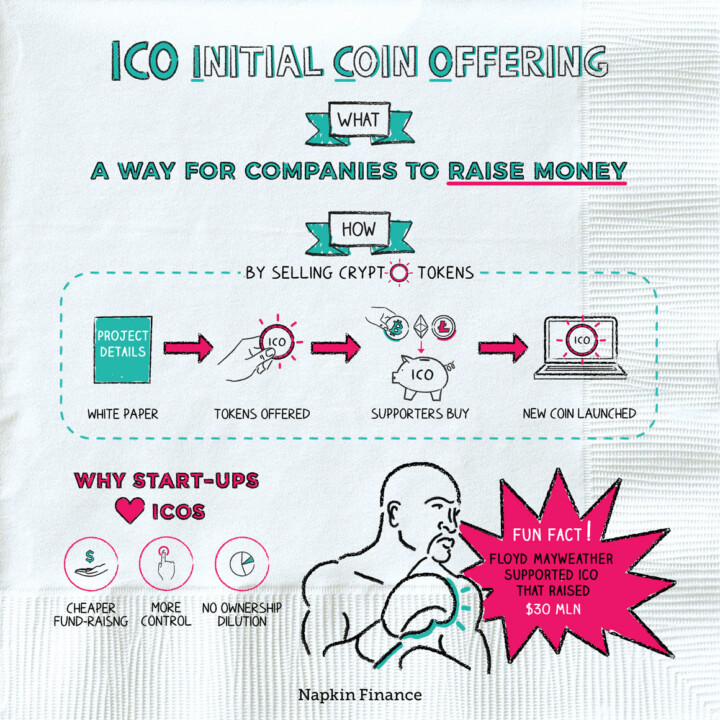

Learn moreWhat Is an ICO?

The Wild West of Finance

An ICO, or Initial Coin Offering, is a way for startups to raise money by inventing and...

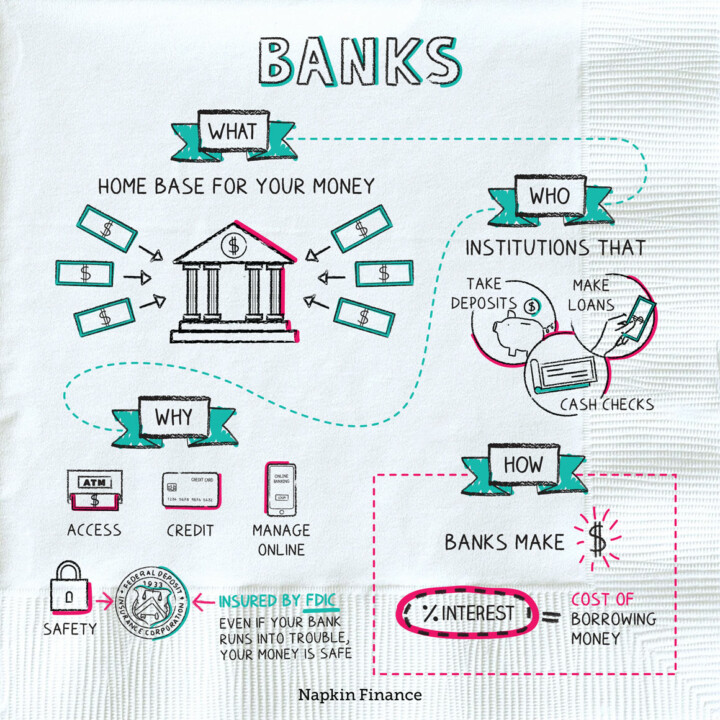

Learn moreBanks

Bank on It

Banks are institutions that take deposits, cash checks, and make loans. They are essentially home bases for...

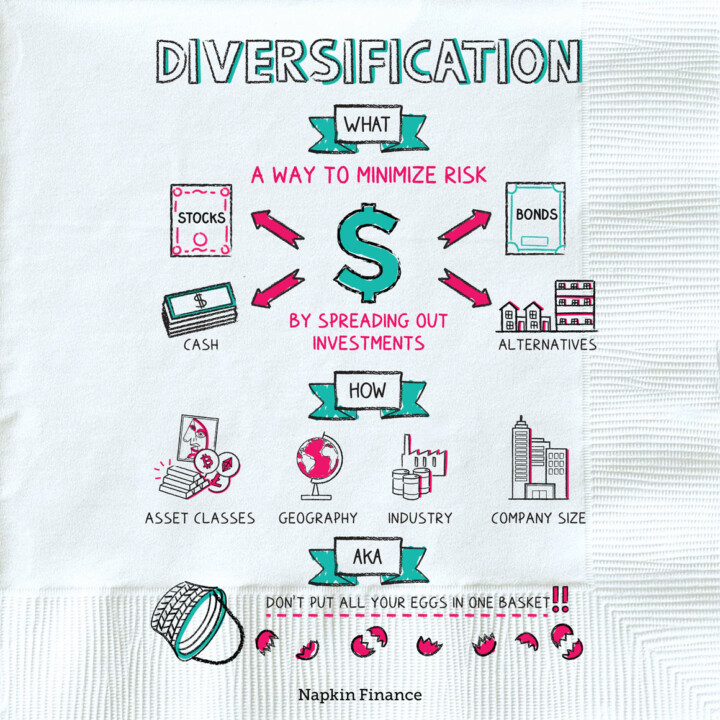

Learn moreDiversification

Spread Your Bets

Diversification is the practice of dividing your money among lots of different types of investments. It’s the...

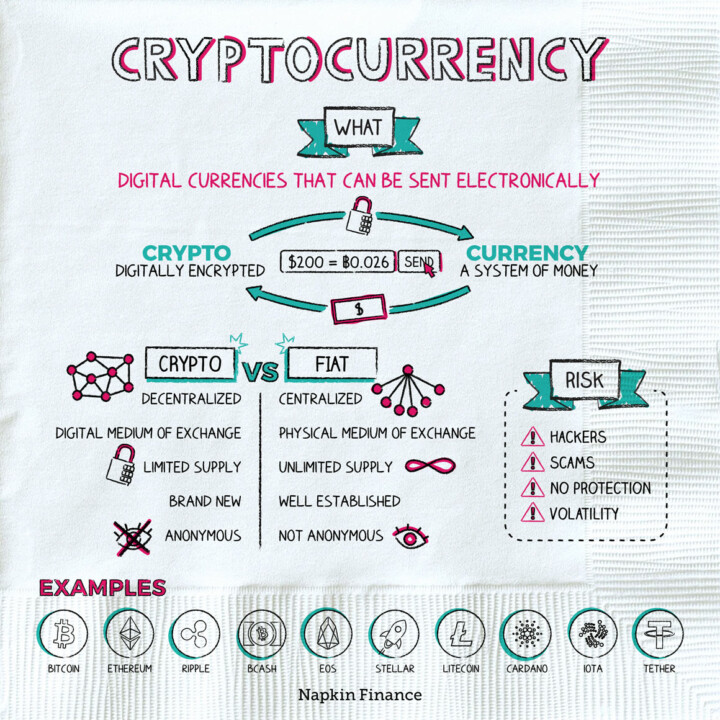

Learn moreCryptocurrency

Tales of the Crypto

Cryptocurrency is digital money that can be sent electronically anywhere in the world.

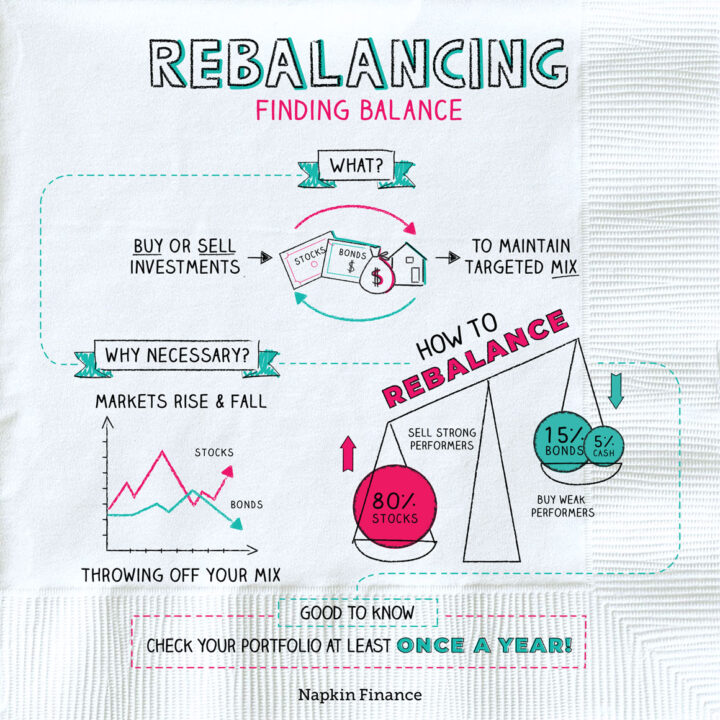

Learn moreRebalancing

Move Your Assets

Know how self-help gurus are always talking about “finding the balance” in your personal life? That same...

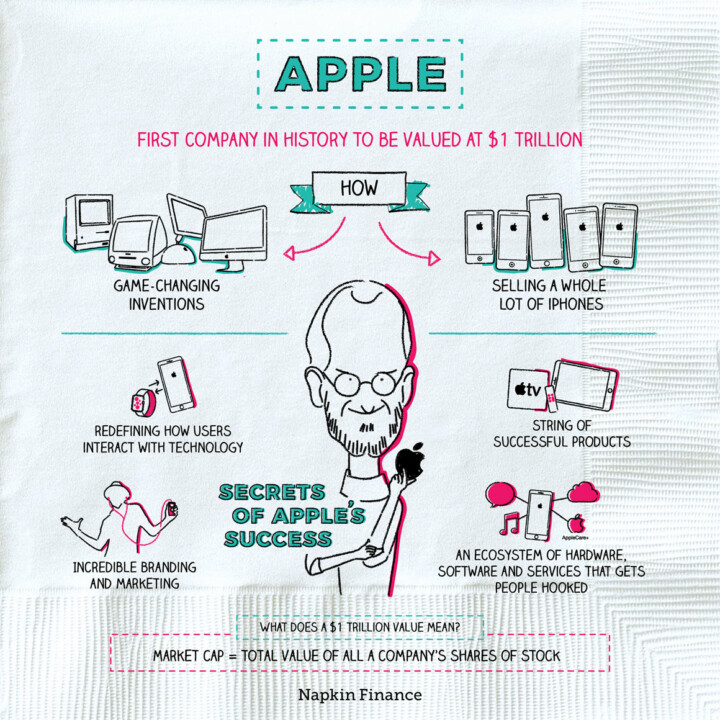

Learn moreApple

The Big Apple

Apple was the first business in history to be valued at $1 trillion—the largest value ever recorded...

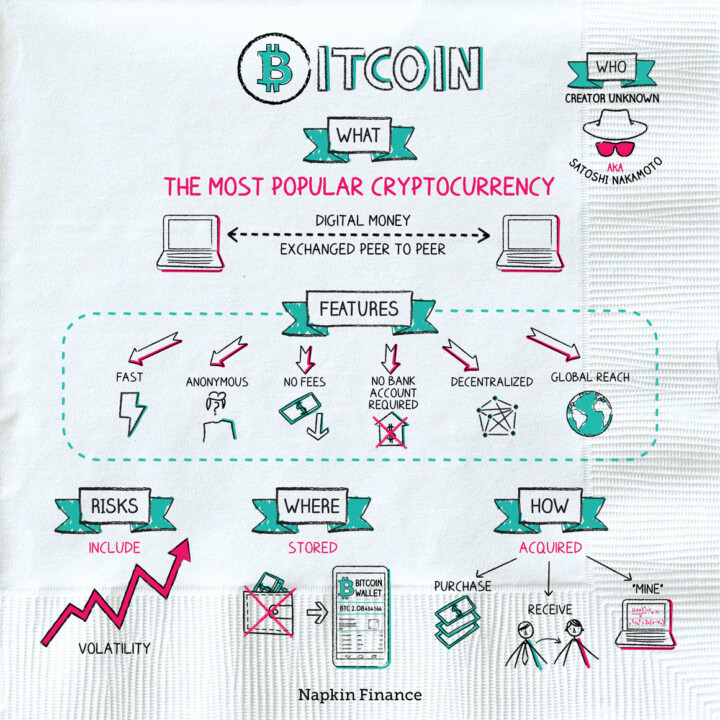

Learn moreBitcoin

Not So Silky Road

Bitcoin is the world’s first type of digital money, or cryptocurrency. Unlike traditional paper money, Bitcoin only...

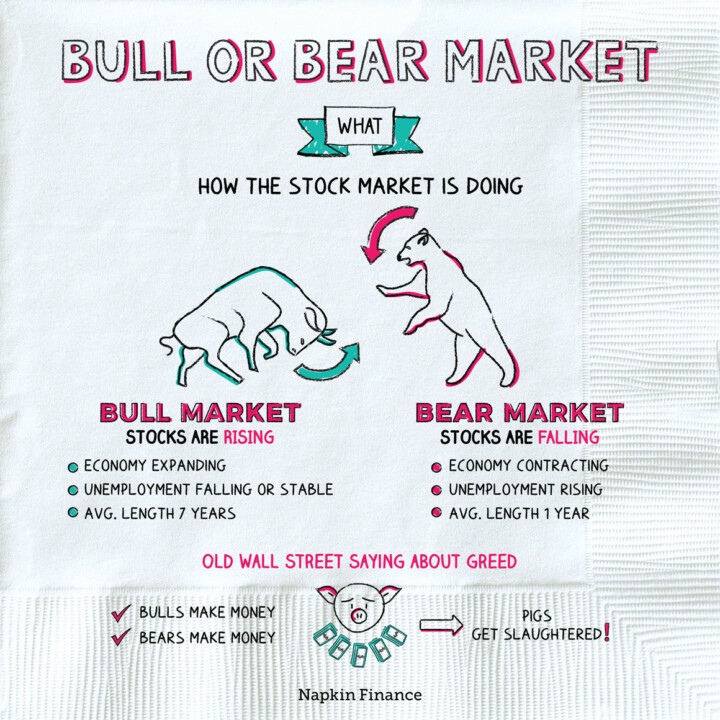

Learn moreBull or Bear Market

Into the Wild

Wall Street may be a bit of a rodeo, but there are no literal bulls or bears....

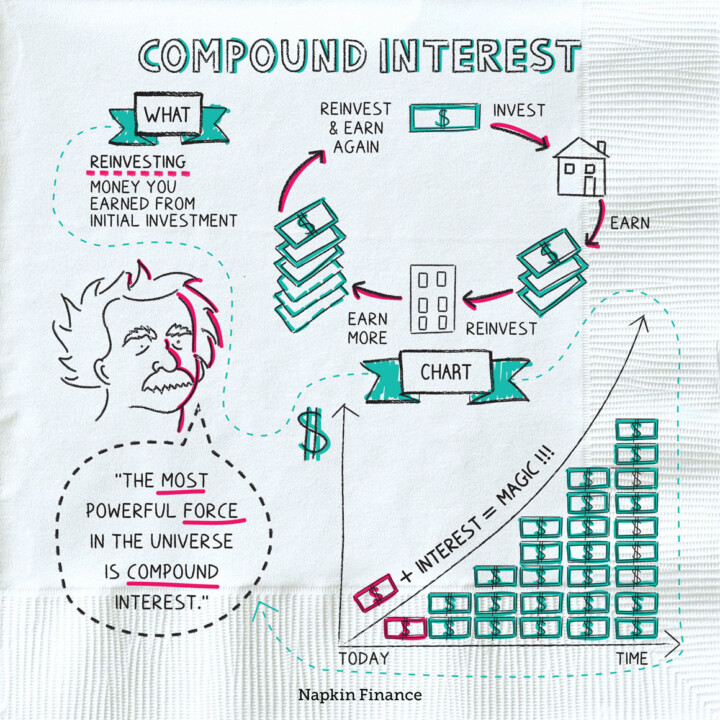

Learn moreCompound Interest

Make Bank

The most powerful force in the universe is compound interest. — Albert Einstein

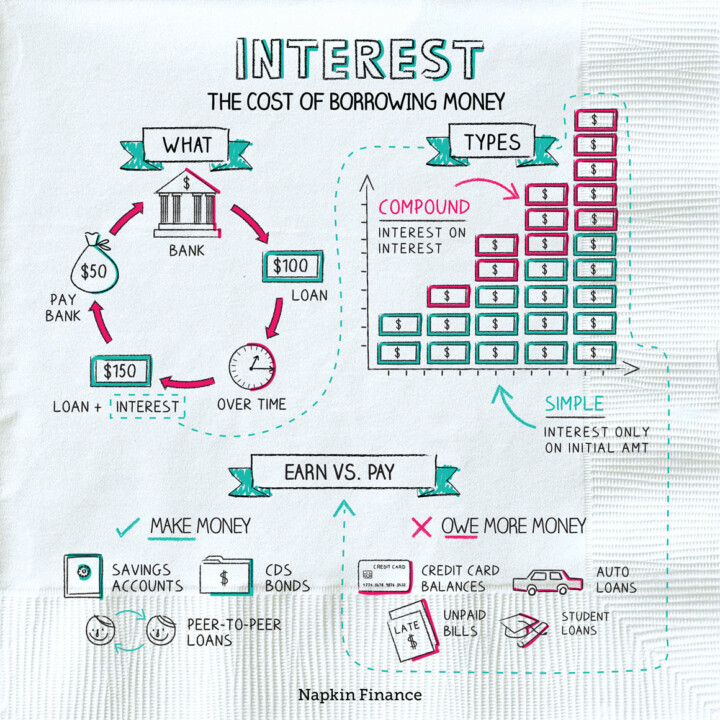

Learn moreInterest

Pay Up

Interest is the cost of borrowing money. For a borrower, interest is the price of taking on...

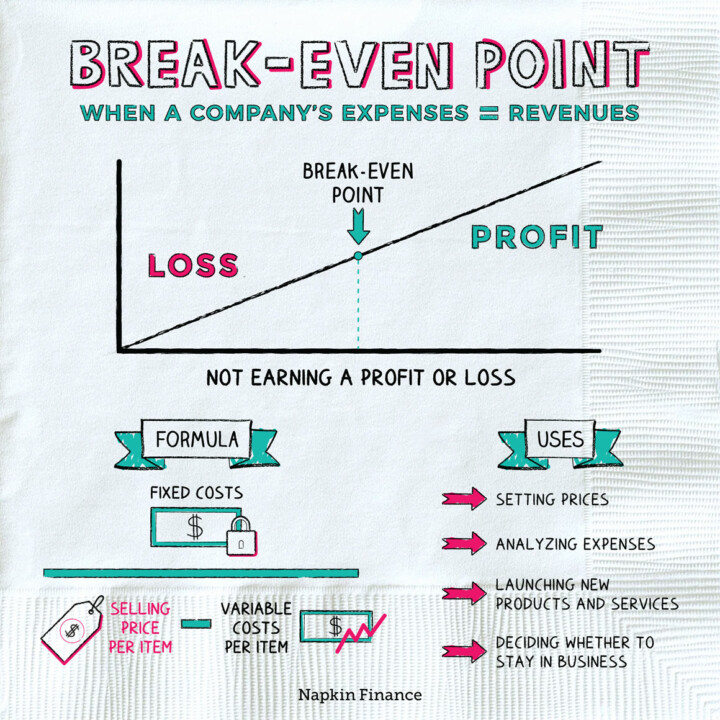

Learn moreBreak-Even Point

Point Break

A company is at its break-even point when its revenue equals its expenses. It is neither making...

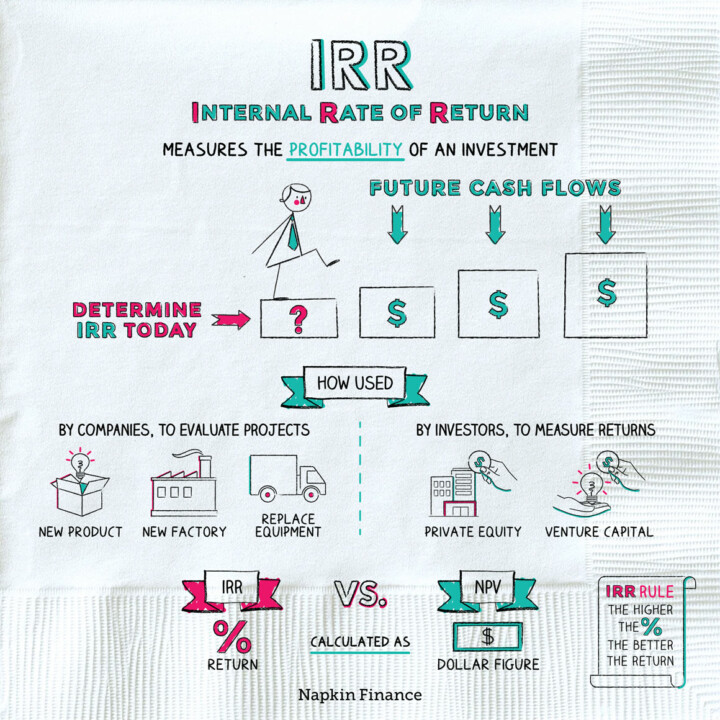

Learn moreIRR

Crunch the Numbers

The internal rate of return, or IRR, is a measure of an investment’s or a project’s profitability....

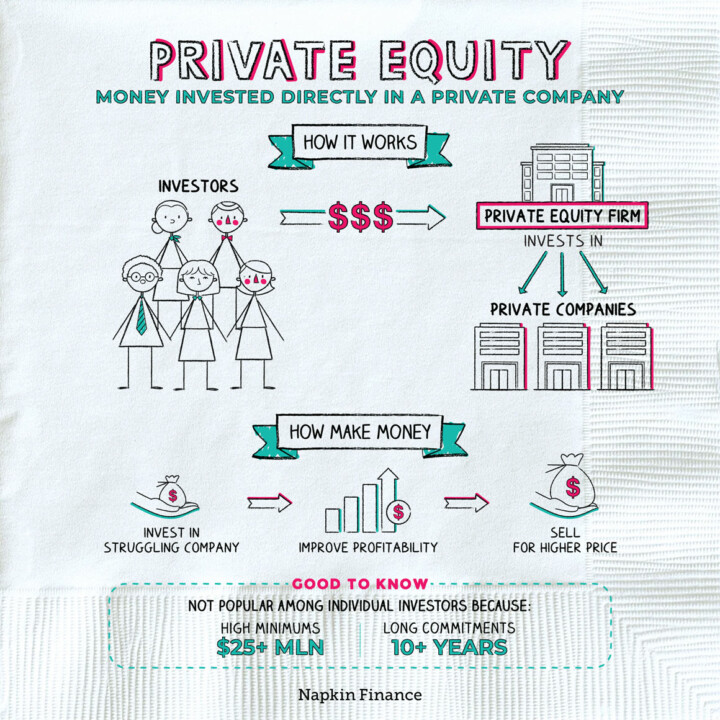

Learn morePrivate Equity

Members Only

Private equity is money invested directly into a private company. Private equity funds pool money from many...

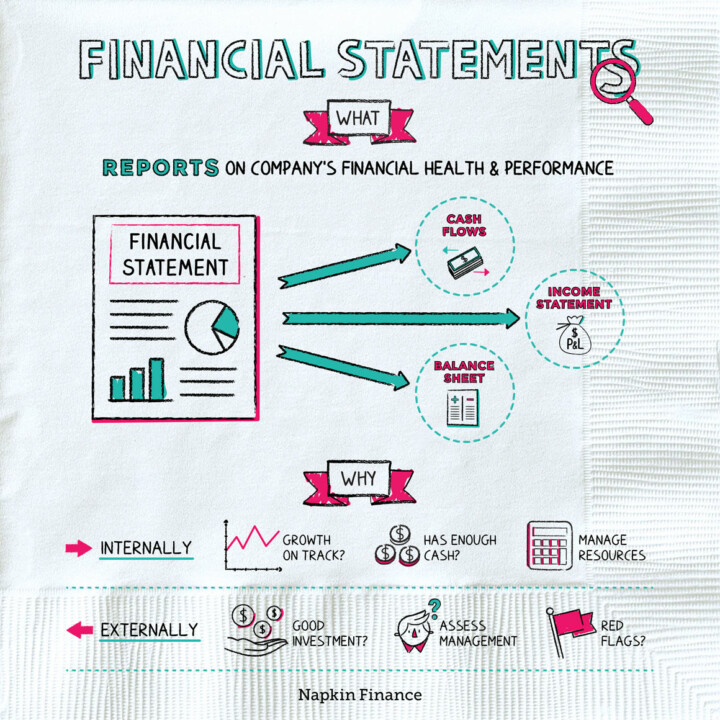

Learn moreFinancial Statements

State of Affairs

Financial statements are reports a company puts together to measure how it’s doing. Companies create their financial...

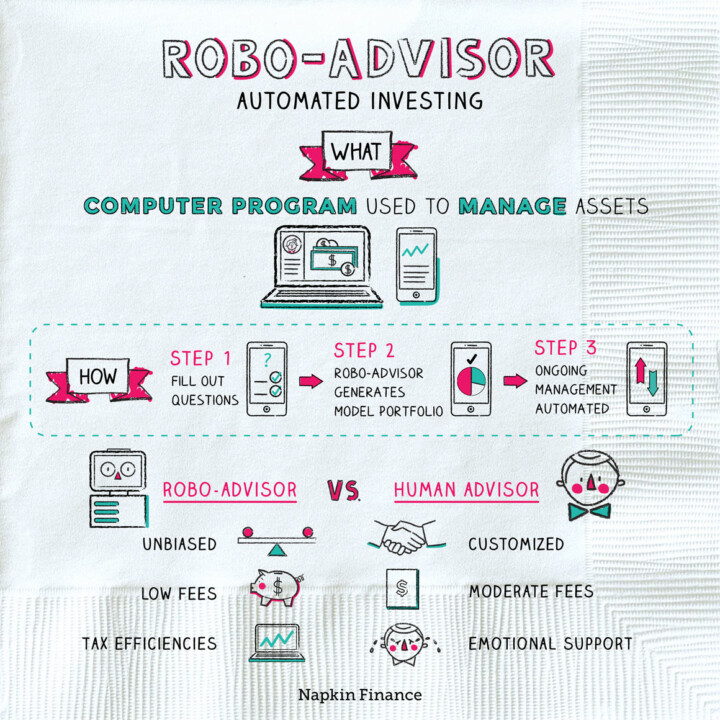

Learn moreRobo-Advisor

Autopilot

A robo-advisor is an investment management company that uses a computer program instead of a live human...

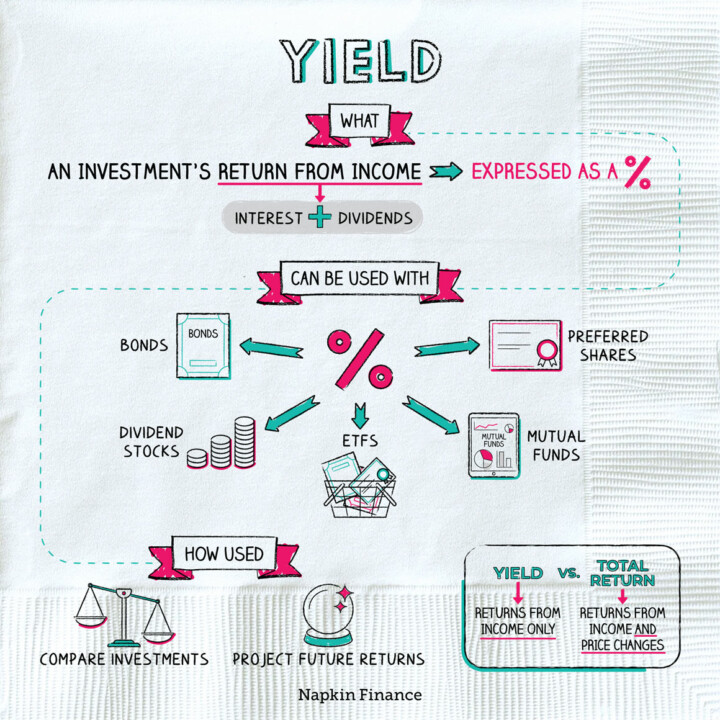

Learn moreYield

Make Coin

Yield is the earnings generated by an investment over a specific period of time, expressed as a...

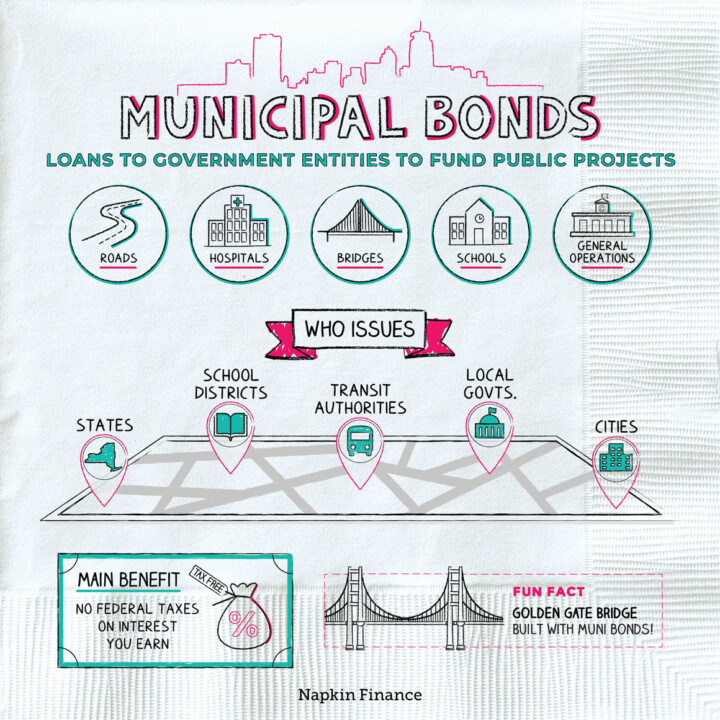

Learn moreMunicipal Bonds

One for the Road

A municipal bond, or muni bond, is a type of bond issued by a state or local...

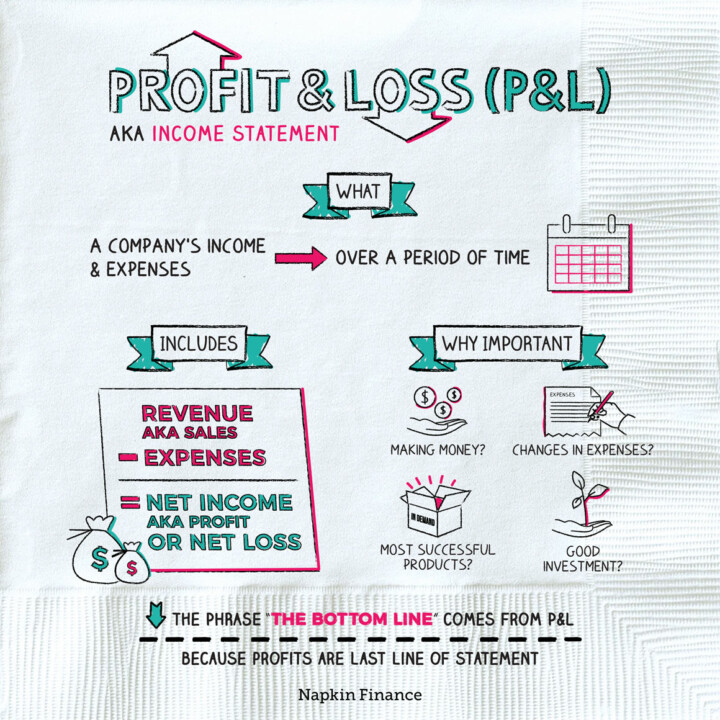

Learn moreProfit and Loss (P&L)

The Bottom Line

A profit and loss statement, or income statement, shows the money a company earned and what it...

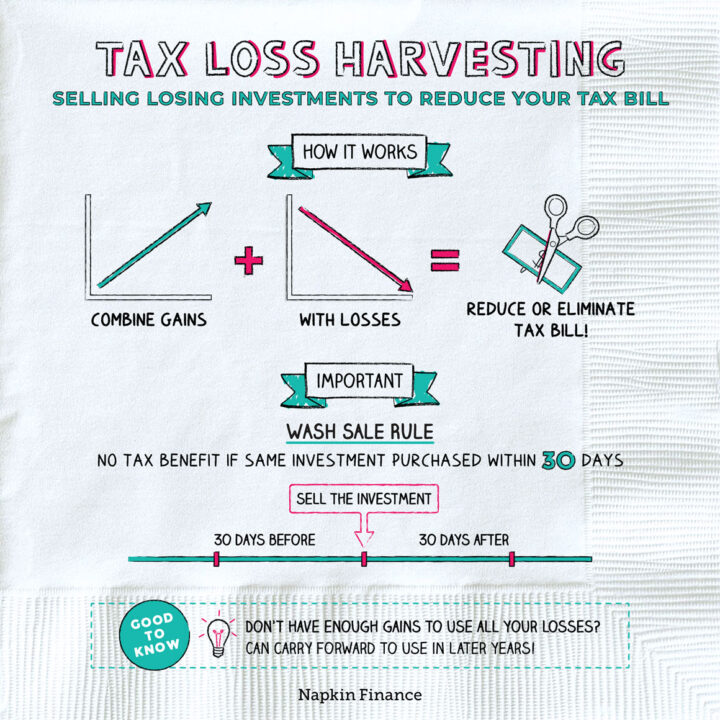

Learn moreTax Loss Harvesting

Cut Your Losses

Tax loss harvesting is a trading strategy investors can use to try to reduce their taxes. It’s...

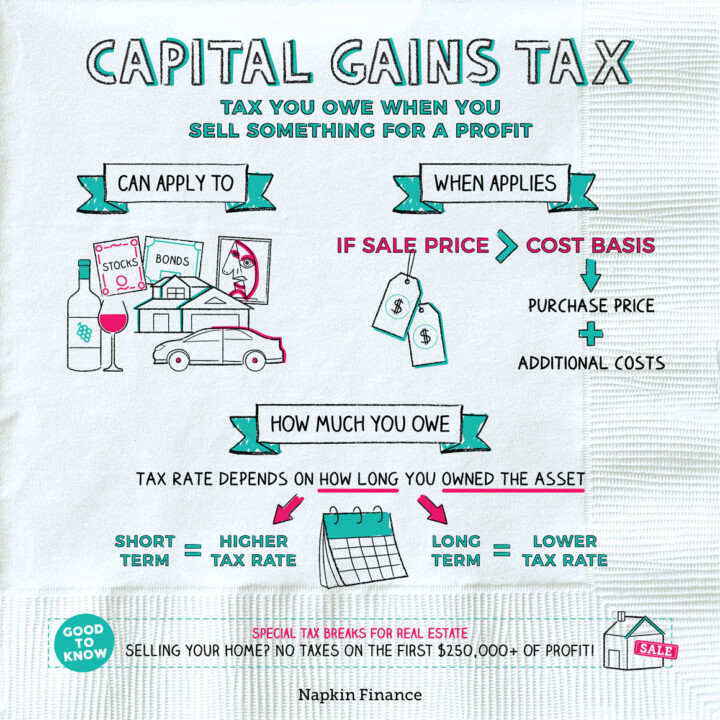

Learn moreCapital Gains Tax

The Taxman Cometh

If something you own goes up in value and you sell it, then you’ve made a profit....

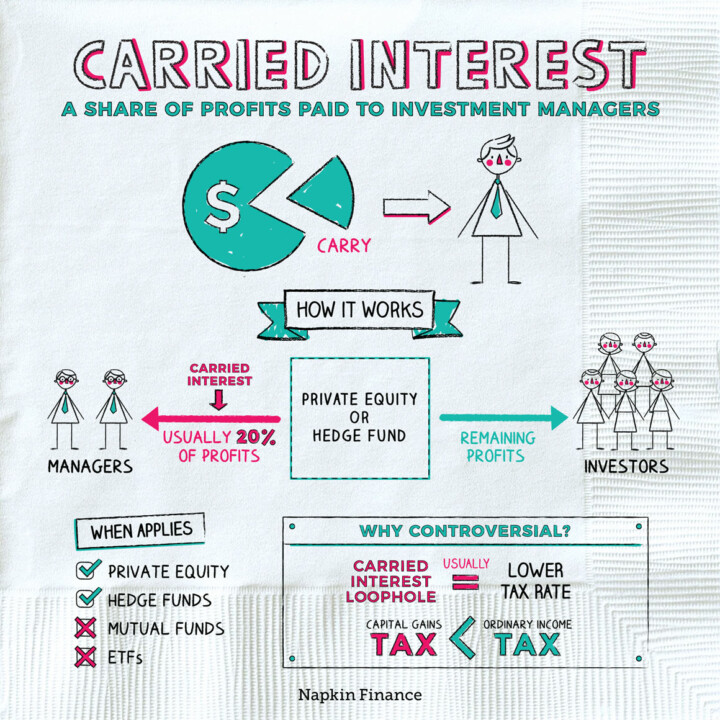

Learn moreCarried Interest

In the Interest Of

Carried interest is a share of a private equity or hedge fund’s profits that is paid to...

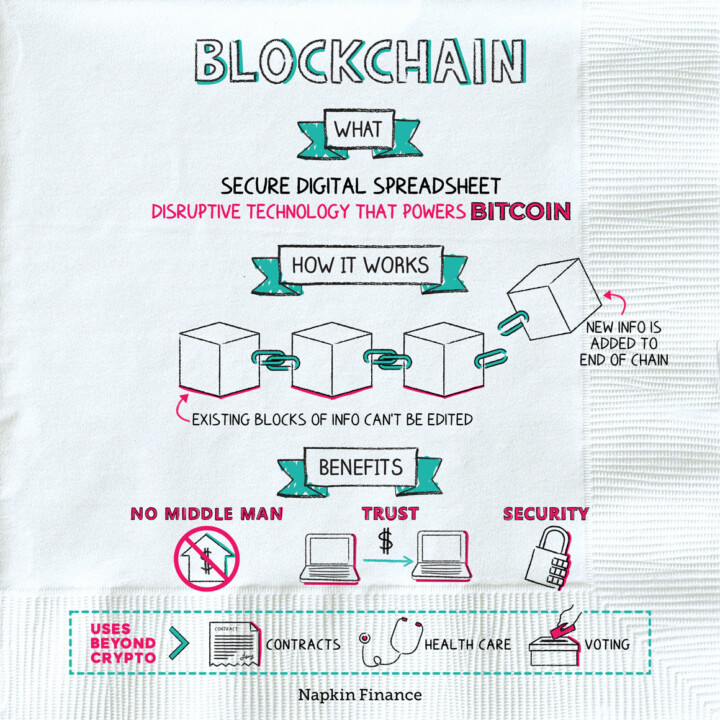

Learn moreBlockchain

Chain Gang

Blockchain is the recordkeeping technology that serves as the foundation for Bitcoin and some other types of...

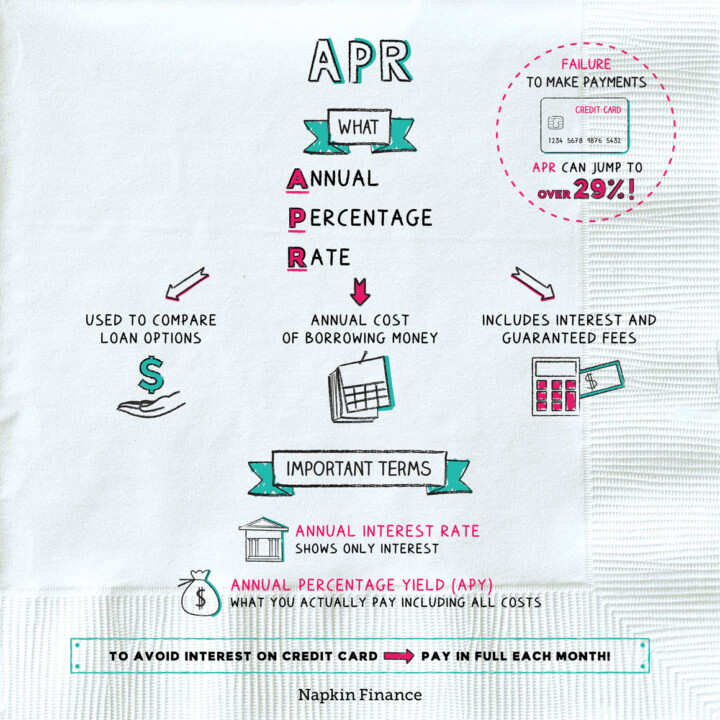

Learn moreAPR

Another Day, Another Dollar

An annual percentage rate (APR) represents the annual cost of borrowing money, including fees. Because the APR...

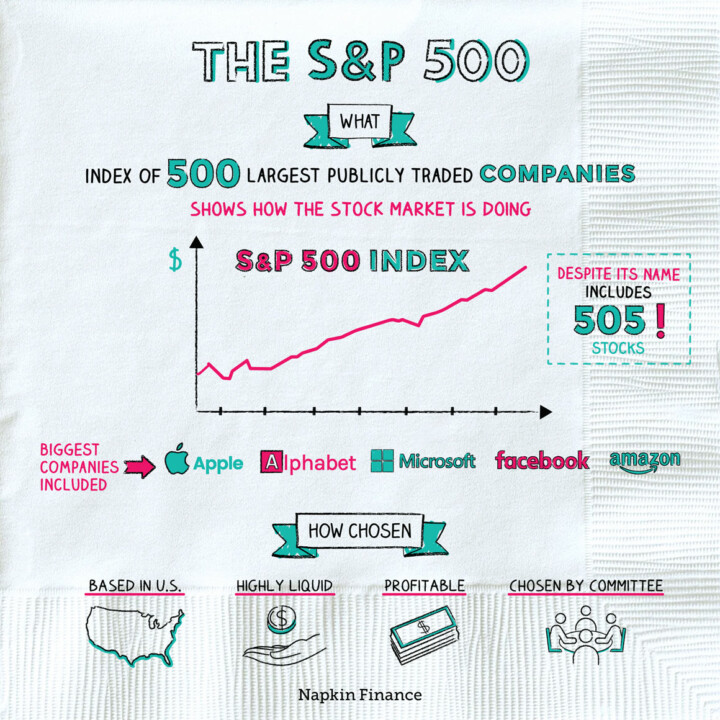

Learn moreThe S&P

Make the Market

The Standard & Poor’s 500 Index—also known as the S&P 500, or just the S&P—is an index...

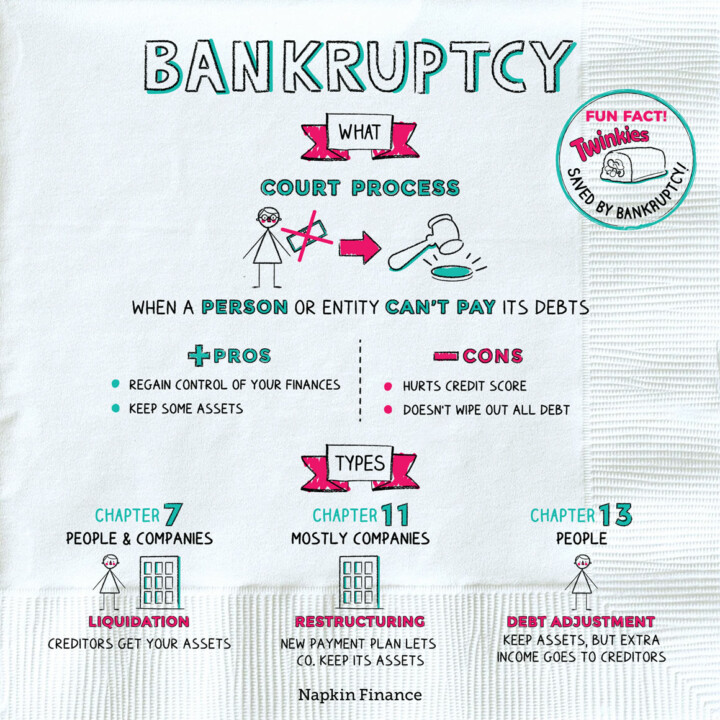

Learn moreBankruptcy

Lose Your Shirt

Bankruptcy is the legal process for consumers or businesses to get help with their debt. Bankruptcy starts...

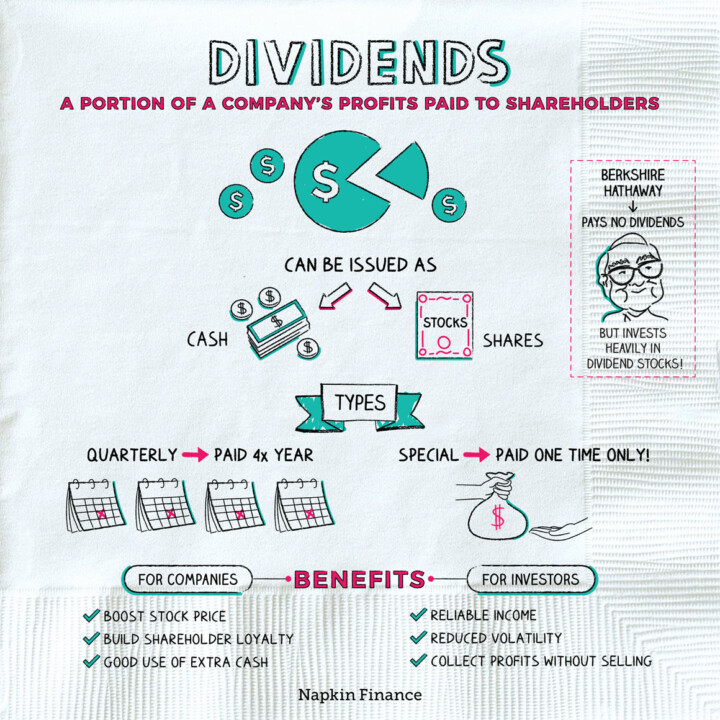

Learn moreDividends

Show Me the Money

A dividend is a portion of a company’s profits that is paid to its shareholders in the...

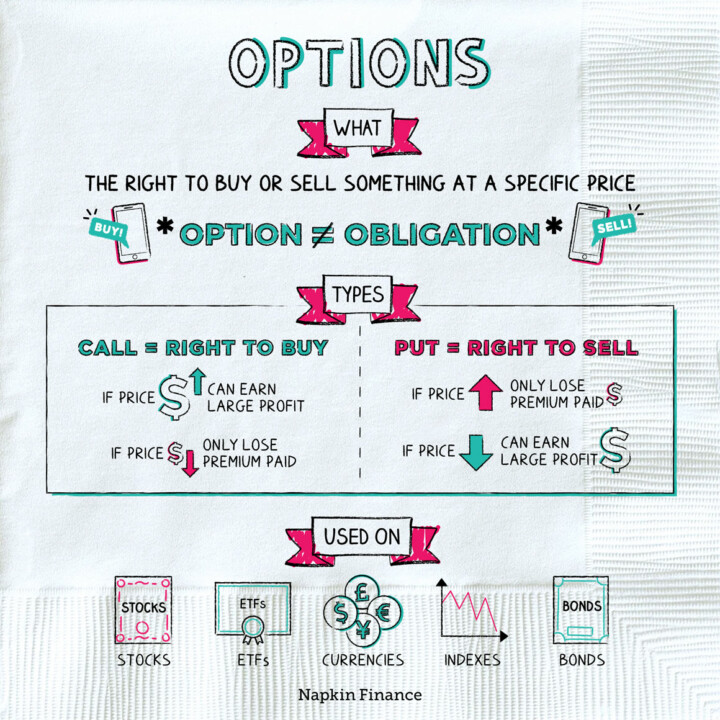

Learn moreOptions

Coming Attractions

An option is the right, but not obligation, to buy or sell an investment at a specific...

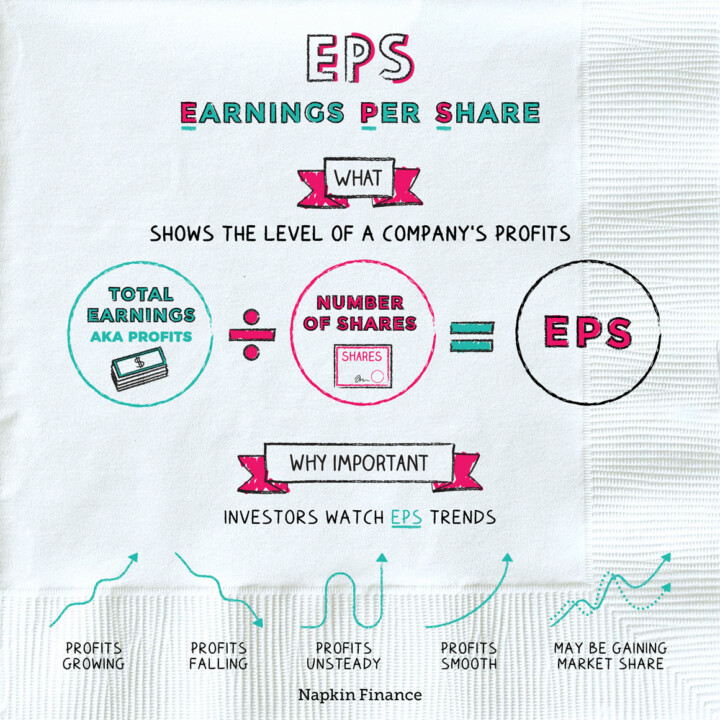

Learn moreEPS

Bang for the Buck

Earnings per share (EPS) is a financial metric that helps investors evaluate a company’s profitability. It’s calculated...

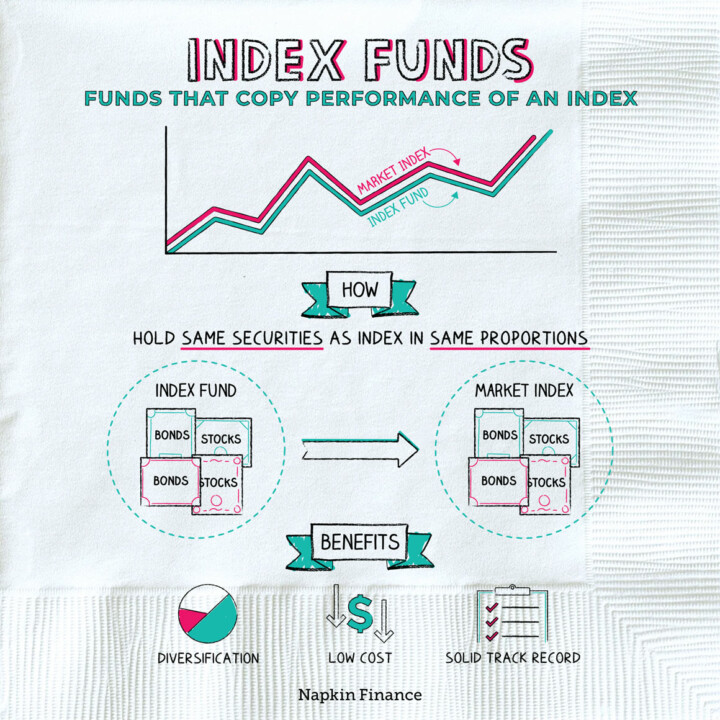

Learn moreIndex Funds

Copy That

An index fund is a professionally managed collection of stocks, bonds, or other investments that tries to...

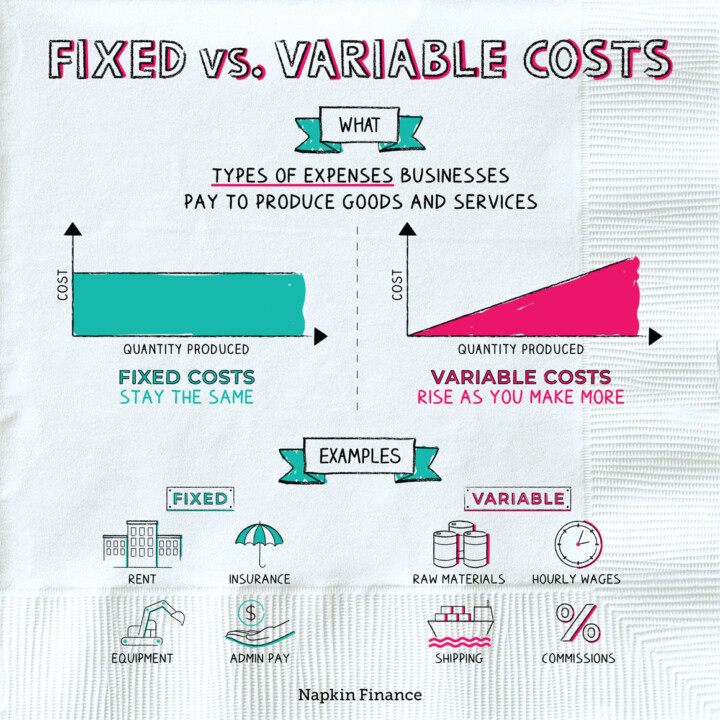

Learn moreFixed vs. Variable Costs

At All Costs

Fixed and variable costs are types of expenses that businesses pay in order to operate.

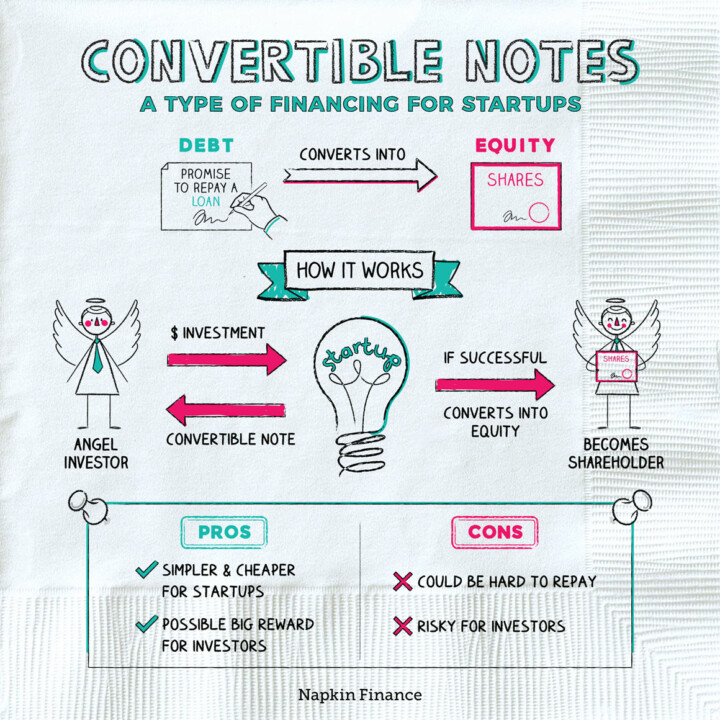

Learn moreConvertible Note

Take Note

A convertible note is a type of short-term loan for a business. However, instead of being repaid...

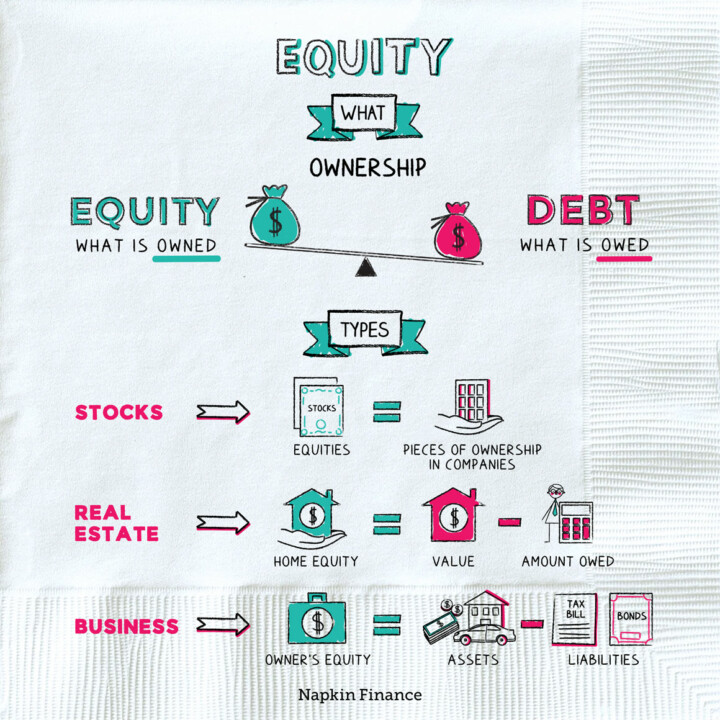

Learn moreEquity

Own It

Equity is ownership. You can have equity—or an ownership stake—in any asset, meaning anything of value.

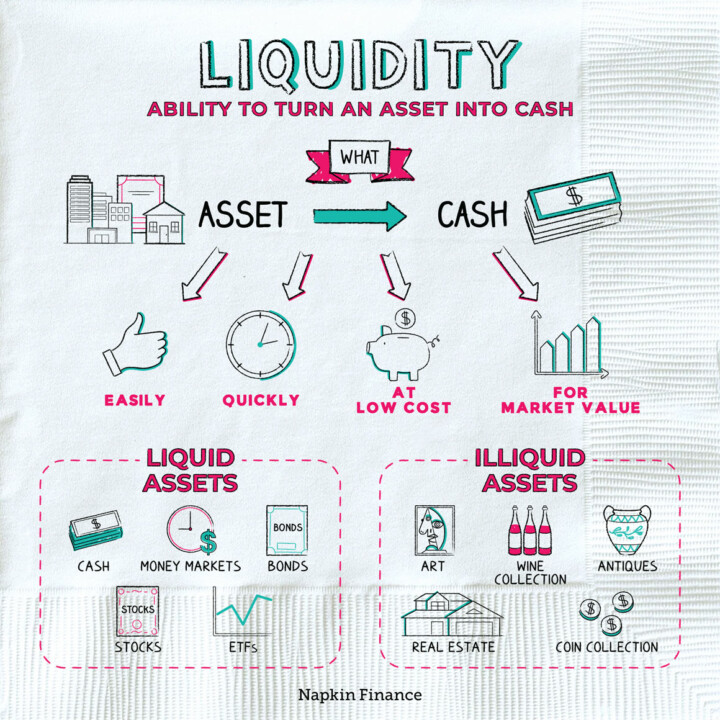

Learn moreLiquidity

Cashing Out

Liquidity refers to how easily you can sell an investment or asset at a fair price.

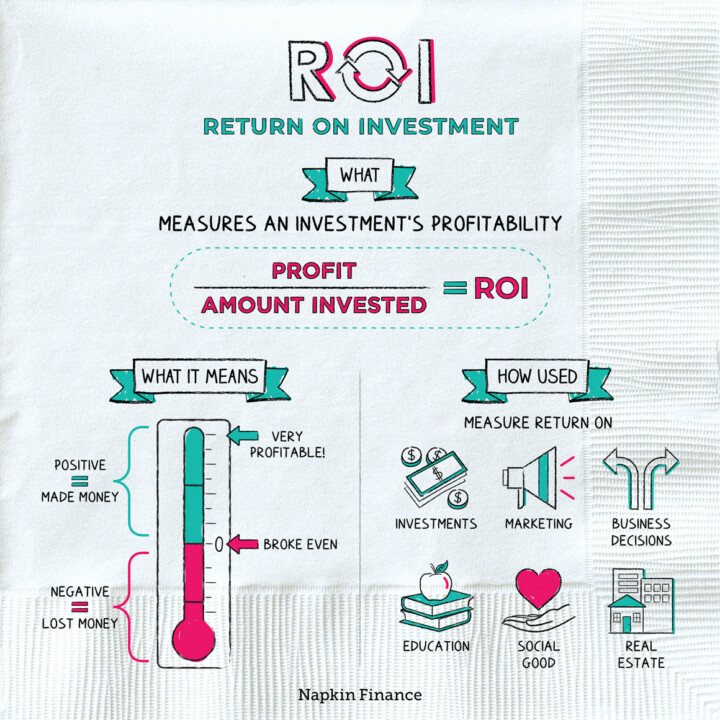

Learn moreROI

Many Happy Returns

Return on investment, or ROI, is a ratio for measuring the profitability of an investment. It puts...

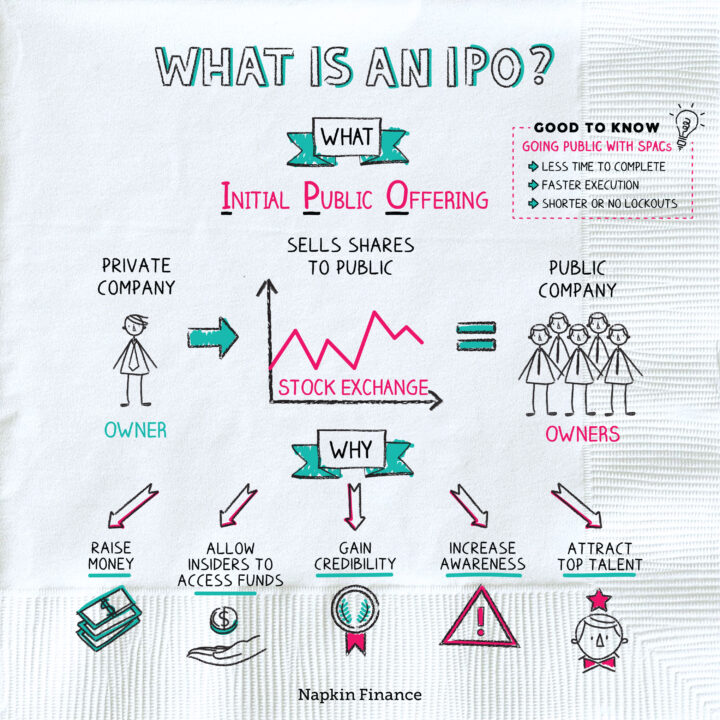

Learn moreIPO

Opening Bell

An IPO, or initial public offering, is when a company’s shares start trading on a stock exchange...

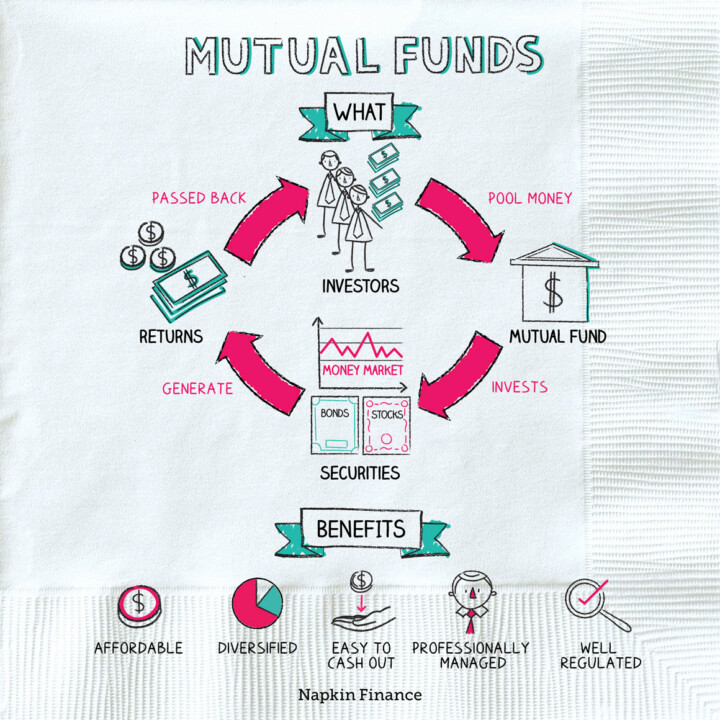

Learn moreMutual Funds

Join Forces

A mutual fund is a professionally managed fund that pools lots of investors’ money in order to...

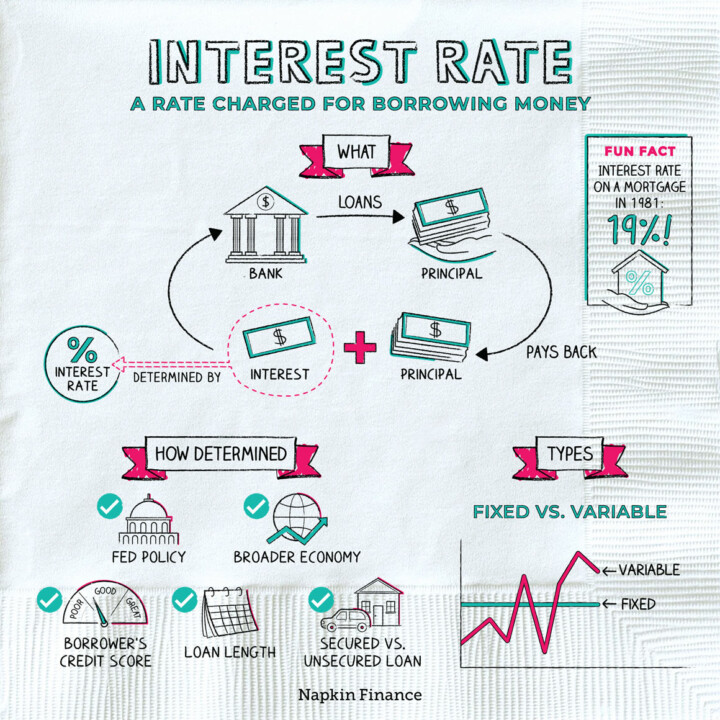

Learn moreInterest Rate

At Any Rate

Interest is what a lender charges you to borrow money. It is usually expressed as a percentage...

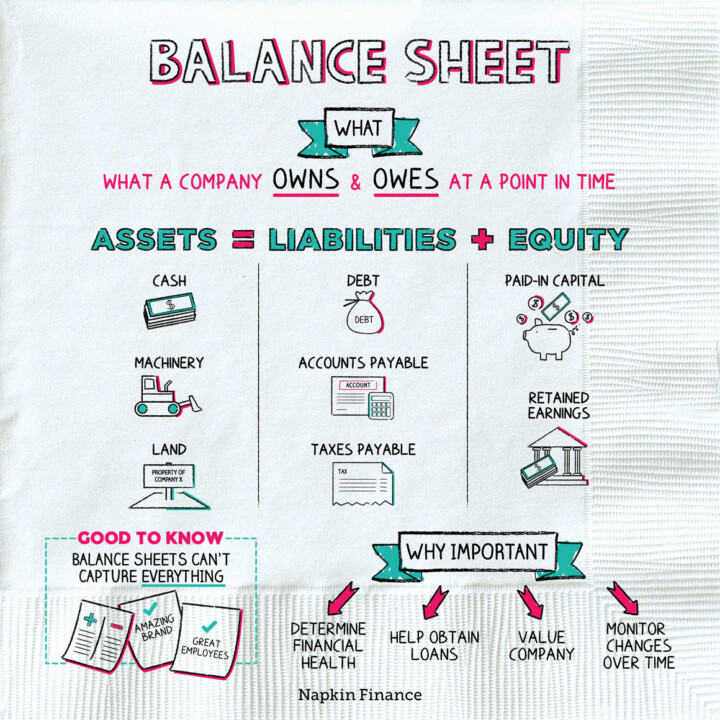

Learn moreBalance Sheet

Cook the Books

A balance sheet is a snapshot of financial health, showing what a company or person owns and...

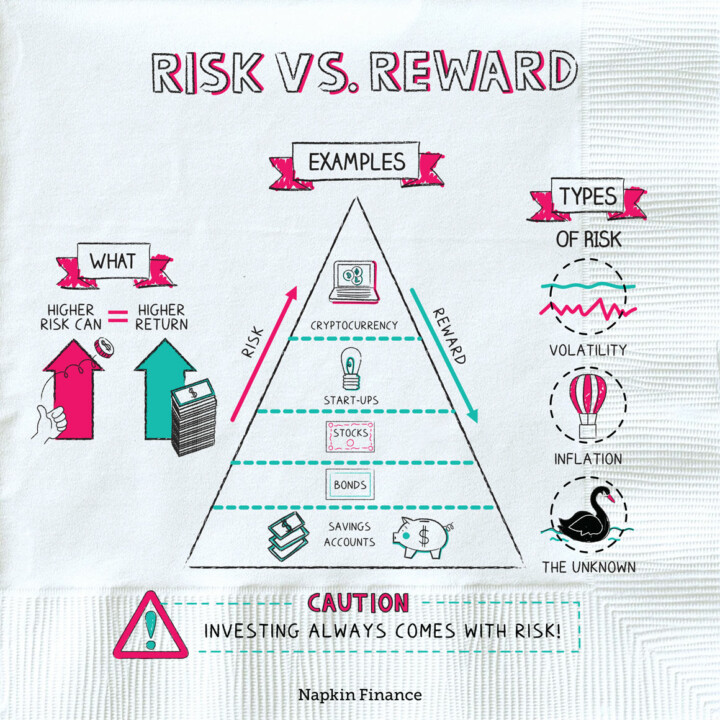

Learn moreRisk vs. Reward

Double Down

All investments come with risk. With financial investments, risk is usually tied to reward. That means investments...

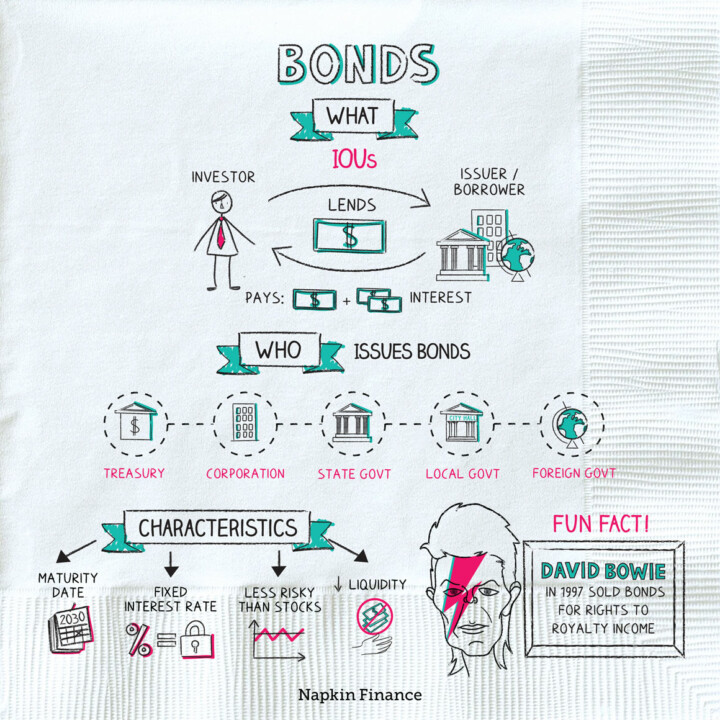

Learn moreBonds

Bonds, James Bonds

Bonds are essentially IOUs. When you buy a bond, you become a lender to whatever entity issued...

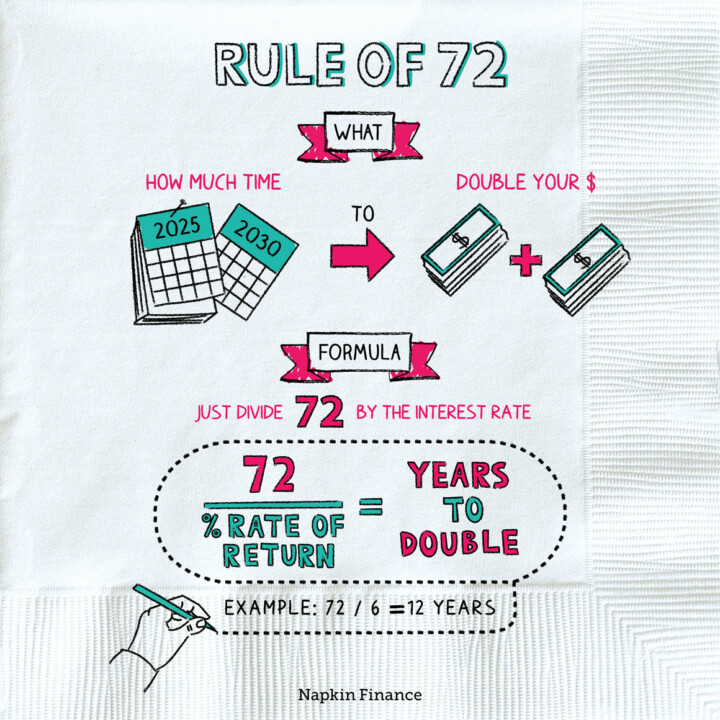

Learn moreRule of 72

Crunch the Numbers

The rule of 72 is an easy, back-of-the-napkin way to figure out how long it will take...

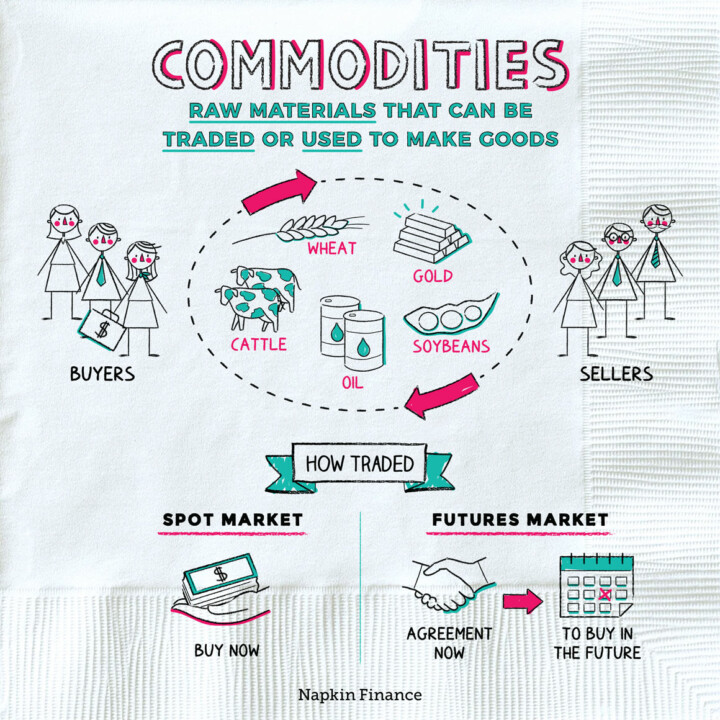

Learn moreCommodities

Back to Basics

Commodities are raw materials. They are the inputs, or ingredients, that are used to make most of...

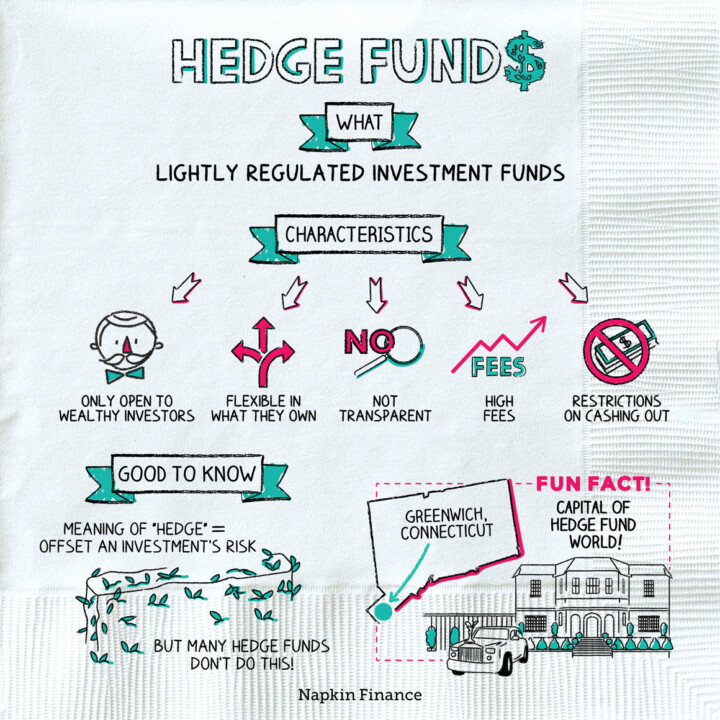

Learn moreHedge Funds

Hedge Your Bets

Hedge funds are investment funds that pool many investors’ money and then hire one or more professional...

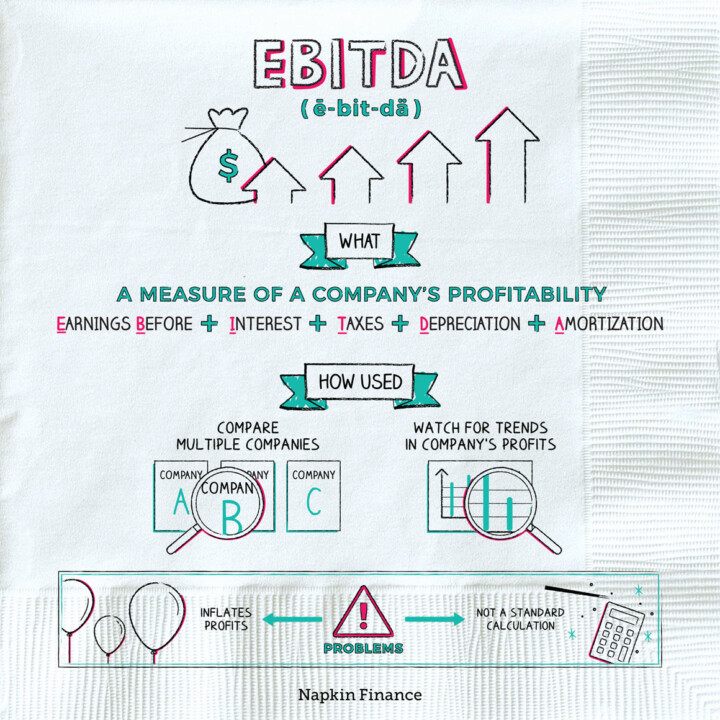

Learn moreEBITDA

How You Slice It

EBITDA (pronounced “ee-bit-tah”) stands for “earnings before interest, taxes, depreciation, and amortization.” It’s one measure of a...

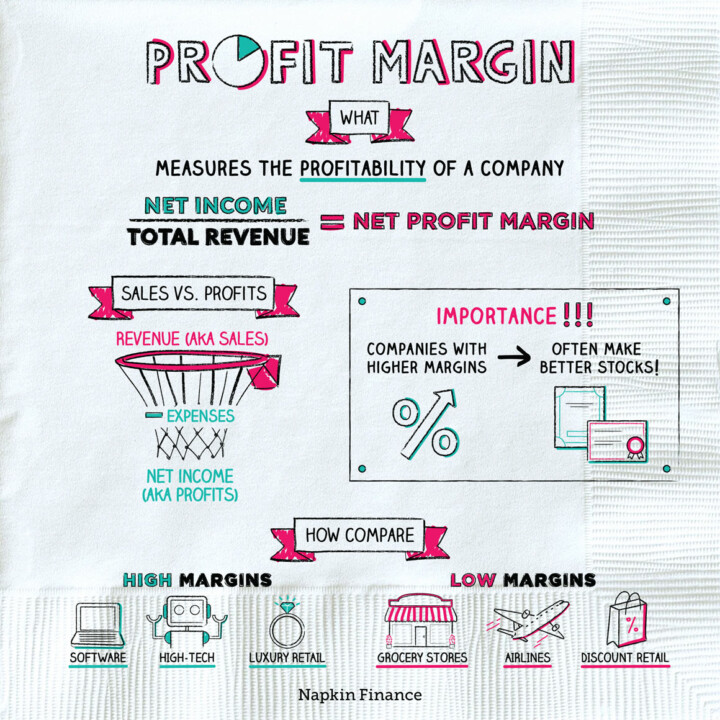

Learn moreProfit Margin

Margin of Error

A company’s profit margin measures the portion of its total sales that it gets to keep as...

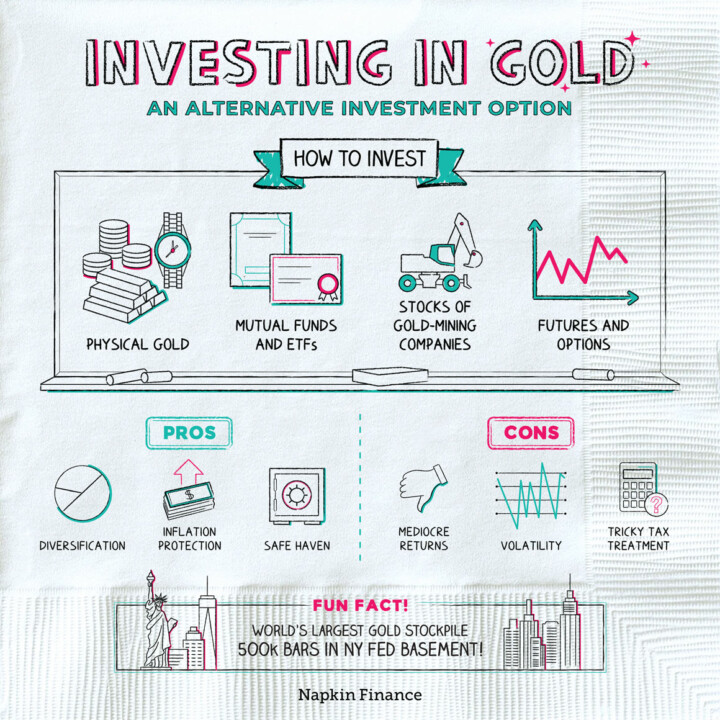

Learn moreInvesting in Gold

Worth its Weight

Gold is a precious metal that’s used in everything from jewelry and artwork to industrial goods and...

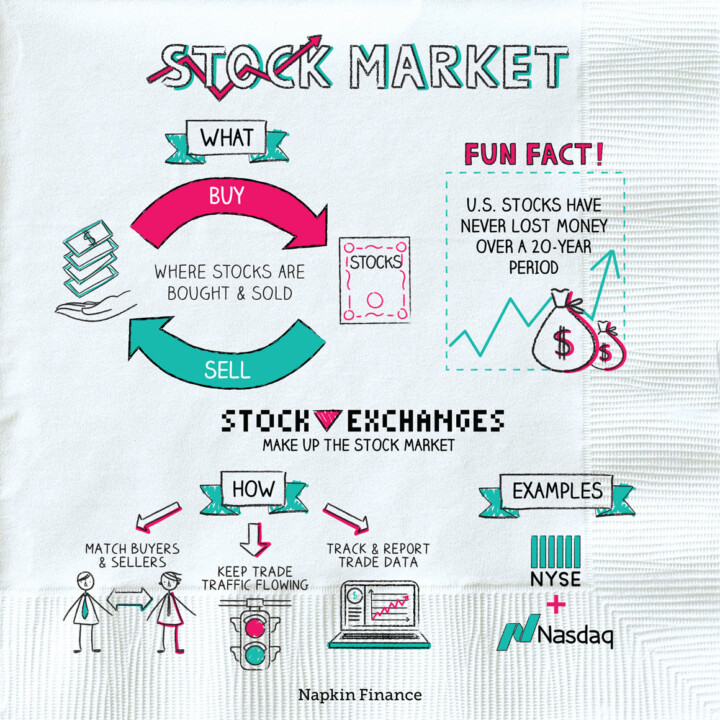

Learn moreThe Stock Market

Greed Is Good

The stock market is the collection of physical and electronic markets where buyers and sellers come together...

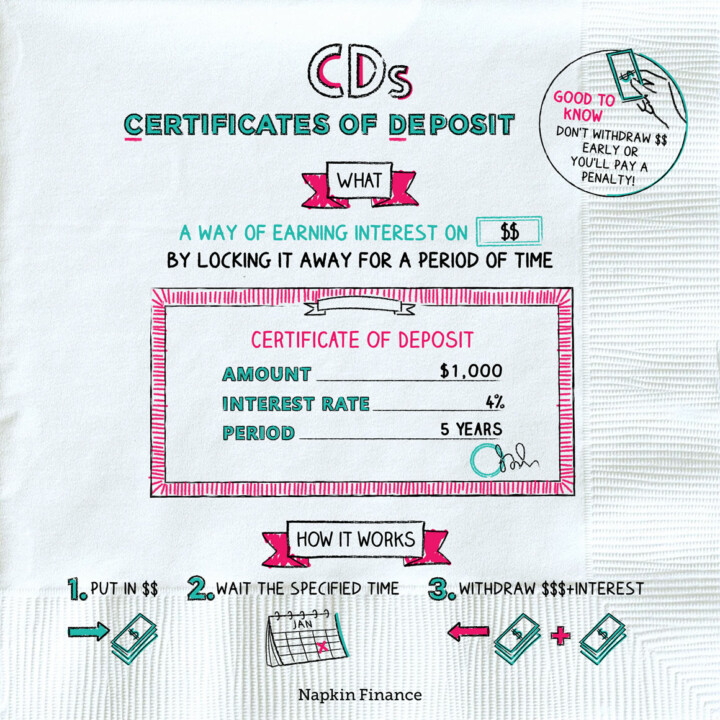

Learn moreCDs

On Principal

Certificates of Deposit, or CDs, are low-risk investments that pay interest. You can think of them as...

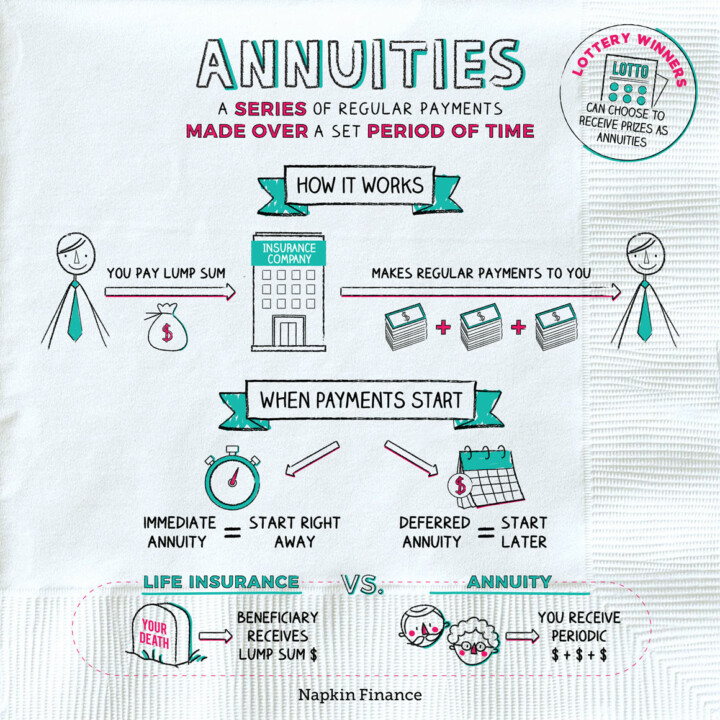

Learn moreAnnuities

Nest Egg

An annuity is a series of regular payments made over a set period of time. Annuities can...

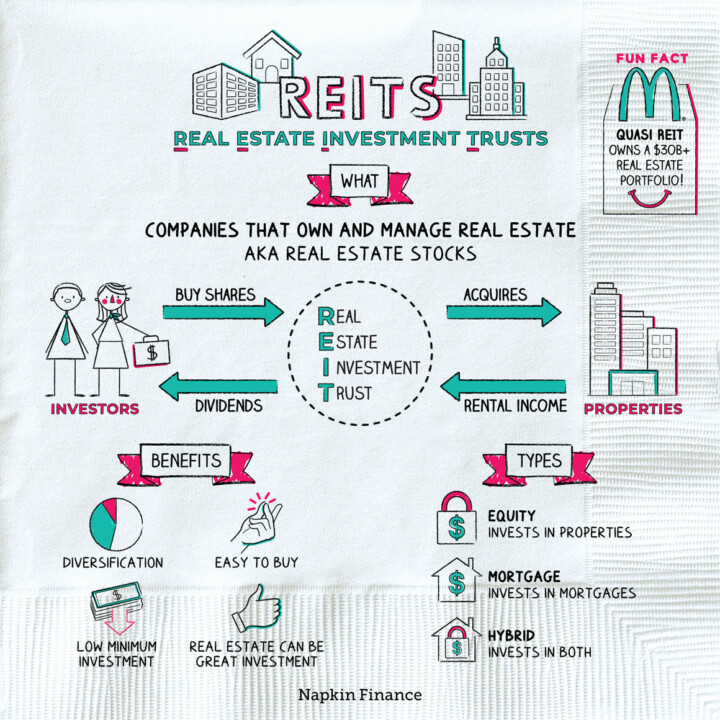

Learn moreREITs

Take Stock

A real estate investment trust, or REIT, is a company that owns, manages, or finances real estate....

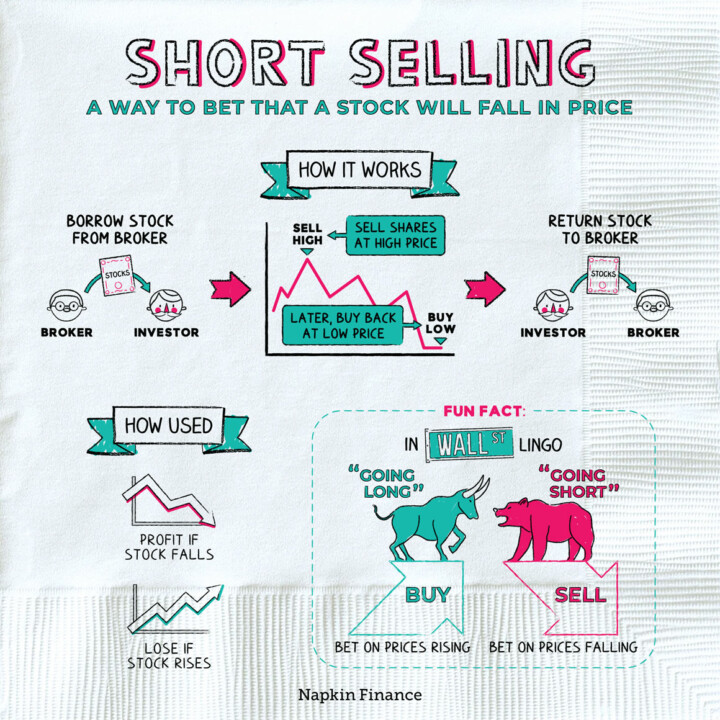

Learn moreShort Selling

The Big Short

Short selling is a way to bet that a stock will fall in price. Normally, an investor...

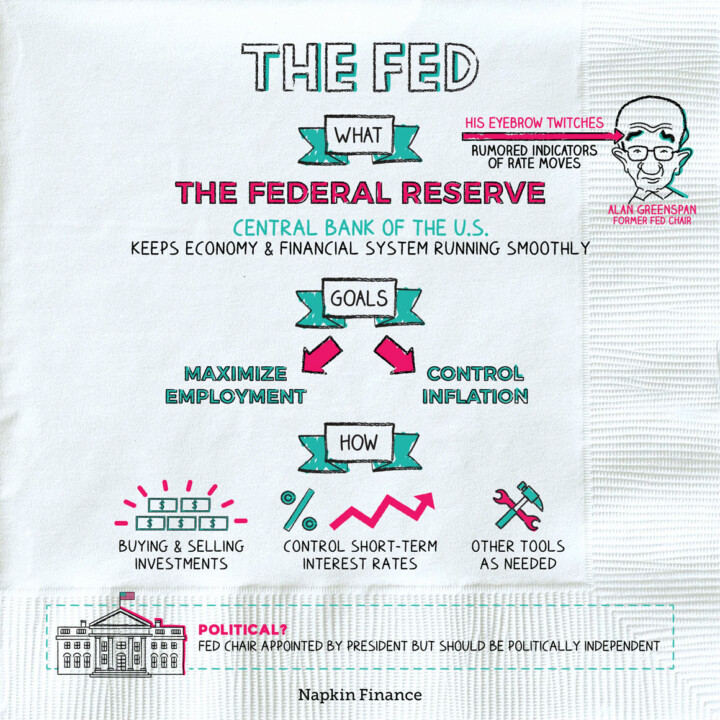

Learn moreThe Fed

Making a Federal Case

The Fed is the central bank of the U.S. Its overarching role is to make sure that...

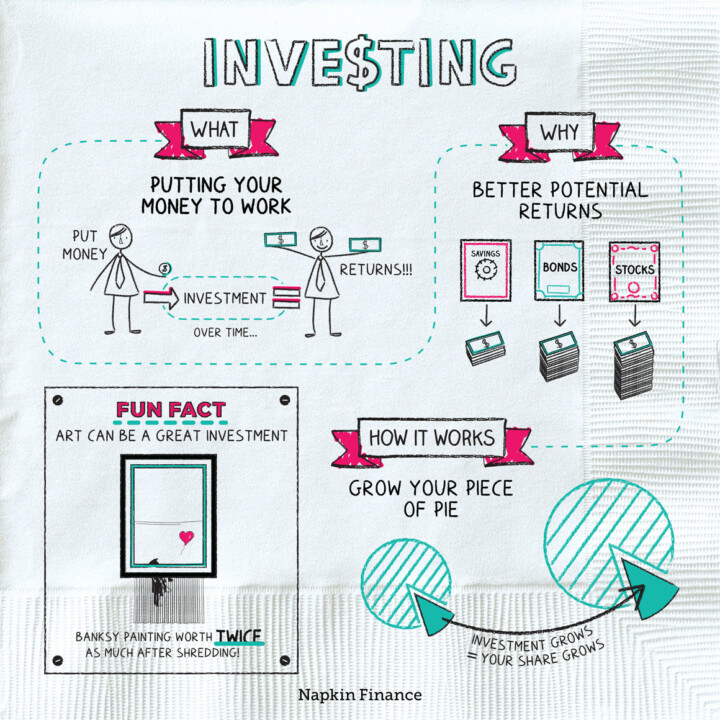

Learn moreInvesting

Piece of the Pie

Investing is putting your money to work in the hopes of earning a return. You probably already...

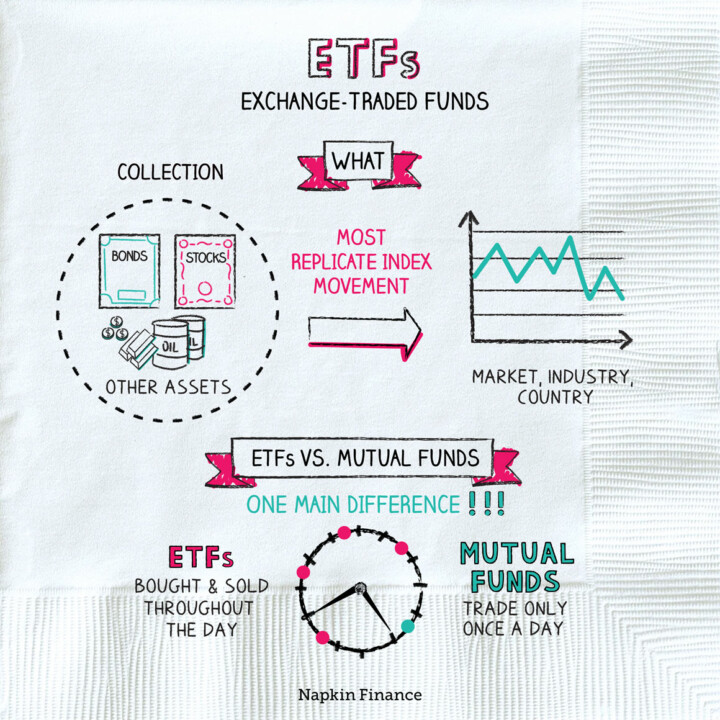

Learn moreETFs

Jack-of-All-Trades

Exchange-traded funds (ETFs) are investment vehicles similar to mutual funds. Like mutual funds, ETFs are professionally managed...

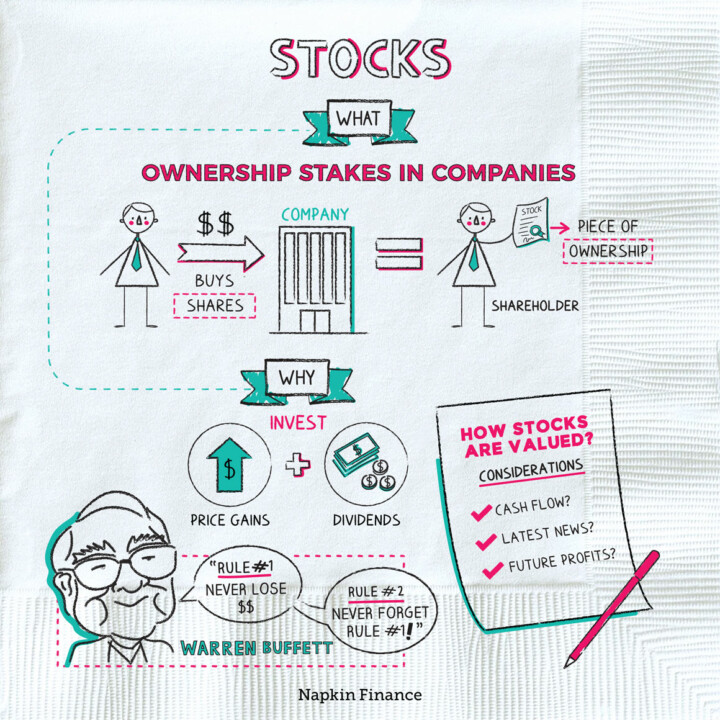

Learn moreStocks

Buy Buy Buy

Stocks are pieces of ownership in companies. If you bought one stock of, say, Amazon, and Amazon...

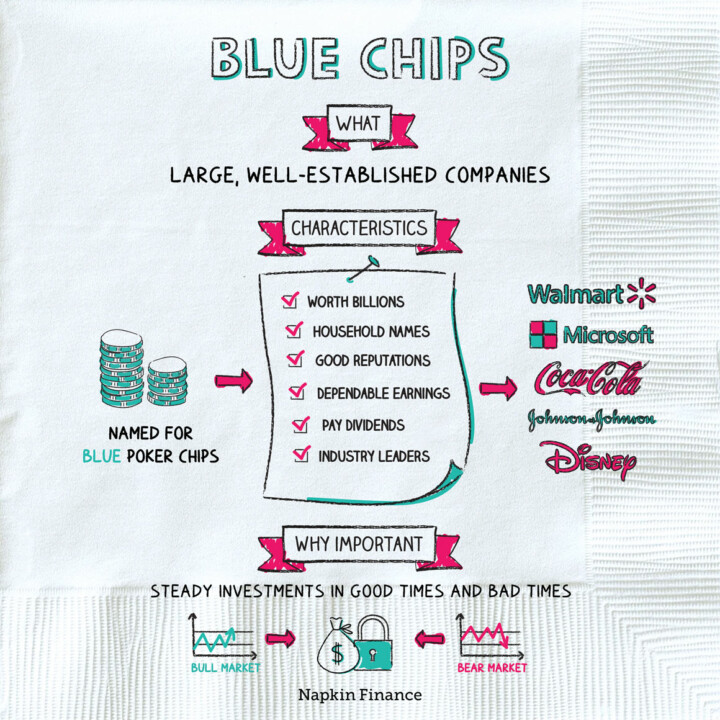

Learn moreBlue Chips

Steady Eddy

A blue chip is a company that is financially sound and well established. These companies usually sell...

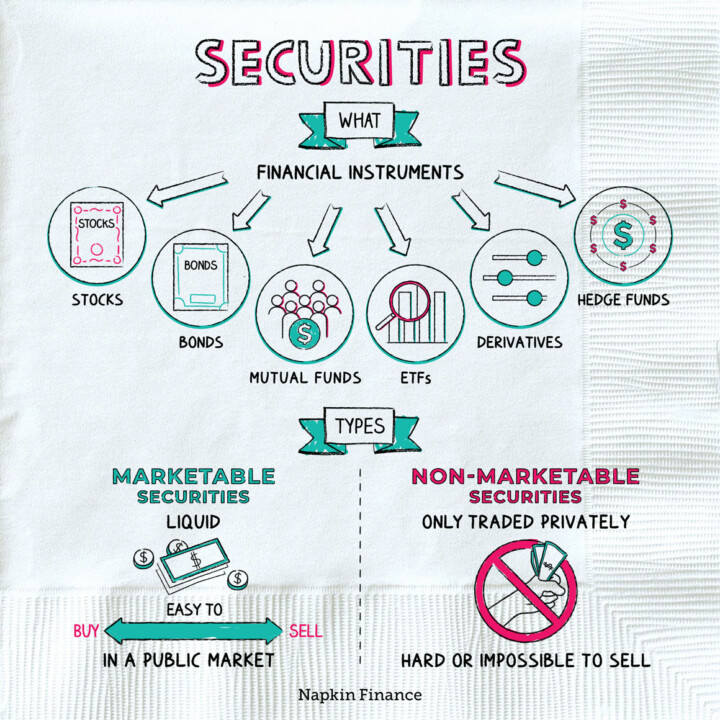

Learn moreSecurities

Market Maker

“Securities” is the term used to describe stocks, bonds, mutual funds, and other types of financial investments....

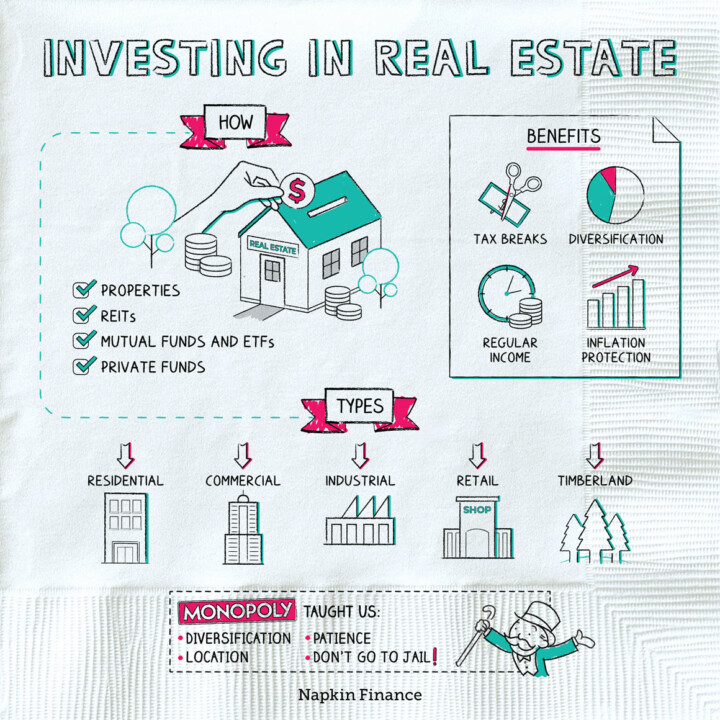

Learn moreReal Estate

Location, Location, Location

Buying real estate—whether on your own or by pooling your resources with other investors—is one possible way...

Learn more