Depreciation

Wear and Tear

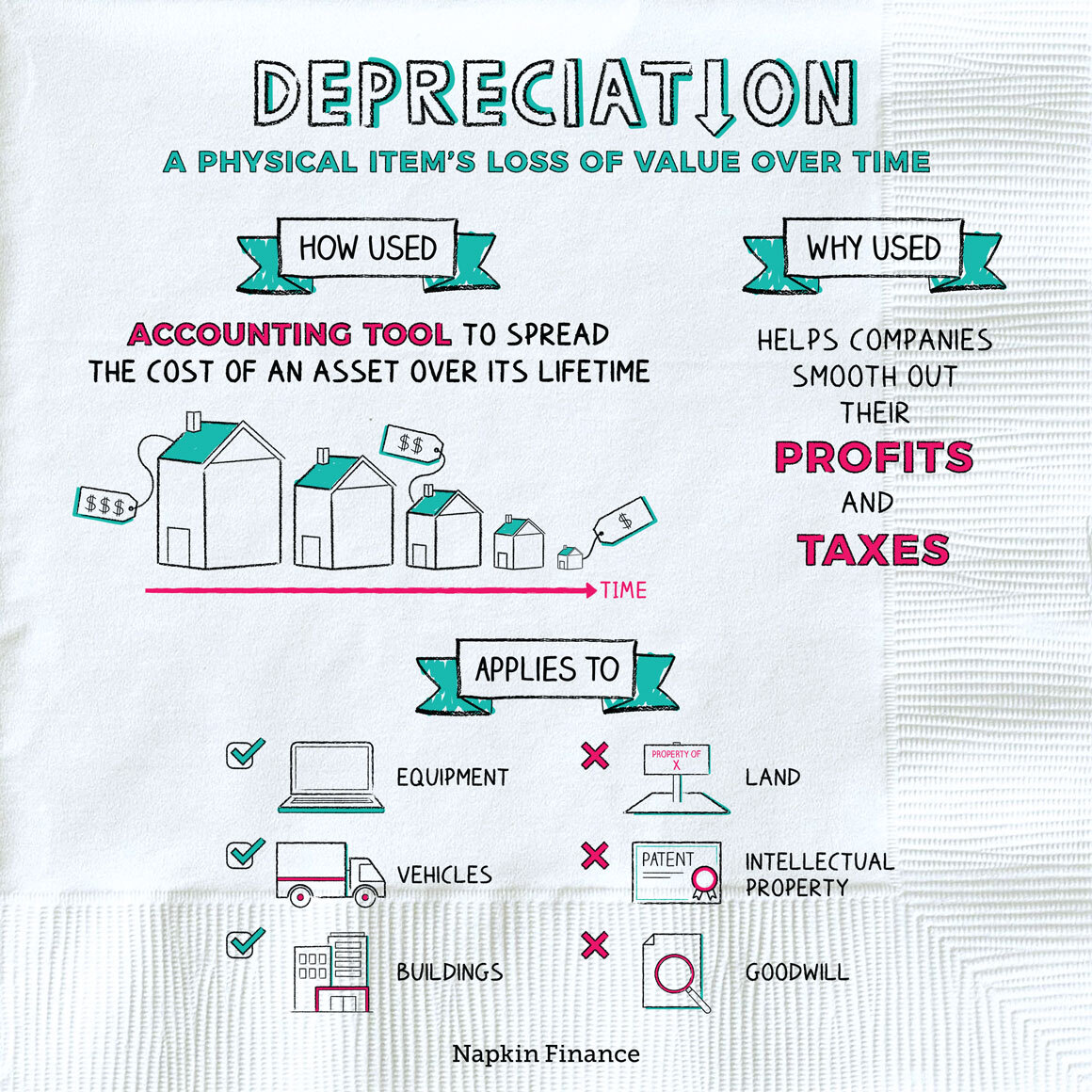

Depreciation is a physical asset’s loss of value over time.

Just as your once new car is worth less today than it was when you bought it (even if you’ve kept it in perfect condition), lots of physical assets lose value over time due to wear and tear and age.

How much value a particular item has lost in a particular period—like the $2,000 your car lost in the last year (for example)—is called the item’s depreciation.

For businesses, depreciation is an accounting tool used to spread out the cost of assets over their lifetimes. It can help companies:

- Show smoother profits over time

- Even out what they pay in taxes from year to year

If a company buys a large asset, such as a truck, in a given year, it doesn’t count the truck’s full purchase price as an expense that year. Instead, it counts a much smaller value—the truck’s depreciation for that year—as an expense. The next year the company would again count a certain amount of depreciation as an expense (and so on).

Smoother expenses mean smoother profits. And smoother profits mean smoother taxes (since companies are taxed on their profits).

Depreciation is only relevant to physical items that lose value over time, such as:

- Machinery

- Equipment

- Vehicles

- Buildings

Physical items that don’t lose their value, such as land, don’t depreciate. Some nonphysical, or “intangible,” assets do lose value over time (think of a patent that will eventually expire). But in those cases, companies use a process called amortization instead of depreciation.

To figure out an item’s depreciation, you first need to know its:

- Cost—i.e., how much the company paid for that truck.

- Salvage value (if any)—i.e., how much the company can eventually sell that truck for once it’s too old to keep using in its business.

By subtracting the salvage value from the cost, you arrive at the total amount of depreciation the asset will experience over its useful life.

However, companies also have to decide how to spread that item’s total lifetime depreciation over its useful life (e.g., how much depreciation to report for that truck’s first year in use compared with its fifth). There are a few ways of doing this:

| Type | What it means |

| Straight line | Spreads the item’s depreciation equally over its useful life |

| Double declining balance | Depreciation starts higher and ends lower; assumes the item loses most of its value in its early years |

| Unit of production | If a piece of machinery will produce 100,000 iPhone cases over its useful life and last year it produced 20,000, then assume it lost 20% of its value |

| MACRS | A specific method companies have to use on their tax returns |

Depreciation is an item’s loss of value over time. For businesses, it’s a helpful tool for both accounting and tax purposes. Depreciation lets a business spread out the cost of an item over its useful life, which can help it smooth out its profits and tax bills from year to year. There are various methods for calculating depreciation, but the IRS typically requires a specific one.

- A new car loses somewhere between 9% and 11% of its value the moment you drive it off the lot.

- Farmers can depreciate the value of livestock they use for breeding. The IRS once let a farmer in Louisiana depreciate the value of an ostrich.

- Depreciation can be a (surprisingly legal) way for companies to manipulate their profits from year to year. That’s because they have some leeway when making assumptions about an item’s useful life and salvage value. Companies can also periodically change which method they use for calculating depreciation.

- Items lose value over time due to wear and tear. This decrease is known as depreciation.

- Depreciation lets a business spread out the cost of an asset over its useful life for accounting and tax purposes.

- You can calculate depreciation in multiple ways. The simplest way is to assume that an asset loses an equal amount of its value every year.

- Depreciation only applies to physical items that lose their value. Non-physical items, such as intellectual property, don’t depreciate. Neither do physical things that hold their value over time, such as land.