Growth vs. Value Investing

Moves Like Buffett

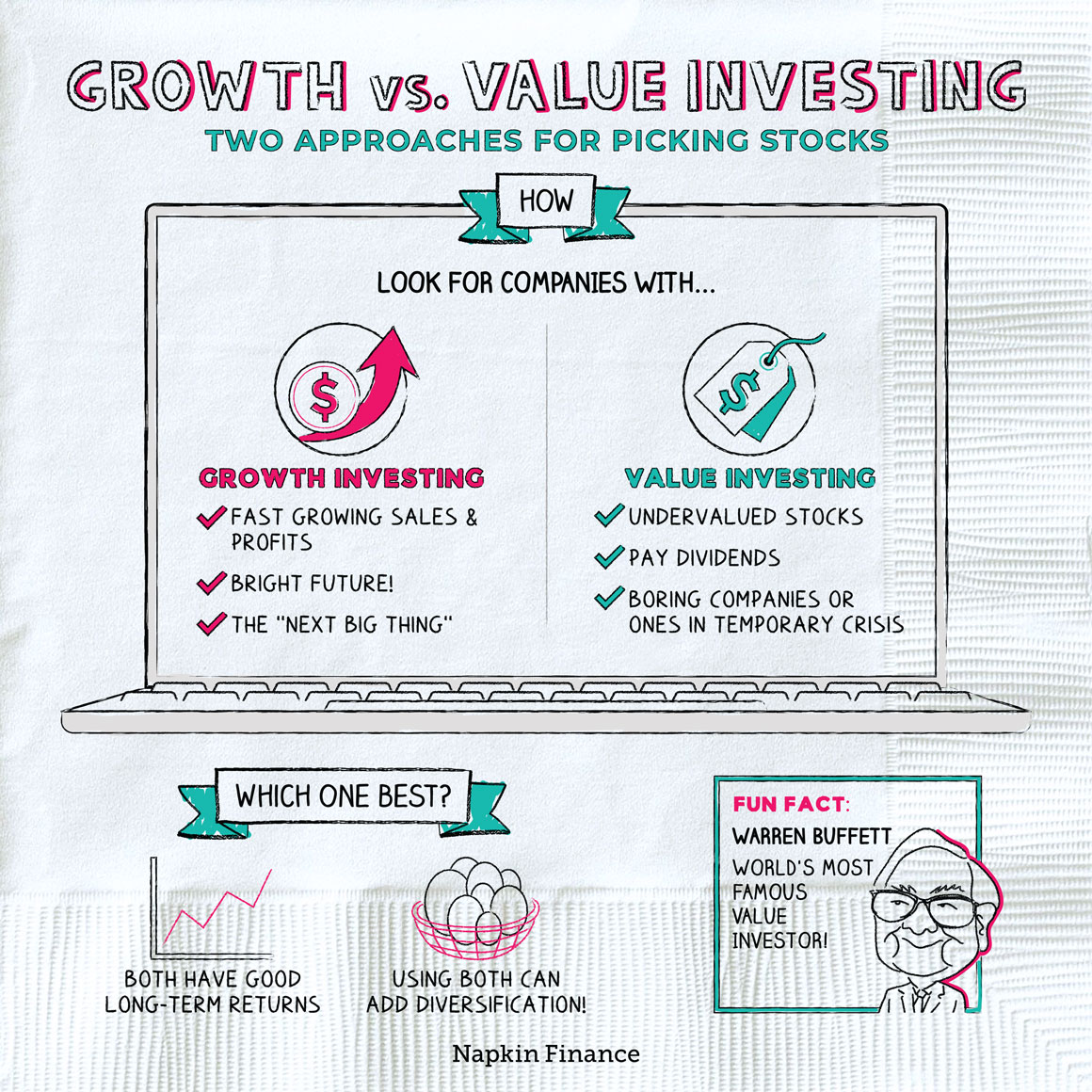

Growth and value investing are two different approaches to investing in stocks.

Growth investors aim to invest in fast-growing companies, while value investors focus on finding undervalued stocks.

Growth investors buy stock in companies that are expanding rapidly and have (or will soon have) strong profits. These companies might have a new product or a unique business model that’s disrupting an existing industry, which is why investors expect big gains.

Value investors look for undervalued stocks or those trading for less than they’re actually worth. These companies are still fundamentally strong but have hit a temporary hiccup, such as a corporate scandal.

Investors who follow one approach or the other often have some specific characteristics in mind that they look for in a company before investing:

- Growth investors may look for:

- Fast-growing sales

- Fast-growing profits

- Quickly expanding into new geographic areas or new products

- Gaining market share

- Value investors may look for:

- Low P/E ratios

- High dividends

- Companies suffering a short-term setback

- Slow and steady profits

That said, every investor may have their own particular preferred approach and criteria.

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it’s marked down.“

—Warren Buffett

Growth investors and value investors may evaluate hundreds or thousands of stocks while they’re searching for a stock with the right characteristics. But the types of companies that meet each one’s criteria often end up fitting a certain profile.

Here’s what a typical growth stock or typical value stock might look like:

| Growth | Value | |

| Company type | Young and up-and-coming | Older and more boring |

| Industries |

|

|

| Examples |

|

|

In terms of returns, growth and value investing are pretty evenly matched.

Often, one approach will show better returns for a few years in a row. But inevitably, then the other approach will pull ahead and go through a period of stronger returns (investors may say that one approach is “in favor,” while the other is “out of favor” when this happens).

Instead of only investing according to one style, it usually makes sense to diversify by holding a bit of both. That can give you a mix of different types of companies in a variety of industries. And it means that you don’t have to worry about which approach is in or out of favor.

There are a few basic ways to invest with a growth and/or value approach:

- Mutual funds—Invest in a fund run by a professional manager who will try to pick great growth or value stocks.

- ETFs—Buy an ETF that tracks a growth or value index.

- Pick your own stocks—Do your own research and put together your own mix of growth and/or value stocks.

Picking stocks yourself gives you more control over exactly what you own, but it also takes a lot more legwork. Investing with funds can give you instant diversification, but it also means you’re paying a management fee to the company that runs the fund.

Growth and value are two different styles investors can use to pick stocks. Growth investors look for companies with rapidly growing sales and profits. Value investors aim to find stocks that trade for less than what they’re really worth. Either approach can deliver solid returns over time, and it often makes sense to include some growth and some value investments in your portfolio.

- Billionaire Warren Buffett is perhaps the most well-known value investor. He got his start at age 11, investing in Cities Service stock at $38 per share (he could only afford to buy three shares).

- Growth stocks can be agonizing to hold. Over a 20-year period, Monster Beverage’s stock increased 105,000 percent, but on four different occasions it also lost 50 percent or more of its value.

- Value and growth investing are two styles for picking stocks.

- Value investors buy stock in undervalued companies that are still likely to turn a profit in the future because they’re fundamentally strong.

- Growth investors choose companies that are quickly growing and expected to have big earnings.

- Although one approach may do better than the other in any particular year, over the long run, both approaches have solid track records.

- You can follow a growth or value investing style (or both!) by investing in mutual funds or ETFs or by picking stocks yourself.