Quantitative Easing

Easy Money

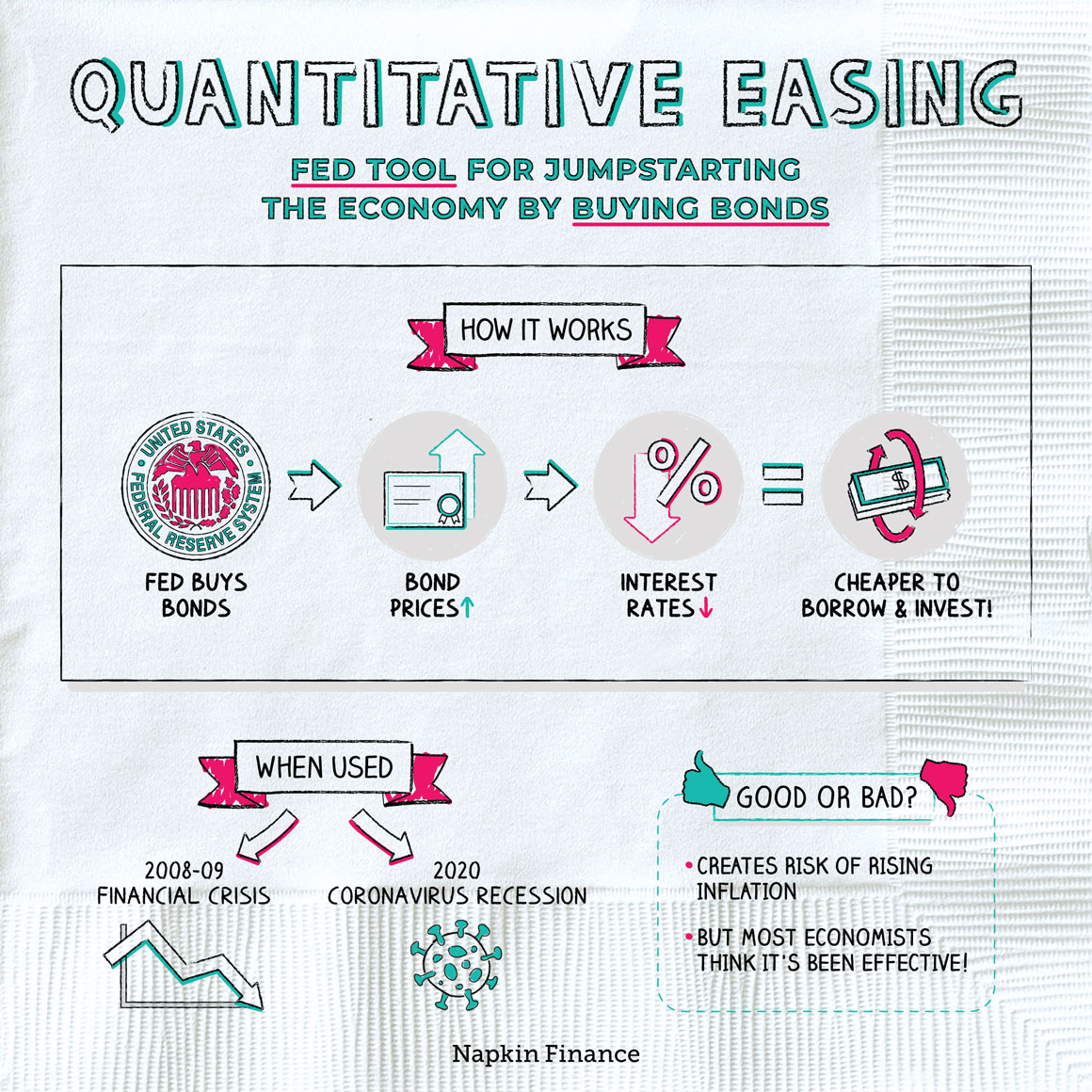

Quantitative easing is when the Fed (or another country’s central bank) buys up large amounts of bonds.

It’s one type of monetary policy tool the Fed can use to try to help the economy when it needs a boost.

Quantitative easing works by lowering interest rates on long-term bonds. Here’s how:

Step 1: The Fed starts buying lots of bonds (think hundreds of billions of dollars) in the bond market.

Step 2: This creates lots of new demand, which pushes bond prices up.

Step 3: Bond prices and interest rates always move in opposite directions. So as bond prices rise, interest rates fall.

With lower interest rates, it’s cheaper for businesses and consumers to take out loans and make investments. More borrowing and investing can help the economy start to regain its momentum and turn around from a slowdown.

Central banks may turn to quantitative easing as a second-resort option.

Usually, their first resort is to lower short-term interest rates. In the U.S., the Fed does this by reducing the:

- Federal funds rate—the interest rate banks charge one another on overnight loans

- Discount rate—the rate the Fed charges banks on loans

However, those two interest rates only apply to very short-term loans (like loans made for one day), and lowering those rates doesn’t do much to affect the interest rates that you might pay on a mortgage or that a business might pay on a loan.

Quantitative easing can let the Fed reduce interest rates throughout the economy, which can have a bigger impact on restarting economic growth.

In theory, central banks can buy any type of bond when they engage in quantitative easing. In practice, they typically buy:

- Government bonds, like Treasuries

- Corporate bonds

- Mortgage-backed securities

Like any type of economic intervention, quantitative easing can be controversial and comes with risks. Those can include:

- Rising inflation—buying bonds increases the amount of money in circulation, which can lead to inflation.

- Ineffectiveness—if quantitative easing doesn’t lower interest rates as promised, investors may start to doubt whether the Fed is really in control of the situation. That kind of doubt and worry can lead to a downward economic spiral.

- A bumpy ending—eventually, the Fed will have to stop buying bonds and let interest rates rise. But rising rates can potentially send the economy back into a downturn.

But all in all, the consensus is that quantitative easing programs (like the types many central banks used in the aftermath of the 2008-09 financial crisis) have been successful in turning struggling economies around.

Quantitative easing is when the Fed (or another central bank) buys up lots of bonds. It’s one tool central banks can use to help restart a slowing economy. Quantitative easing works by lowering interest rates on long-term loans, which can make it cheaper for businesses and consumers to borrow and invest.

- The Fed bought about $3 trillion of bonds and mortgage-backed securities as part of its immediate response to the 2008-09 financial crisis.

- Although quantitative easing (or “QE” as finance types call it) is mainly associated with the 08-09 crisis, it became just as important a tool in supporting the economy during the coronavirus recession, with the Fed buying trillions of dollars in assets during 2020.

- You can measure the total scale of the Fed’s quantitative easing programs by looking at the size of its balance sheet. The Fed’s assets have grown from $900 billion in 2008 to $4.5 trillion in 2015 to more than $7 trillion in 2020.