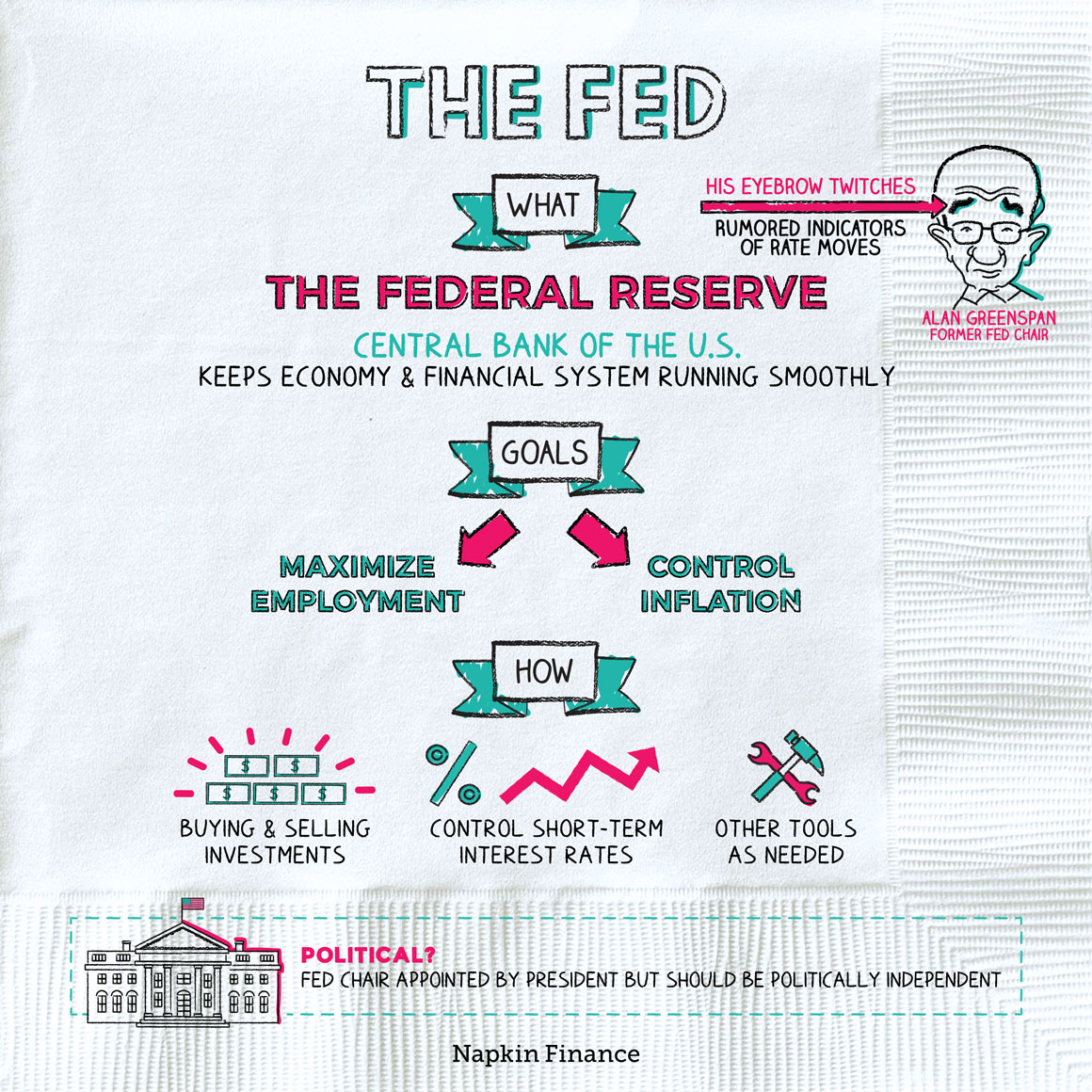

The Fed

Making a Federal Case

The Fed is the central bank of the U.S. Its overarching role is to make sure that the country’s economy and financial system function smoothly.

The Fed has two official goals:

- Maximizing sustainable employment

- Supporting stable prices (i.e., regulating inflation) and moderate long-term interest rates

Here’s what the Fed has in its toolbox:

| What | How | Why |

| Interest rates | The Fed controls very short-term interest rates.

Although it doesn’t control the rate you pay for a mortgage or on your credit card, its actions affect these rates. |

Lowering interest rates hits the gas on economic growth and inflation.

Raising interest rates hits the brakes. |

| Market manipulation | The Fed can buy and sell U.S. government debt, and in some cases other instruments. | By buying long-term debt, the Fed can lower long-term interest rates, which further boosts the economy.

Buying securities has the effect of adding money to the economy—this is why people say the Fed “prints money.” |

| Improvising | If the economy’s in a bind, the Fed may be able to come up with a creative way of helping. | Sometimes, interest rates alone aren’t a strong enough solution. |

At times, the Fed may only use one or two of these tools at a time. But if the economy’s in freefall the Fed may throw the kitchen sink at it.

During the 2008-2009 financial crisis, for example, the Fed cut interest rates essentially to zero and bought trillions of dollars of mortgage-backed securities to help stabilize the economy. But it also got creative: working to prevent massive bank failures by helping orchestrate acquisitions (so failing banks could be purchased instead of going bankrupt).

While monetary policy—changing very short-term interest rates to help control inflation and stabilize employment—is perhaps the Fed’s most vital role, it has a few other jobs, including:

- Supervising and regulating banks: I.e., protecting consumers, promoting safety in financial transactions, and securing the nation’s financial system

- Operating the national payments system: The Fed assists in electronic funds transfers, distributes currency to banks and credit unions, and clears checks

- Developing other financial regulations: The Fed comes up with rules that banks and other financial entities have to play by

“The Fed” isn’t really just one institution. It’s actually a network, made up of three key players:

- Board of Governors

- Seven members, who are appointed by the president and confirmed by the Senate

- Sets policies on some interest rates, issues regulations, oversees banking activities and the regional Federal Reserve Banks

- Federal Open Market Committee

- Board of Governors plus five regional Federal Reserve Bank presidents

- Sets the federal funds rate target (the interest rate you most often hear about in the news)

- Federal Reserve Banks

- Twelve banks in major cities around the country, including San Francisco, Chicago, and Boston

- Oversee banking activities within their set geographic areas

Since the Fed may need to take actions that are unpopular with the party in power—such as by raising rates when the economy is overheating—it is supposed to be politically independent. However, the head of the Fed is appointed by the president, and it’s not unheard of for a president to try to influence it.

The Fed is the central bank of the U.S. It conducts monetary policy in an effort to keep the economy on track, by stabilizing employment and controlling inflation. It also works to protect consumers, oversees banks and credit unions to deter risky behavior, and secures the nation’s system of payments. The Fed isn’t actually just one institution, but rather a network of regional and federal entities.

- It’s true that the Fed metaphorically prints money, but it doesn’t literally print money—the Treasury does.

- The stock market typically jumps when the Fed says (or hints) that it might cut rates and falls when it announces plans to hike rates. Vigilant traders used to scrutinize former Fed chairman Alan Greenspan’s every move—down to twitches in his eyebrows—for clues about what the Fed’s next action might be.

- The Fed aims to keep the U.S. economy and financial system on track.

- The Fed controls some interest rates and may be able to affect the financial system in other ways, depending on the needs of the day.

- The Board of Governors, Federal Open Market Committee, and twelve regional Federal Reserve Banks are the three components of the Fed.

- In addition to influencing monetary policy, the Fed also works to protect consumers, ensure the stability of the nation’s financial system, and oversee certain banking activities.