The Stock Market

Greed Is Good

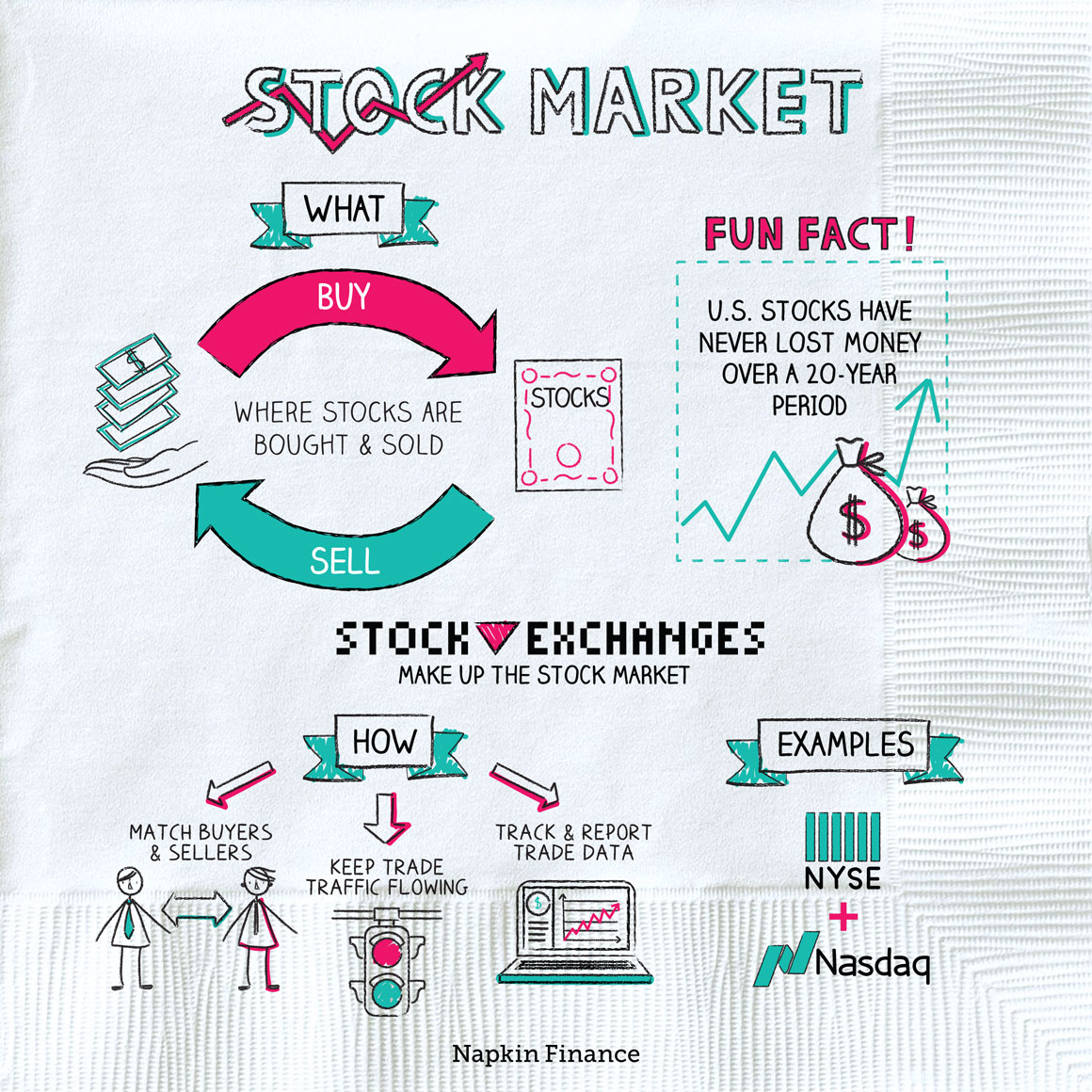

The stock market is the collection of physical and electronic markets where buyers and sellers come together to trade shares.

Most (though not all) of the world’s stock trading happens through stock exchanges. You can think of the stock market as like one giant, global auction. In that case, then stock exchanges are a bit like individual auction houses.

The main stock exchanges in the U.S. are:

- The New York Stock Exchange (NYSE)—which has a physical trading floor but also handles electronic orders

- The Nasdaq—which is an all-electronic exchange

Their main roles are to:

- Match buyers and sellers

- Keep trade traffic flowing

- Track and report data on trades so that investors can see what the market is doing

Investors can only trade stocks that are “listed” on a given exchange with that exchange. But most individual investors (like you) don’t trade directly with the exchange. Instead, you’d set up an account with a broker, who handles the actual mechanics of trading for you.

There are 60 major stock markets around the world of which the NYSE is the largest. Some of the other major players include:

- Tokyo Stock Exchange → Japan

- London Stock Exchange → United Kingdom

- Hong Kong Stock Exchange → Hong Kong

- Shanghai Stock Exchange → China

- BSE (formerly the Bombay Stock Exchange) → India

- Shenzhen Stock Exchange → China

The stock market has its own language, which can make getting started a little intimidating. To help make sense of it all, some terms to know include:

- Ask price: What you can pay to buy a share.

- Bid price: What you can receive for selling a share.

- Broker: A person (or company) that buys and sells shares on your behalf.

- Dividend: Company profits paid to shareholders as cash.

- Earnings: A company’s profits. Companies report profits four times a year, and those events often drive a lot of movement in their stock prices.

- Initial public offering (IPO): When a company first “lists” its shares with a stock exchange and its shares start trading in the stock market.

- Ticker symbol: A few letters that identify a company’s shares in the stock market, like “AAPL” for Apple.

- Trading volume: Number of shares traded each day.

The stock market is really the sum of all individual stocks. When an individual stock moves—because, say, investors are expecting higher or lower profits—the market as a whole moves a tiny bit (think fractions of fractions of a percent).

But often lots of stocks move up and down together because of big-picture stuff that’s happening in the economy. Some of those big-picture things that tend to move the market include:

| Economic growth | Higher economic growth = higher corporate profits = stocks go up

Lower economic growth = lower corporate profits = stocks go down |

| Interest rates | Higher interest rates = stocks go down

Lower interest rates = stocks go up |

| Tax rates | Taxes lowered on corporate profits = stocks go up

Taxes raised on corporate profits = stocks go down |

| Inflation | Strong inflation or strong deflation = more uncertainty = stocks go down

Moderate or steady inflation = less uncertainty = stocks go up |

| Economic growth in other countries | Higher economic growth = higher corporate sales to other countries = stocks go up

Lower economic growth = lower corporate sales to other countries = stocks go down |

| Shocking events | Pandemics, terrorist attacks, or other big shocks = more uncertainty = stocks go down |

The stock market is where investors can trade stocks, or shares, which are small pieces of ownership of publicly traded companies. Most trading happens on stock exchanges—of which there are dozens around the globe. The stock market moves up and down for many reasons, including with levels of corporate profits, interest rates, and inflation.

- Wall Street is named for a real wall. In the seventeenth century, Dutch colonists built a wall in lower Manhattan to help them defend against an expected British invasion.

- Wall Street didn’t become an official financial hub for another hundred years when a group of local merchants signed an agreement under a famous buttonwood tree on Wall Street. The Buttonwood Agreement was the predecessor to the NYSE.

- The NYSE is so large that it’s bigger than the 50 smallest major stock exchanges combined.

- Although U.S. stock may lose money in a given year—or even over several years—they have always bounced back. Returns on the S&P 500 have never been negative over a twenty-year period.

- The stock market is the collection of physical and electronic markets around the world where investors can trade shares of companies.

- Most trading in the stock market happens on stock exchanges. The role of exchanges is to link buyers with sellers and keep transactions flowing smoothly.

- The stock market is made up of all individual stocks—so when individual stocks move, the market moves.

- Economic growth, interest rates, tax rates, and inflation can influence the broader stock market’s movements.