Municipal Bonds

One for the Road

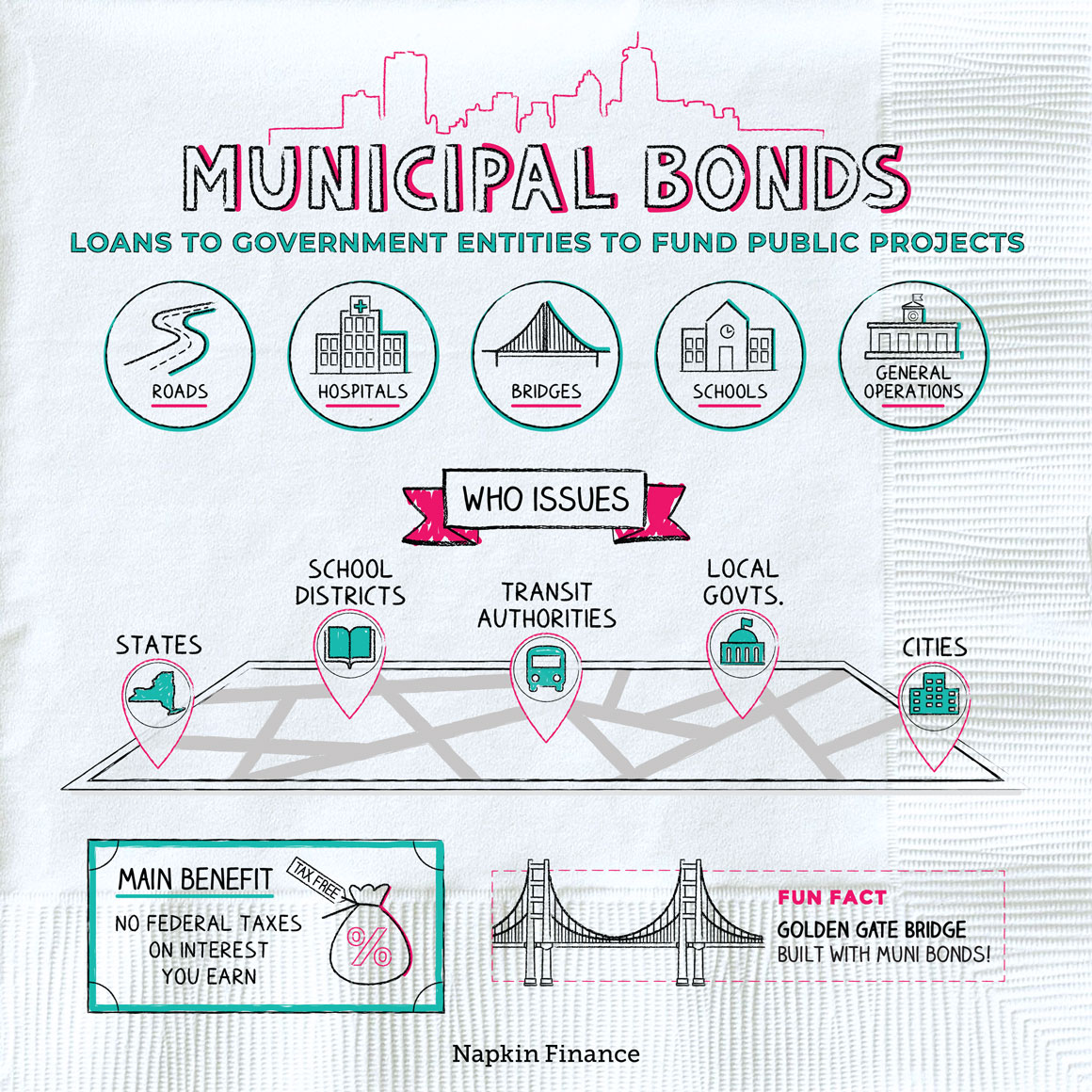

A municipal bond, or muni bond, is a type of bond issued by a state or local government to raise money for public projects.

Think of a muni bond as essentially a loan from an investor to the government.

When a government entity needs to raise money to pay for a big project, it sells bonds to interested investors. Here’s an example of how it can work:

The state decides to issue muni bonds

to pay for a new highway.

↓

Investors buy the muni bonds,

which provides the government the money it needs.

↓

The government may use funds from the highway (like tolls)

or from other sources to repay investors.

↓

Investors receive interest (usually semiannually)

plus the original investment when the bond matures.

Muni bonds can be issued by states, cities, counties, or other municipal entities, like a water district.

Governments use muni bonds to raise funds for projects that will benefit the public. Common examples include:

- Roads, highways, bridges, and other infrastructure

- Hospitals

- Schools and libraries

- Government buildings

- Power plants

- Sewer systems

Other bonds may be issued to fund an entity’s day-to-day operations.

Muni bonds can be a popular investment option because they offer:

- Low risk—Because they’re backed by government entities, muni bonds generally come with low risk of default. (Bonds are usually issued with credit ratings, which rate how likely the borrower is to make on-time payments—like a credit score.)

- Tax advantages—The interest you earn is usually exempt from federal income taxes. If you buy bonds from an entity in your home state, there’s a good chance you can also skip state income taxes.

- Steady income—Muni bonds are often popular with retiree investors as a way of earning a steady paycheck from their portfolio.

Because tax advantages are a main draw of municipal bonds, they typically make more sense to hold in a taxable account (like an ordinary brokerage account instead of an IRA or 401(k)). Those tax benefits become more valuable for investors who are in higher tax brackets—so the bonds also tend to be popular with wealthy investors.

The two most common types of muni bonds are general obligation and revenue bonds. The major difference is what pot of money investors are paid from.

| General obligation bond | Revenue bond | |

| Repaid with | The general revenues of the entity, i.e.:

|

Funds from a specific source, i.e.:

|

| Who issues |

|

|

General obligation bonds are often considered to be lower risk and so come with lower interest rates than revenue bonds.

All municipal bonds are different, so it’s important to do your research on what’s being offered, when it’s available, and the exact bond specifications. In fact, you might want to talk with an investment advisor or broker to make sure you know what you’re getting into.

Here are a few things to keep in mind:

- Although each muni bond typically has a $1,000 face value, brokers don’t usually sell them one-by-one. You may need at least $5,000 to buy anything and at least $100,000 to start to build a diversified portfolio.

- Bonds can be short term or long term, ranging from around one year to decades.

- In some cases, the issuer may be able to “call,” or redeem, a bond early, in which case you receive your principal back sooner than you’d expected.

- Some muni bonds are considered illiquid, meaning they’re hard to sell if you need quick cash.

If you do decide to invest, buying individual bonds isn’t the only way to go. There are also mutual funds and ETFs that invest exclusively in muni bonds.

State and local governments issue municipal bonds to raise money to pay for general expenses and fund specific projects, including building new roads, schools, and water systems. Municipal bonds can be a popular option for investors because they’re usually low risk and pay interest that’s typically exempt from federal income taxes.

- What do the Golden Gate Bridge, Hoover Dam, and New York City subway system have in common? All are brought to you by muni bonds.

- Muni bonds are around 20 times less likely to default than corporate bonds with similar credit ratings.

- Municipal bonds are debt investments issued by state and local government entities to raise money to fund operations or certain projects.

- The bonds can be issued by states, cities, counties, utility providers, transit authorities, school districts, hospitals, and more.

- The two main types of muni bonds are general obligation and revenue bonds. General obligation bonds are generally paid back with taxes on residents, while revenue bonds are paid with revenues from a specific source, like highway tolls.

- The advantages of investing in muni bonds can include favorable tax treatment, reliable steady income, and comparatively low risk.

- However, it can be difficult for the average investor to build a portfolio of muni bonds, and individual bonds can also be difficult to sell if you were to one day need quick access to your cash.