Featured Napkin

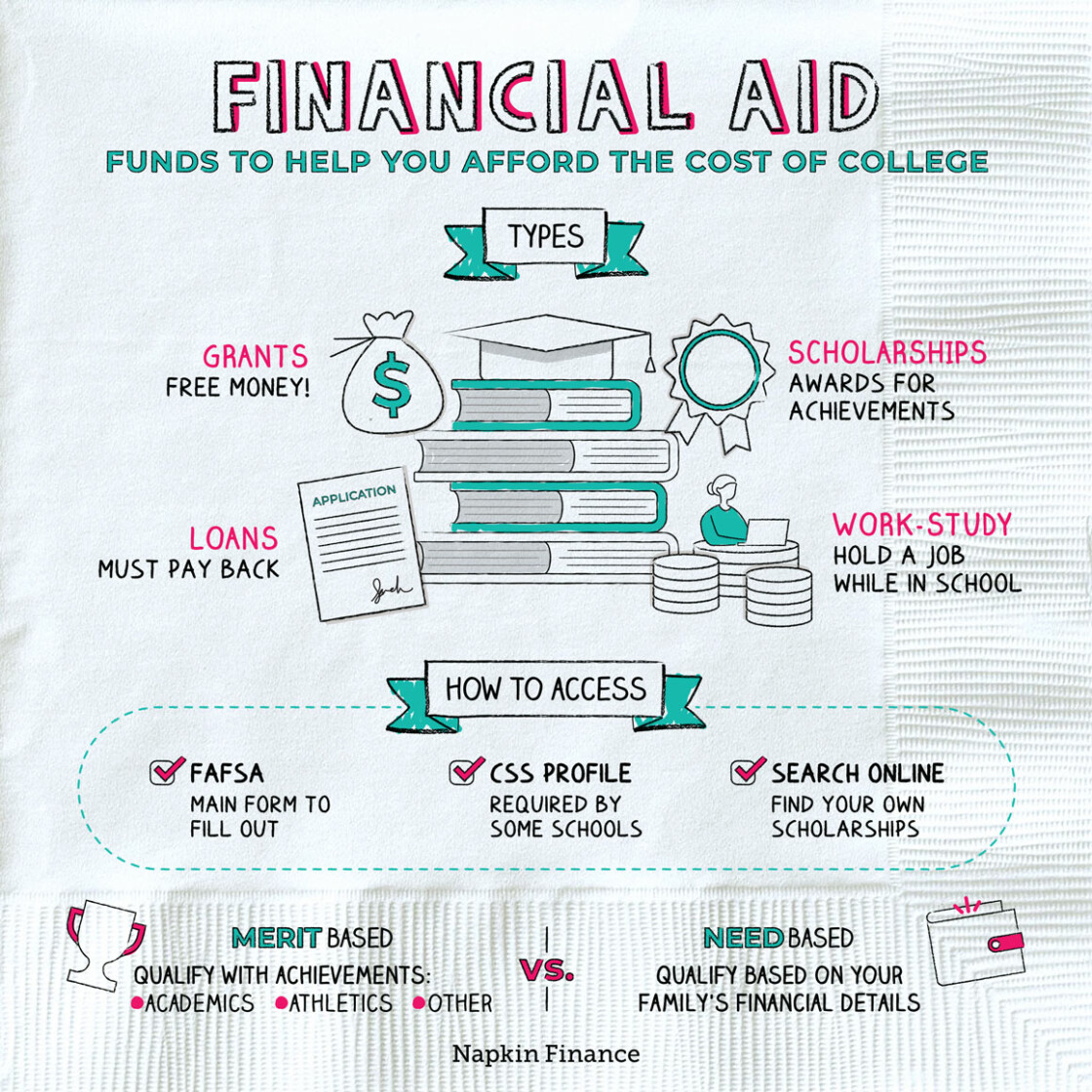

Financial Aid

Lean on Me

Financial aid can refer to any of a number of types of assistance that help students afford the cost of higher education (whether college or grad school). Financial aid is there to help you close the gap between how much money you need and how much you have.

Learn moreMore college Napkins...

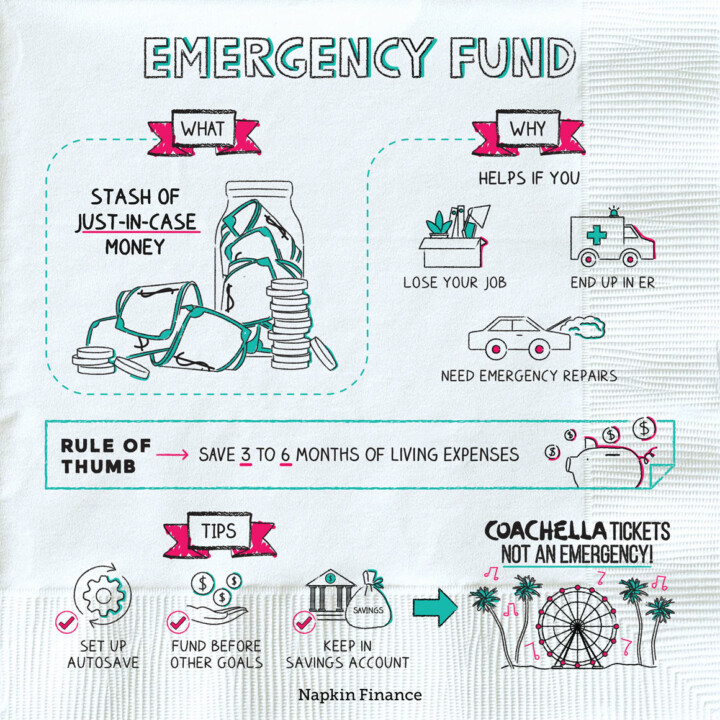

Emergency Fund

Cash Cushion

An emergency fund is your stash of just-in-case money. Along with your insurance coverage, it’s a vital...

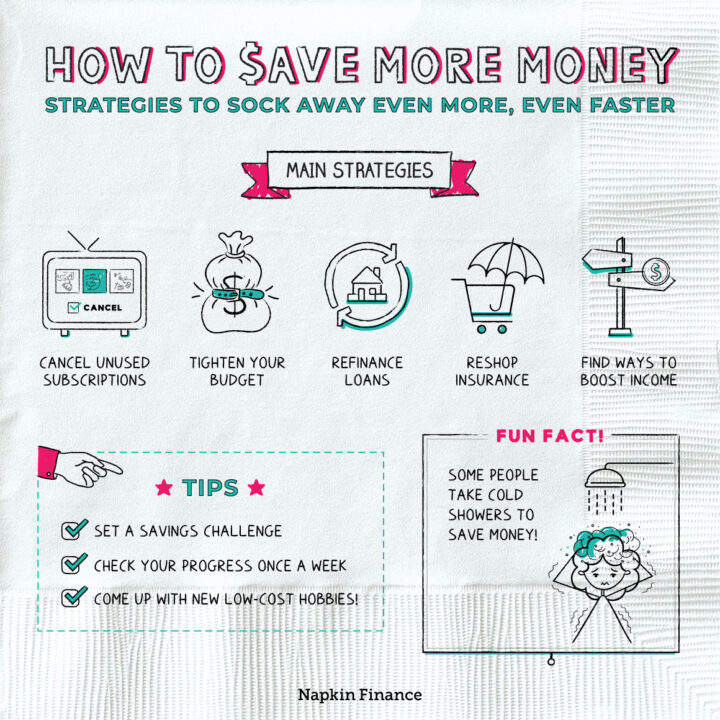

Learn moreHow to Save More Money

Keep the Change

Like many good habits, saving more money is easier said than done. Once you’ve gotten into a...

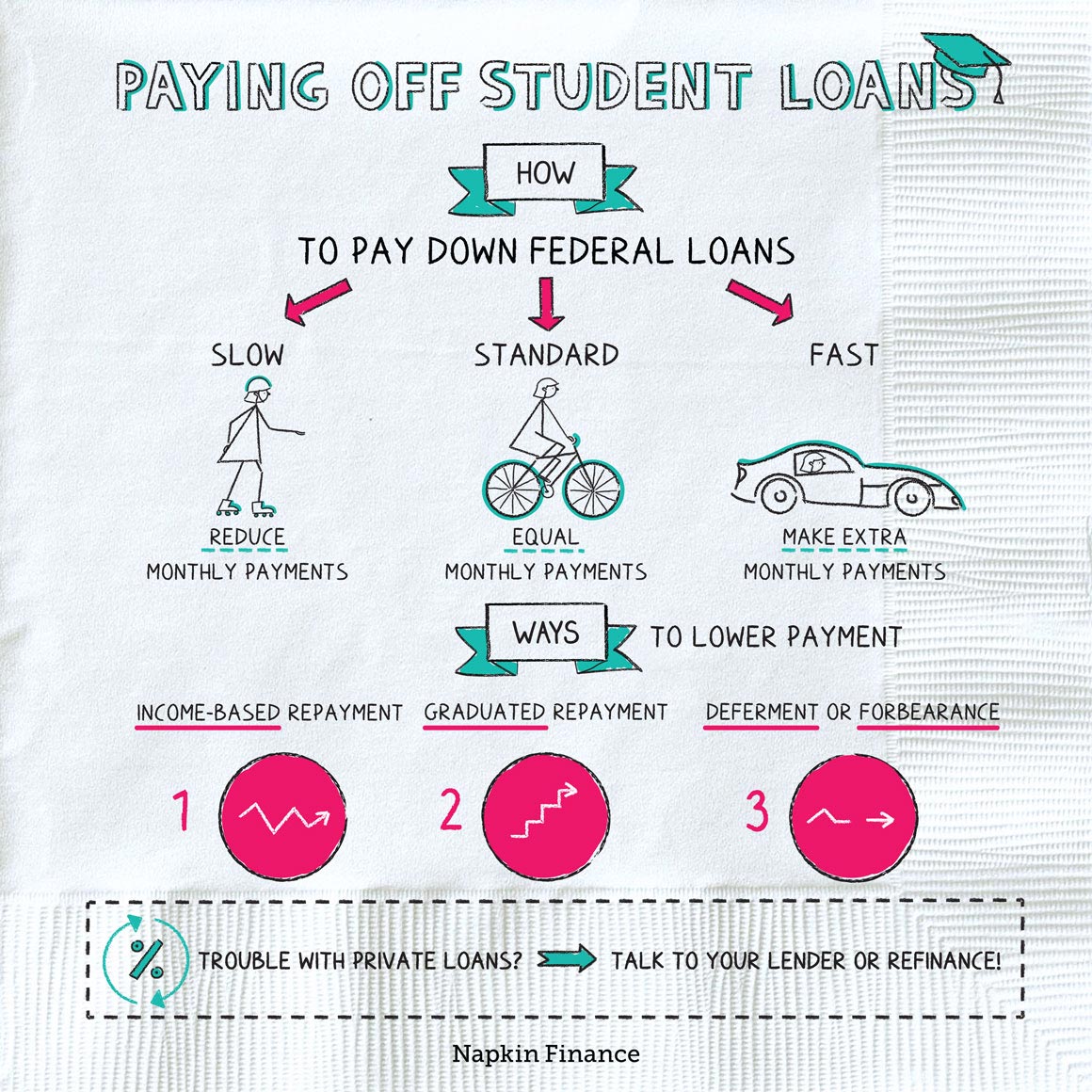

Learn morePaying Off Student Loans

Take a Load Off

It might seem like there’s only one way to pay down your student loans (namely: slowly, painfully,...

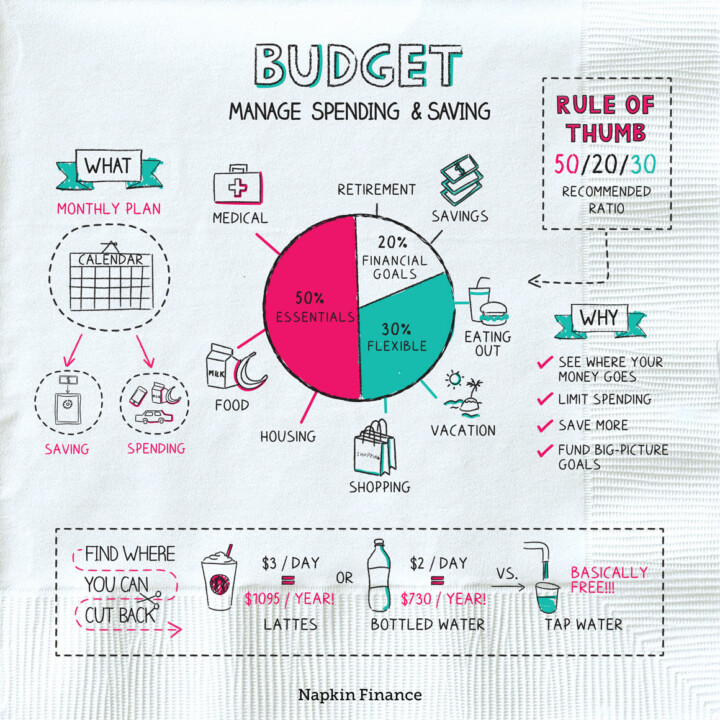

Learn moreBudget

Nickels and Dimes

A budget is a plan you can use to better manage your spending and saving. When you...

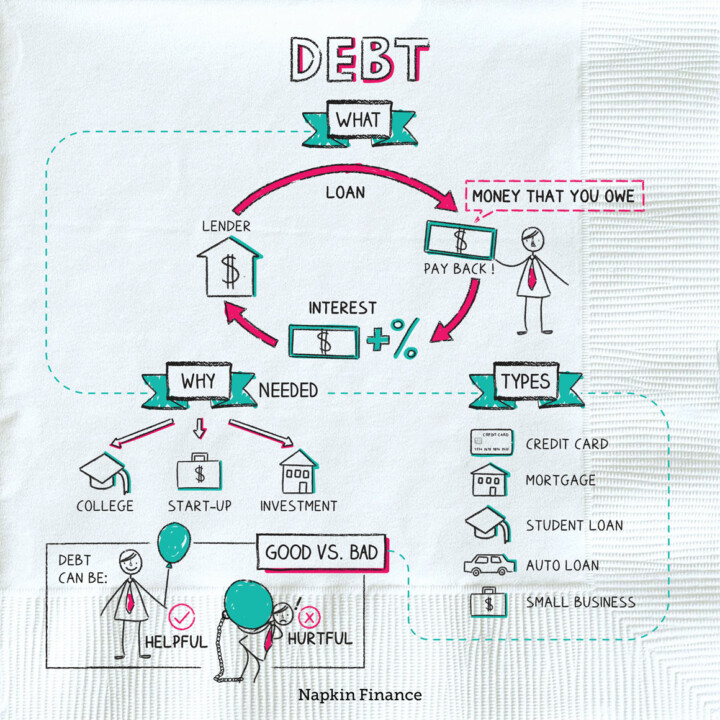

Learn moreDebt

It All Adds Up

Debt is money that you owe to another person or a financial institution. When you borrow money,...

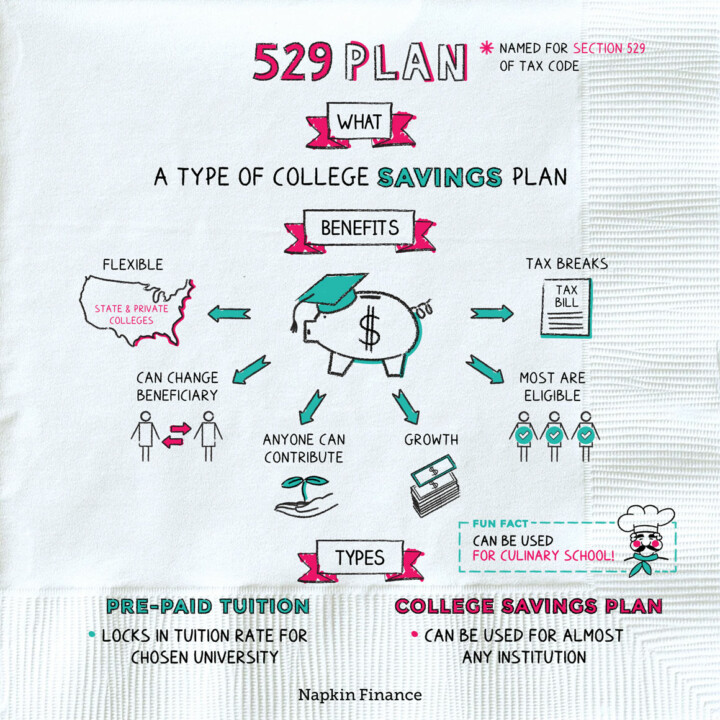

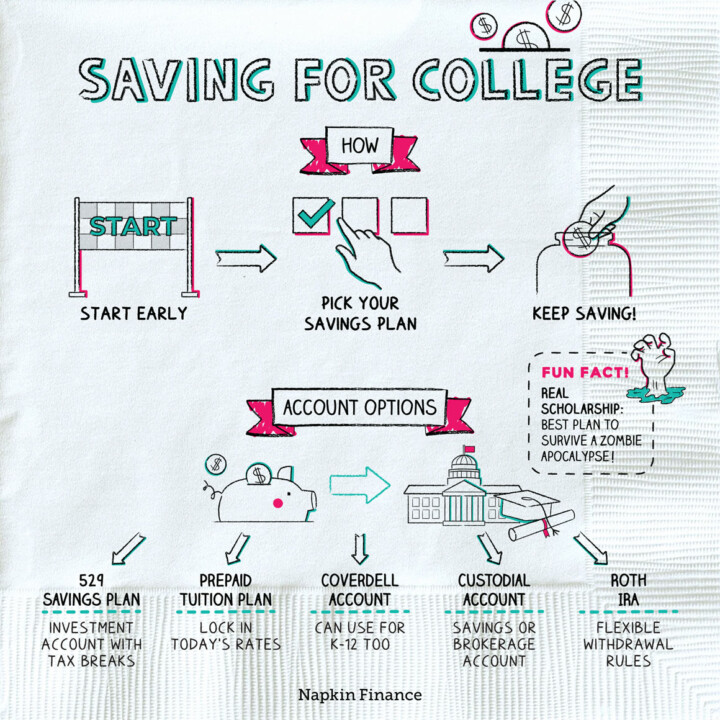

Learn more529 Plan

Higher Ed, Higher Returns

A 529 plan is a tax-advantaged college savings account sponsored by a state government or education institution....

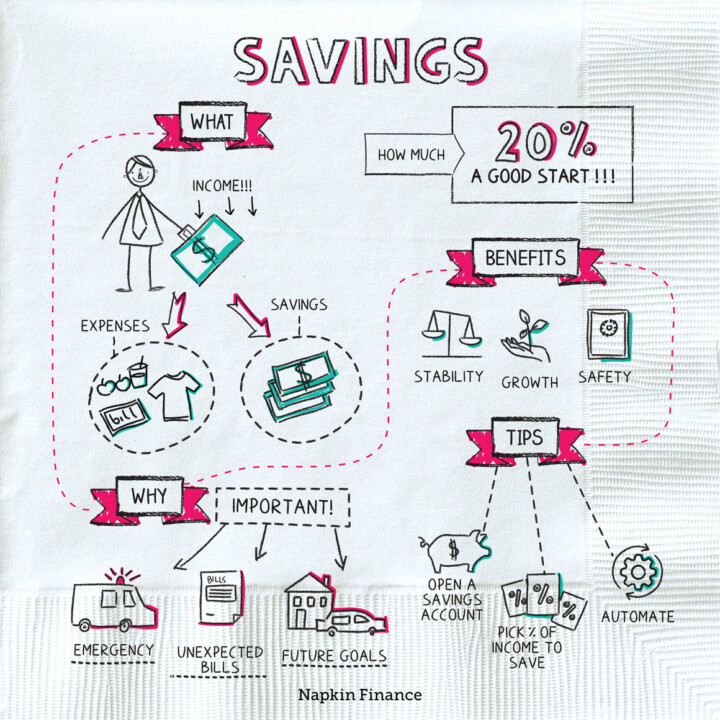

Learn moreSavings

One Penny at a Time

Savings are funds that you put aside and don’t spend. Life can be full of surprises, both...

Learn moreSaving for College

Pay Your Dues

Saving for college means setting aside funds for education expenses. It means making a dedicated investment in...

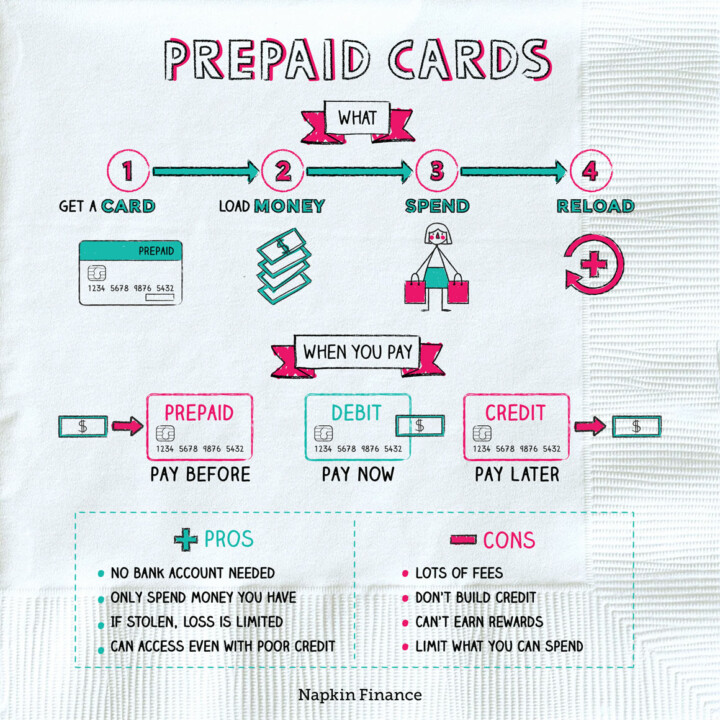

Learn morePrepaid Card

Top Off

A prepaid card lets you spend money that you’ve already added to the card. It’s similar to...

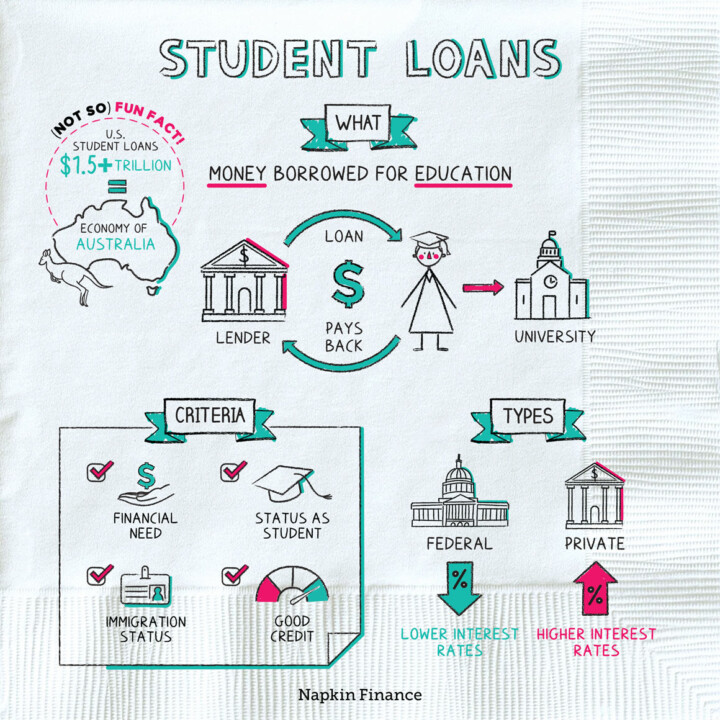

Learn moreStudent Loans

Old College Try

A student loan can be any kind of borrowed money that’s used to pay for education. Although...

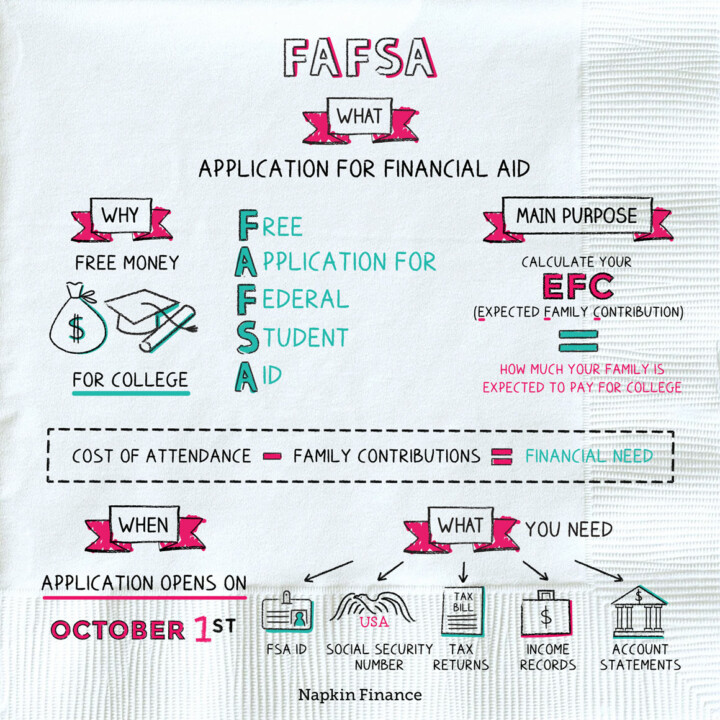

Learn moreFAFSA

Aid and Abet

The Free Application for Federal Student Aid, or FAFSA, is a form that college and grad students...

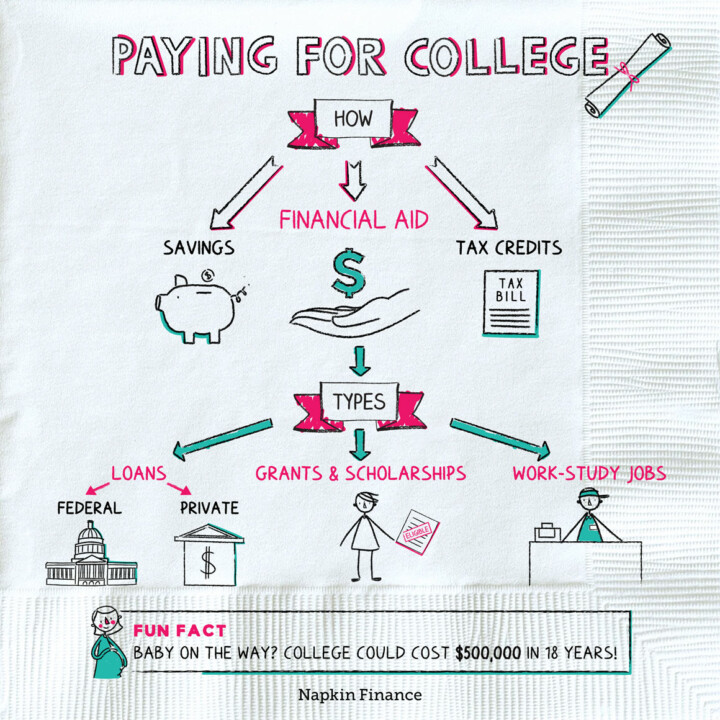

Learn morePaying for College

Higher Education, Higher Costs

Going to college can lead to better jobs and bigger paychecks. But it comes at a high...

Learn more