Real Estate

Location, Location, Location

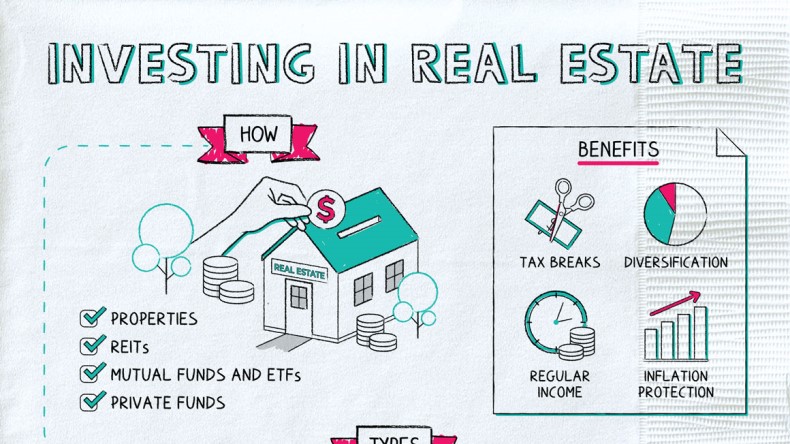

Buying real estate—whether on your own or by pooling your resources with other investors—is one possible way you can invest your money.

Investing in real estate means owning land plus any buildings and other natural or man-made features on it.

There are three main ways you can make money on a real estate investment:

- Price gains—i.e., you buy a property for a lower price and eventually sell it for a higher one

- Charging rent—whether you’re renting apartments to families, office complexes to corporations, or storefronts to retail businesses

- Harvesting resources—such as if you own timberlands or oil-producing properties

And those three ways aren’t mutually exclusive. For example, you could buy a duplex, rent it out to tenants for a few years, and then eventually sell it for a profit to boot.

When it comes to investing in real estate, the world is your oyster. You might opt for:

| Type | Examples |

| Residential | Single-family homes, townhomes, condos |

| Commercial | Office buildings, restaurants, storefronts |

| Industrial | Warehouses, factories |

| Land | Farms, ranches, timberlands, or even raw land that isn’t currently being put to any use |

Although investing in real estate may make you mainly think of home flippers, there are actually a number of different ways of going about it:

- Go it alone. Buy an entire property all on your own and then rent it out to tenants or renovate it and resell it (or both!).

- Buy real estate stocks. So-called Real Estate Investment Trusts (aka REITs) are stocks of corporations that almost exclusively own and rent out properties. They make being a real estate magnate accessible to ordinary people.

- Invest in a mutual fund or ETF that owns REIT stocks or shares of companies that are otherwise closely tied to real estate.

- Invest in a private pooled fund. These may be called private placements or limited partnerships. They’re a bit like hedge funds that focus on real estate.

Real estate investing can be risky but can also come with big rewards, such as:

- Tax breaks—you can usually deduct a host of costs if you’re a landlord, such as property taxes, mortgage interest, and the cost of repairs.

- Income—if you choose your tenants wisely, you can receive steady, reliable income.

- Diversification—if you already own stocks and bonds, adding some real estate to your portfolio can reduce risk through the benefits of diversification.

- Inflation protection—investing in real estate is considered to be one of the best ways of making sure your money keeps pace with inflation over time.

Of course, you should balance these benefits with risks, such as high up-front costs (plus the extreme patience you may need to exercise as a landlord).

“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense… it is about the safest investment in the world.“

—President Franklin D. Roosevelt

Before investing in real estate, you’ll want:

- Adequate resources: In addition to the cost of purchasing the property, you’ll face regular demands on your cash for property taxes, maintenance, and insurance.

- Basic real estate knowledge: You don’t need to be a realtor, but you should know the ins and outs of the market in your area.

- Tax smarts: Investing in real estate comes with its own set of tax rules (which are surprisingly different from the rules that apply to the home you live in). You’ll want to make sure you know them inside and out if you want to avoid a big tax bill when it’s time to sell.

Investing in real estate can mean becoming a landlord, buying real estate stocks or mutual funds, or investing in private real estate ventures. You can invest in real estate with residential, commercial, industrial, or even undeveloped properties. Investing in real estate comes with many benefits, including tax breaks, steady income, diversification, and inflation protection.

- Warren Buffett, one of the richest people in the world, still lives in the Omaha, Nebraska, house he bought in 1958 for $31,500.

- Some 90% of the world’s millionaires made their money through real estate.

- Monopoly has been teaching us about real estate since the 1930s, but Parker Brothers originally rejected the game because it contained (they claimed) 52 errors, including length, complexity, and theme.

- In addition to traditional stocks and bonds, real estate can be a solid way to invest your money.

- Investing in real estate can mean buying and fixing houses to sell for a profit, renting out a property to collect money from tenants, or joining multiple investors to join a private real estate venture.

- Possible investment properties can include single-family homes, storefronts, restaurants, warehouses, and even undeveloped land.

- The benefits of real estate investing include tax breaks, steady income, diversification, and keeping pace with inflation.