Dividends

Show Me the Money

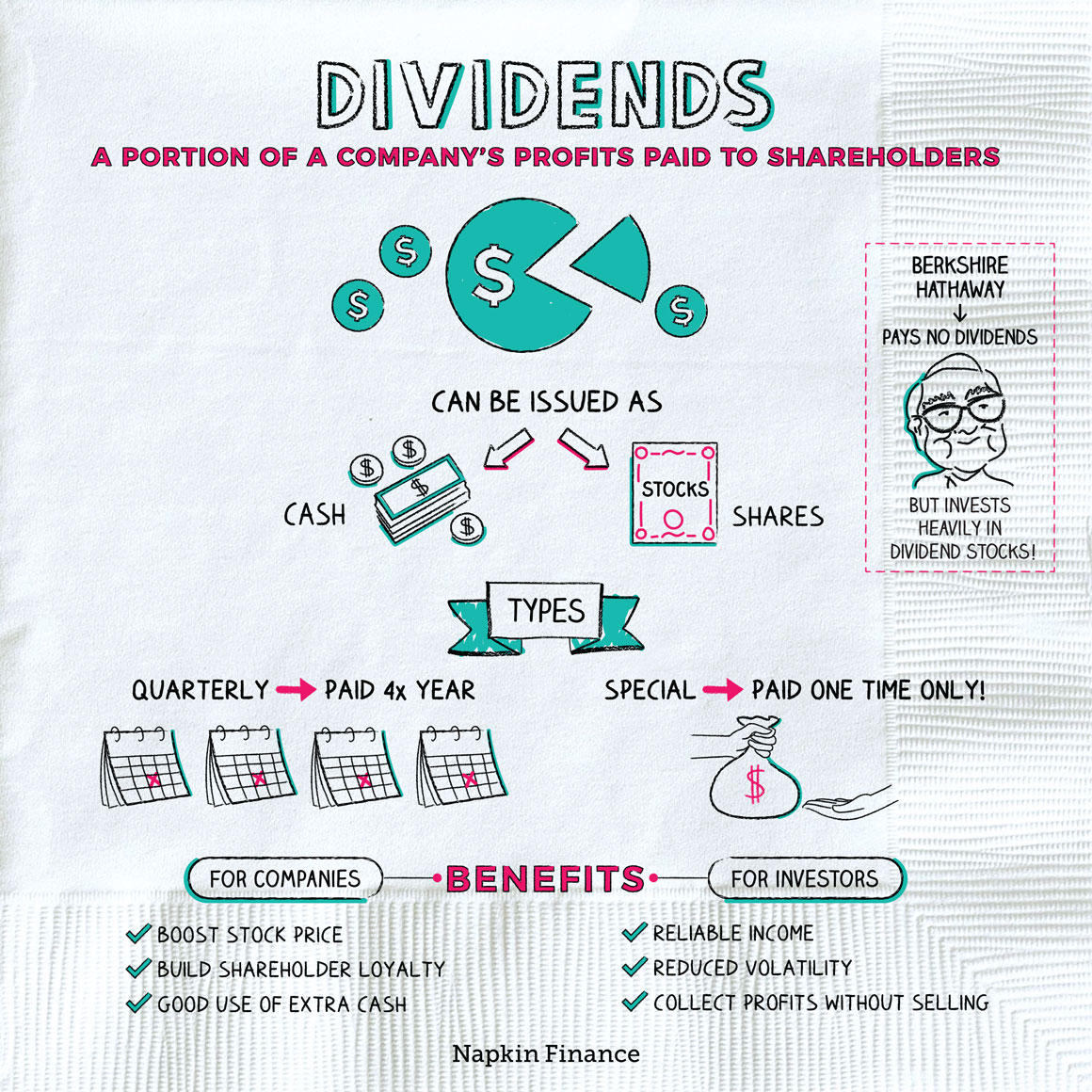

A dividend is a portion of a company’s profits that is paid to its shareholders in the form of cash or more stock.

The decision to pay dividends is made by a company’s board of directors. There are a variety of reasons why it might decide to share (or not) the wealth.

| Reasons to pay | Reasons not to pay |

| Company has plenty of cash and profits coming in | Company needs to reinvest those profits and cash in order to keep growing |

| Could help attract investors, boost its stock price, or signal financial strength | Could use the extra money to pay down debt or make an acquisition instead |

| Gesture to thank shareholders and build loyalty | Doesn’t have enough profits to pay a dividend; worried profits could fall in the future |

Typically, dividends are more common among more mature companies—ones that are successful and profitable but whose fast-growing days are behind them. Younger companies typically don’t pay dividends because they want to invest all of their profits back into their businesses.

The main types of dividends are:

- Regular dividends: Cash amounts paid periodically to shareholders—usually quarterly. These are the most common kind.

- Special dividends: One-time cash payments to shareholders. These are unusual and tend to happen only in special circumstances.

- Stock dividends: Instead of paying cash, the company issues additional shares to existing shareholders.

No matter the type, dividends are always paid on a per-share basis.

For cash dividends, they’re issued as a dollar amount per share. For example, if an investor has 100 shares in a company that pays 10 cents per share, the investor would end up with a $10 dividend. The investor could then spend that money or reinvest it.

Stock dividends, by contrast, are usually paid on a percentage basis. A 10% dividend on 100 shares would leave an investor with 110 shares after the dividend is paid.

Dividend-paying stocks tend to be popular investments—particularly when it comes to companies that have paid a steady dividend for years (or decades). That’s because they:

- Are usually paid by well-established companies, so performance is less volatile.

- Can provide a steady stream of income for retirees or other investors who need to periodically take cash out of their portfolios.

- Can give investors a chance to collect some of their profits along the way without having to sell any shares.

While dividend-paying stocks can be a good addition to your portfolio, they shouldn’t make up all of it. Diversification is key!

Like most other money that lands in your pocket, any cash dividends you receive are also going to be taxed (for share dividends, you may not owe taxes until you sell the shares). The tax rate you pay depends on the type of dividend you receive:

- Qualified dividends: Taxed at the (usually lower) long-term capital gains rate

- Ordinary dividends: Taxed at your (usually higher) income tax rate

There are complicated rules for determining when dividends count as “ordinary” or “qualified,” but you don’t need to know them. The 1099 you receive from your broker (or wherever your shares are held) will tell you how much you received of each type.

Companies can increase or decrease how much they pay out in dividends at any time—even if they’ve consistently paid a dividend in the past. Although companies strive to avoid “cutting” (i.e., reducing) their dividends because doing so is incredibly unpopular with investors, it does sometimes happen if a company falls on hard times.

A dividend is a portion of a company’s earnings that it pays out to its shareholders. Dividends come in the form of cash or more shares. Companies that pay dividends are often well established and do so as a way to reward shareholders and drive up demand for their stocks. Startups and other fast-growing companies that either need or want to reinvest their profits usually don’t pay dividends.

- Although Warren Buffett invests heavily in dividend stocks, he’s maintained a strict no dividends policy for Berkshire Hathaway. The company has paid only one dividend, in 1967, and he jokes the decision must have been made while he was in the bathroom.

- The “dividend aristocrats” are a club of companies that have increased their dividends every year for at least the last 25 years. There are usually fewer than 100 of these unicorn-like companies at any time, and they’re among the giants of their industries (think Johnson & Johnson and Exxon Mobil).

- Despite his company’s immense success, Apple founder Steve Jobs famously hated dividend payments so much so that the company took a 17-year break from paying them.

- Dividends are amounts of cash or stock that companies may pay to their shareholders.

- Companies typically pay dividends if they have strong profits and cash flow but don’t need to reinvest the money in their businesses.

- For investors, dividends can be a good way to increase your income and even reduce your portfolio’s risk. But dividend stocks should be just one part of a well-diversified portfolio.