Annuities

Nest Egg

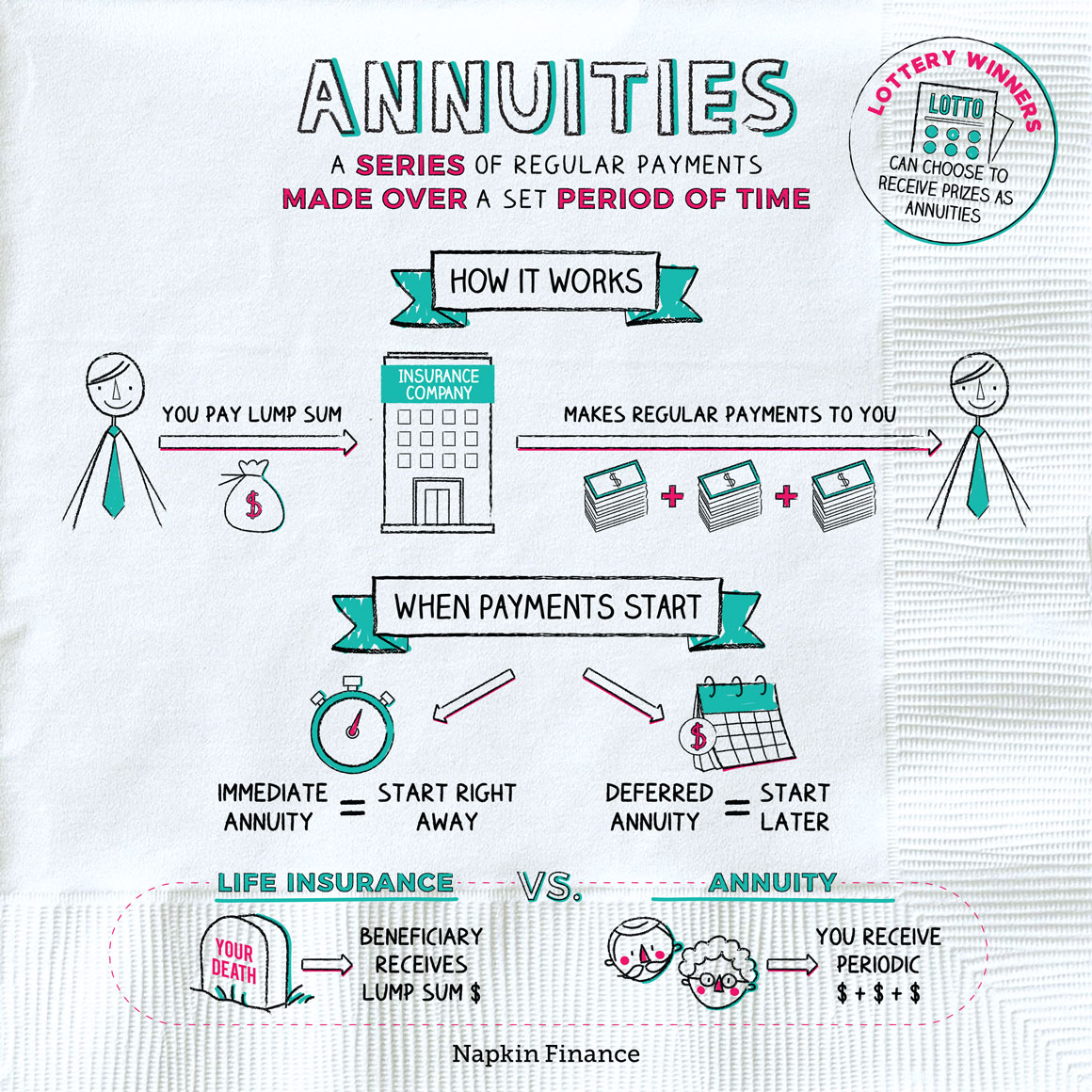

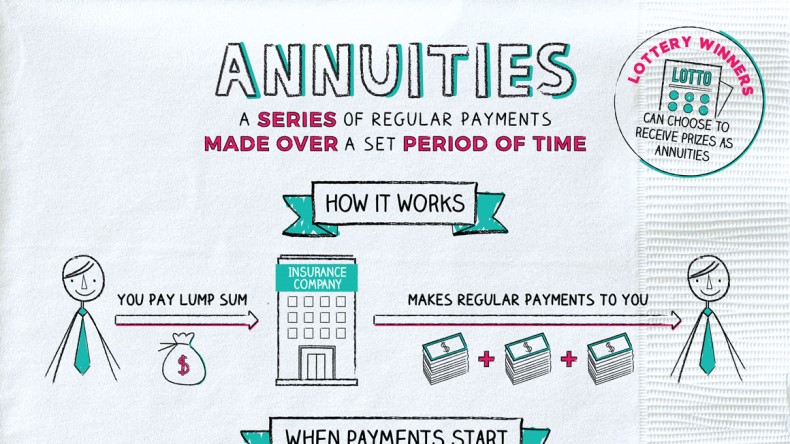

An annuity is a series of regular payments made over a set period of time.

Annuities can be purchased from insurance companies, and they’re often a popular option for retirees. By using your life’s savings to buy an annuity, you can convert a lump sum of cash into a steady stream of income. You could also receive an annuity from a legal settlement, an inheritance, or lottery or game show winnings.

The most basic version of an annuity works like this:

You pay an insurance company a

large lump sum of money, like $500,000

↓

The insurance company starts paying you

a small sum of money every month, like $1,500

↓

You receive that $1,500 every month for

the rest of your life

↓

When you die, the insurance company

stops making payments

But in real life, there are almost endless variations on that basic version.

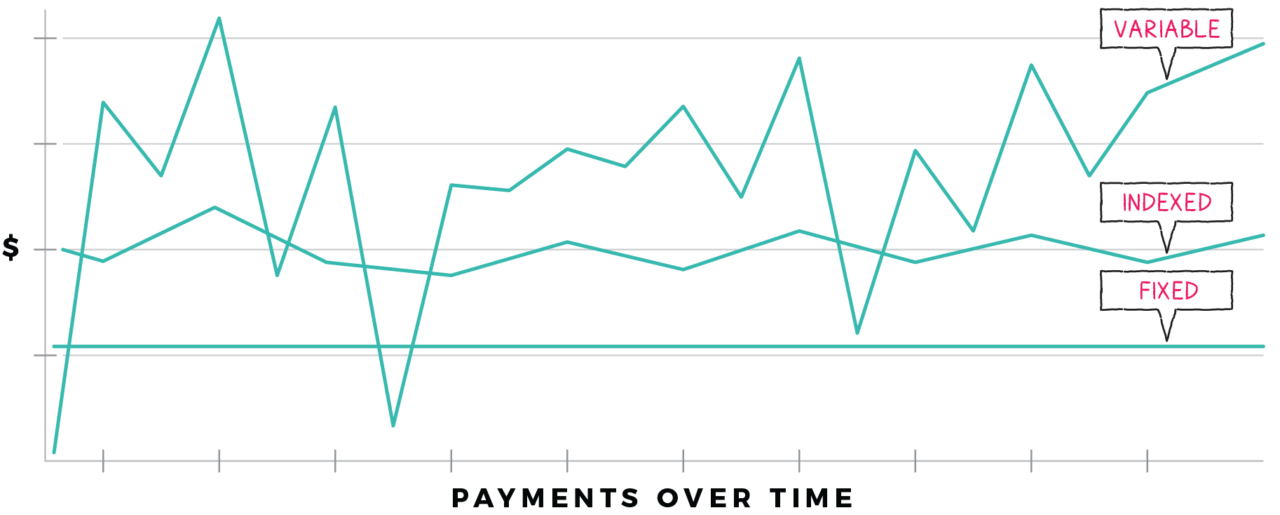

There are three main types of annuities:

- Fixed: Pays out the same amount every period—like that $1,500 per month in the example above.

- Variable: The money you pay into the annuity is invested in mutual funds, and the income you receive depends on those funds’ performance.

- Indexed: Provides a payout that’s tied to the performance of a specific stock market index, like the S&P 500. (However, the annuity typically limits how much your payments rise when the index goes up or fall when the index goes down.)

You can also choose between immediate and deferred annuities.

- Immediate: Payouts begin almost immediately after you buy the annuity—as soon as one month later. Most immediate annuities are fixed annuities.

- Deferred: Payouts don’t begin until a later date—whether five, ten, 20, or more years later.

Whether an immediate or deferred annuity is best for you typically depends on whether or not you’re already retired. Retirees who want payouts right away might prefer immediate annuities, whereas deferred variable annuities are better suited for those saving up for retirement.

In addition to those main varieties, there are a range of additional features annuity buyers may be able to choose from:

| Feature | Description |

| Cost of living adjustment | Payouts increase with the rate of inflation |

| Death benefit | If you die before the annuity has paid out a certain amount, it will pay an additional sum to your beneficiaries |

| Guaranteed withdrawal benefit | Lets you withdraw a certain portion of the money you’ve paid in |

| Joint life | Payments continue as long as you or your spouse is still alive |

No matter which type of annuity you choose, you won’t pay taxes as your account grows. But, any payouts you receive are generally taxed as income (like wages you receive from your job).

One major drawback of annuities is that they can come with high fees. Some of the fees they might charge include:

- Surrender charges if you withdraw money at certain times

- Administrative fees

- Service fees

- Investment expense ratios

- Sales commissions

- Fees for special features added to your contract

Annuities and life insurance policies are both contracts offered by insurance companies, but they are offered for two very different purposes:

- Life insurance policies pay out money to a person of your choosing, also known as your beneficiary, when you die.

- Annuities primarily provide you with funds for retirement (though you may choose to add a death benefit).

Annuities can be a great source of steady income for retirement with some tax benefits. There are many different types of annuities to choose from, so carefully consider your needs before you buy one and be sure to understand the fees of any annuity you consider.

- Annuities became popular during the Great Depression when they were seen as a more reliable source of income than stock market investments.

- Annuities originated in Roman times when citizens would make a one-time payment in exchange for lifetime payments made once a year.

- The word annuity is derived from the Latin word “annus,” which means year.

- Annuities are contracts with insurance companies that make regular payouts to investors over a set period of time.

- The main types of annuities are fixed versus variable and immediate versus deferred.

- Money in an annuity grows tax free, but payments received from an annuity are taxed as income.

- Annuities can be a helpful tool for retirees who need to convert a lump sum of saved money into a stream of income in retirement.