What Is an ICO?

The Wild West of Finance

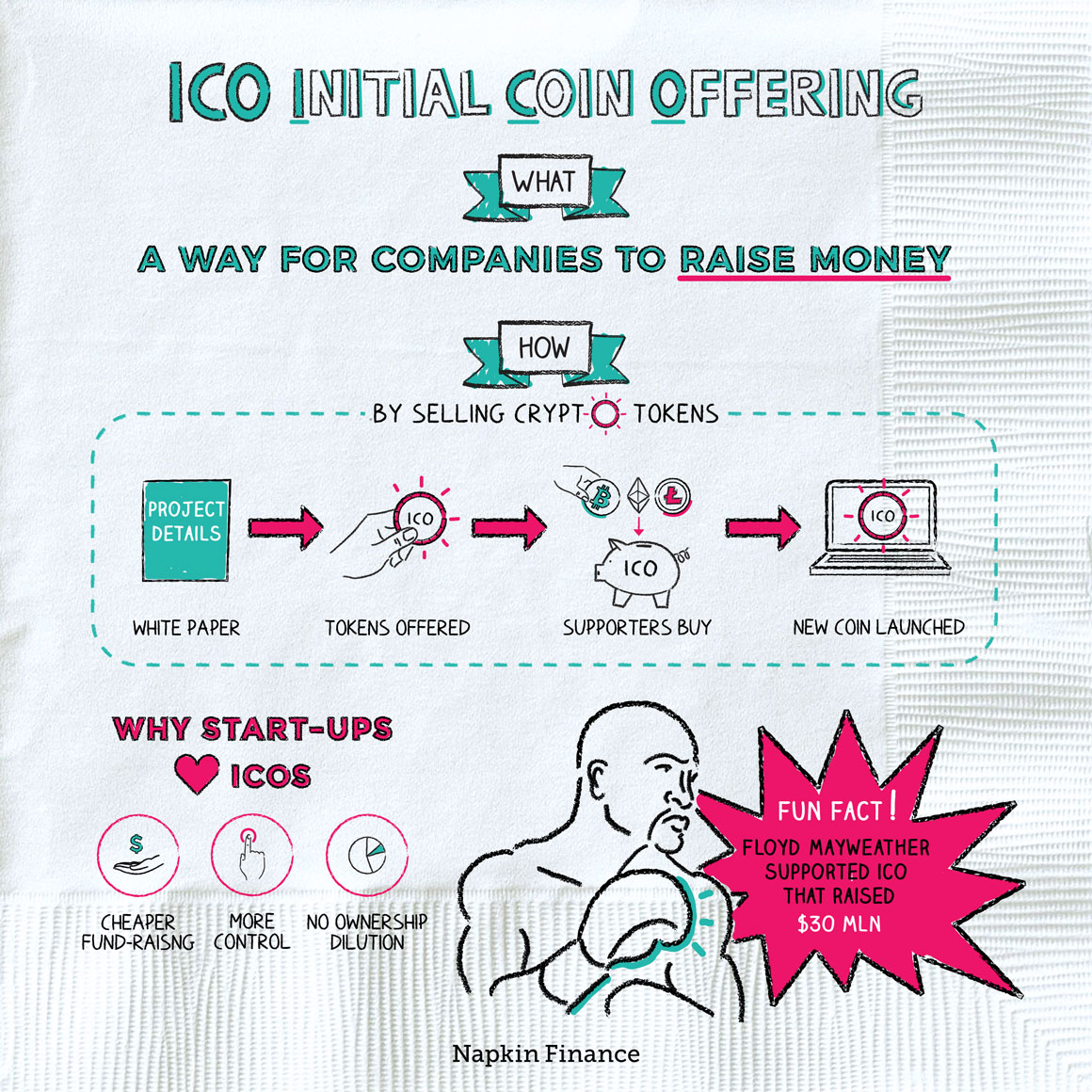

An ICO, or Initial Coin Offering, is a way for startups to raise money by inventing and issuing a new type of digital money. Normally, early investors become part owners of a startup. With an ICO, investors receive this new currency instead, which could end up being worth a lot of real money or could turn out to be worthless.

During an ICO campaign, crypto “tokens” are offered by the startup behind the ICO to investors in exchange for other cryptocurrency, such as Bitcoin or Ethereum. The token, or “coin,” is issued on the blockchain, a secure distributed ledger. These tokens only become currency if the funding goal of the ICO is met.

What happens during an ICO campaign:

- Tokens are sold during an initial offering

- Supporters buy these cryptocoins, usually with virtual currency

- If the money raised meets the minimum amount needed within the set time frame, the startup can proceed with its plan

- If the money raised does not meet the minimum amount set, funds are typically returned to investors

Before selling their tokens, a startup generally issues a white paper, which tells prospective investors about the company and how the ICO will work. An ICO white paper typically includes details on:

- The amount of money the startup plans to raise

- How funds will be used

- The startup’s business plans

- What type of currency can be used to buy tokens

- The timeline of the ICO

- Backgrounds of the founders and other team members

Just like a kickstarter crowdfunding campaign, supporters of an ICO have the option of helping a company meet its funding goals. Unlike a Kickstarter campaign, however, backers of an ICO are keen on getting a financial return on their investment.

Here are some of the ways ICO investors may be hoping to earn a return:

The new cryptocurrency could take off over the long term, earning investors Bitcoin-sized riches.

Early ICO investors may receive a discount compared with later investors. Some investors may buy in early and hope to sell their position quickly when the price is higher.

The currency could have some kind of redeemable value with the issuing startup. For example, a gaming startup might create a currency that can be used for purchases on its gaming system.

ICOs offer many benefits for startups, including:

- Cheaper fundraising. Because ICOs are often practically unregulated, companies have to jump through fewer hoops and can pay less in legal and related costs than with traditional types of fundraising.

- No ownership dilution. When a company holds an IPO or sells an ownership stake to a venture-capital firm, existing owners see their positions get reduced, or “diluted.” With an ICO, existing owners hold onto what they have.

- More control. When a VC firm invests in a startup, the firm typically gains a say in the company’s business, such as by selecting a director for the company’s board. With an ICO, a company’s founders can keep more control over their business.

Some investors have been ripped off by ICO scams. An ICO may be advertised online but then disappear after raising money for a few days. At the same time, there have been success stories of legitimate companies that are building promising products and have used ICOs for funding.

Some ICOs fall between these extremes. Some companies may turn to an ICO because they can’t convince VC firms or other traditional sources of funding to make an investment. Those companies might not be complete scams, but they also might not be 100% grown-up companies with real business plans.

| Pros | Cons |

| Chance to get in on the ground floor of a successful startup | Poor disclosures, as white papers may be incomplete or falsified |

| Backers may enjoy being part of a disruptive movement | Lack of regulation |

| Possibility of making a lot of money | May have difficulty exiting an investment |

| Risk of hackers stealing funds | |

| Value of tokens can fluctuate wildly | |

| Risk of outright scams |

ICOs are controversial. Believers say they can offer a more efficient way for startups to raise money. Skeptics say that the ICO market is a fraud-ridden bubble. What both sides can agree on is that investing in an ICO is a high-risk gamble. As with any extreme-risk investment, ICO investors could stand to make huge profits or could lose everything.

- ICOs let startups raise money by selling a newly created digital currency. Investors typically pay for the new currency with an existing cryptocurrency.

- Sometimes, a new currency comes with certain rights or a redeemable value with the issuing startup. In other cases, investors may be hoping to turn a profit by trading the currency or holding it long term.

- For startups, ICOs can offer lower costs than traditional financing and let founders keep more control over their companies.

- ICOs are the current Wild West of financing. Some investors may make a lot of money, and others may lose their money to business failures, hacking or outright scams.

An ICO is a popular but controversial new way for startups to raise funds. In exchange for investors’ money, a startup invents a new type of online currency. Supporters say that ICOs offer efficient ways for startups to crowdsource early investments, while skeptics say they are hotbeds of fraud. Investing in an ICO is extremely risky.

- Cannabiscoin, Catcoin, Sexcoin and Whoppercoin are all real cryptocurrencies. With enough Whoppercoins, you can get a free burger at a Burger King in Russia.

- One of the fastest ICOs on record was the Basic Attention Token, which raised $35 million in 30 seconds to fund development of a new web browser.

- Athletes and celebrities are jumping on the ICO bandwagon. Floyd Mayweather, Jr. promoted an ICO for a blockchain-based prediction market that raised $30 million. Paris Hilton tweeted her support for the LydianCoin ICO and has posted pictures of herself with the founders of Ethereum.

Ratings of ICOS: https://icorating.com/

Comprehensive list of ICOs, crowdsales, and token sales: https://www.icoalert.com/

A video explaining what an ICO is, by The Blockchain Guys: https://www.youtube.com/watch?v=v9uFp_XavVw