ROI

Many Happy Returns

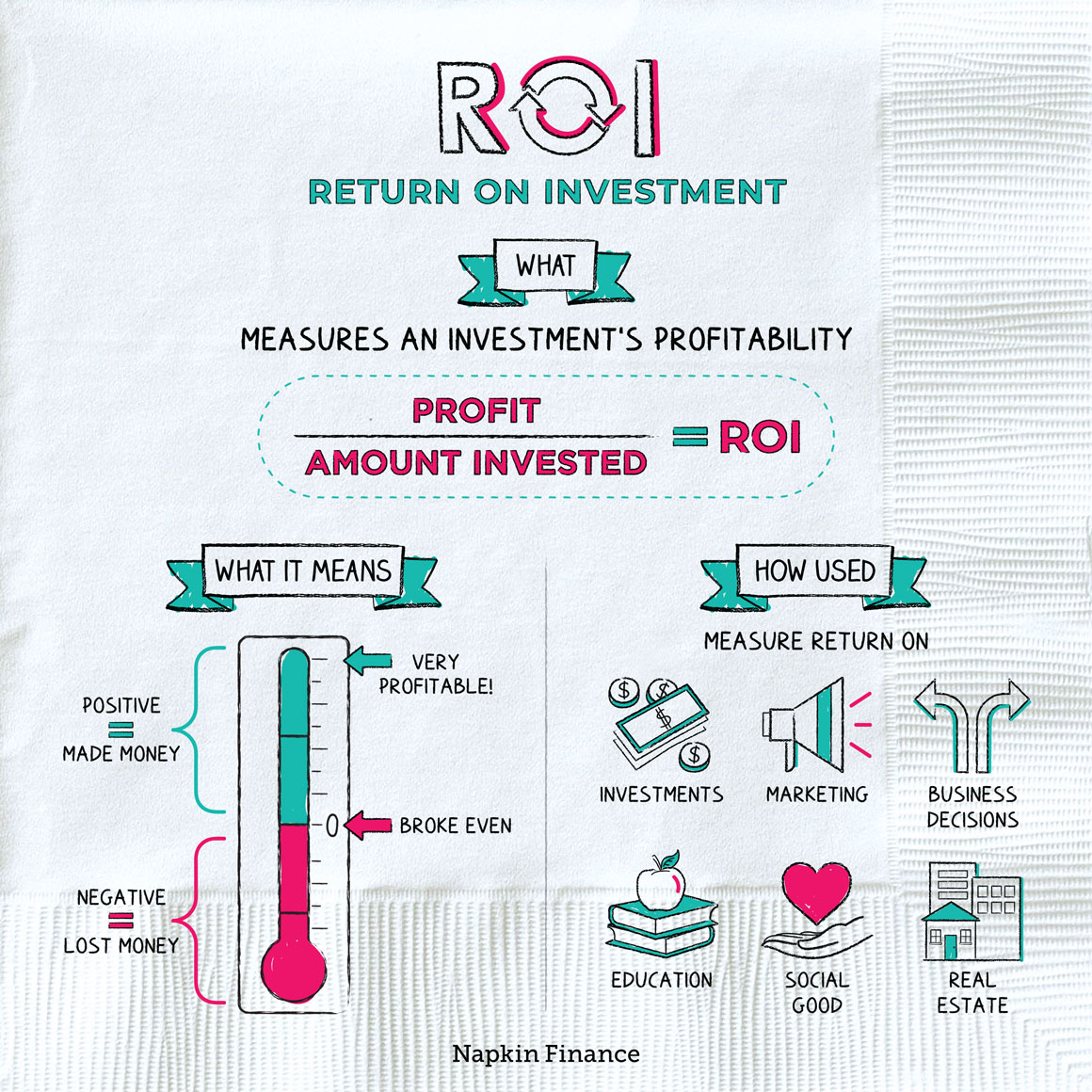

Return on investment, or ROI, is a ratio for measuring the profitability of an investment. It puts a percentage figure on the benefit or return you earned compared with the amount you invested.

Although ROI is mainly used for calculating returns on financial investments, you can also use it to measure the return on an investment you made with your time or other resources.

The formula for calculating ROI is:

Ending value of investment – Amount you invested

—————————————————————————–

Amount you invested

For example, let’s say you invest $1,000 in a stock and then sell your shares for $1,500 two years later. Your ROI ist:

$1,500 – $1,000

———————

$1,000

= 50%

ROI is typically expressed as a percentage, so in this case, your ROI would be 50%. If you made money, your ROI will be positive. A negative ROI means you lost money.

ROI is a useful tool for measuring your past investment returns, comparing your investments, or choosing between new investing opportunities.

But you can also use it to measure what you’re getting back from the resources you put into other areas, such as:

- Marketing

- ROI can gauge a company’s return on its marketing or advertising campaigns.

- Social media ROI can measure how many likes or clicks your posts generate for your effort.

- Business development

- Companies often estimate a project’s ROI—whether investing in a new product line or replacing old equipment—before they decide whether or not to pursue it.

- Education

- ROI can describe how much you learned and retained from your education or training.

- You can also use it to compare the cost of additional education (like a graduate degree) against the extra income you’d earn after finishing the degree.

- Social good

- Social ROI considers the value an investment creates for a community in terms of its social, environmental, and economic impacts.

- Real estate

- Real estate investors often use ROI in deciding whether to buy a particular property.

- ROI might calculate returns from regular rent payments or the projected resale value of a house.

While ROI can be useful, it has some important limitations:

- It doesn’t consider how long it took you to earn your return.

- An investment that returns 50% in one year is more profitable than an investment that returns 50% over ten years. But based on ROI alone, they’ll look identical.

- It doesn’t consider risk.

- You may earn 200% in a cryptocurrency investment and only 5% on a bond investment.

- Judged on ROI alone, the crypto wins hands down, but the bond investment was much safer.

- It doesn’t consider nonfinancial benefits.

- Getting that advanced degree might not boost your earnings by as much as you’d like, but you still might feel it’s worth it for personal reasons.

- It can’t give you deeper insights into how you earned your return.

- A company could make separate investments in online advertising, email campaigns, and social media.

- A solid ROI could tell it that overall those investments paid off, but it wouldn’t tell the company which of those efforts was most successful.

ROI is a simple way to measure the benefit received from an investment—whether you’re investing in stocks and bonds, your company’s growth, or your own education. A higher ROI signals a more profitable investment, while a negative ROI signals a loss. While ROI is useful, it’s only one number and can’t capture everything, so it shouldn’t be the only thing you consider when making investment decisions.

- Wondering about the ROI on your pricey college degree? Men with a bachelor’s degree on average earn around $900,000 more over their lifetime than those with only high school degrees. Women earn about $630,000 more.

- Comparing that with the roughly $30,000 per year average cost of college gives you an ROI of about 750% for men and 525% for women.

- “I don’t consider the bloody ROI.” That was CEO Tim Cook’s response during an annual shareholder meeting when pressed to justify the company’s financial investments in environmental sustainability and worker safety.

- ROI stands for return on investment.

- ROI tells you how much benefit you get from investing your money, time, or resources into something.

- Many people use ROI to evaluate and compare investment returns, but you can also use it to gauge the value of marketing campaigns, business opportunities, education, and even scientific research.

- ROI does not take into account some important factors, such as how long you hold an investment before generating a return or the risk involved in a particular investment.