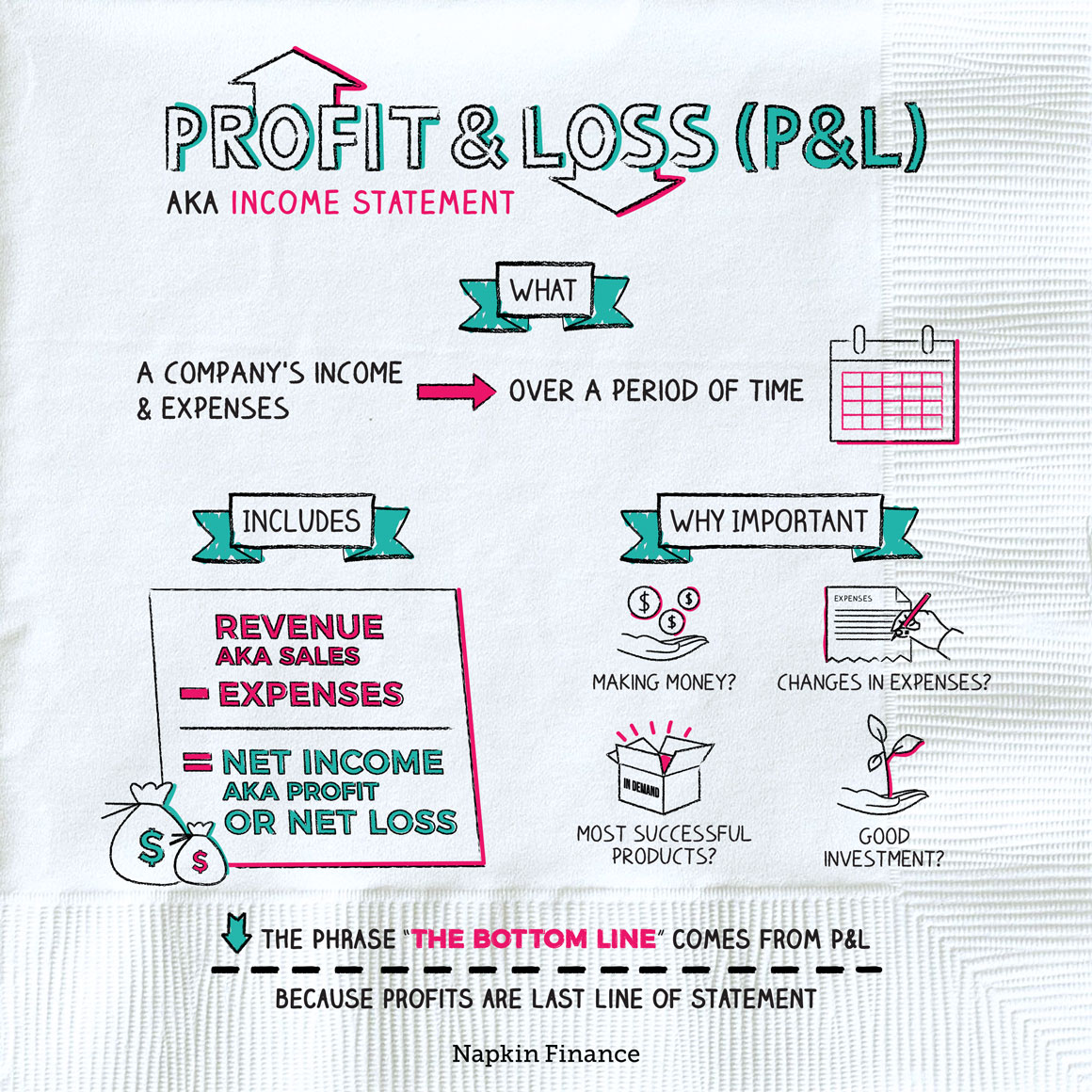

Profit and Loss (P&L)

The Bottom Line

A profit and loss statement, or income statement, shows the money a company earned and what it paid in expenses over a certain period.

The basic formula of the statement is:

Revenues (aka sales)

– Expenses

= Profits (aka net income or net loss)

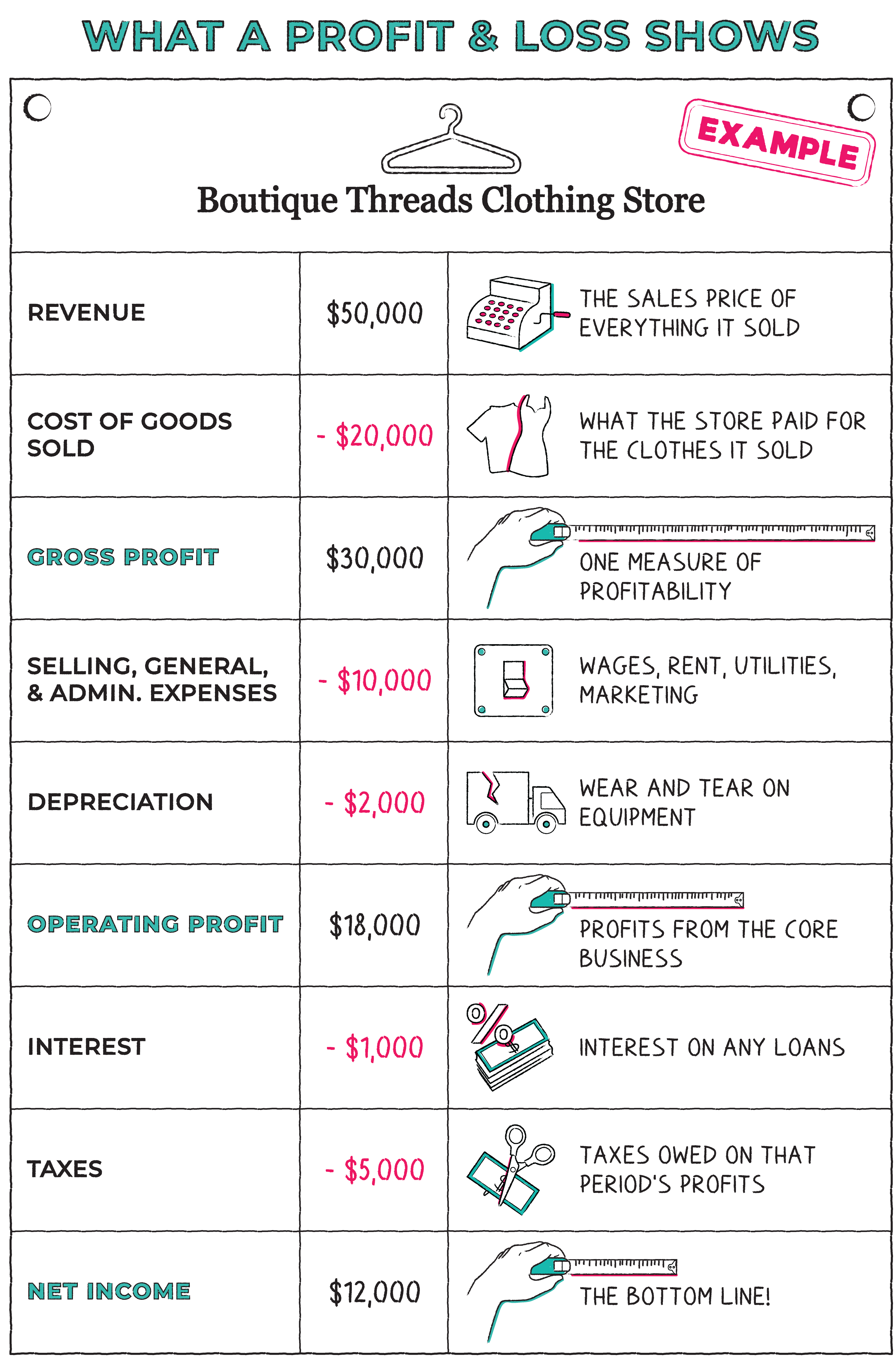

Revenue, or sales, is straightforward: It puts a dollar figure on how much the company sold in its main business activities. For a clothing store, revenue would mean the total of all sales for the period (after any returns or discounts).

Expenses typically include a wide range of costs, including:

- The cost of what you sold—i.e., how much the store paid for those clothes it sold.

- Employee wages.

- The cost of rent, utilities, marketing, and other basic expenses of running the business.

- Depreciation—Suppose the store owns a truck. Every year the truck gets older and loses a bit of its value. That loss is factored in through depreciation.

- Interest payments on any debt.

- Taxes.

Although there can be slight variations, the information on an income statement follows a pretty standard flow.

Here’s what a basic income statement might look like for that clothing store:

The bottom line is arguably the most important part of the statement because it tells the business how much money it’s actually making. You can also turn this number into a percentage to understand a company’s profits as a percent of sales.

Although the reports may sound like a snoozefest if you’re not an accountant, they’re actually incredibly important to companies themselves and investors. Here’s why:

- The main role of a profit and loss statement is to figure out whether or not the business made money in a given period and how much it earned or lost.

- Looking at how profitable different parts of the business are can help the company improve its performance. For example, if the clothing store is earning a 25% profit on jewelry but only 10% on jeans and jewelry is selling better, it may decide to carry more jewelry and fewer jeans.

- Prospective investors may want to see statements for several past periods before forking over their money.

A profit and loss statement only tells you about a company’s past results (i.e., its most recent quarter or year). But those past results can give important clues about the company’s future.

Here are some potential positive or negative trends to watch for when looking at statements for several periods:

| Positive trends | Negative trends |

| Growing sales | Declining sales |

| Growing profits | Declining profits |

| Growing or steady profit margins | Falling profit margins |

| Steady growth | Unstable or inconsistent growth |

| Steady expenses | Sudden or unexplained increases or decreases in expenses |

Those are the broad strokes. But, of course, running a business (or analyzing one) is complicated.

Ultimately, a company’s income statement gives you some important clues as to how it’s been doing in the past or could do in the future. But it’s just one piece of a pretty complex puzzle.

A profit and loss statement, or income statement, is one of a company’s important financial reports. It tells management and interested investors the company’s revenues, expenses, and profits over a specific period of time. Looking at trends in a company’s profit and loss statements over time can give you important clues about where the business could be headed.

- Want to become a billionaire? Read a lot of financial statements. Billionaire investor Warren Buffett has been known to read companies’ annual reports essentially around the clock—even on his own family’s vacations.

- A $6,000 gold-and-burgundy shower curtain was among the expenses former Tyco CEO Dennis Kozlowski fraudulently claimed as a company expense before he went to prison.

- A profit and loss statement shows what a company’s sales, expenses, and profits were over a given period.

- The statement can provide valuable information for the company itself, in making decisions about how to run the business, and also for potential outside investors.

- Trends in a company’s profit and loss statements can give clues about its longer-term business prospects and potentially even alert investors to any red flags.

- The statements are a vital source of information but only one small piece of the bigger picture when it comes to analyzing a company.