Profit Margin

Margin of Error

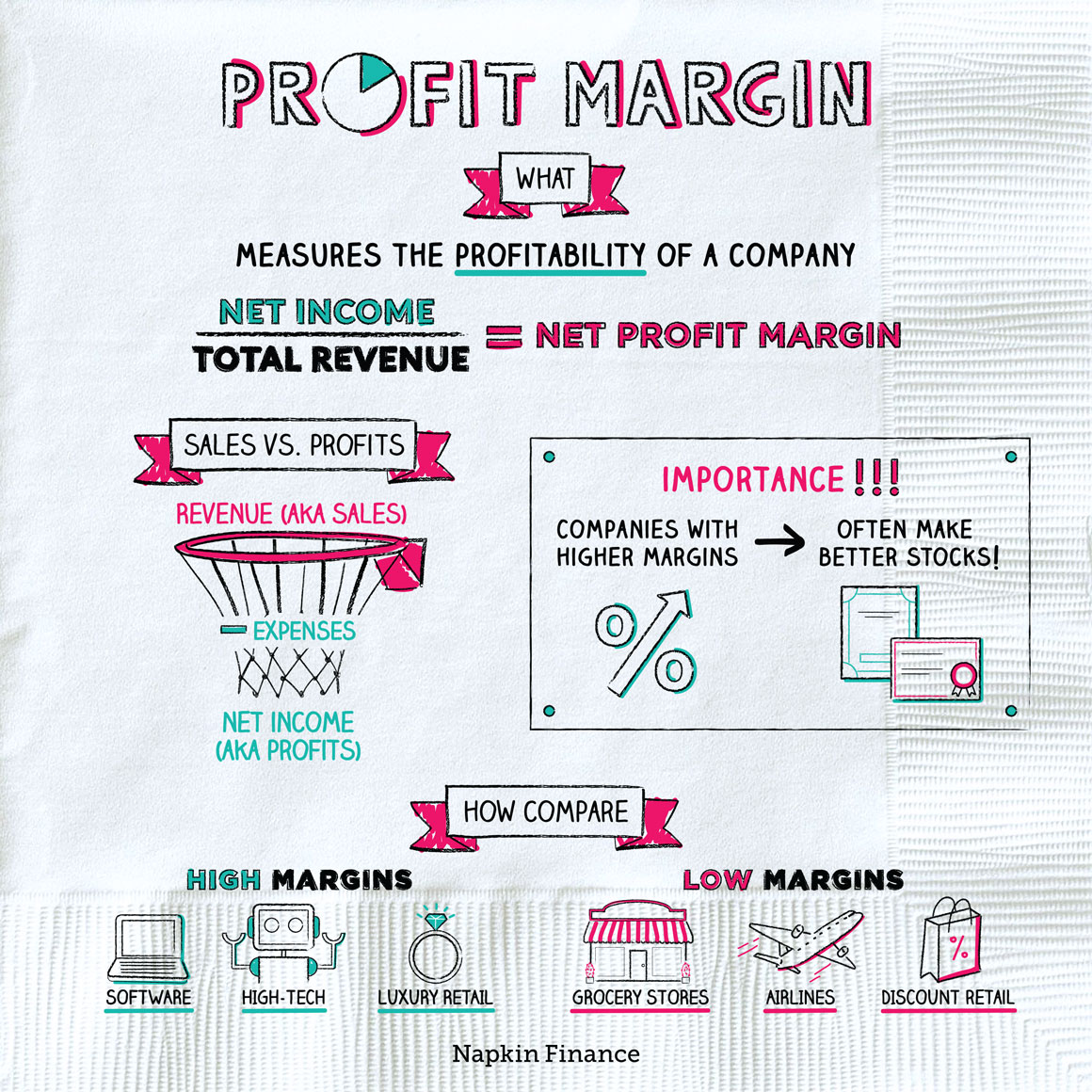

A company’s profit margin measures the portion of its total sales that it gets to keep as profits. It’s often used to measure a company’s financial strength.

In the simplest terms, profit margin shows you what percentage of each dollar of sales is ultimately kept as profits. A company with a 10% profit margin keeps ten cents of every dollar it brings in. The rest goes toward expenses.

To find the profit margin, you only need to know two numbers:

- Total revenue (aka total sales): All the money that comes in the door

- Net income: What’s left after subtracting costs (such as input costs and worker wages) and expenses (such as taxes, rent, and utilities) from total revenue

Some simple division then gives you the profit margin:

Net income / Total revenue = Profit margin

You can find both of those numbers in a company’s profit and loss statement.

The profit margin helps you figure out whether or not a business is doing well. Investors often use it to compare companies within the same industry. Companies with higher margins are more profitable and often see their stock prices rise faster than competitors with lower margins.

Company management typically also pays close attention to margins. Executives may watch their margins to:

- Find and address excessive costs

- Rethink their mix of product or service offerings

- Track revenue patterns (such as seasonal increases or decreases)

- Help them secure a loan or attract investors

Although high margins are almost always better, some types of industries and businesses just naturally have higher margins, while others have lower ones. Here’s a look at which types of businesses tend to fall into each category and why:

| High margin | Low margin | |

| Examples |

|

|

| Why high or low? | Have little need for physical inventory or stores. Or, can charge higher prices for premium products. | Have high overhead and high costs of inventory. Or, can only charge low prices for their products. |

There are different types of profit margins, each of which slice and dice a company’s income in different ways. The two most common are gross and net.

| Type | What it reflects | Why useful |

| Gross margin | Profits after the costs of making or buying the inventory it sold | Shows how effective the company is at making and selling what it sells |

| Net margin | Profits after all of the company’s expenses | Shows the effectiveness of the entire organization |

Profit margin is usually a better measure of a company’s financial success than looking at only revenue because profit margins account for costs and expenses.

For example, a company with high revenue might actually be losing money if it also has high expenses.

Profit margin is one measure of a company’s financial success. It tells you how much of a company’s sales it ends up keeping as profits—after accounting for all its expenses and costs. Investors watch profit margins closely because companies with higher profit margins often perform better in the stock market.

- The social networking industry has some of the highest profit margins of any industry out there at more than 35%.

- Car dealers, amusement parks, furniture stores, and home improvement stores typically have very low margins.

- Profit margin measures the percentage of sales a company keeps as profits after subtracting for all its costs and expenses.

- Profit margin is a measure of a business’s profitability. Investors use it to compare companies and decide where to park their money, while companies themselves use it to evaluate how to improve their operations.

- Some industries, like software, tend to naturally have high margins. Others, like grocery stores, almost always have low margins.

- Profit margin is usually a better measure of a company’s financial health than revenue alone.