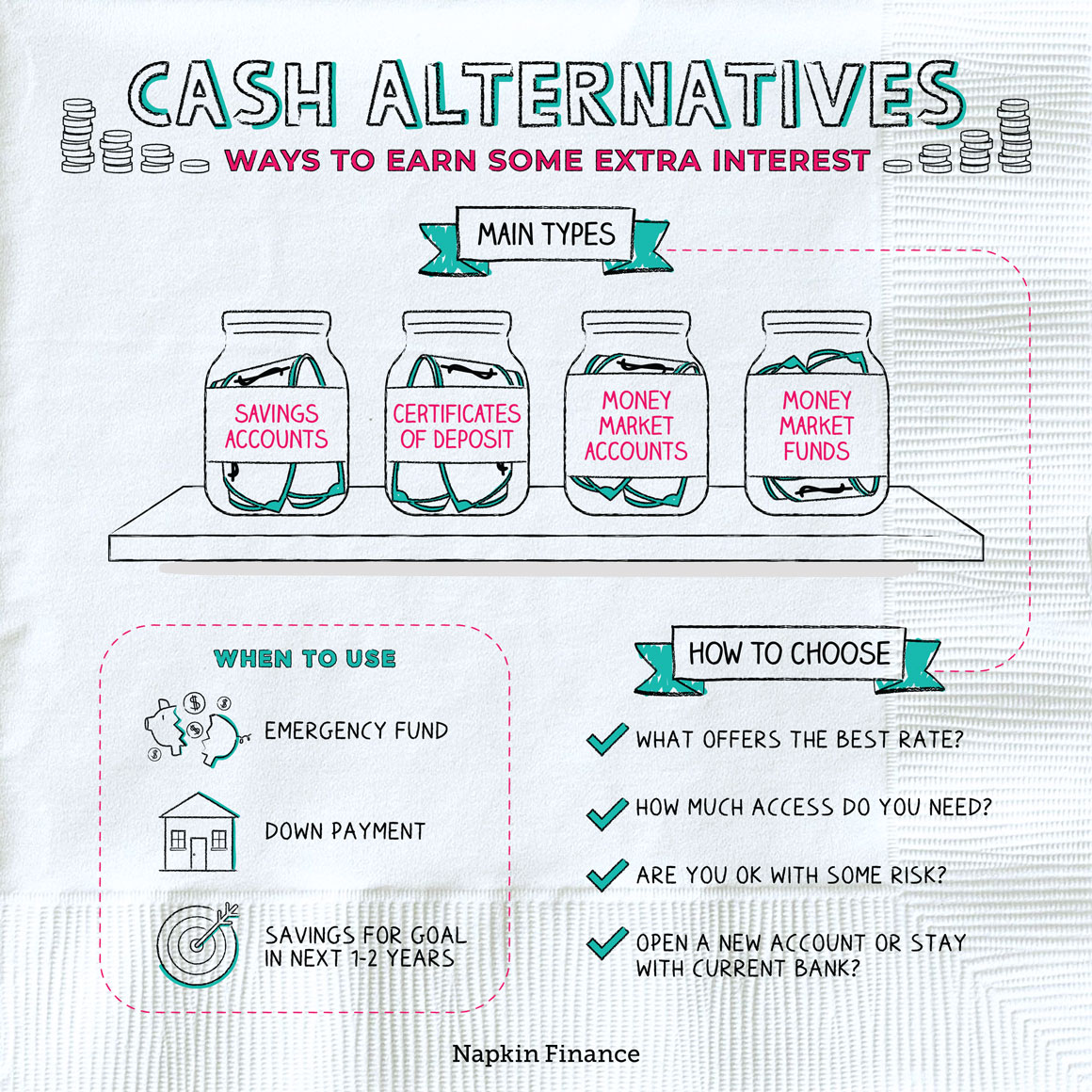

Cash Alternatives

Cash In

Cash alternatives are investment types that you can consider as alternatives to simply holding money in your checking account.

They’re options that are basically as safe as cash, but that can let you earn a slightly higher return than you might earn in your main bank account.

The advantages of holding some of your money in cash alternatives can include:

- Easy access—in case something comes up and you need to get to the money in a hurry

- Higher interest—compared with what you would earn in a checking account

- Safety—because unlike stocks and bonds, cash alternatives shouldn’t fall in value

If you’re holding cash alternatives within a broader portfolio that also contains stocks and bonds, they can also provide diversification.

Cash alternatives can be a good option for any money that you might need to access quickly or that’s earmarked for a near-term purpose. You might consider them for your:

- Emergency fund

- Down payment fund—if you’re planning to buy in the next one to two years

- Savings fund for a wedding, vacation, or any other short-term goal

That said, you shouldn’t hold too much money in cash and cash alternatives. Money that you’re saving for a long-term goal, like retirement, should generally be invested in higher-growth investments, like stocks.

Once you’re ready to invest in cash alternatives, here are the main options you’ll have to consider:

| Savings accounts | Certificates of Deposit (CDs) | Money market accounts | Money market funds | |

| What it is | A bank account that pays higher interest | A bond-like investment that ties your money up | A bank account that pays higher interest | Mutual fund that invests in CDs, government bonds, and other very safe options |

| How to buy/ invest | Choose a bank and open an account | Pick a bank and pick a CD term | Choose a bank and open an account | Choose a broker or mutual fund firm and open an account |

| FDIC insured? | Yes | Yes | Yes | No |

| Pros |

|

|

|

|

| Cons |

|

|

|

|

As with any financial product, it’s important to check the terms of the specific account, CD, or fund you’re considering.

Here are some questions to ask as you’re deciding what type of cash alternative to buy:

- What product currently offers the best interest rate?

- If your main goal is to earn a higher yield, you might go with whatever pays the most.

- Do you want to open a new account or stay with your current bank or broker?

- If you want to keep things simple and avoid opening new accounts, you might first look at what products your current bank or broker offer.

- Are you ok with tying up your money for a period of time?

- If you’re not ok with locking it away, then CDs probably aren’t for you.

- How much risk are you comfortable with?

- Although money market funds are very low risk, because they’re not insured, they’re not considered risk free.

For many people, the choice comes down to a mix of convenience, access, and yield.

FDIC insurance covers bank accounts and CDs for up to $250,000 per depositor, per institution. That means you generally don’t want to hold more than $250,000 in any one particular bank.

If you hold more than that amount in cash and cash alternatives in total (lucky you), consider splitting your holdings up among multiple institutions.

Cash alternatives are banking and investment options that can offer better interest rates for your cash than a checking account. In exchange for those higher rates, these accounts and other products might limit how much access you have to your cash or come with slightly higher risk.

- Although it’s rare to find a cash alternative that pays more than 1% these days, in the mid-1980s, you could earn 11% on a six-month CD. (Granted, there was crisis-level inflation at the time.)

- During the 2008-09 financial crisis, one money market fund had to liquidate after suffering losses on short-term loans issued by Lehman Brothers.

- Money market funds are still (comparatively) very safe investments, but investors have never fully regained confidence in them since then.

- Cash alternatives can offer the chance of a slightly higher interest rate than what you’d earn on your money in a checking account.

- The main types of cash alternatives are savings accounts, CDs, money market accounts, and money market funds.

- Which option is right for you may depend on how much access you need to the money, how much risk you’re comfortable taking on, and what type of product offers the best interest rate.

- Cash alternatives may be a good choice for your emergency fund, down payment fund, or any money saved up for a near-term goal.