Active vs. Index Investing

Pick Sides

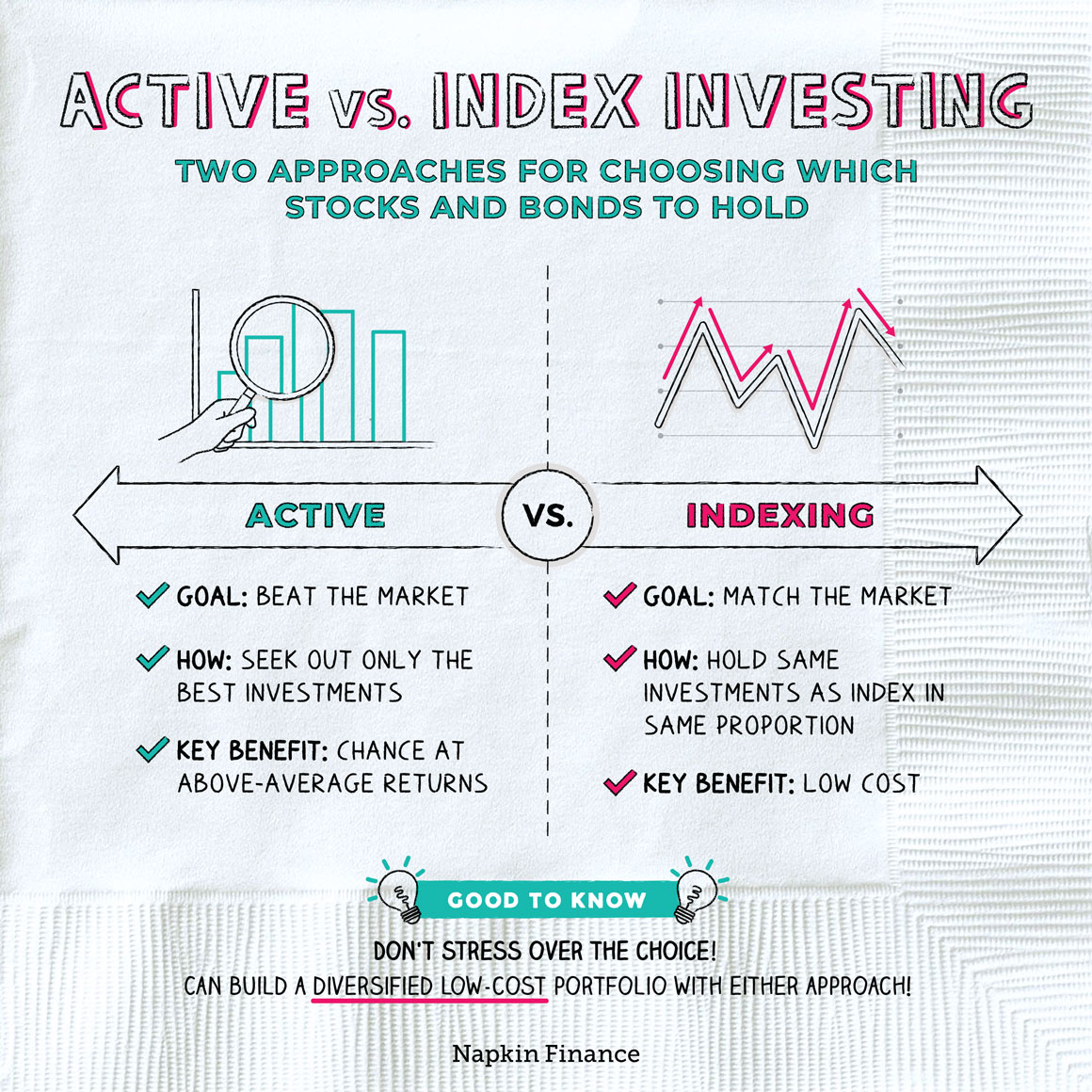

Active and index investing are two different ways of choosing individual investments.

With active investing, investors try to pick and choose only the best investments to buy—like the stocks that they think will rise the most in value. With index investing, investors build a portfolio that’s designed to match the performance of an index, like the S&P 500.

Here are some of the most important distinctions between the two approaches:

| Active | Indexing | |

| Aim | Try to earn better-than-average returns—i.e., to “beat the market” | Try to simply match the market’s returns |

| How achieved | Analyze underlying investments, like specific stocks, to try to identify ones with the best potential | Buy all the stocks contained in an index in the same proportions as the index and hold them |

| Key feature | The chance for superior returns | Low costs |

Investors might choose between active and index investing when they’re investing in:

- Stocks

- Bonds

- Some types of alternatives, like commodities

Most mutual funds can be categorized as either active funds or index funds. Most exchange-traded funds, or ETFs, follow index investing, but some follow active management.

Although either approach can help you build a diversified portfolio, there are some key trade-offs that investors typically face with the two investing styles:

| Active | Indexing | |

| Pros |

|

|

| Cons |

|

|

Even sophisticated professional investors can (and do) disagree over whether active or index investing is better. And many investors can find themselves getting hung up on the decision.

Here are a few questions and approaches to help you choose which way to go:

- Do you want the sure thing or the gamble?

- Index investing is usually lower cost. Saving money on investment expenses is a surefire way of improving your returns.

- Active investing is usually higher cost. But if you’re able to invest with a winning manager (or pick winning investments yourself), you might be able to more than make up for those higher costs with better returns.

- Do you want a low maintenance portfolio, or would you rather be more involved?

- Index investing can be a good choice if you want investments that you can set and forget because you don’t have to worry about a manager making bad calls.

- On the other hand, if you like the idea of trying to pick and choose the best managers (or best stocks and bonds), you might prefer active management.

- Are there other considerations that can help you decide?

- If you’re investing in a taxable account, that might weigh in favor of index investing (index funds often trade less and generate smaller capital gains tax bills than active funds).

- Or, perhaps you have access to solid active funds in your 401(k) but no decent index funds. In that case, it might be an easy call.

Many investors end up using a bit of both. One common compromise, for example, is to use a “core and satellite” approach. In that case, investors may use index funds for the “core” of their portfolio (like for their investments in stocks of large U.S. companies) but use actively managed funds for more niche investments—like international stocks or alternatives.

Ultimately, there’s no need to lose sleep over the decision. What’s most important is to build a diversified portfolio with an appropriate asset allocation, without paying too much in fees. You can accomplish that goal whether you follow active investing, index investing, or a mix of both.

Active and index investing are two main approaches for choosing individual investments, like choosing specifically which stocks and bonds to own. Active investing generally aims to “beat” the market’s returns, while index investing instead aims to match it. Although some investors believe one approach is better than the other, you can build a solid portfolio using either or both styles.

- Warren Buffett may be a legendary active investor, but he’s said time and again that most investors are better off using index funds than they are trying to pick stocks (or pick active managers).

- The first-ever market index was the Dow Jones Transportation index, which was first published in 1884.

- The second-oldest index is the Dow Jones Industrial Average, which has been calculated since 1886. It was created when publisher Charles Dow added up the prices of 12 prominent stocks and then divided by 12 to create an “average” stock price. That basic methodology (called “price weighting”) is still used today.

- Active and index investing are two main approaches for choosing specific securities to own.

- Active investors generally try to seek out and buy only investments that they think will show strong performance. Index investors, by contrast, aim to essentially match the overall market’s performance—by investing in the same securities as a market index.

- You might choose between an active or indexed approach when investing in stocks, bonds, or funds.

- The key advantage of active investing is the chance to earn better-than-average returns, while the key benefit of index investing is lower fees.

- Although there are plenty of reasons to choose one over the other, you can build a diversified, low-cost portfolio using either approach (or a mix of the two).