Featured Napkin

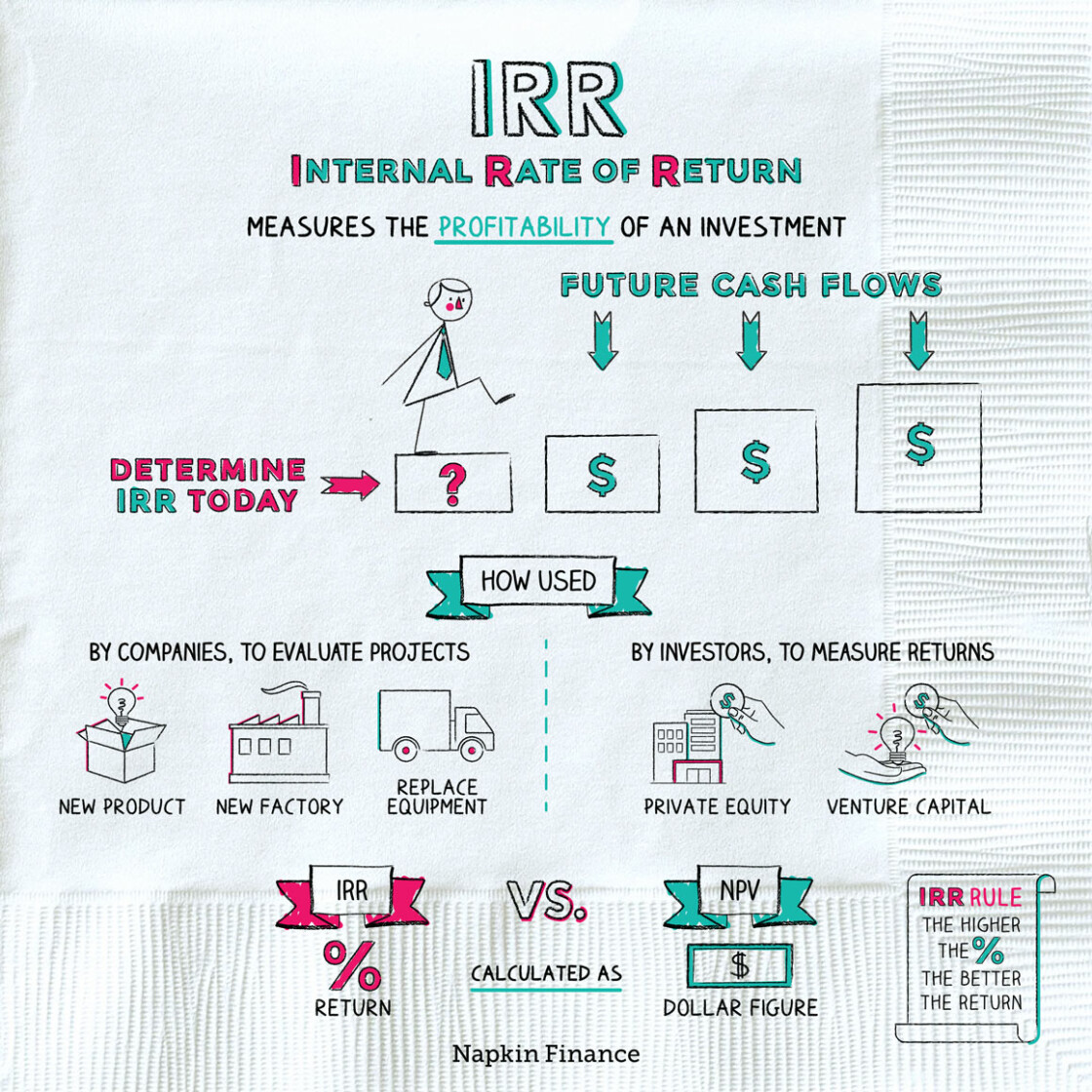

IRR

Crunch the Numbers

The internal rate of return, or IRR, is a measure of an investment’s or a project’s profitability. Investors and companies use the metric to measure or estimate their returns on a particular use for their money.

Learn moreMore economics Napkins...

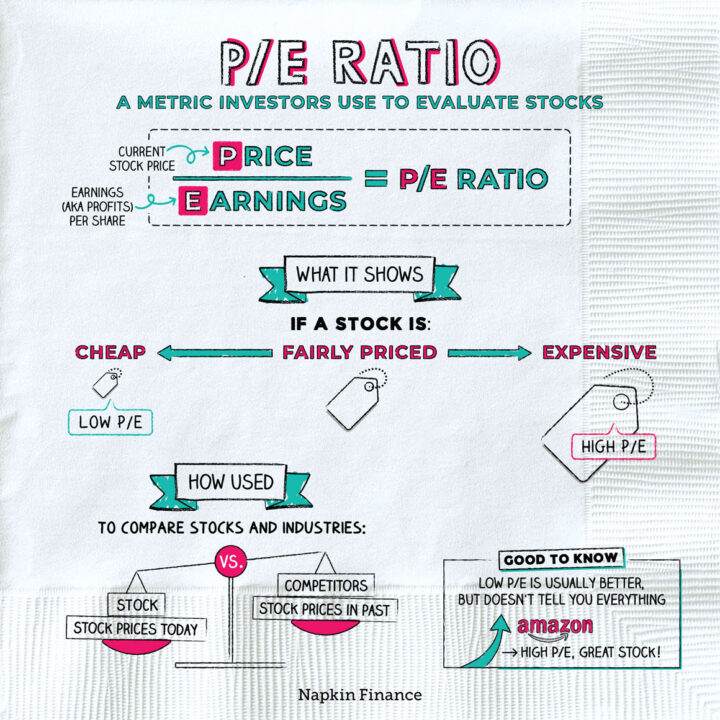

P/E Ratio

At Any Price

The price-to-earnings ratio (or P/E ratio) is a way to evaluate whether a company’s stock is cheap,...

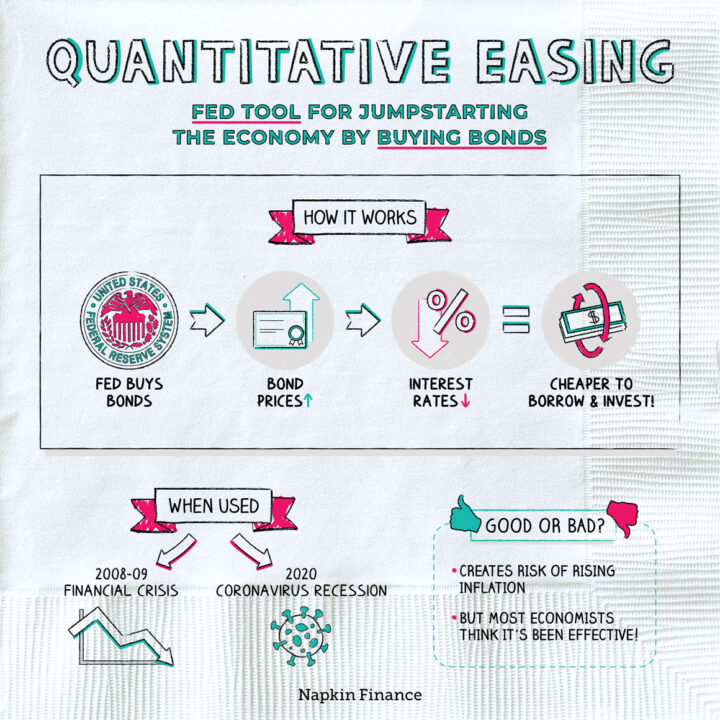

Learn moreQuantitative Easing

Easy Money

Quantitative easing is when the Fed (or another country’s central bank) buys up large amounts of bonds....

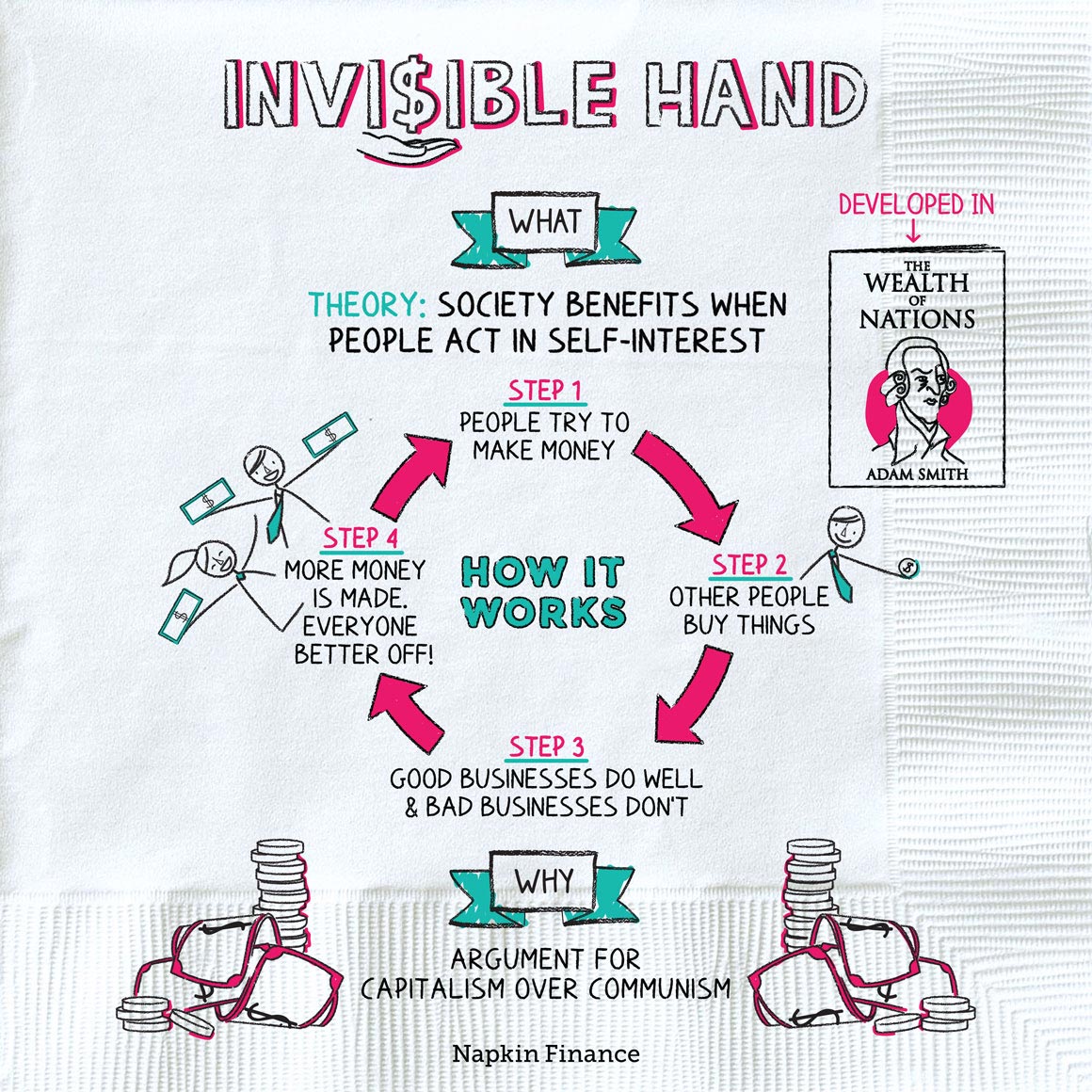

Learn moreInvisible Hand

Helping Hand

The “invisible hand” is an economic theory developed by Adam Smith. It proposes that when people act...

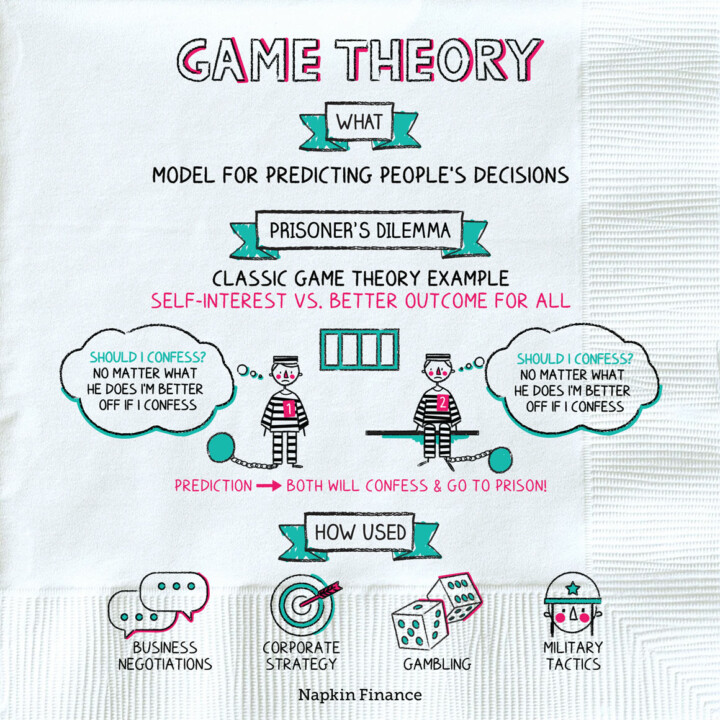

Learn moreGame Theory

Roll the Dice

Game theory is an economic model for predicting people’s decisions in tricky situations.

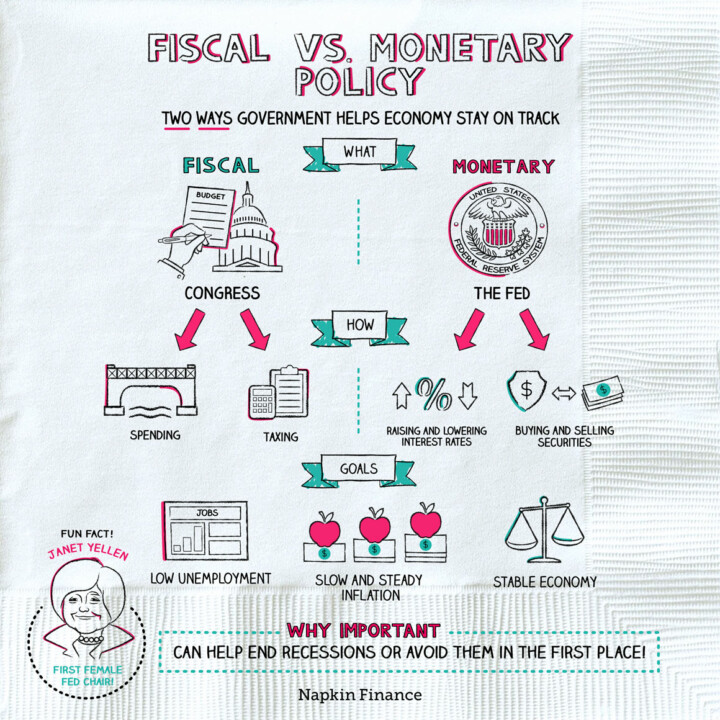

Learn moreFiscal vs. Monetary Policy

Tax and Spend

Fiscal and monetary policy are two tools the U.S. government can use to help the economy stay...

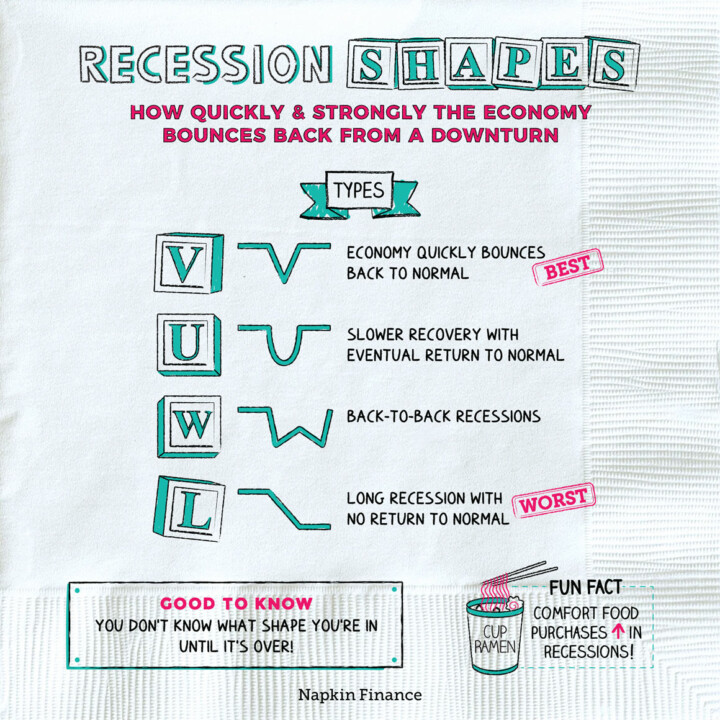

Learn moreRecession Shapes

Give Me a V

A recession is an economic downturn that lasts for at least several months and ripples throughout the...

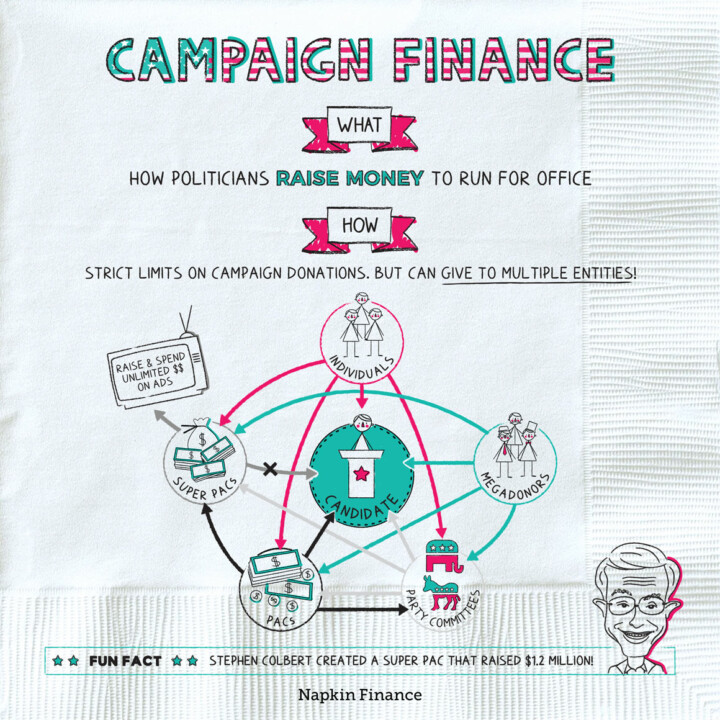

Learn moreCampaign Finance

Follow the Money

Campaign finance describes the way political candidates raise and spend money to run for office.

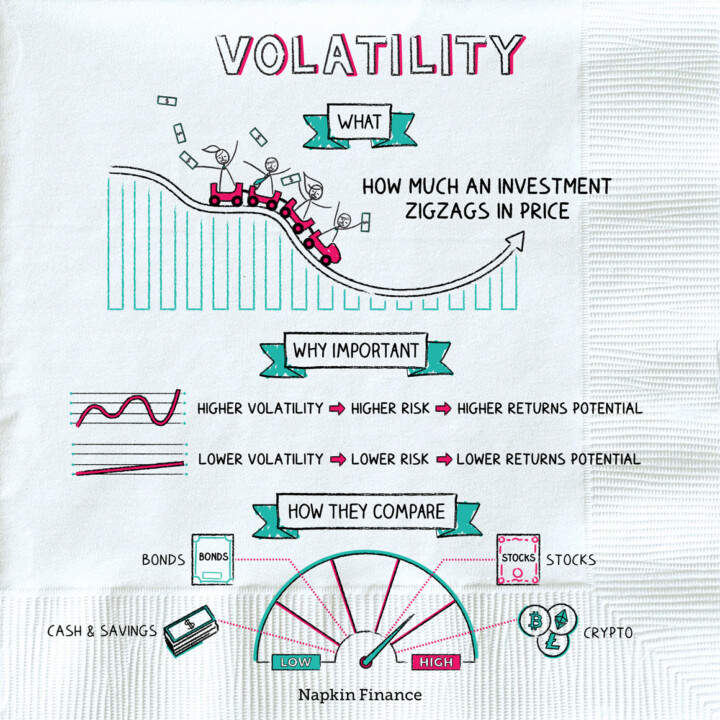

Learn moreVolatility

Rocky Road

Volatility describes how much an investment bounces around in price. More volatile investments zigzag in price more...

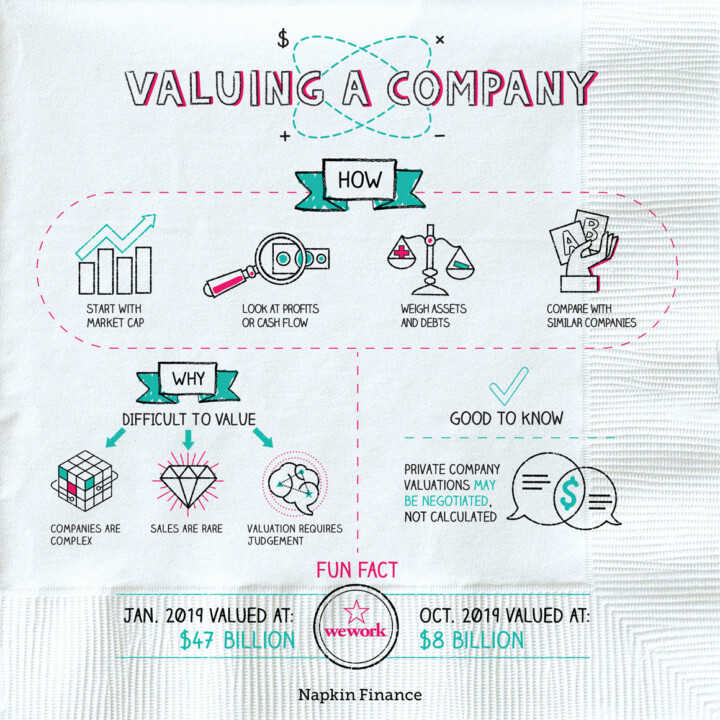

Learn moreValuing a Company

What’s it Worth?

A company’s value is the dollar figure that it might sell for if a person or another...

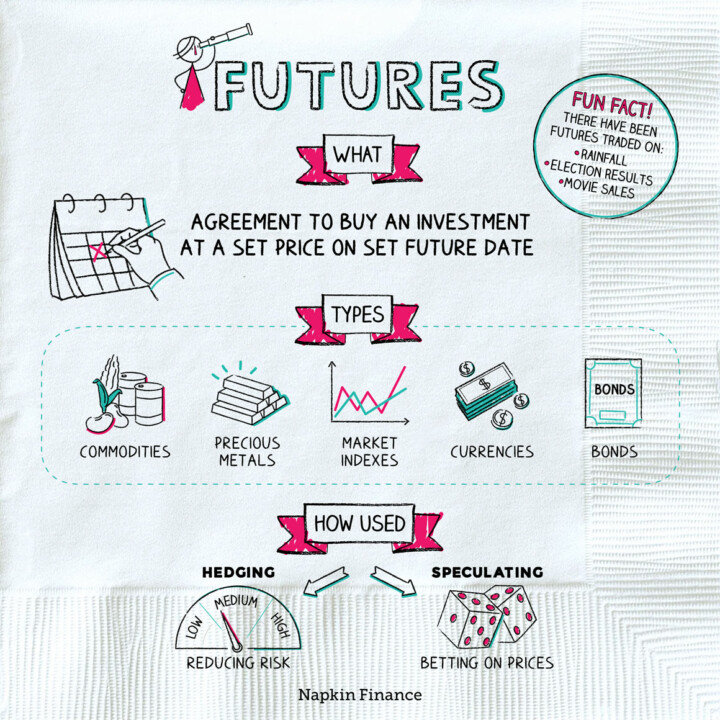

Learn moreFutures

Looking Ahead

A futures contract is an agreement to buy a specific investment at an agreed-upon price on an...

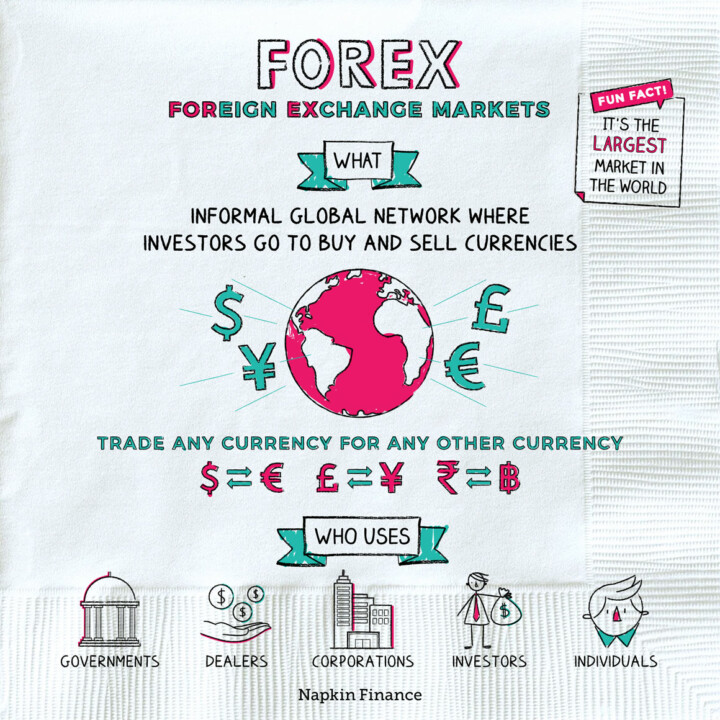

Learn moreForex

Hard Currency

The foreign exchange, or forex, markets are where investors go to buy and sell currencies. Unlike the...

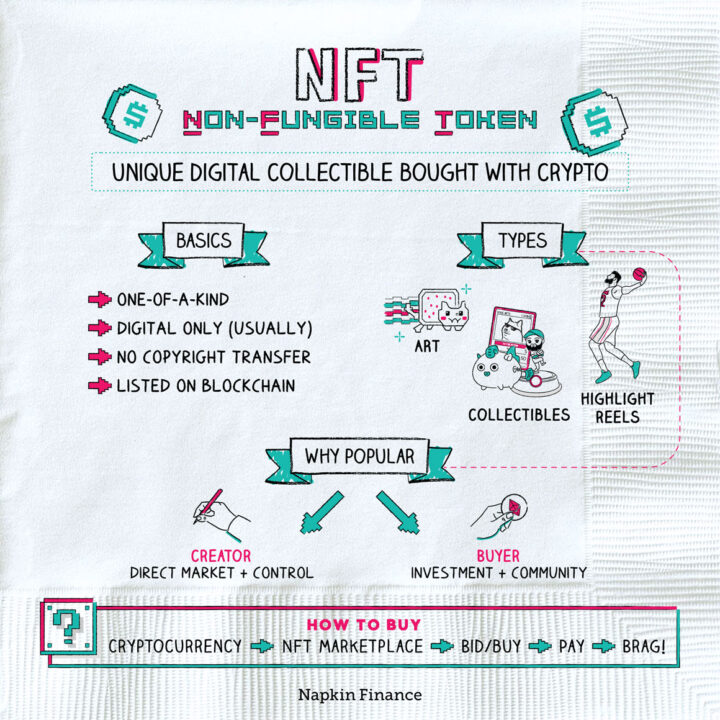

Learn moreNFTs

(Not So) Real World

An NFT, or non-fungible token, is a code that says you own a unique digital item.

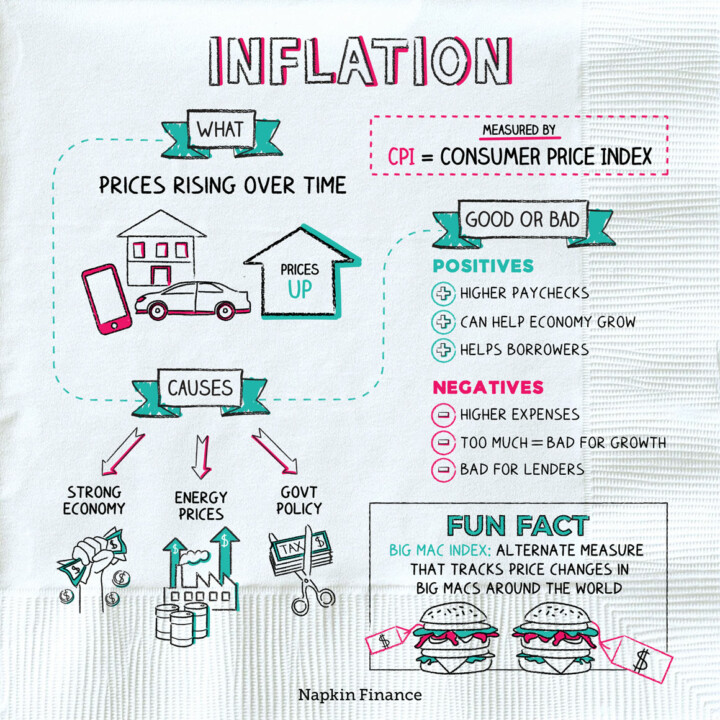

Learn moreInflation

On the Up and Up

Inflation is when prices of things rise over time. For example, in 1980 you could buy a...

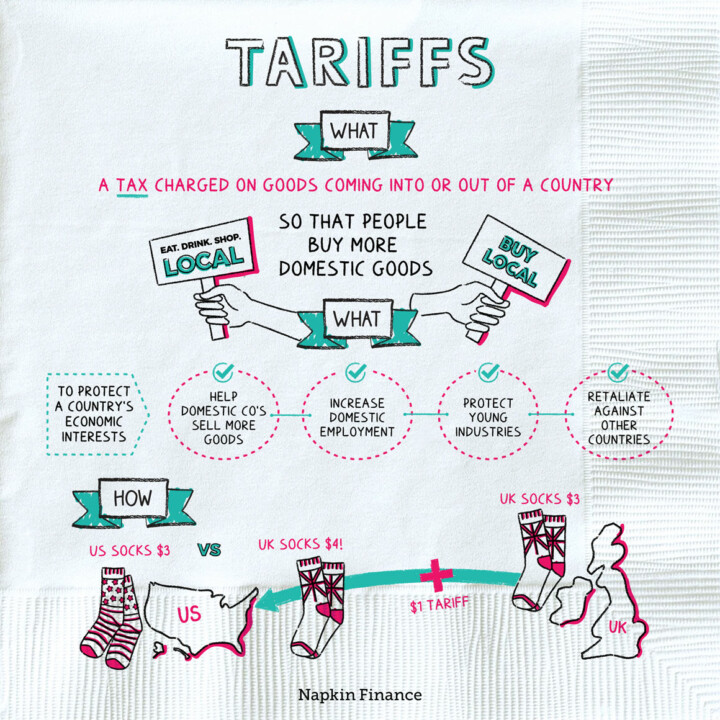

Learn moreTariffs

Barriers to Entry

A tariff is a tax charged on goods coming into or out of a country. When a...

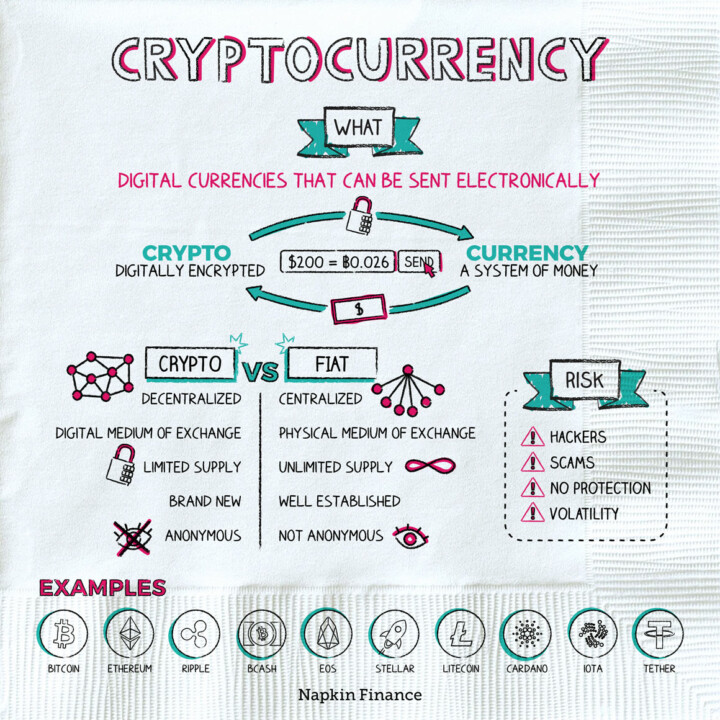

Learn moreCryptocurrency

Tales of the Crypto

Cryptocurrency is digital money that can be sent electronically anywhere in the world.

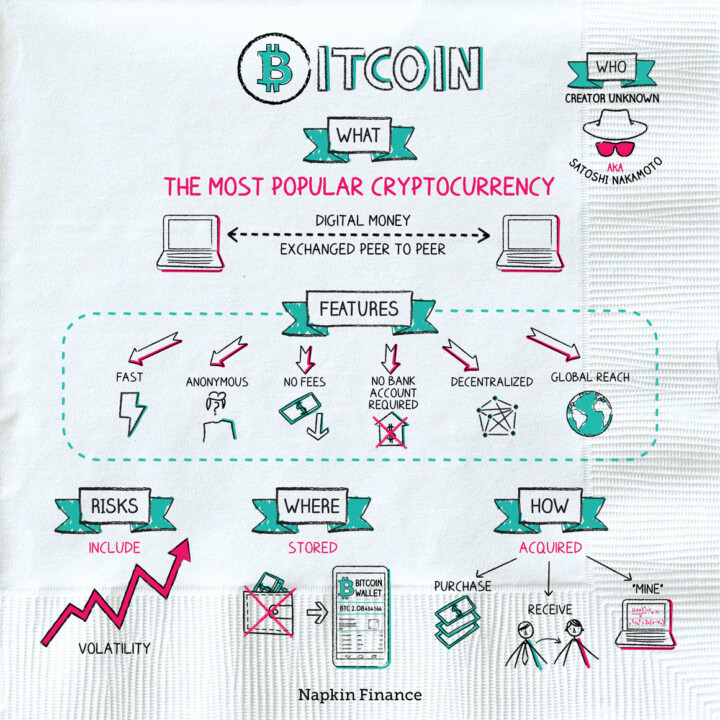

Learn moreBitcoin

Not So Silky Road

Bitcoin is the world’s first type of digital money, or cryptocurrency. Unlike traditional paper money, Bitcoin only...

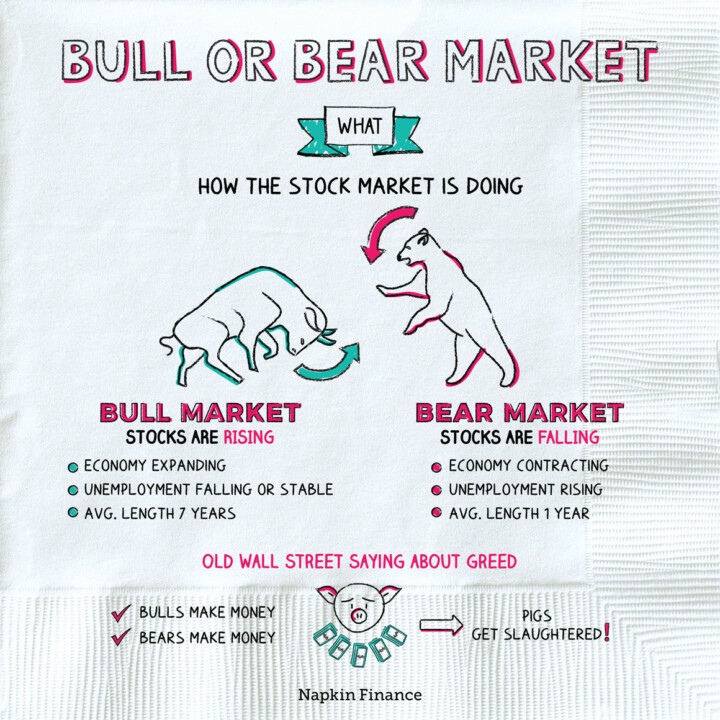

Learn moreBull or Bear Market

Into the Wild

Wall Street may be a bit of a rodeo, but there are no literal bulls or bears....

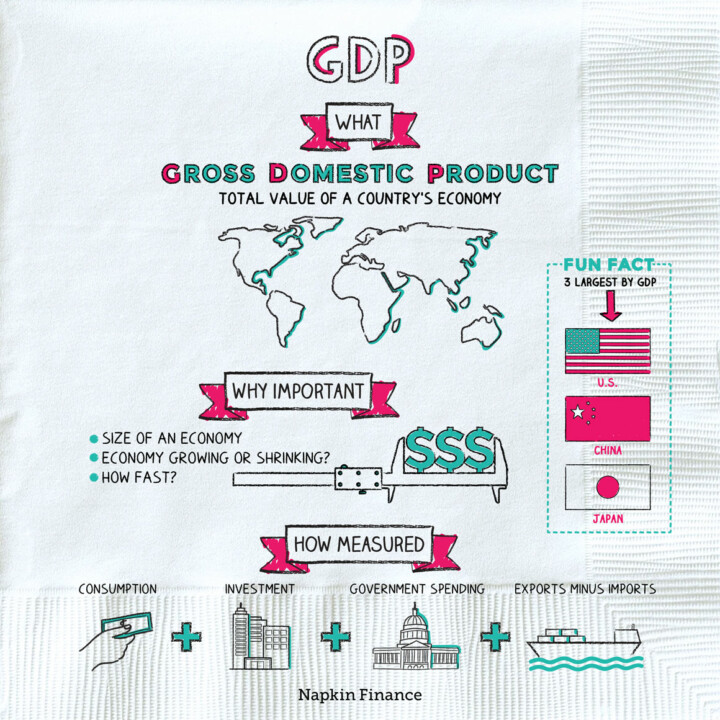

Learn moreGDP

Grossly Underrated

Gross domestic product, or GDP, measures the size of an economy. In essence, it puts a dollar...

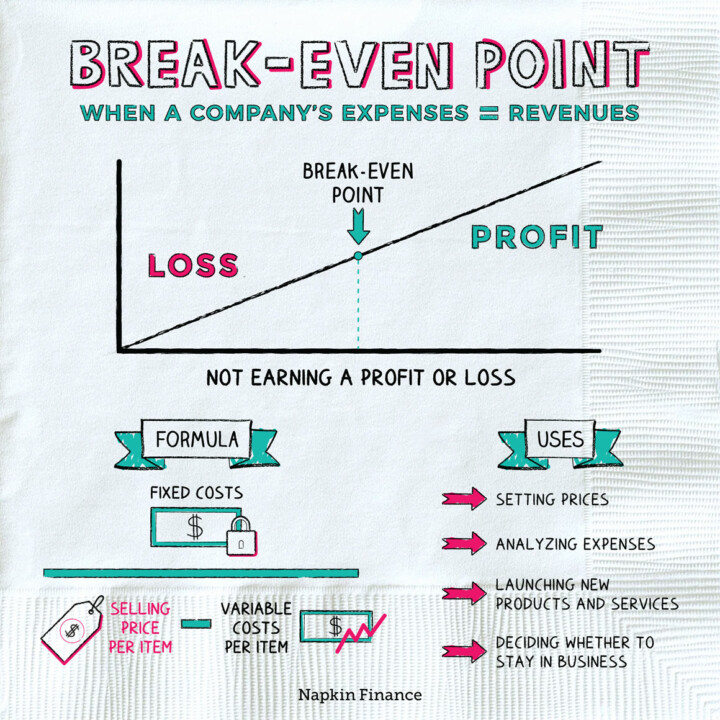

Learn moreBreak-Even Point

Point Break

A company is at its break-even point when its revenue equals its expenses. It is neither making...

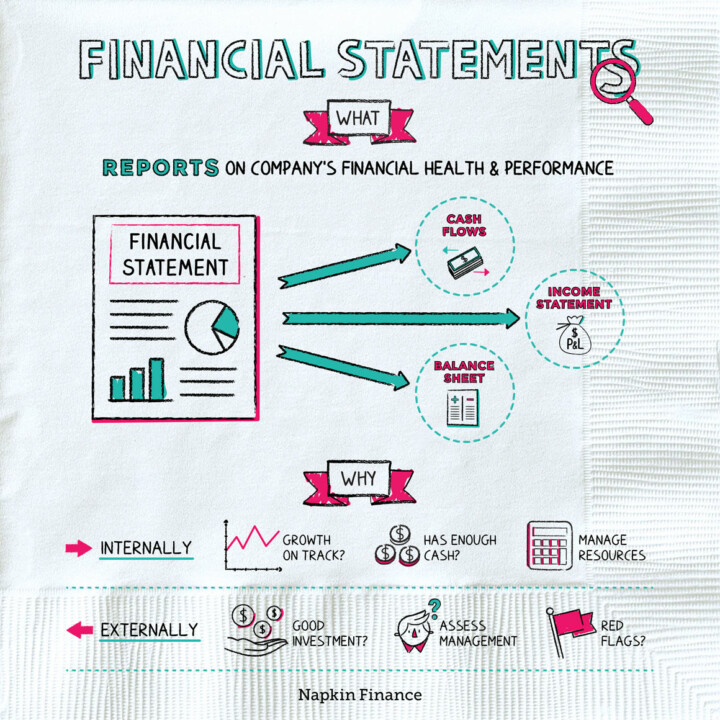

Learn moreFinancial Statements

State of Affairs

Financial statements are reports a company puts together to measure how it’s doing. Companies create their financial...

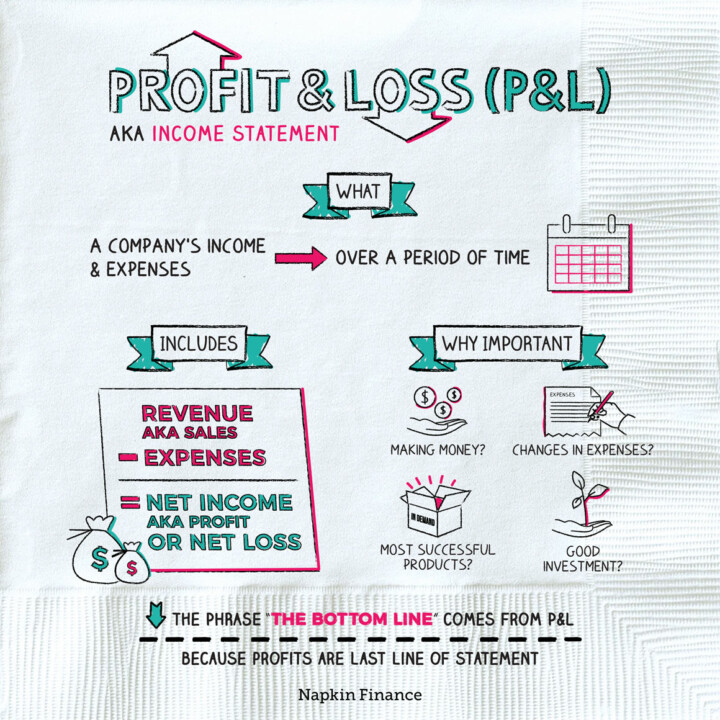

Learn moreProfit and Loss (P&L)

The Bottom Line

A profit and loss statement, or income statement, shows the money a company earned and what it...

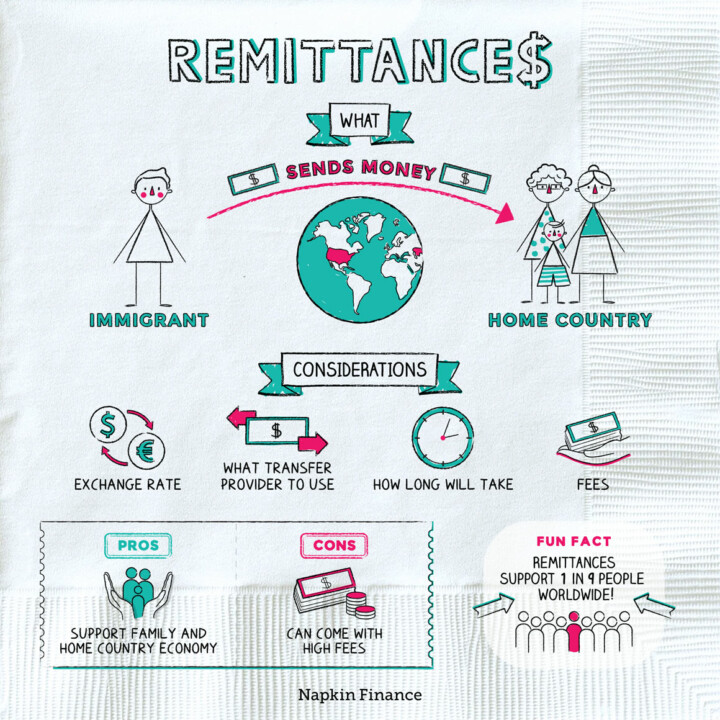

Learn moreRemittance

Check’s in the Mail

Remittances, also known as remittance transfers or international wires, are when someone in one country sends money...

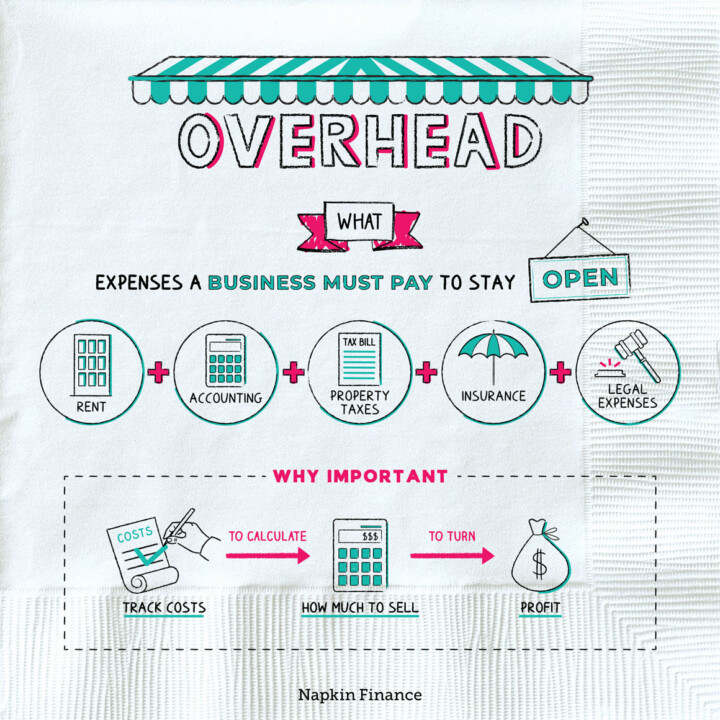

Learn moreOverhead

Keep the Lights On

Overhead refers to the expenses a business must pay just to stay open. Also known as “indirect...

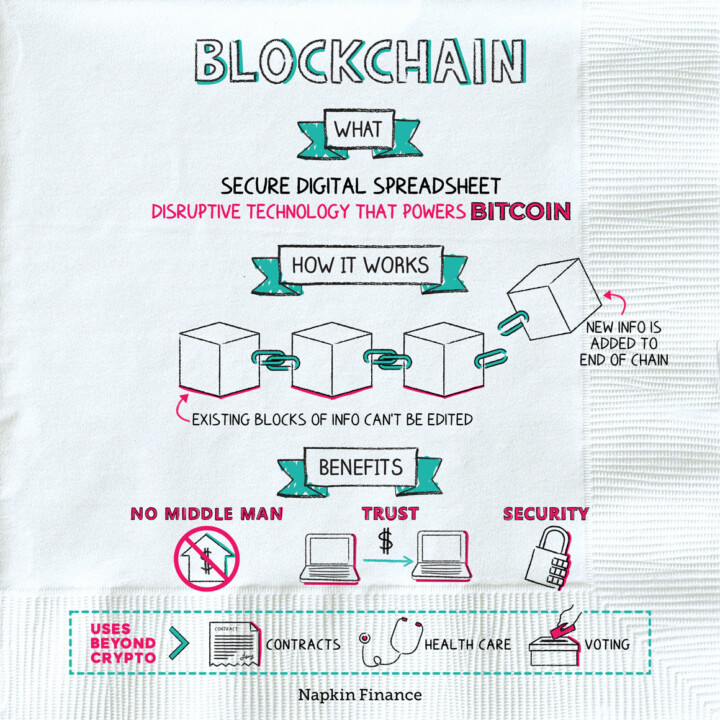

Learn moreBlockchain

Chain Gang

Blockchain is the recordkeeping technology that serves as the foundation for Bitcoin and some other types of...

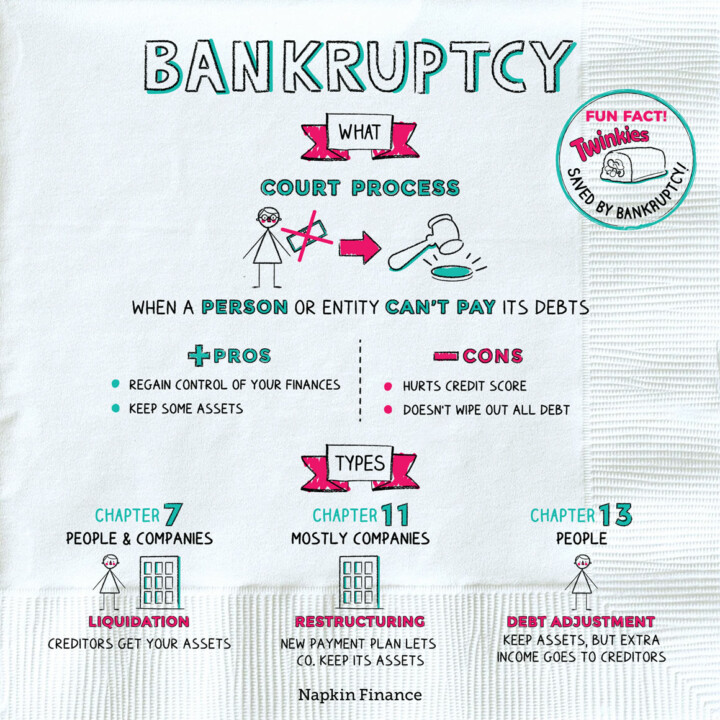

Learn moreBankruptcy

Lose Your Shirt

Bankruptcy is the legal process for consumers or businesses to get help with their debt. Bankruptcy starts...

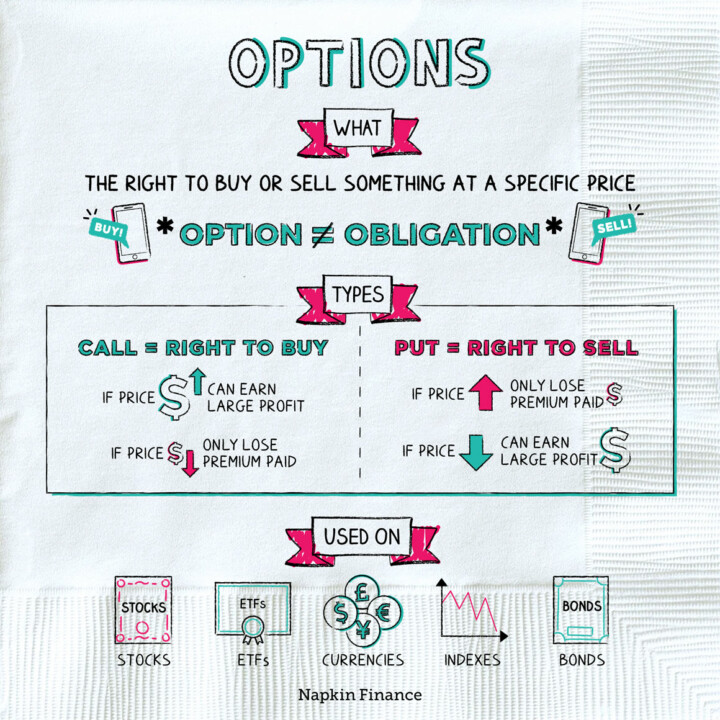

Learn moreOptions

Coming Attractions

An option is the right, but not obligation, to buy or sell an investment at a specific...

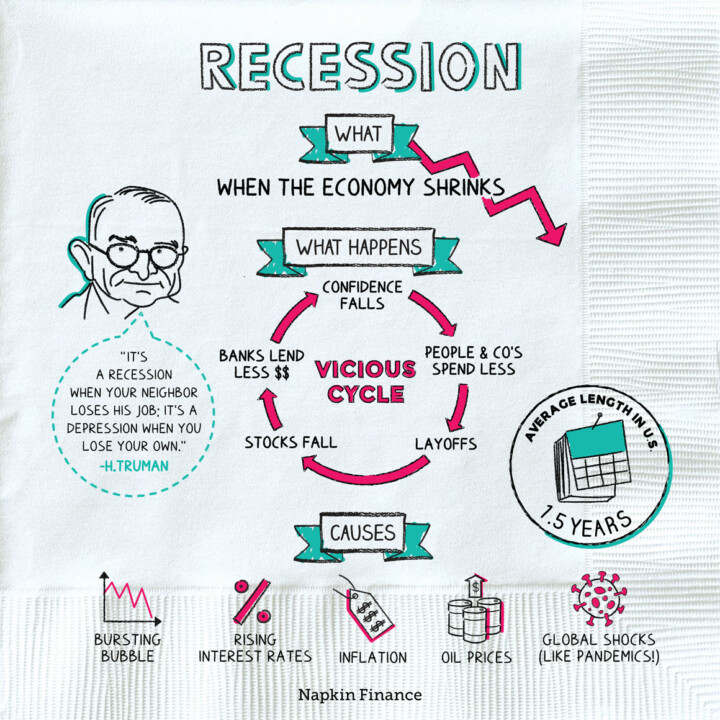

Learn moreRecession

Feel the Pinch

A recession refers to a time when the economy shrinks instead of grows. More specifically, economists typically...

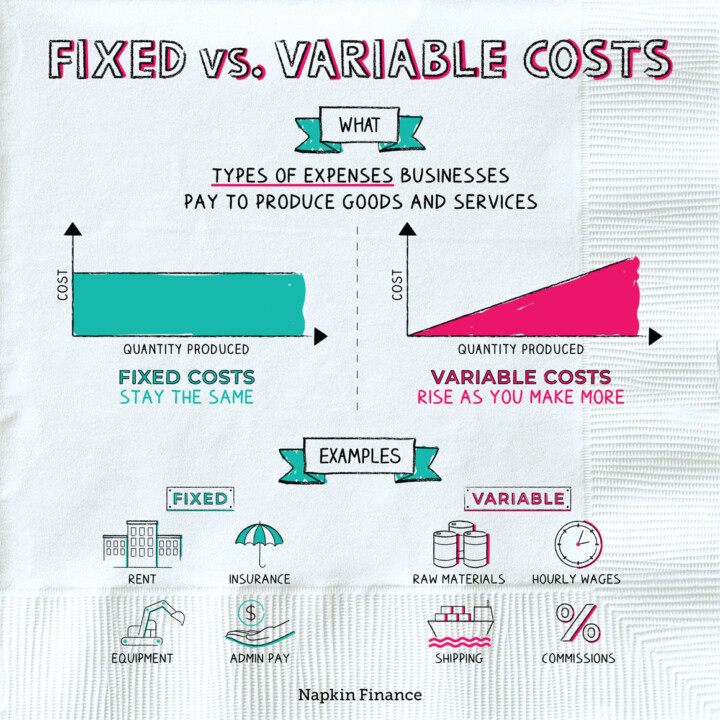

Learn moreFixed vs. Variable Costs

At All Costs

Fixed and variable costs are types of expenses that businesses pay in order to operate.

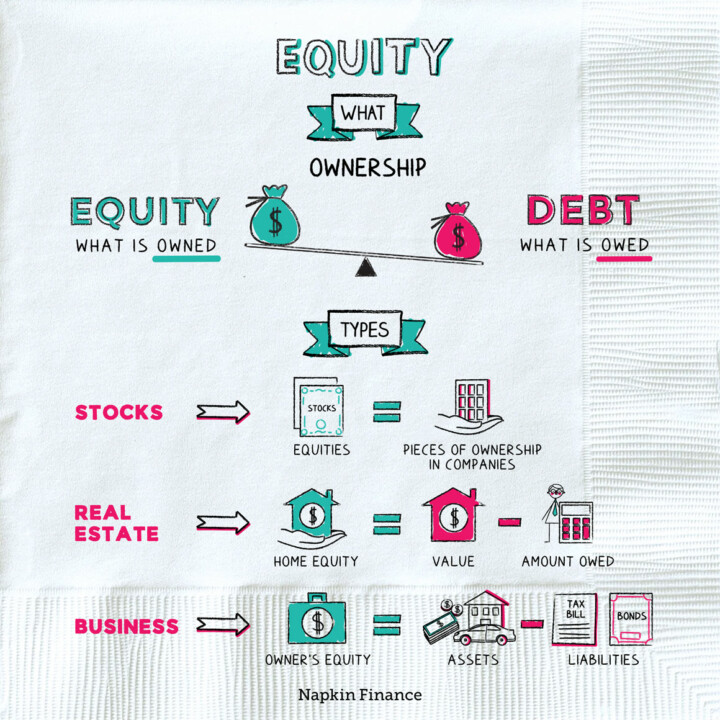

Learn moreEquity

Own It

Equity is ownership. You can have equity—or an ownership stake—in any asset, meaning anything of value.

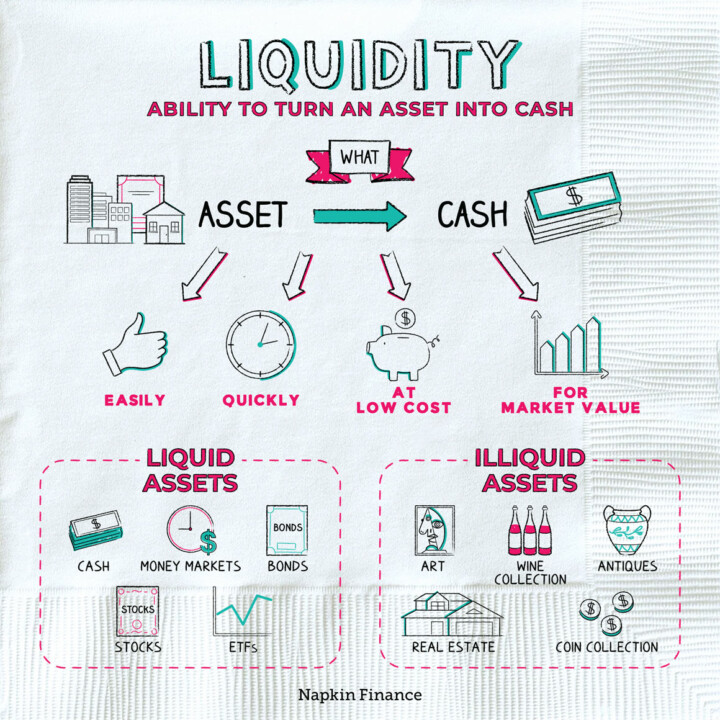

Learn moreLiquidity

Cashing Out

Liquidity refers to how easily you can sell an investment or asset at a fair price.

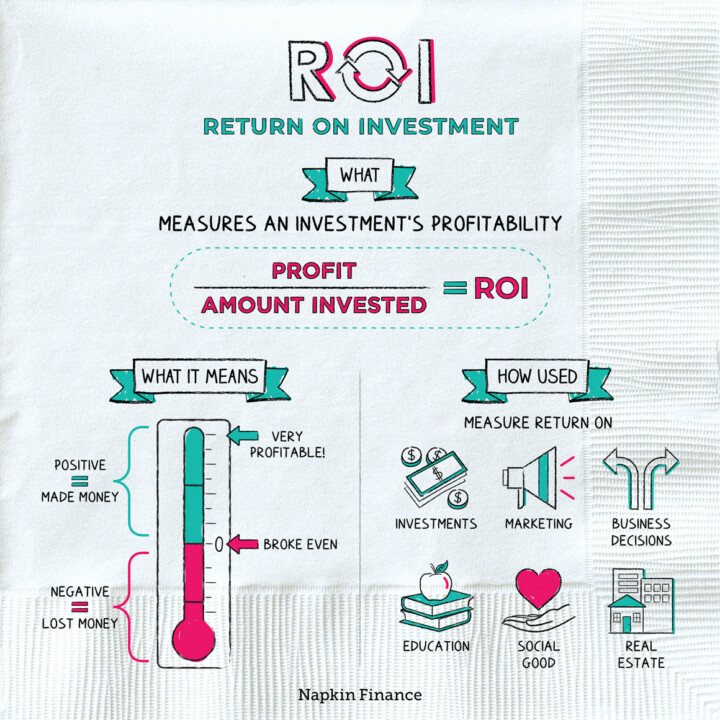

Learn moreROI

Many Happy Returns

Return on investment, or ROI, is a ratio for measuring the profitability of an investment. It puts...

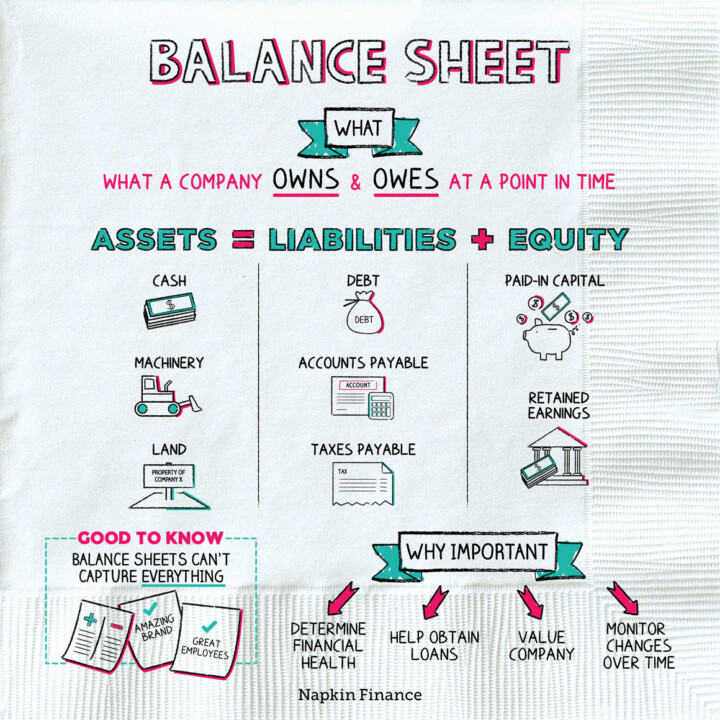

Learn moreBalance Sheet

Cook the Books

A balance sheet is a snapshot of financial health, showing what a company or person owns and...

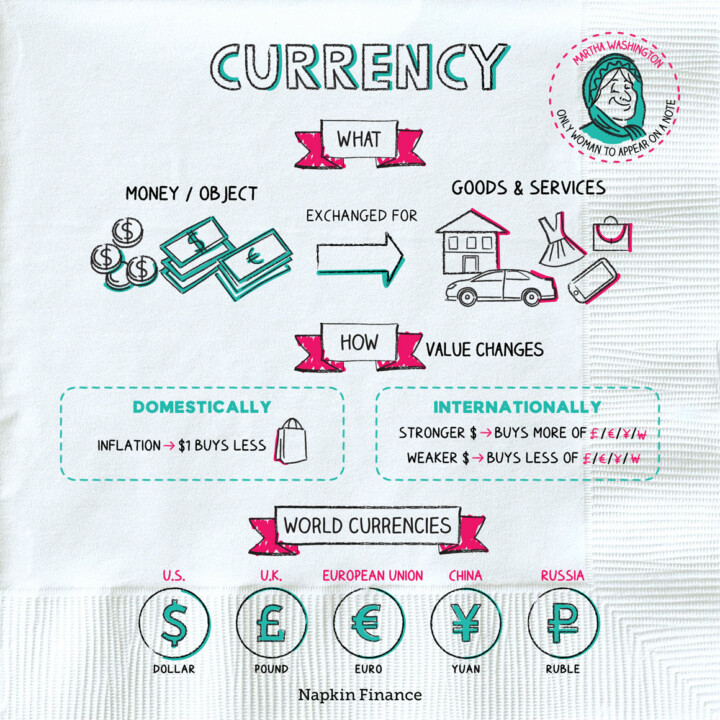

Learn moreCurrency

All About the Benjamins

Currency is anything that people use to store value or trade for goods or services. Currency can...

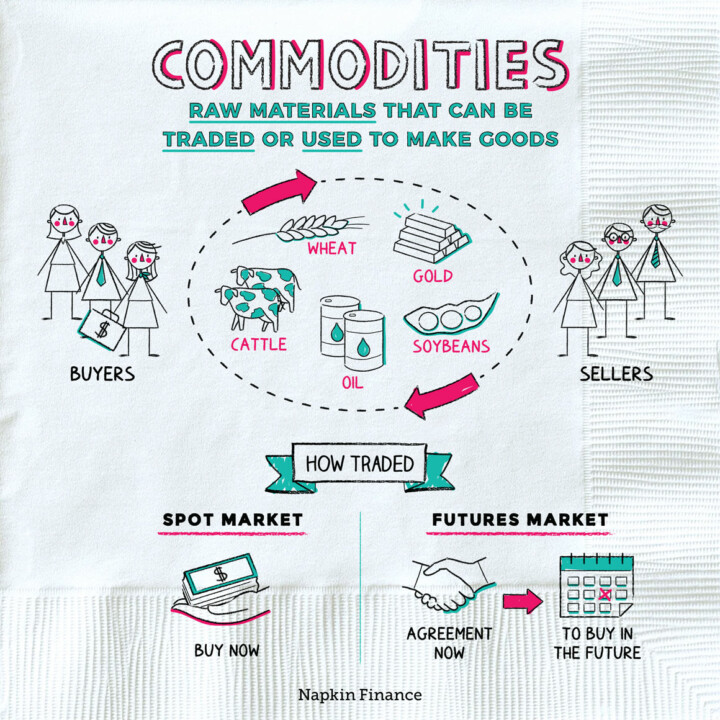

Learn moreCommodities

Back to Basics

Commodities are raw materials. They are the inputs, or ingredients, that are used to make most of...

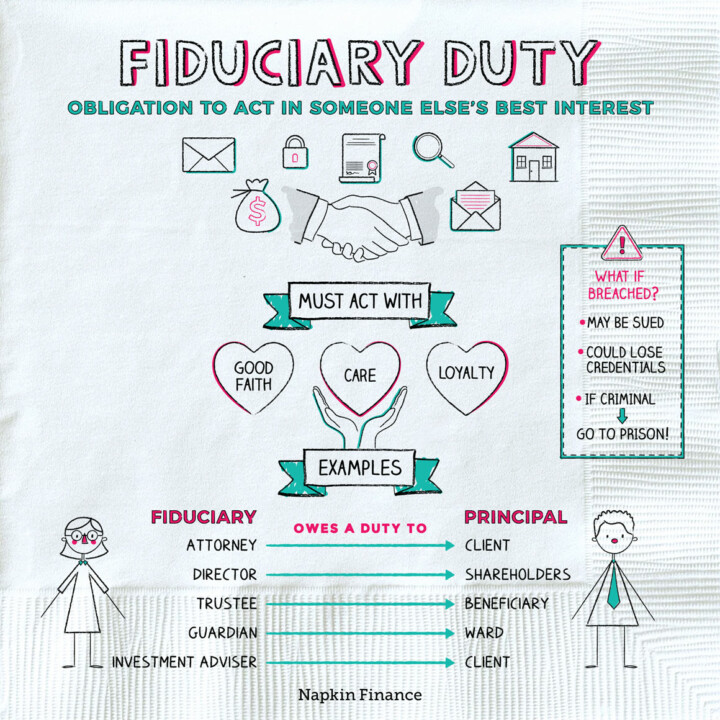

Learn moreFiduciary Duty

Your Best Interest

A fiduciary duty is a legal obligation to act in another person’s best interest.

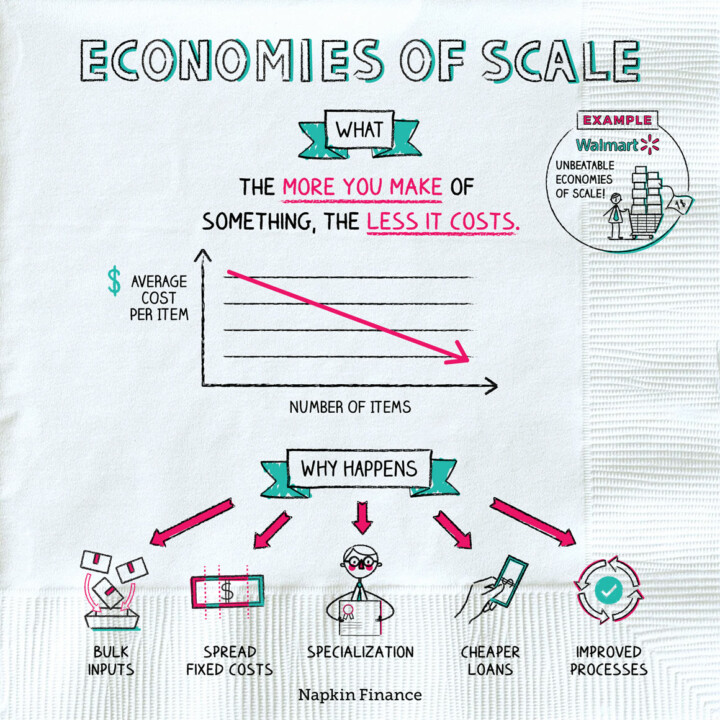

Learn moreEconomies of Scale

The Bigger, the Better

Economies of scale occur when it’s cheaper to produce a lot of something than it is to...

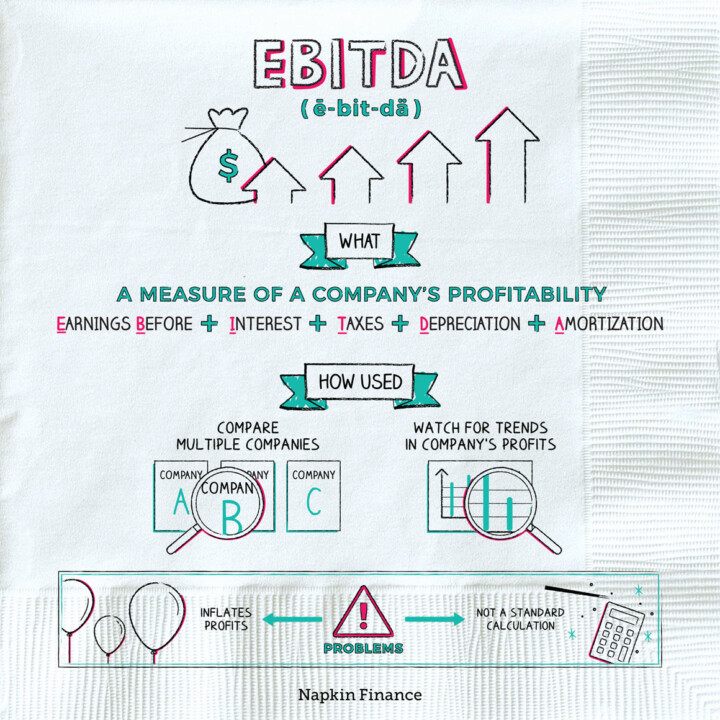

Learn moreEBITDA

How You Slice It

EBITDA (pronounced “ee-bit-tah”) stands for “earnings before interest, taxes, depreciation, and amortization.” It’s one measure of a...

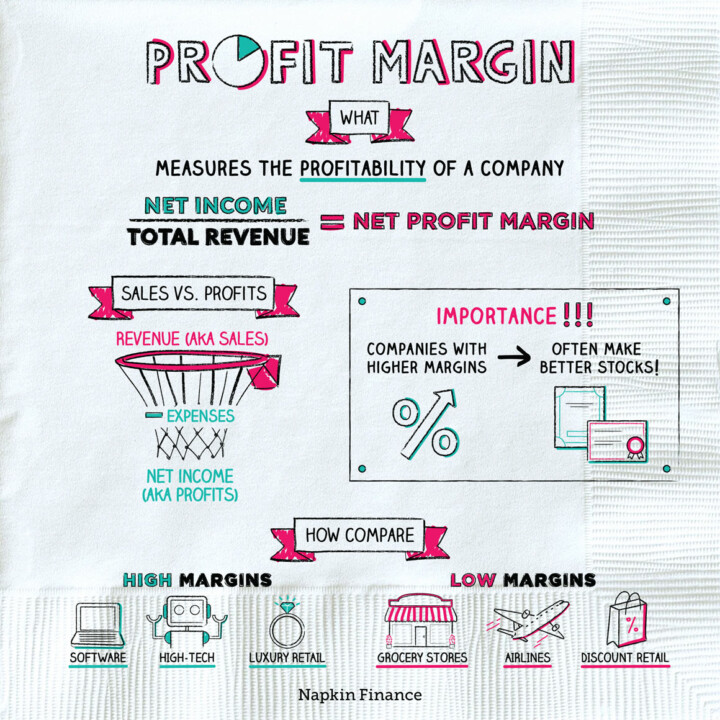

Learn moreProfit Margin

Margin of Error

A company’s profit margin measures the portion of its total sales that it gets to keep as...

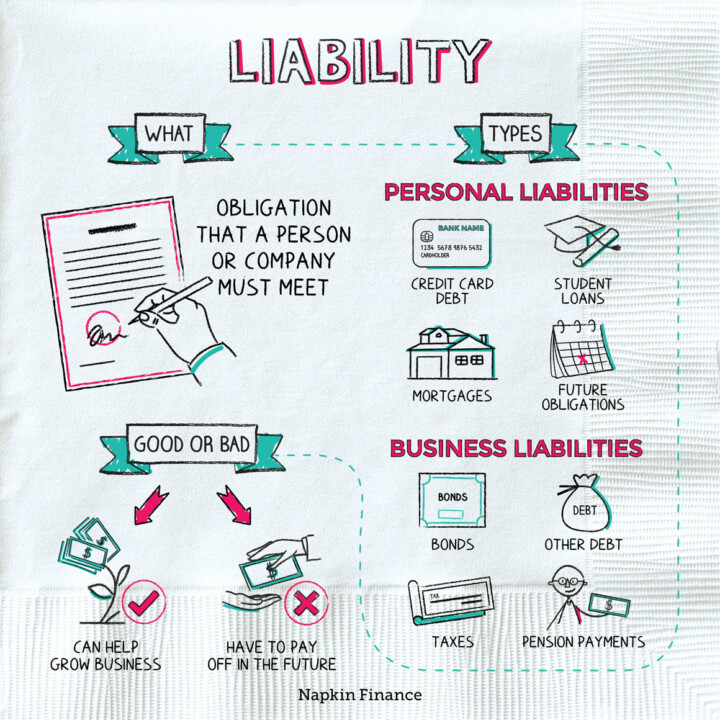

Learn moreLiability

Much Obliged

A liability is something that will require you (or a company) to spend money or resources in...

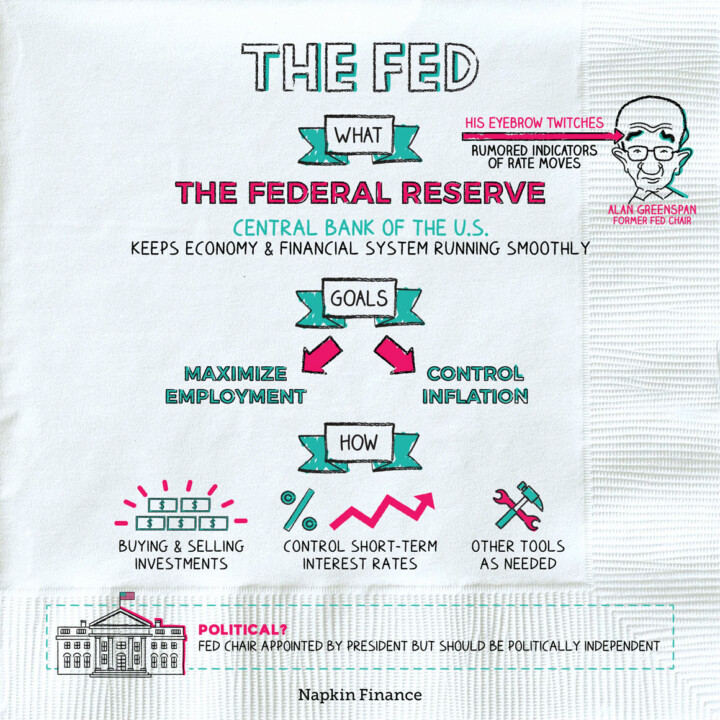

Learn moreThe Fed

Making a Federal Case

The Fed is the central bank of the U.S. Its overarching role is to make sure that...

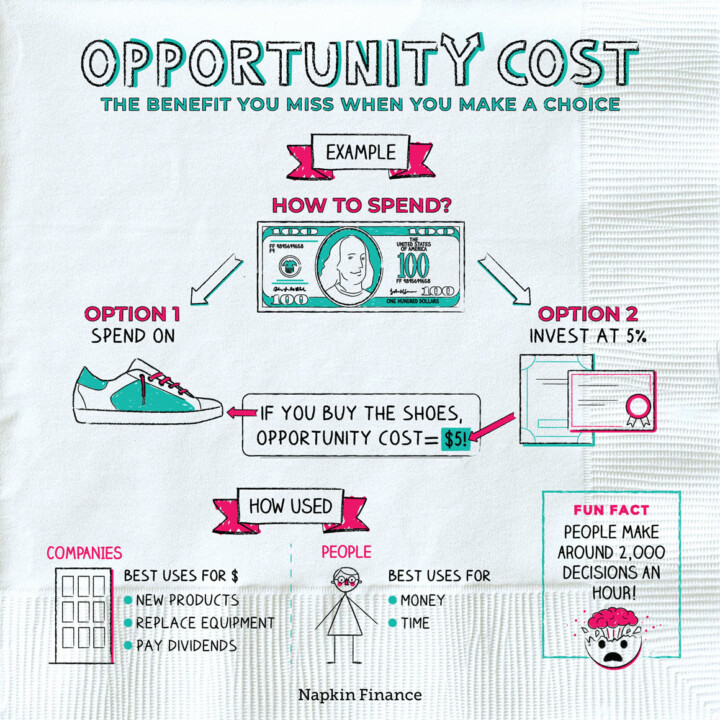

Learn moreOpportunity Cost

Fork in the Road

Opportunity cost is the return or benefit you miss out on by choosing one option over the...

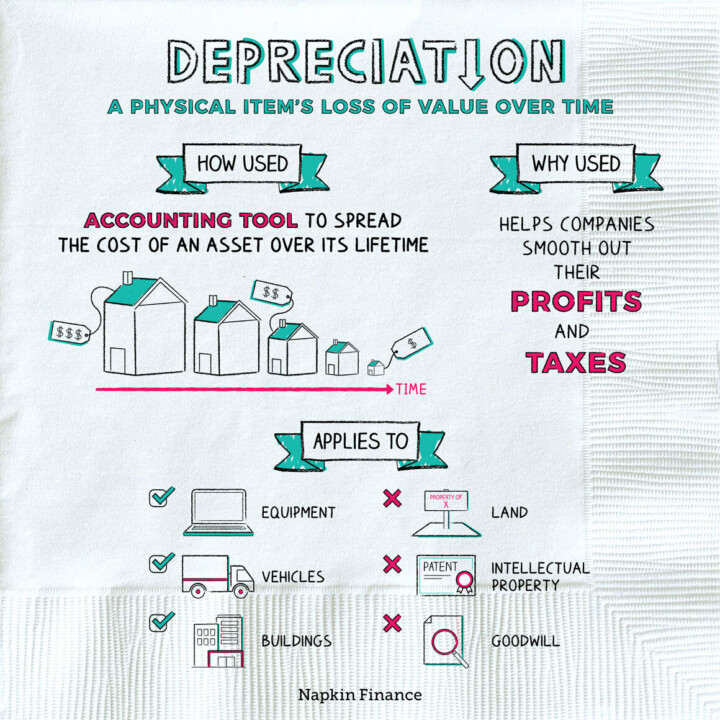

Learn moreDepreciation

Wear and Tear

Depreciation is a physical asset’s loss of value over time. Just as your once new car is...

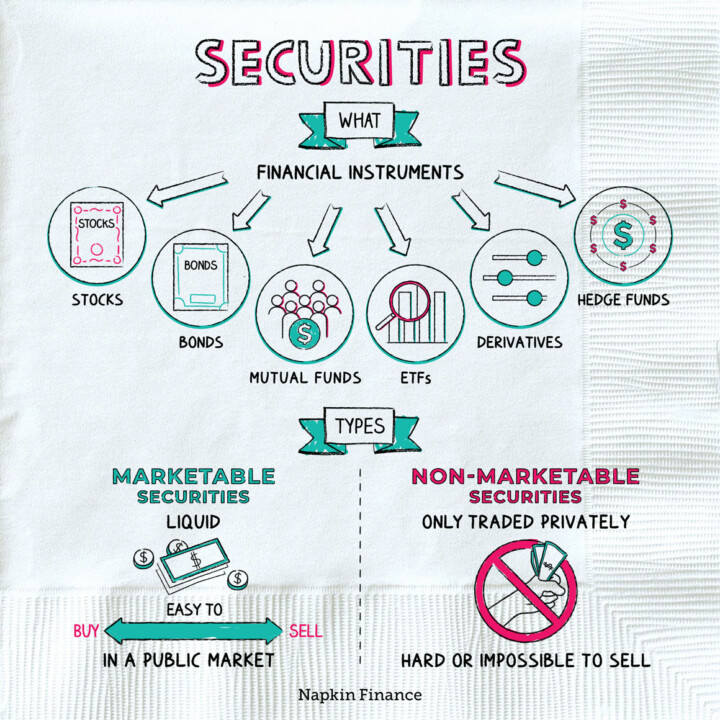

Learn moreSecurities

Market Maker

“Securities” is the term used to describe stocks, bonds, mutual funds, and other types of financial investments....

Learn more