Risk Tolerance

Appetite for Destruction

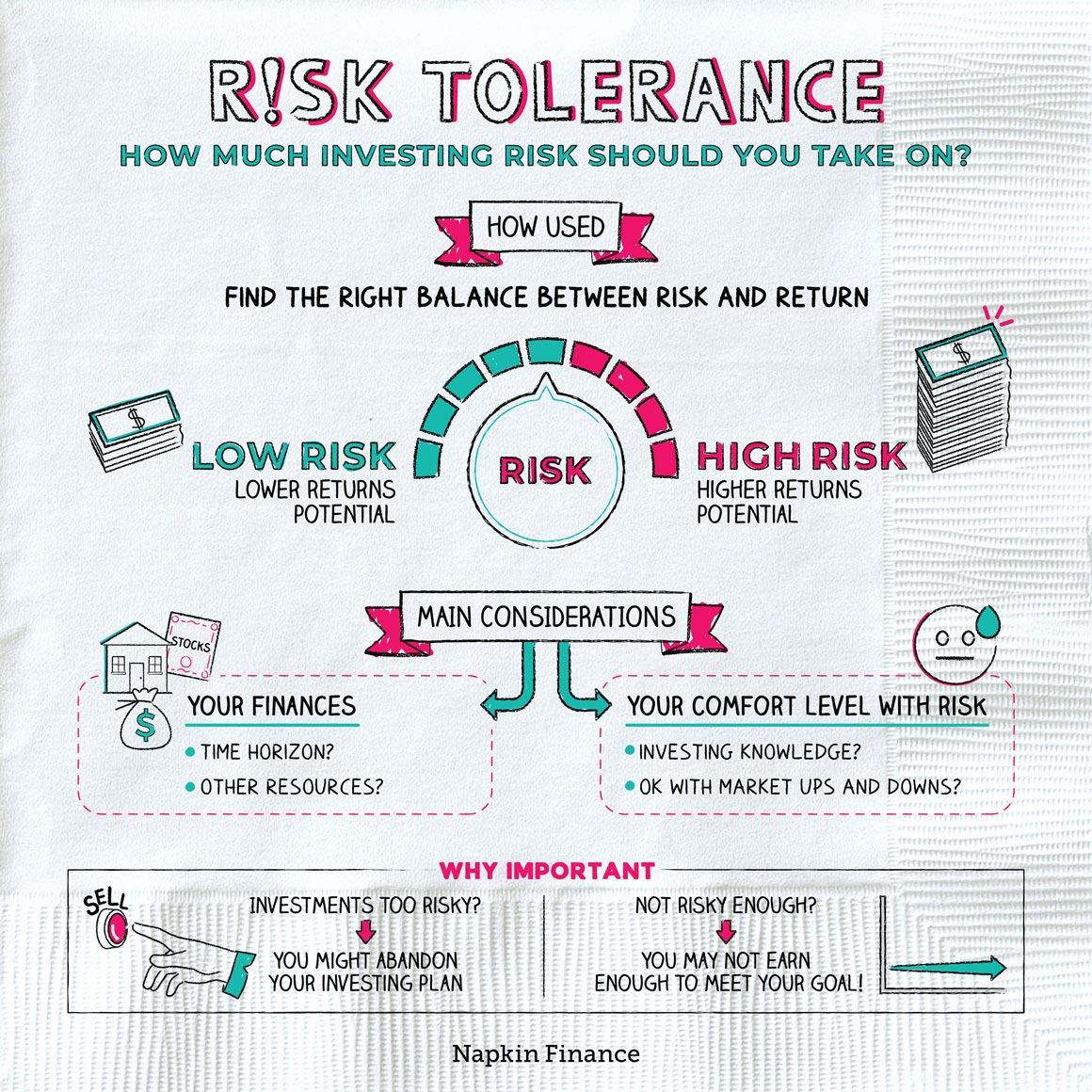

Risk tolerance describes how much risk you can (or should) be taking on with your investments.

Investing always comes with some risk of losing money. But investments that return more also tend to be riskier. Figuring out your risk tolerance can help you figure out the right balance between these two issues: aiming for higher returns while aiming to avoid big losses.

Your risk tolerance boils down to two main considerations: your financial ability to take on risk and your personal comfort level with risk. Here’s what each of those considerations really means:

| Financial ability | Comfort level | |

| Why it matters | If your investment portfolio took a nosedive, would it be catastrophic for your finances, or would you have plenty of other resources to fall back on? | Would you be pulling out your hair if your investments fell 10% or 20%, or are you comfortable rolling with the market’s ups and downs? |

| What to consider |

|

|

Generally speaking, you’ll have a higher risk tolerance if you have a longer time horizon, plenty of other financial resources, and a less important goal. Similarly, the more you know about investing and the greater your comfort level with market drops (because sometimes—they happen), the more risk you can take on.

There’s no defined formula for calculating risk tolerance. Financial planners and advisors typically offer risk tolerance questionnaires to new investors. Your answers will determine where you land on this spectrum:

| Conservative | Moderate | Aggressive |

| Lowest risk tolerance | Moderate risk tolerance | Greatest risk tolerance |

| Low financial ability and personal comfort level | Ability and/or comfort level somewhere in the middle | High financial ability and personal comfort level |

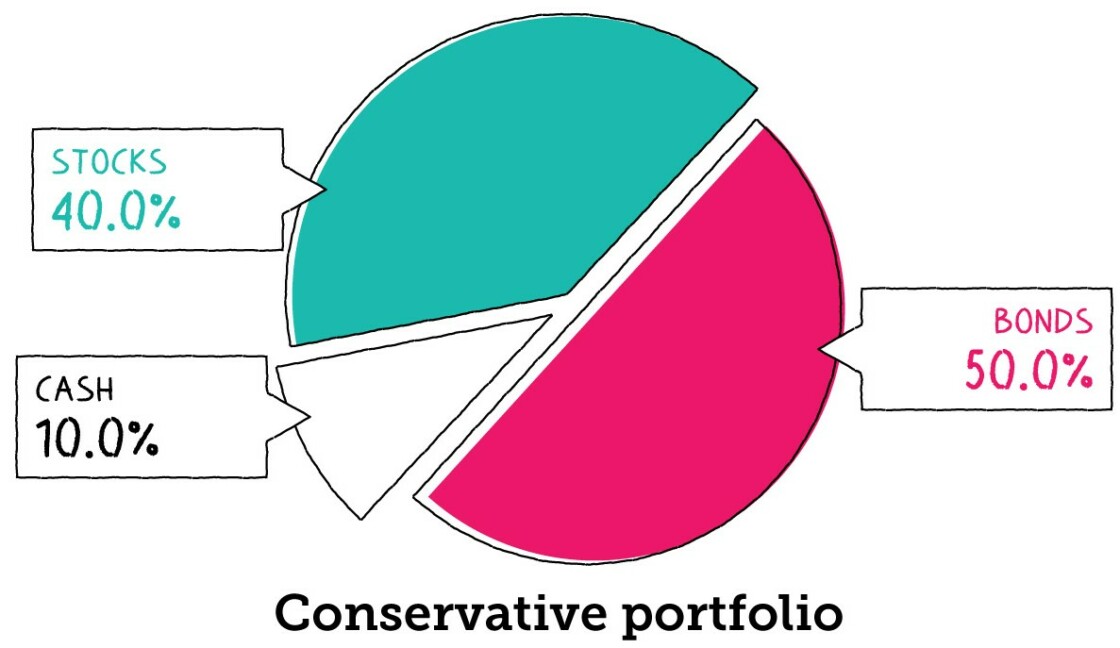

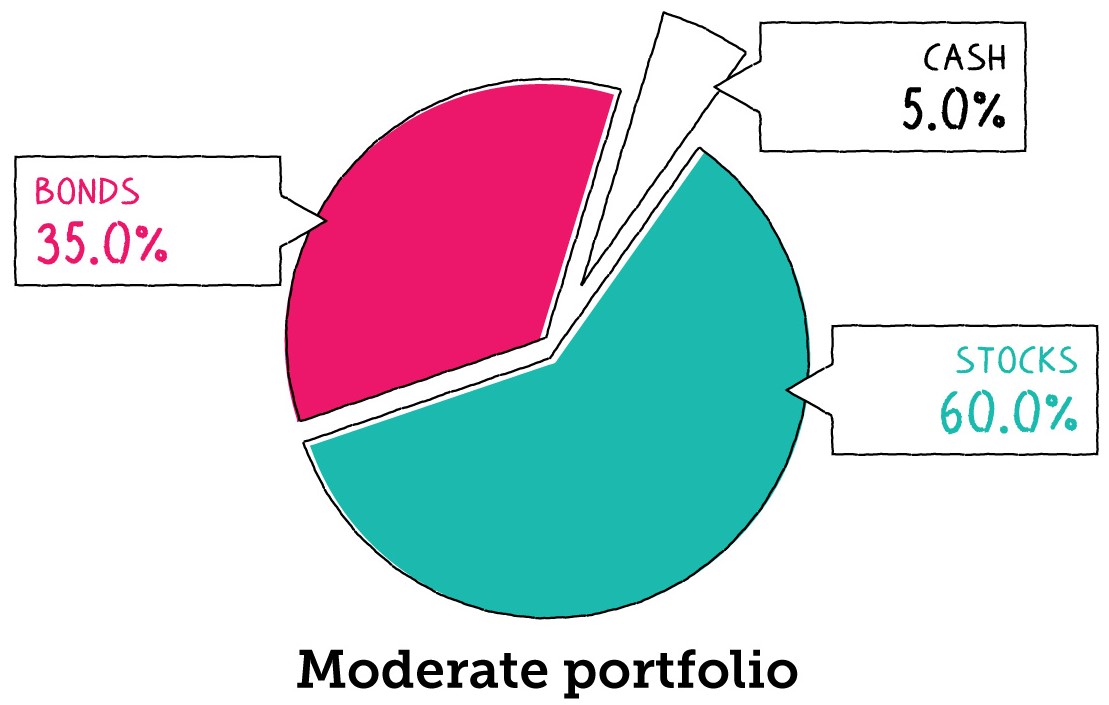

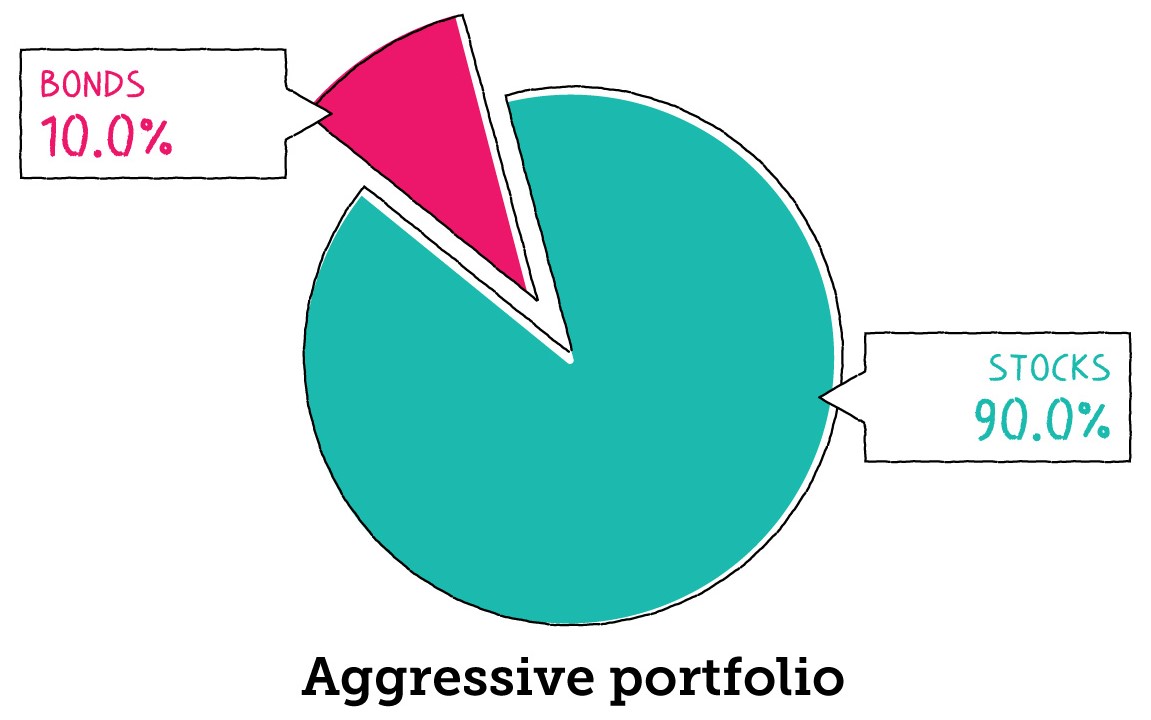

You can use your risk tolerance to figure out your asset allocation—or how much of your portfolio to invest in stocks, bonds, and other assets. Although fine-tuning your asset allocation can be complex, in the big picture, it’s all about finding that right balance between potential risk and reward.

Here’s how those three main risk tolerance categories might translate into an actual portfolio:

Although having a high risk tolerance may sound like the best result (so you can aim for those big profits!), it’s important to be honest when assessing yours.

If the strategy you choose is too aggressive, you may be tempted to sell your investments when the market falls, meaning you then lose out when it bounces back. Selling investments after they’ve fallen in price tends to ruin your long-term returns.

But on the other hand, only keeping money in a savings account means you’ll never earn a decent return. It may feel safe in there, but you won’t have much of a chance at, say, building up a comfortable retirement fund.

Your risk tolerance describes your financial ability to withstand losses and your comfort level with market ups and downs. Understanding your risk tolerance is important so that you can choose an investment portfolio with the right balance of potential reward and potential risk.

- “Penny stocks”—i.e., stocks with very low share prices—may sound cute, but they can be incredibly risky investments. That’s partly because there are high rates of fraud among the stocks. But it’s also partly due to the cold hard math of denominators. (If you lose 50 cents on a $100 stock, it’s only a loss of 0.5%. If you lose 50 cents on a $1 stock, it’s a loss of 50%.)

- Most people experience a fight-or-flight response to risky situations because their brains release cortisol. The brains of adrenaline junkies, however, release dopamine—the “pleasure” neurotransmitter.

- It’s not always the case that taking on less risk means you earn a lower return. Women tend to invest more conservatively than men but still earn better returns (on average), possibly because they trade less.

- Risk tolerance refers to your ability to take on risk with your investments.

- Two main considerations go into your overall risk tolerance: your financial capacity to take on risk and your personal comfort level with risk.

- Investments that return more are also usually riskier. Figuring out your risk tolerance is important so that you can earn a sufficient return but avoid taking on more risk than you can really handle.

- Your risk tolerance can help you choose the right asset allocation, which describes the mix of stocks, bonds, and other investments you hold.