Featured Napkin

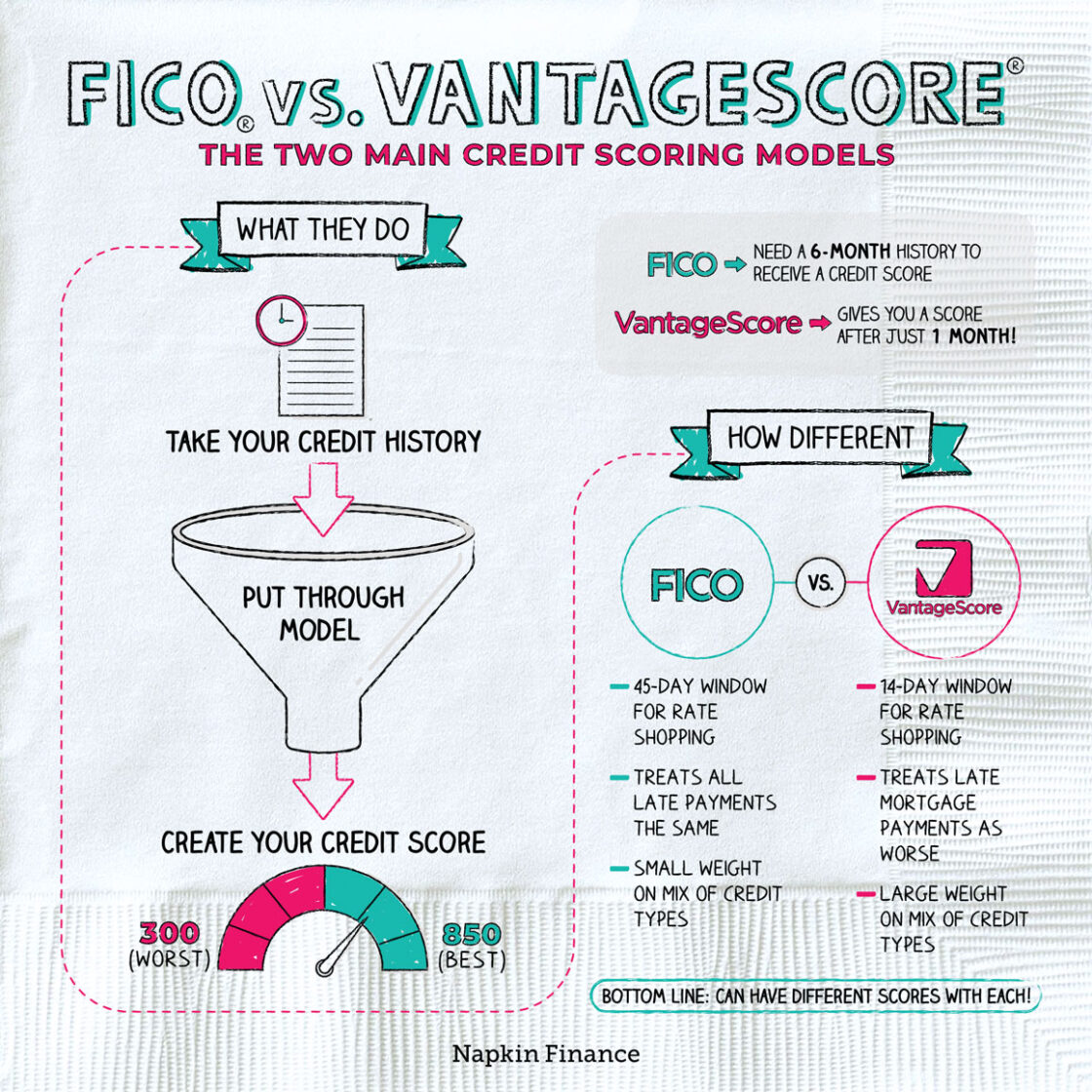

FICO vs. VantageScore

Settle the Score

FICO and VantageScore are two of the most common credit scoring models. Contrary to popular belief, you don’t actually have just one credit score—you can have a number of different scores. One thing that can drive differences in your scores is which company’s model is used, FICO or VantageScore. In...

Learn moreMore credit Napkins...

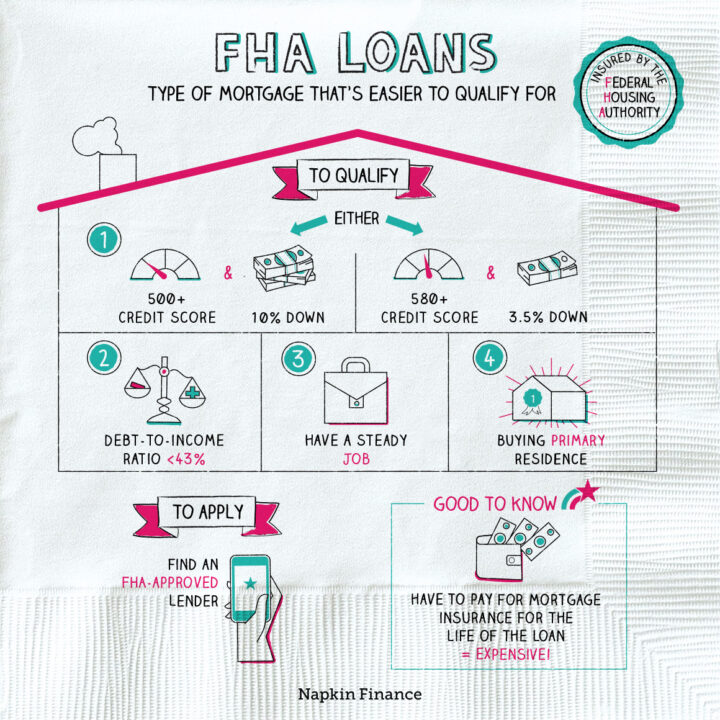

FHA Loans

Helping Hand

FHA loans are a type of mortgage loan that’s available to people who might not qualify for...

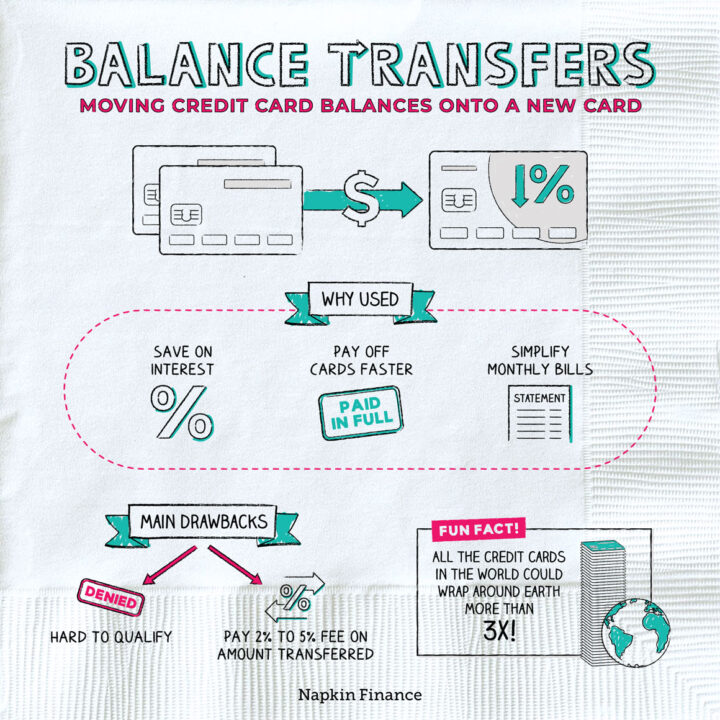

Learn moreBalance Transfers

Shell Game

Balance transfers are a way to move what you owe on one (or more) credit cards and...

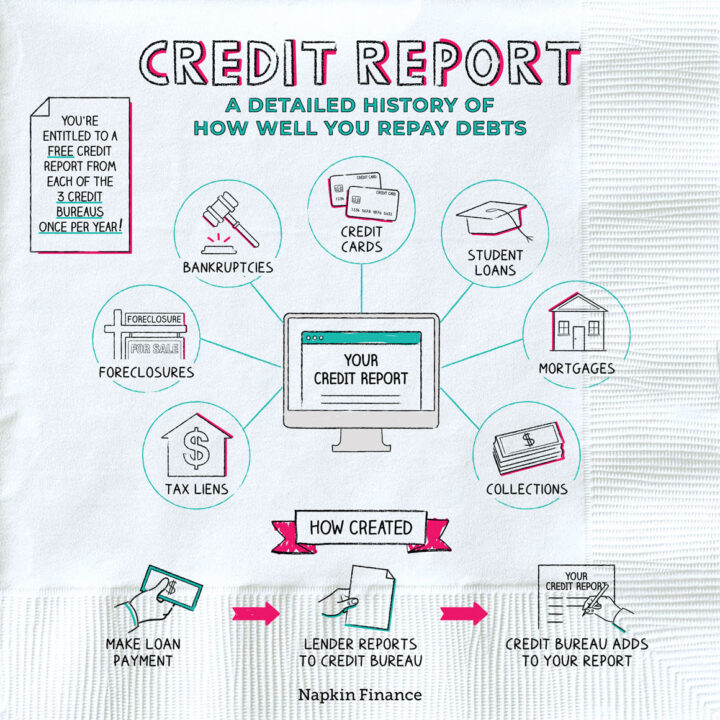

Learn moreCredit Report

Good Marks

Your credit report is a detailed history of your past use of credit. It’s a bit like...

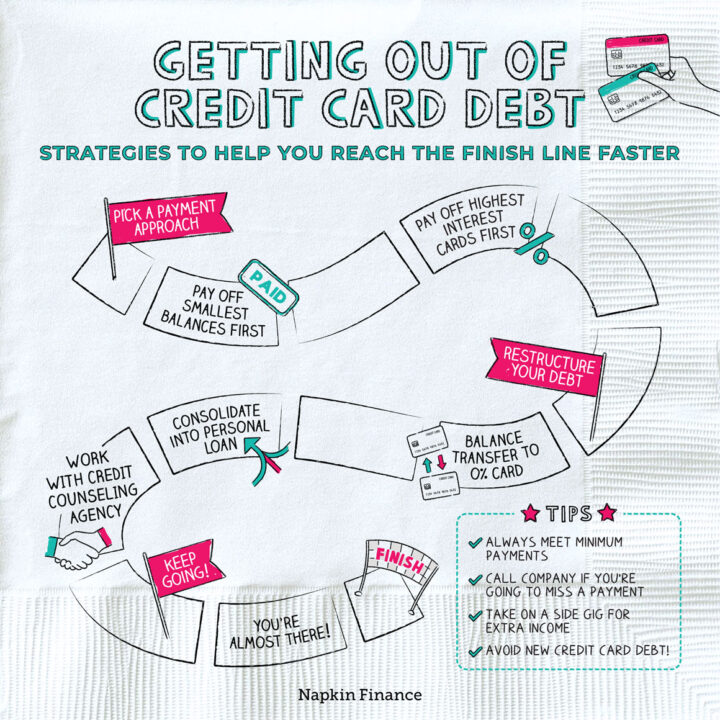

Learn moreGetting Out of Credit Card Debt

Pay the Piper

Credit card debt can be overwhelming. As interest accrues, your balances may keep increasing even if you’re...

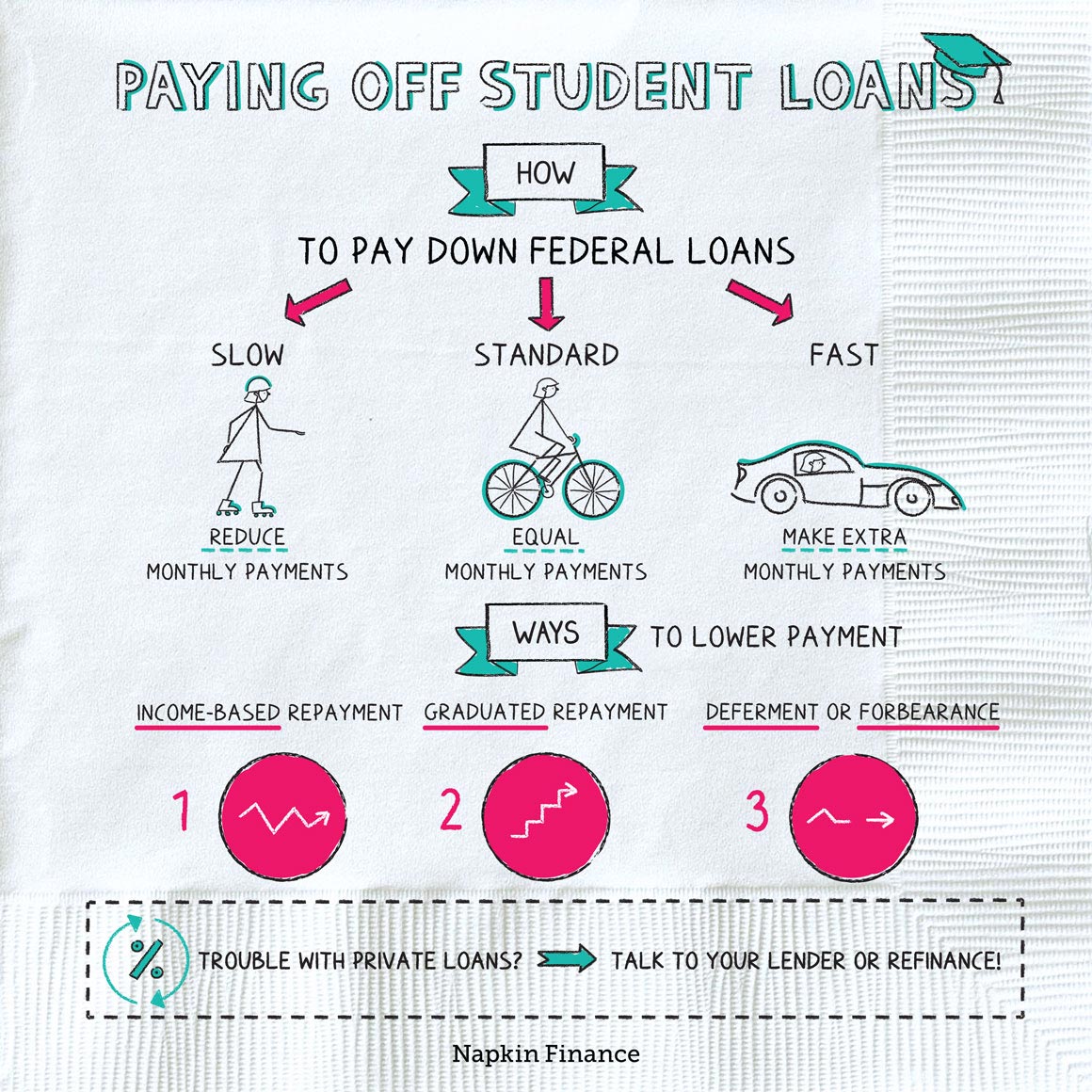

Learn morePaying Off Student Loans

Take a Load Off

It might seem like there’s only one way to pay down your student loans (namely: slowly, painfully,...

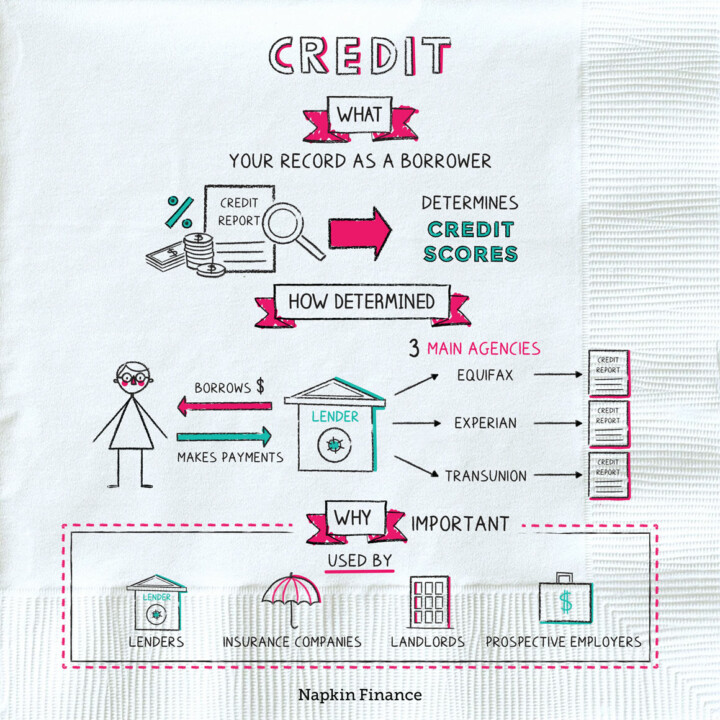

Learn moreCredit

Permanent Record

Credit is, simply put, your financial reputation. Your credit history describes your record as a borrower, including...

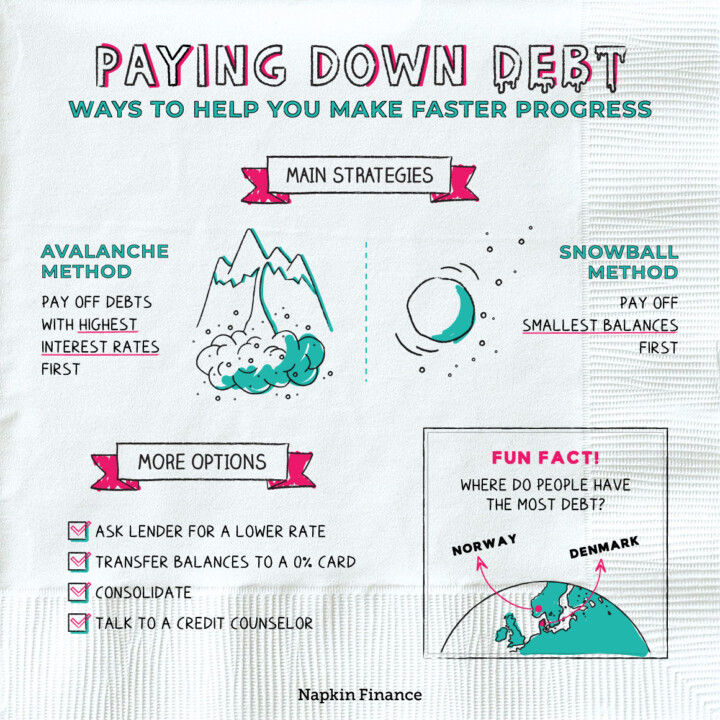

Learn morePaying Down Debt

Get Low

Paying down debt can make you more financially secure and give you more flexibility when deciding what...

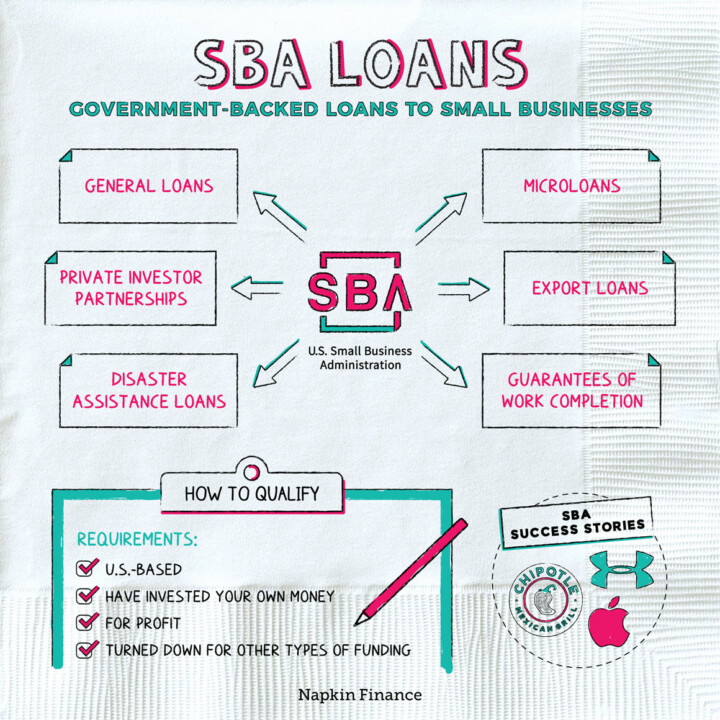

Learn moreSBA Loans

Helping Hand

SBA-guaranteed loans (or just “SBA loans”) are business loans backed by the U.S. Small Business Administration (SBA)....

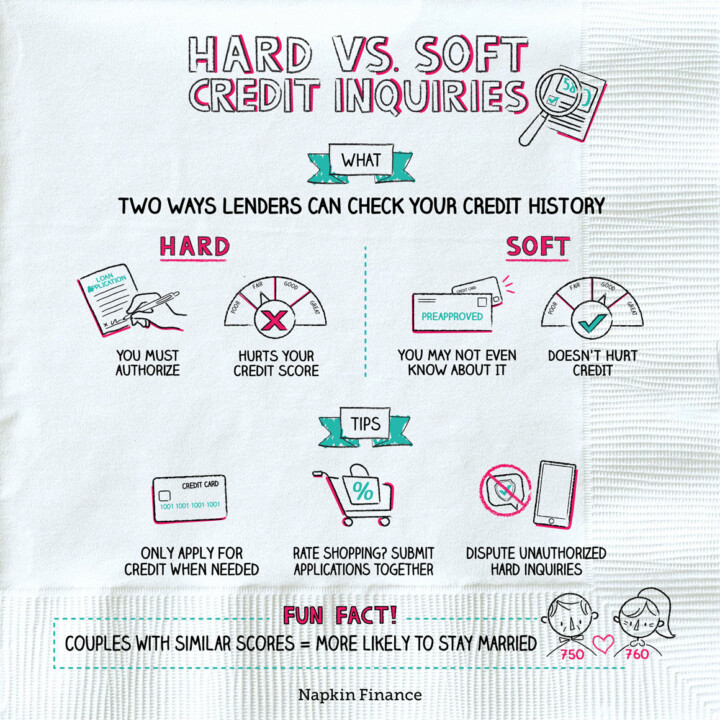

Learn moreHard vs. Soft Credit Inquiries

Extra Credit

Banks, lenders, and others use your credit report and scores to determine your creditworthiness. In other words,...

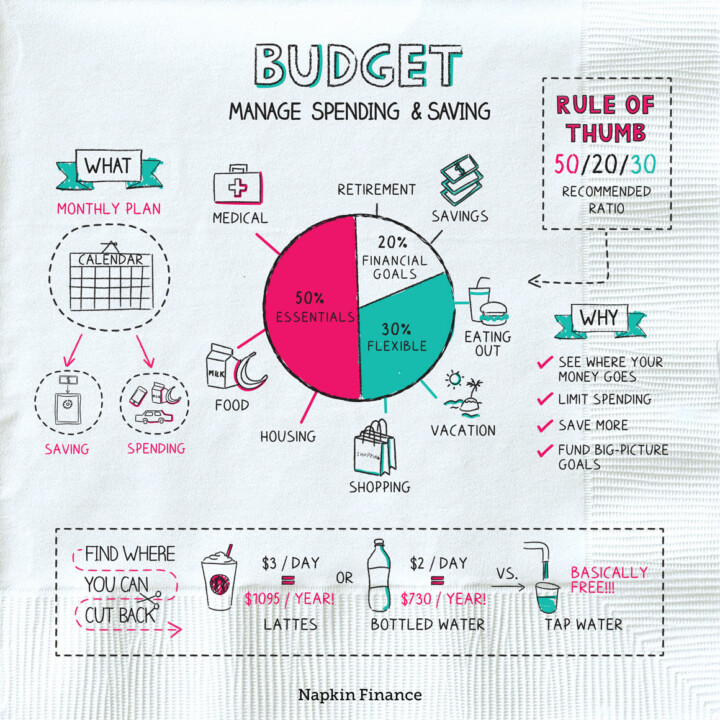

Learn moreBudget

Nickels and Dimes

A budget is a plan you can use to better manage your spending and saving. When you...

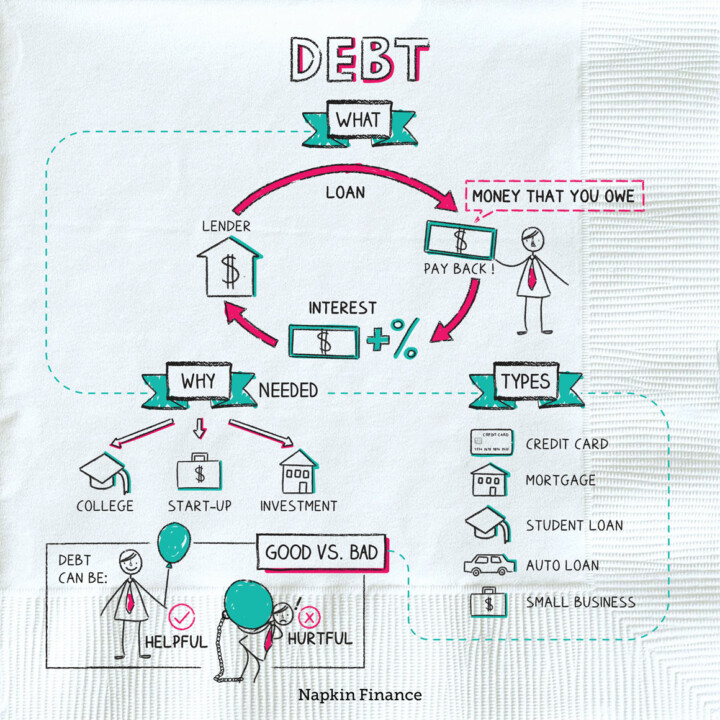

Learn moreDebt

It All Adds Up

Debt is money that you owe to another person or a financial institution. When you borrow money,...

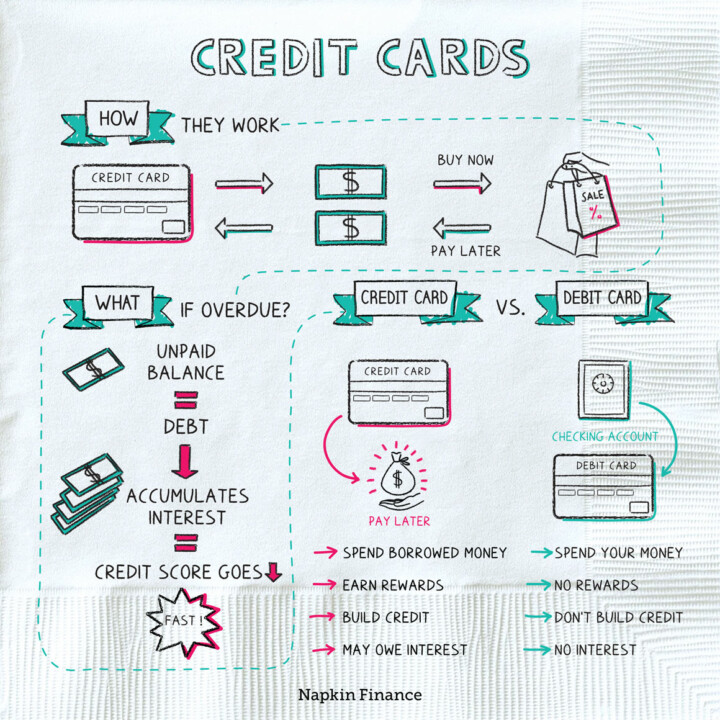

Learn moreCredit Cards

Swipe Right

A credit card lets you buy now and pay later, all without the hassle of counting out...

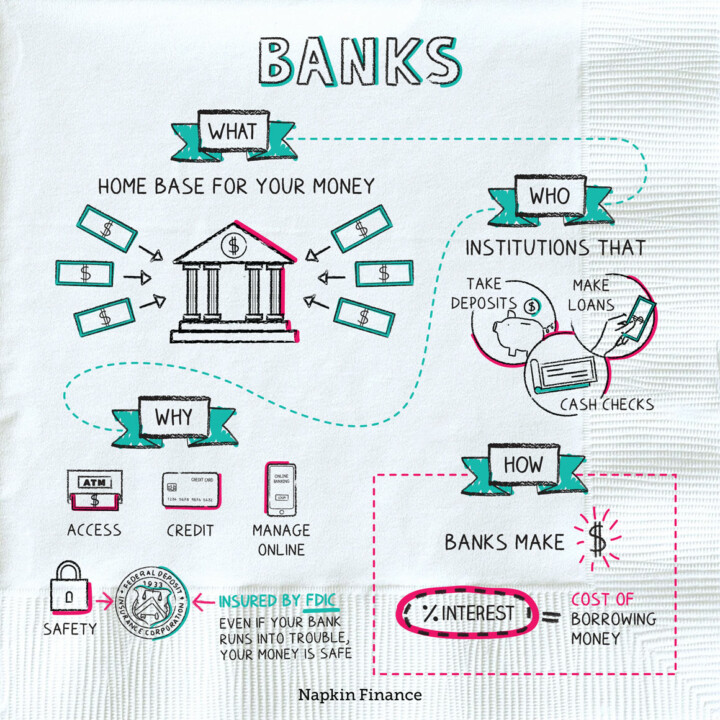

Learn moreBanks

Bank on It

Banks are institutions that take deposits, cash checks, and make loans. They are essentially home bases for...

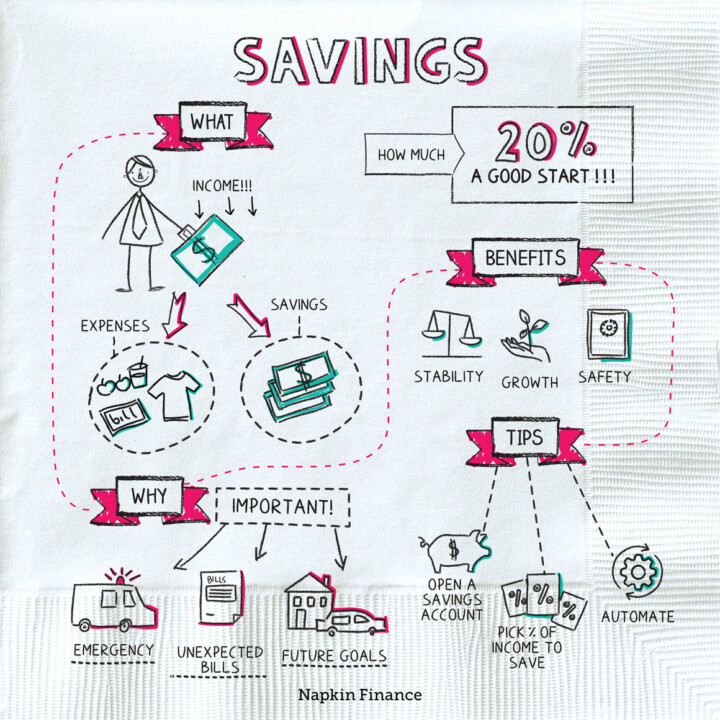

Learn moreSavings

One Penny at a Time

Savings are funds that you put aside and don’t spend. Life can be full of surprises, both...

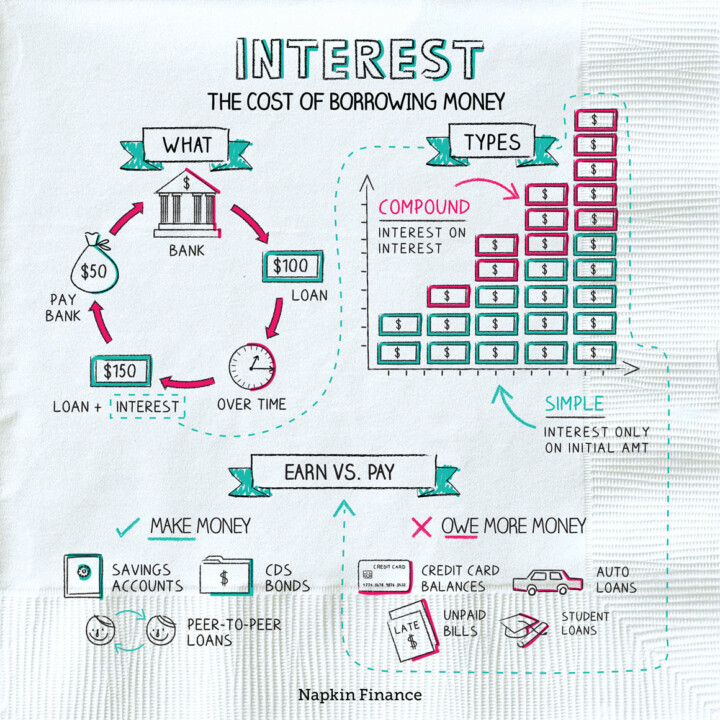

Learn moreInterest

Pay Up

Interest is the cost of borrowing money. For a borrower, interest is the price of taking on...

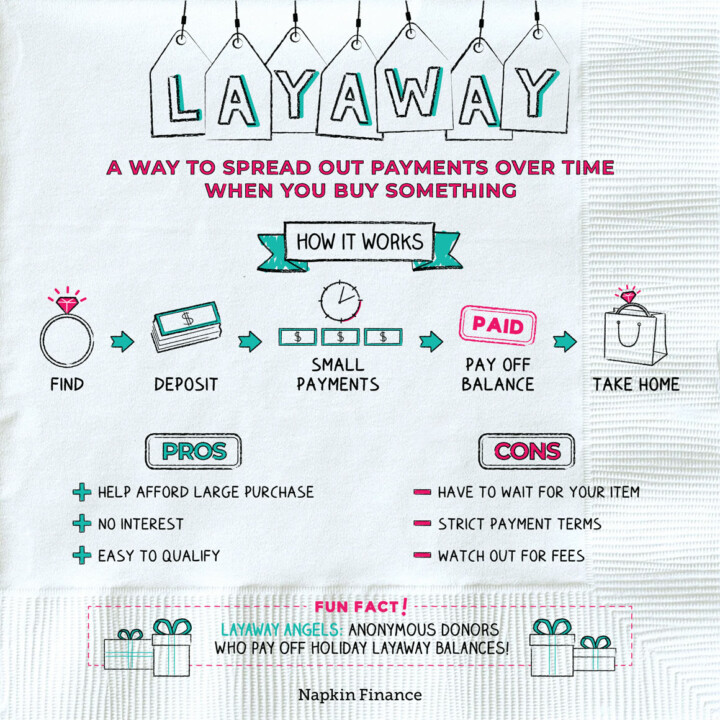

Learn moreLayaway

Bill Me

Layaway lets you spread out payments over time when you buy something. Buyers often use it for...

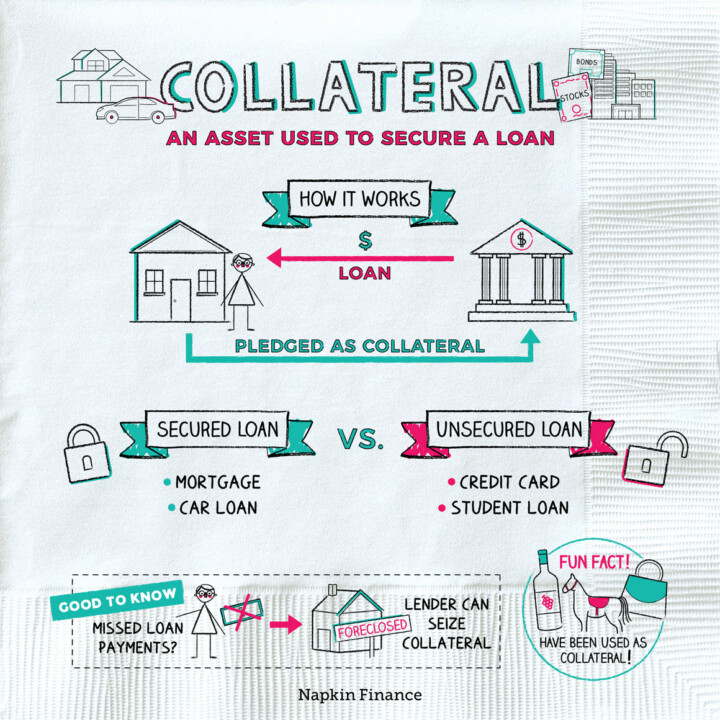

Learn moreCollateral

Give and Take

Collateral is something that a borrower pledges to a lender to secure certain types of loans. If...

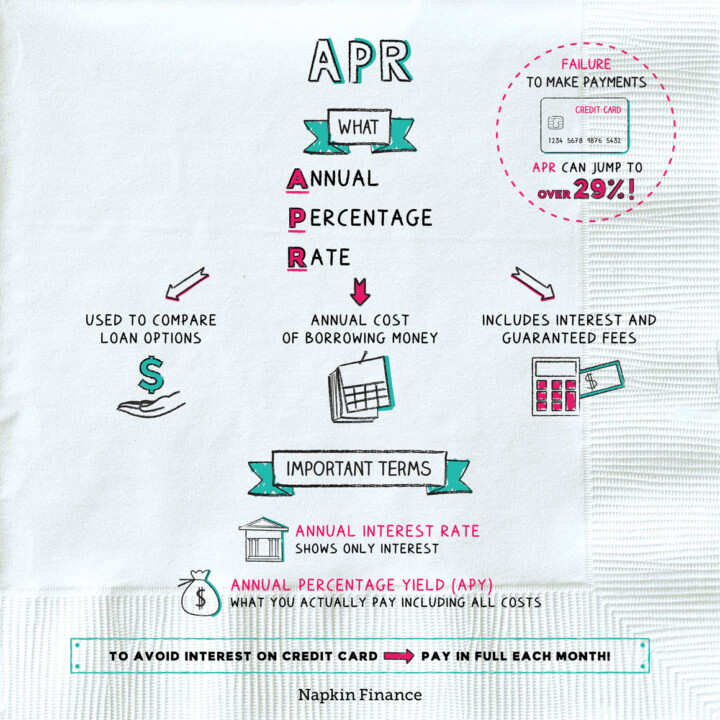

Learn moreAPR

Another Day, Another Dollar

An annual percentage rate (APR) represents the annual cost of borrowing money, including fees. Because the APR...

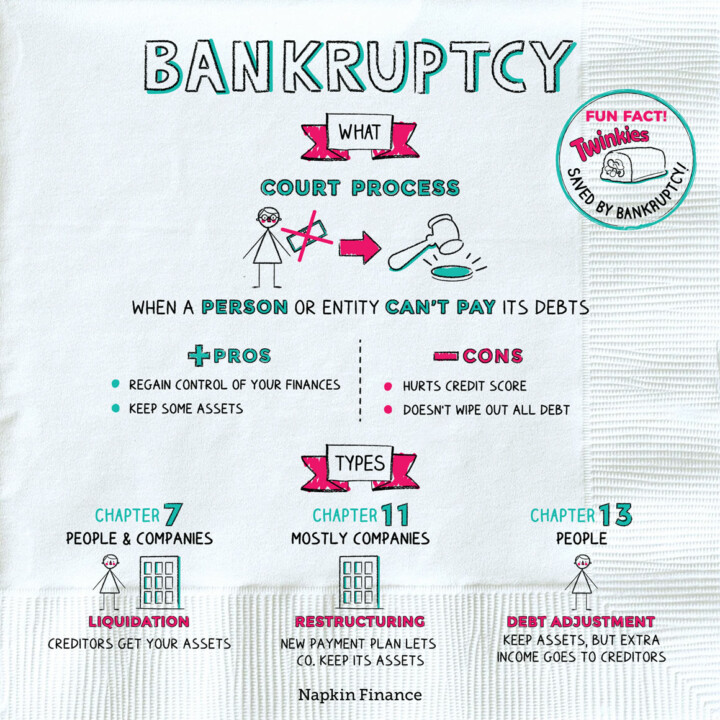

Learn moreBankruptcy

Lose Your Shirt

Bankruptcy is the legal process for consumers or businesses to get help with their debt. Bankruptcy starts...

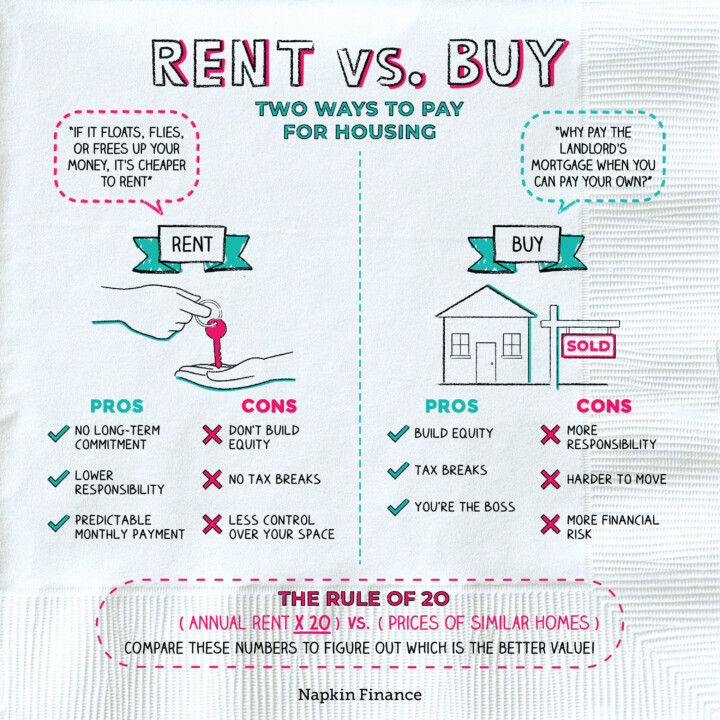

Learn moreRent vs. Buy

Where the Heart Is

The choice between renting or buying a home may be one of the biggest decisions you make...

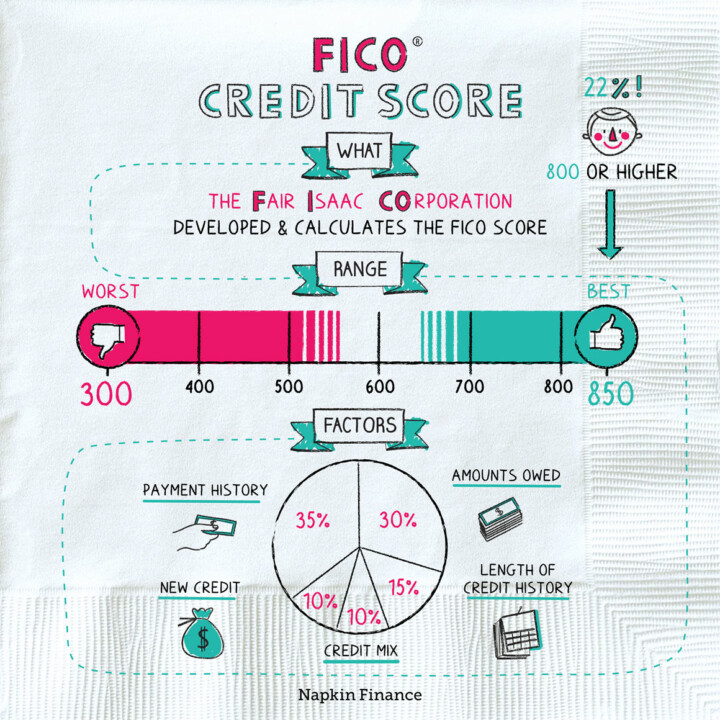

Learn moreFICO

Score Some Points

Although you might hear the phrase “your credit score” tossed around, you actually have multiple credit scores—potentially...

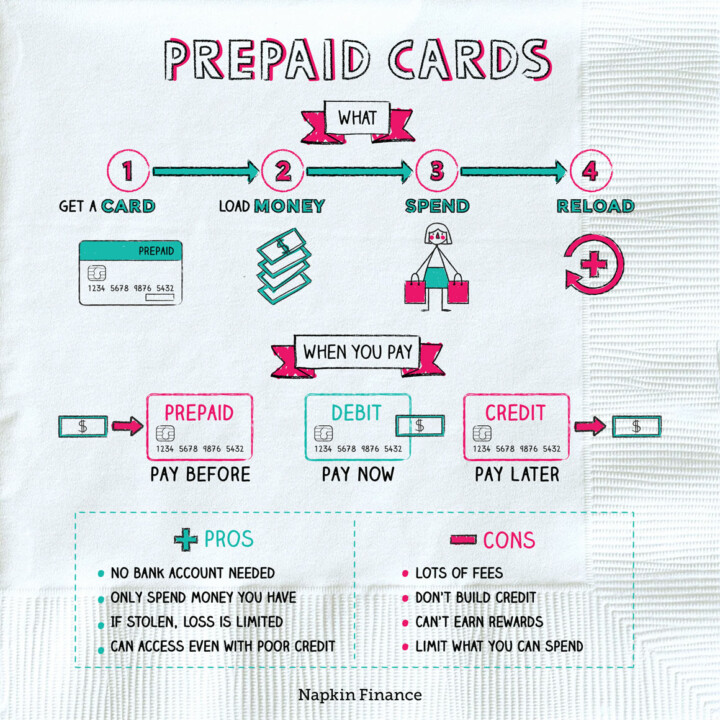

Learn morePrepaid Card

Top Off

A prepaid card lets you spend money that you’ve already added to the card. It’s similar to...

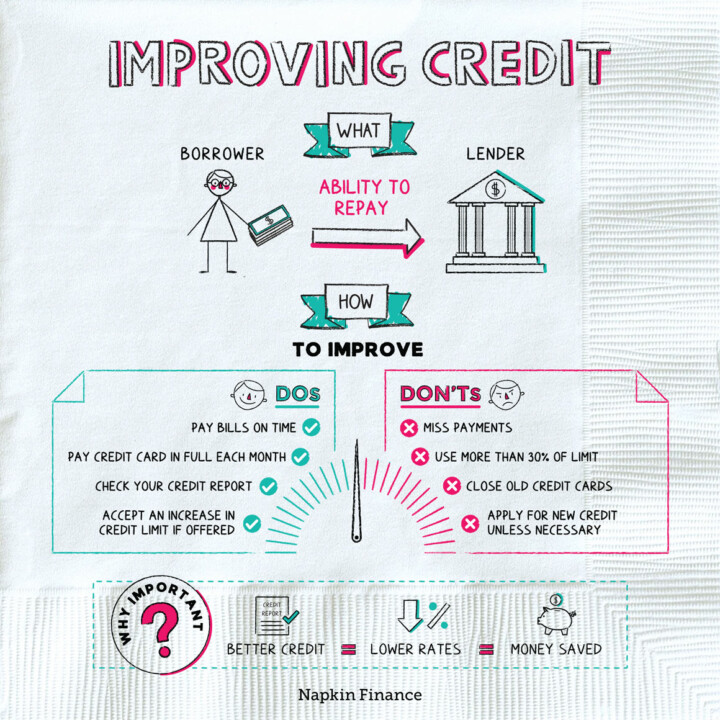

Learn moreImproving Credit

Extra Credit

Your credit report and credit scores describe whether you have a good track record of repaying borrowed...

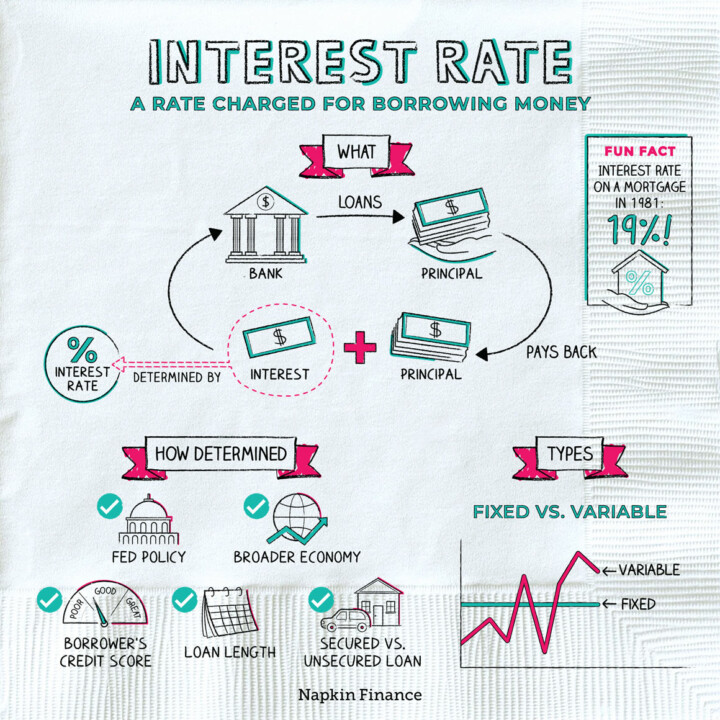

Learn moreInterest Rate

At Any Rate

Interest is what a lender charges you to borrow money. It is usually expressed as a percentage...

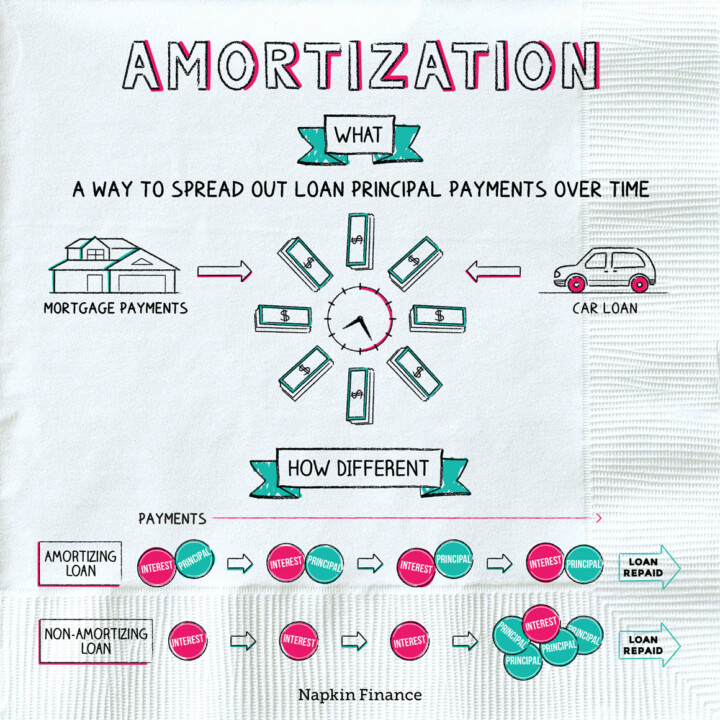

Learn moreAmortization

Another Day, Another Dollar

Amortization is a way of paying off a debt by spreading payments over a period of time....

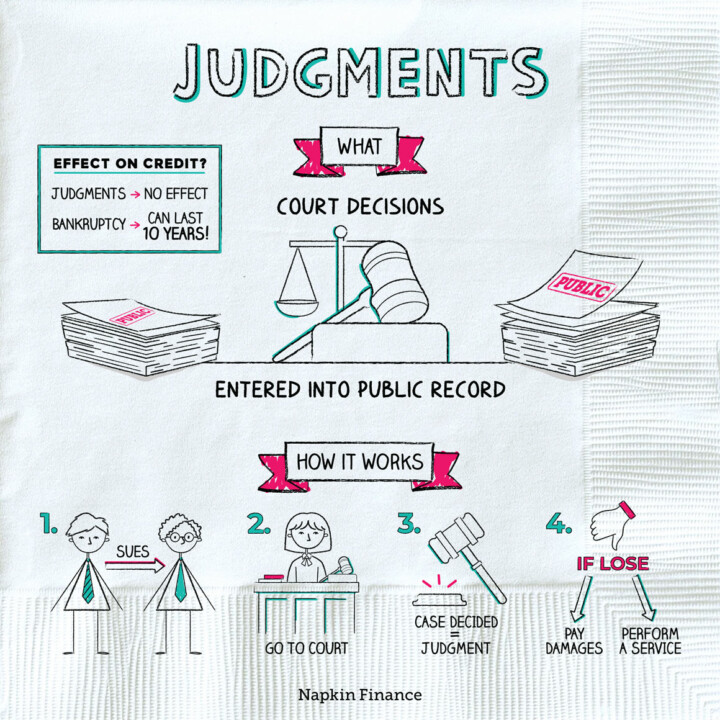

Learn moreJudgments

By the Book

A judgment is a decision made by a court that’s been entered into the public record (i.e.,...

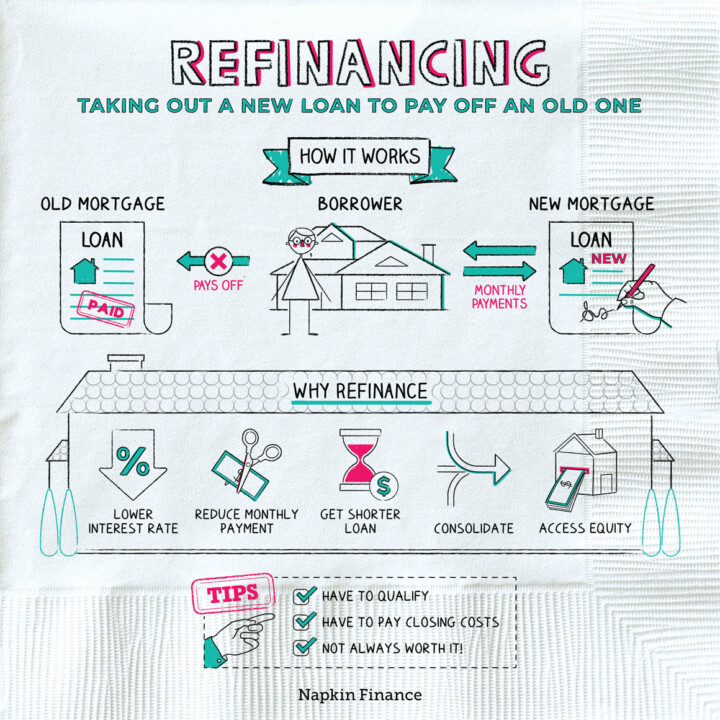

Learn moreRefinancing

Cash in Your Chips

Refinancing is getting a new loan to replace an old one. Borrowers usually refinance in order to...

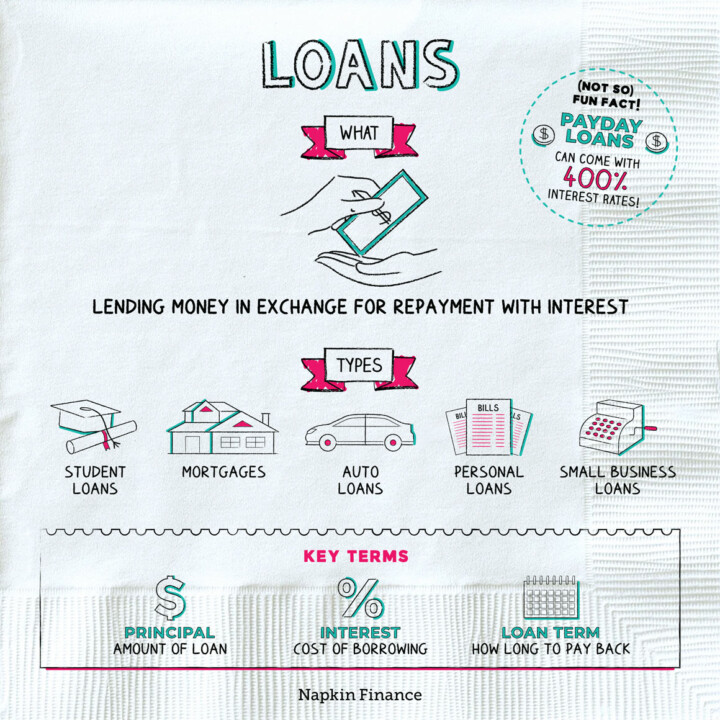

Learn moreLoans

Lend a Hand

A loan is when someone gives money to someone else in exchange for future repayment of that...

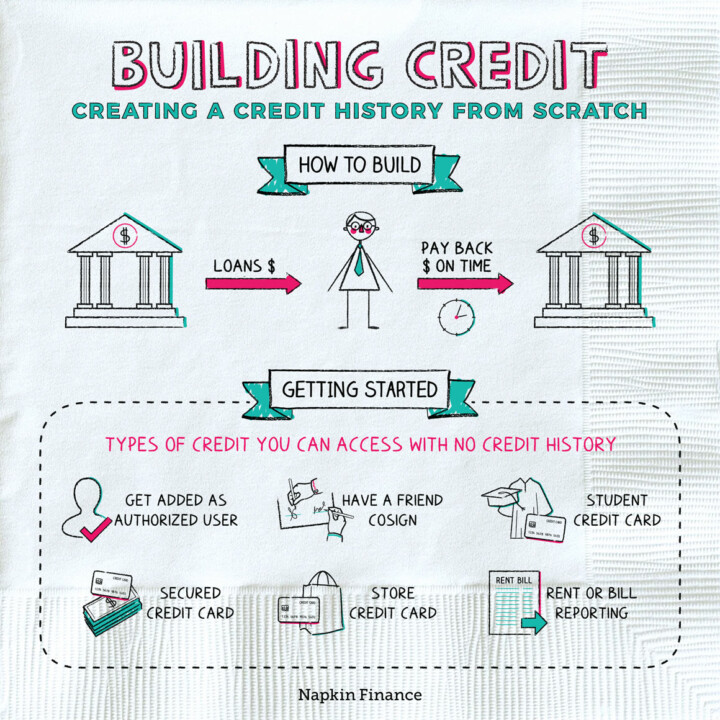

Learn moreBuilding Credit

Bit by Bit

Credit is money that’s available to you to borrow whether through a credit card, mortgage, car loan,...

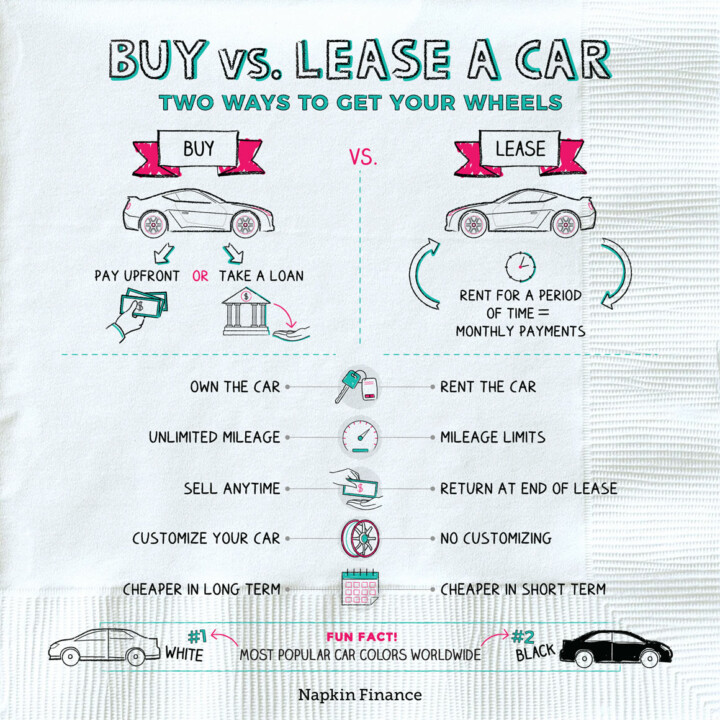

Learn moreBuy vs. Lease a Car

Joy Ride

When you need a car, you have two options: buy or lease. If you buy a car,...

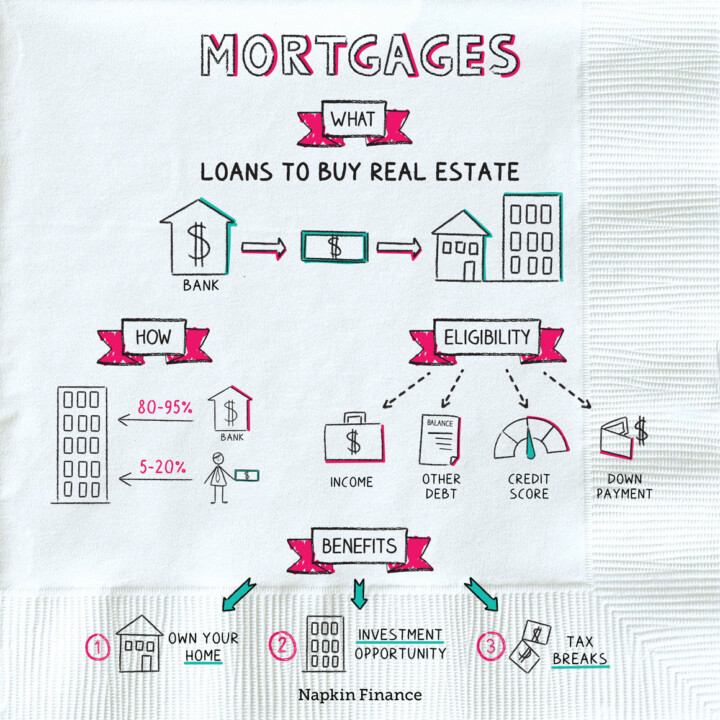

Learn moreMortgages

Home Sweet Home

A mortgage is a type of loan that people use to help them buy a house or...

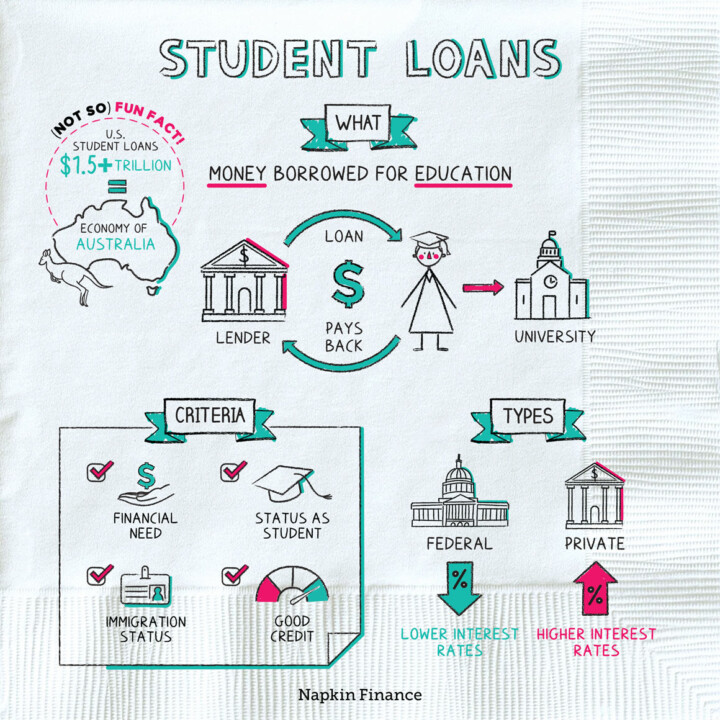

Learn moreStudent Loans

Old College Try

A student loan can be any kind of borrowed money that’s used to pay for education. Although...

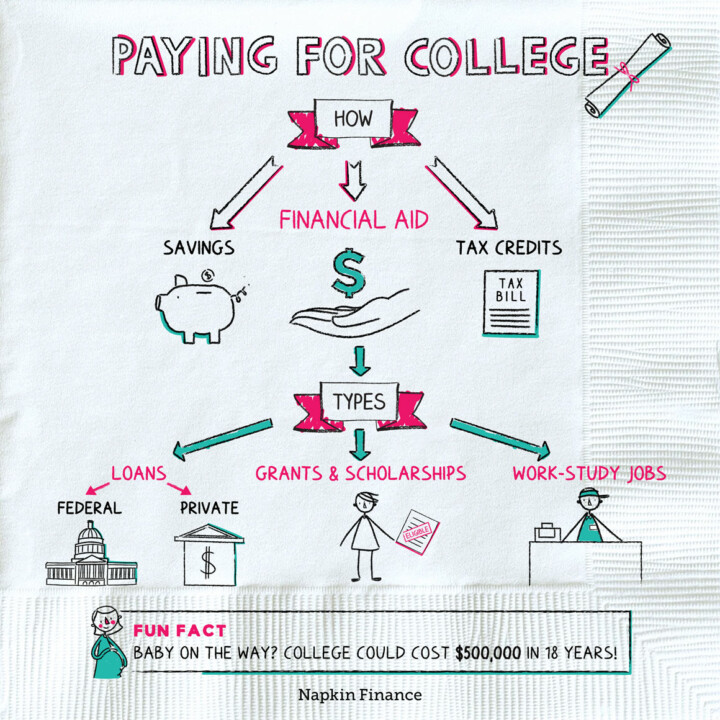

Learn morePaying for College

Higher Education, Higher Costs

Going to college can lead to better jobs and bigger paychecks. But it comes at a high...

Learn more