Private Equity

Members Only

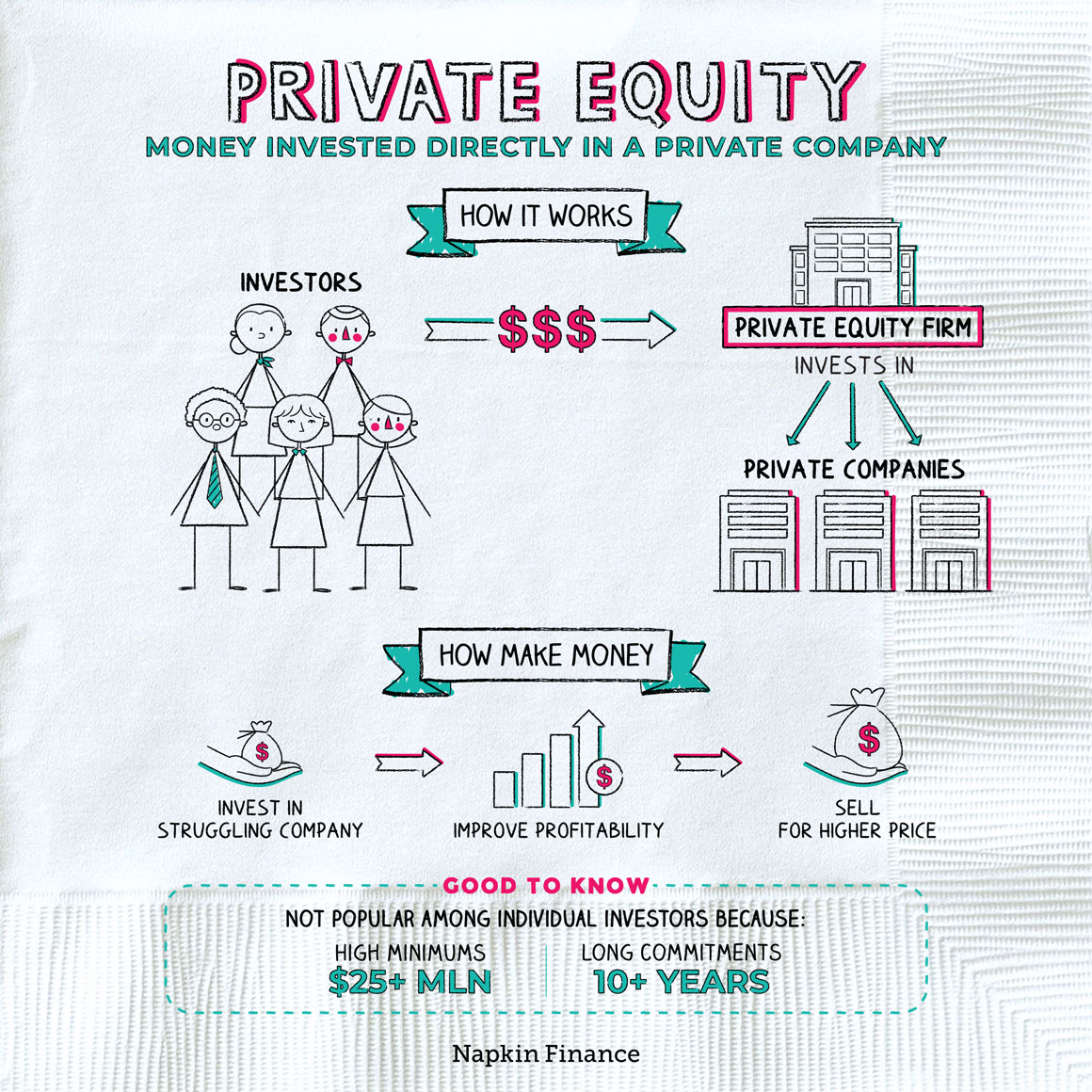

Private equity is money invested directly into a private company.

Private equity funds pool money from many investors—whether people or institutions—then buy ownership stakes in a number of private companies in the hopes of later selling those ownership stakes for a profit. It’s generally a higher risk, higher return investment option.

Here’s how investing in a private equity fund typically works:

An investor “commits” to investing

a certain amount of money in the fund.

↓

When the fund’s manager finds a new investment,

it “calls” these commitments—meaning investors

then have to pay in the funds they’ve committed.

↓

The fund makes investments. If it’s successful, the companies it

invests in grow, and the fund makes money.

↓

When the fund sells an investment for a profit, it pays

those profits out to its investors.

↓

Eventually, the fund sells its last investment. It distributes any

remaining cash to its investors and winds down operations.

The life cycle of a given private equity fund often lasts ten years or more.

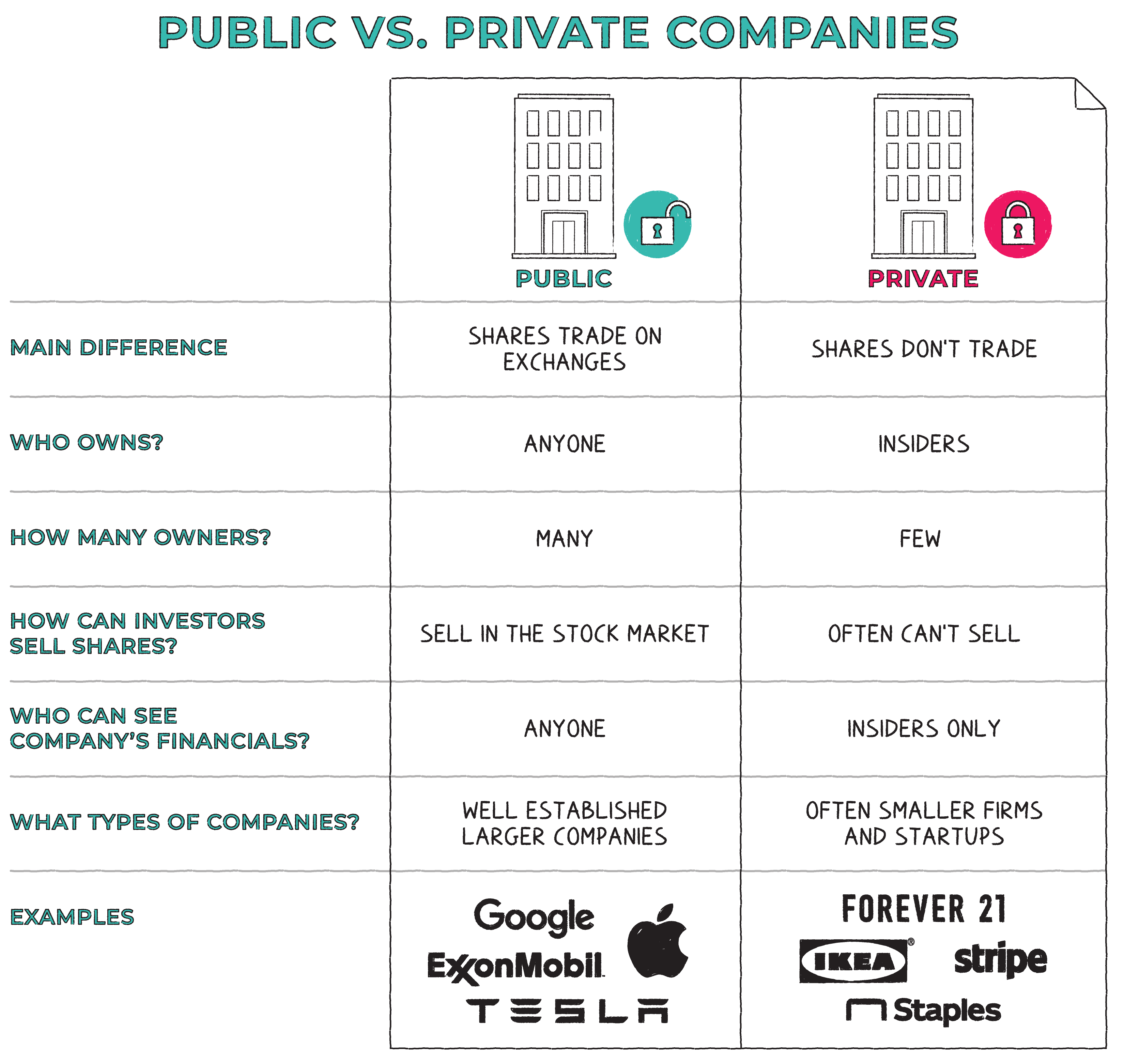

Private equity funds generally only invest in private companies—meaning ones that don’t have shares that trade on stock exchanges. Here’s how private companies compare with public ones:

Private equity funds often invest in established companies that are struggling to turn a profit. In that case, the fund may take a controlling interest in the company and try to improve its profitability—such as by cutting expenses, selling off parts of the business, or firing an old management team and hiring a new one.

But venture capital is also a form of private equity, and venture capital firms typically follow a very different strategy. In that case, the aim is to make early investments in promising young startups and then earn a big return as those startups grow and take off.

In either case, the aim is ultimately to sell their investments for a nice profit.

Private equity funds generally don’t aim to hold their investments forever. But because they invest in private companies, they can’t turn around and sell their stakes in the stock market whenever they want to.

Here are the main ways they can cash out of the investments they’ve made:

- Initial Public Offering (IPO)—eventually, a startup (or a more mature private company) may be ready to go public. Then, the private equity firm can sell its shares in the stock market.

- Merger or acquisition—the underlying company may be bought by another company.

- Employee buyout—sometimes, employees will decide they want to buy their company back from the private equity firm.

- Sell to another investor—the private equity firm could simply sell its stake to another investor.

Private equity tends to be a popular investment option for institutions, such as university endowments or foundations. It’s less common among individual investors because it:

- Requires a massive initial investment—often $25 million for a single fund.

- Ties your money up for a long time—you’re typically committed to staying invested in your fund for its full life cycle, which could easily last more than ten years.

- It’s hard to diversify—any particular private equity fund could be wildly successful or a wild failure. But given those minimum investment amounts, spreading your money around with a number of funds is nearly impossible for all but the very wealthiest.

That all said, it’s possible you’re indirectly in private equity if you have a pension, since pension funds can be big investors in the private equity world.

“Not all private equity people are evil. Only some.“

—Paul Krugman

Private equity is a direct investment in a private company. Private equity firms pool money from many investors in order to invest in a portfolio of private companies. Private equity funds generally either focus on turning around struggling mature companies or investing in fast-growing startups. It’s rare for individuals to invest in private equity funds, because they typically require multimillion-dollar commitments and tie your money up for years.

- Private equity doesn’t always work out. See: Toys “R” Us, which went bankrupt seven years after its purchase by three private equity firms, leaving 300,000 people out of jobs.

- Assets held by private equity firms total in the trillions of dollars.

- Private equity is money invested by a firm or an individual directly into a private company.

- Investments are usually made by a private equity firm, which pools the money of interested investors to make private equity investments in a number of companies.

- Private equity investments are generally more popular among institutions than among individual investors because they require multimillion-dollar minimum investments and can tie your money up for a decade or more.

- Venture capital is a subset of private equity and invests primarily in startups (often in the tech industry) with high growth potential.