REITs

Take Stock

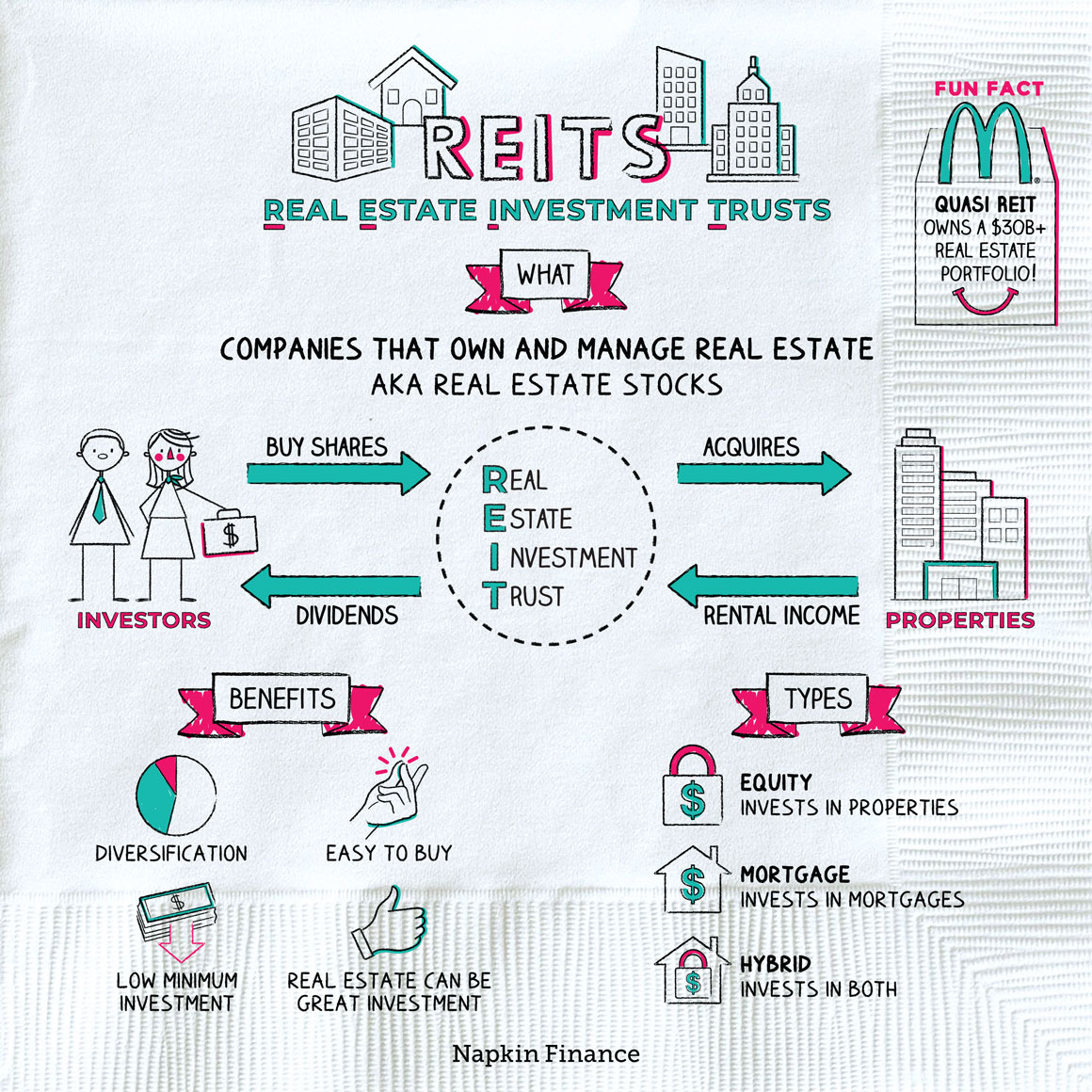

A real estate investment trust, or REIT, is a company that owns, manages, or finances real estate. Investing in REIT stocks can be an easy way for anyone to invest in real estate.

There can be big advantages to investing in real estate, including:

- Tax benefits

- Receiving regular income from tenants

- Diversification

- Inflation protection

But many investors can’t afford the financial commitment of buying entire properties and becoming a landlord. (Not to mention the commitment in time and headaches.)

REITs can offer a way for basically anyone to access the advantages of investing in real estate because they:

- Are easy to buy—you can buy shares through an online broker just as you would any ordinary stock.

- Have low minimums—since you can invest with as little as the cost of one share.

- Provide instant diversification—since one REIT may own hundreds of properties.

And they still provide access to those same advantages as direct real estate investing, like regular income and tax benefits.

REITs can invest in many types of properties, including:

- Apartments

- Hotels

- Infrastructure

- Office buildings

- Shopping malls

- Warehouses

- Hospitals

A REIT might specialize in one specific property type or invest across a spectrum of property types. Many only own properties in the U.S., but some also hold international investments.

There are three main types of REITs, and they differ in how they invest and where earnings come from:

| Equity | Mortgage | Hybrid | |

| What they invest in | Own properties that they rent out | Own mortgages or mortgage-backed securities | Own properties and mortgages |

| How they make money | Rent payments from tenants; can also profit if properties they own rise in value | Interest income on the mortgages they own | Rent payments, rising property values, and interest on mortgages |

You can invest in publicly traded REITs through:

- Shares of individual REITs

- Mutual funds

- ETFs

There are also so-called “private REITs,” which don’t have shares that trade on stock exchanges. They’re a bit like hedge funds for real estate investing and may only be available to institutional investors or very wealthy individual investors.

REITs follow a different set of tax rules than ordinary corporations. Here’s what you need to know:

- REITs themselves don’t pay any corporate income taxes.

- To qualify for that cushy treatment, they’re required to pay out at least 90% of their income to investors each year in the form of dividends.

- If you invest, a portion of those dividends may be taxed at your ordinary income rate, while a portion may qualify for the lower capital gains rate.

Why do they get those special rules? Investing in real estate directly (i.e., by owning properties yourself) comes with a host of tax perks. But most ordinary investors can’t afford to become a real estate magnate.

The government gives REITs special tax treatment so that little guys can get in on those tax perks too.

A REIT, or real estate investment trust, is a company that buys, manages, or finances real estate. For investors, buying REIT stocks can be an easier and more affordable way of investing in real estate than buying entire properties. REITs can invest in different types of properties, including hotels, restaurants, hospitals, and office buildings.

- McDonald’s is one of the world’s largest real estate companies. That’s because it owns many of the properties where its restaurants are located and then leases those properties out to its franchisees.

- Zillow estimates the value of the White House and surrounding grounds at more than $400 million. (According to Zillow’s stats, the house itself is about 55,000 square feet and has 35 bathrooms.)

- Nearly 90 million Americans invest in REITs.

- A REIT is a company that buys and manages or finances real estate.

- Investing in REITs can provide many of the same advantages as investing in real estate directly, including a steady stream of income, diversification, and inflation protection.

- You can invest in a REIT by purchasing shares of the companies themselves, mutual funds, or ETFs.

- REITs can own many different types of properties, including hotels, warehouses, and apartment buildings.

- Some REITs only own properties, while others invest mainly in mortgages or in a mix of mortgages and properties.