EPS

Bang for the Buck

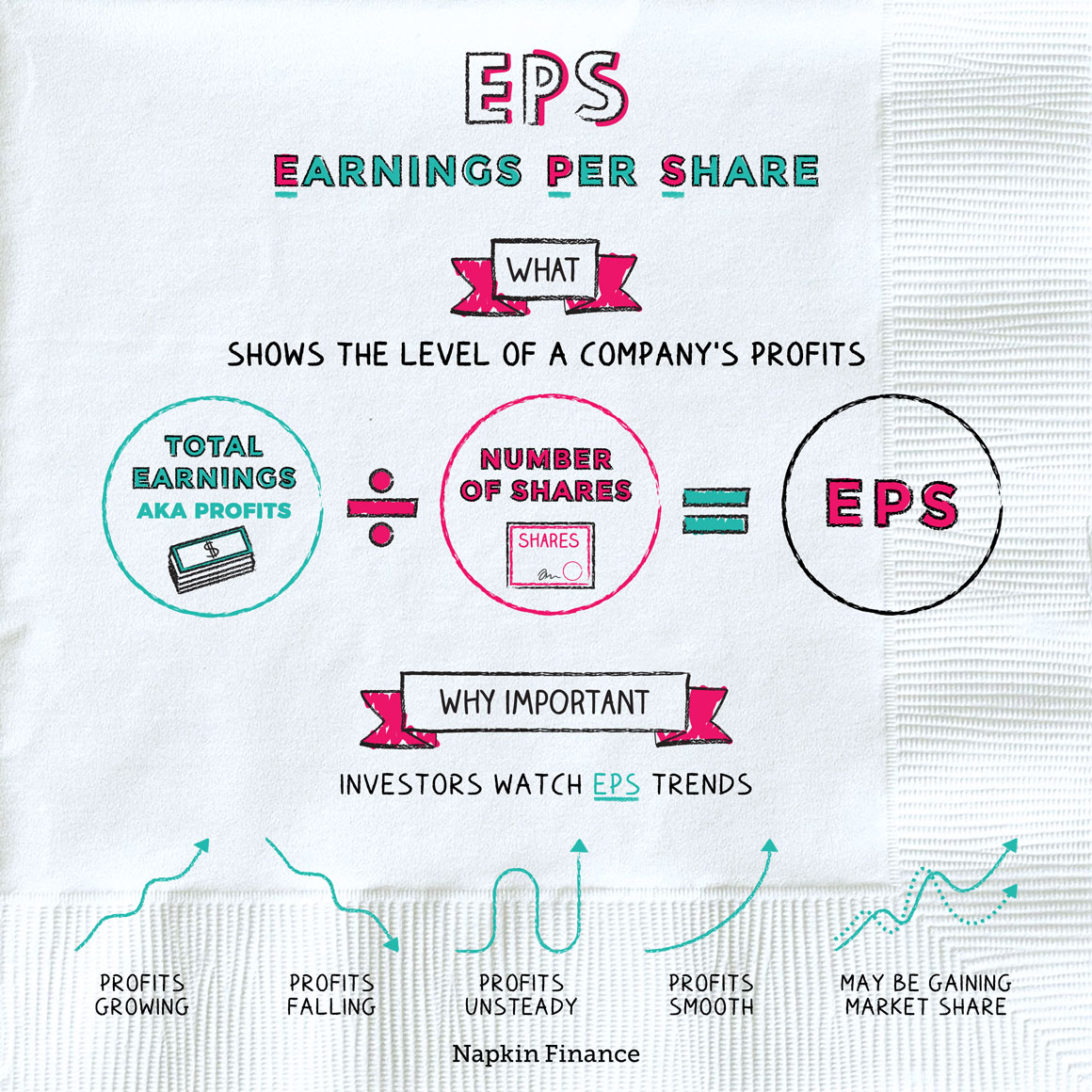

Earnings per share (EPS) is a financial metric that helps investors evaluate a company’s profitability.

It’s calculated by dividing a company’s profit by the number of shares of common stock in circulation. For example, a company that made a profit of $5 million in one year and has one million shares outstanding has EPS of $5.

To calculate EPS, you only need two pieces of information about a company:

- Profit over a particular period—usually one quarter

- Profit = sales – expenses

- The number of shares outstanding

- Only “common stock” (which is what people are typically referring to when they talk about stocks) is included in this figure

- Preferred shares are not included

Suppose Company ABC has:

- Net income (aka profit): $6 million

- Expenses: $1.5 million

- Shares outstanding: 2 million

You can subtract to determine net income:

- Profit = $6 million – $1.5 million = $4,500,000

And you can divide to determine the company’s EPS:

- EPS = $4,500,000 / 2,000,000 shares = $2.25

Both businesses and investors use EPS to evaluate a company’s financial health.

EPS tells investors how much of a company’s profit a shareholder is, theoretically, entitled to for each share they own. This is important because profits are typically the main figure investors use in determining a stock’s value. One share of a company with EPS of $5 is usually worth more than one share of a company with EPS of $1.

But a single EPS figure doesn’t mean much, just as a company’s stock price on its own doesn’t mean much.

Instead, investors mainly focus on trends in a company’s EPS from quarter to quarter:

| Trend | What it means | Effect on stock |

| EPS increasing | Profits are growing | Stock price should rise |

| EPS decreasing | Profits are falling | Stock price should fall |

| EPS is bumpy | Profits are uncertain | Stock price may be bumpy |

| EPS is smooth | Profits are steady | Stock price may be smooth |

| EPS growing faster than that of peer companies | Company may be gaining market share | Stock price should rise faster than stock prices of peer companies |

But even those trends need to be put into context. For example, even a very successful company could have consistently negative EPS if it invests aggressively in growth. In that case, the stock could nonetheless rise if investors believe that one day the company will turn a fat profit.

It can be a major news and market event when large companies announce their EPS for the most recent quarter. Here is one way EPS announcements can play out:

Financial analysts come up with

predictions for Company A’s EPS.

On average, analysts predict EPS of $5.

↓

Company A announces EPS of $6.

↓

That’s much better than expected,

so Company A’s stock shoots up in price.

↓

Stock prices of companies in the same industry

as Company A may go up in price too.

↓

If other companies announce better-than-expected

EPS, it’s a sign the whole economy is doing better

than investors thought.

↓

The whole stock market could go up significantly.

Similarly, when a company’s EPS is lower than analysts were expecting, its stock typically falls. And if many companies report worse-than-expected EPS, the whole market could fall.

Earnings per share is a financial metric used by businesses and investors to analyze a company’s ability to generate profits for shareholders. Since a company’s EPS can change a lot from quarter to quarter, it’s important to look at trends over time rather than focusing on any one EPS figure.

EPS is a useful metric but not a comprehensive one. Always consider a company’s EPS alongside other performance data and in the context of the company’s overall strategy for a more accurate picture.

- Analysts expect that Berkshire Hathaway, the company behind the most expensive stock in the world, will have EPS of more than $16,000 by 2020.

- Considering its size, Amazon barely turns a profit—mainly because it invests heavily in growing its business. Its stock has nonetheless enjoyed a massive run-up in recent years because investors expect that one day its profits will be huge.

- Earnings per share, or EPS, is a financial metric that describes a company’s profits.

- EPS is calculated by dividing a company’s periodic profit by the number of outstanding shares of common stock.

- Although stocks with high EPS generally trade for higher prices than stocks with low EPS, the number means more in context than it does on its own.

- Analysts look at short- and long-term trends in EPS for indications of a company’s prospects.

- It can be a major market event when prominent companies announce their most recent EPS.