Bitcoin

Not So Silky Road

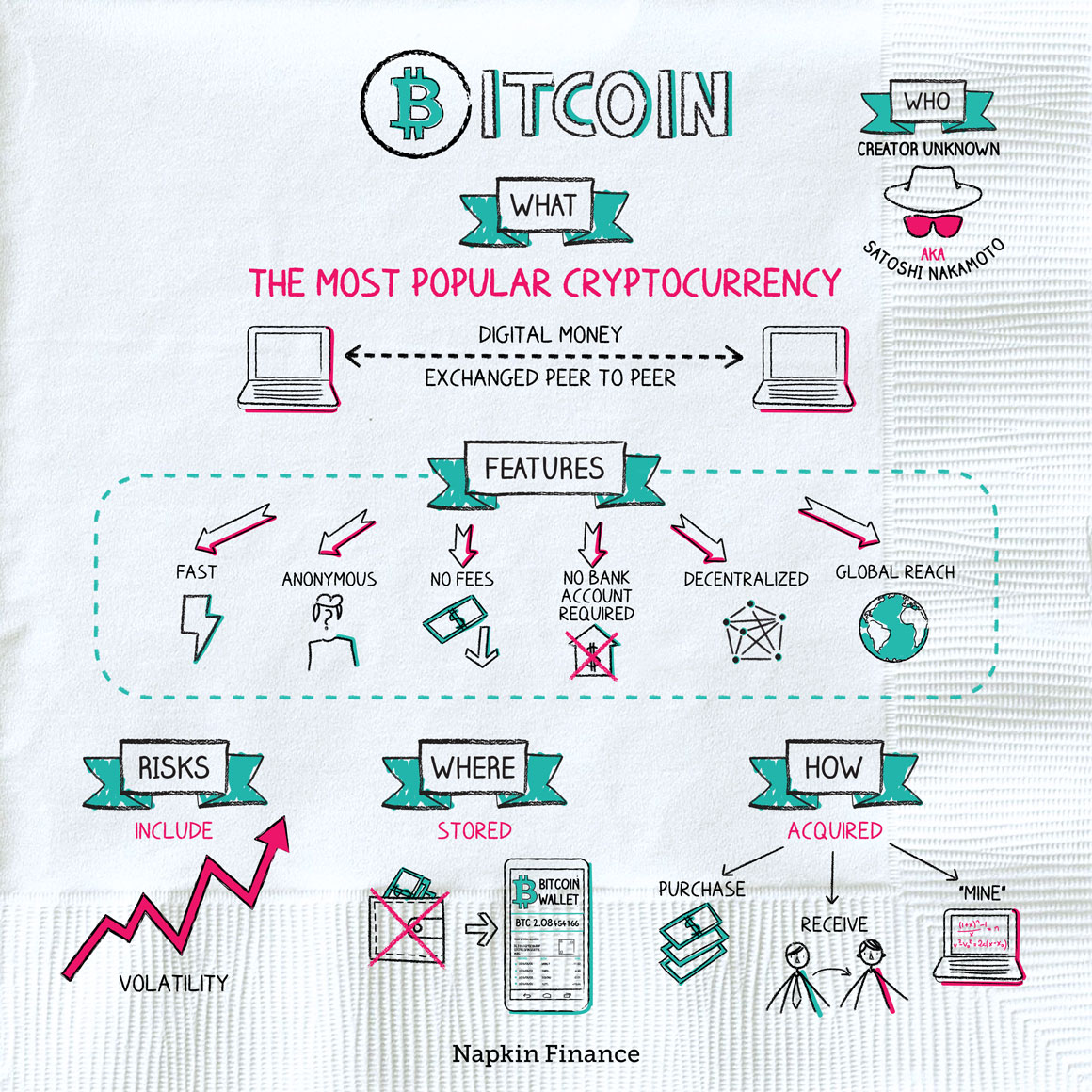

Bitcoin is the world’s first type of digital money, or cryptocurrency.

Unlike traditional paper money, Bitcoin only exists online and isn’t controlled by any government, country, or bank. It’s exchanged peer-to-peer, and digital encryption is used to control security and the creation of new units of currency.

Bitcoin is arguably the most successful cryptocurrency. Here’s the path it took to reach that status:

2008: The world economy was a mess, and faith in the traditional financial system was low. An author calling himself Satoshi Nakamoto, but whose real name is unknown, released a paper explaining how a digital peer-to-peer currency could work.

2009: Satoshi mined the first block of Bitcoin—equivalent to the first bills of a new currency being printed. The first Bitcoin-to-dollars exchange rate was set, which allowed the first purchases of Bitcoins to take place.

2010: A man in Florida paid for two pizzas with 10,000 Bitcoins—the first physical purchase using the currency.

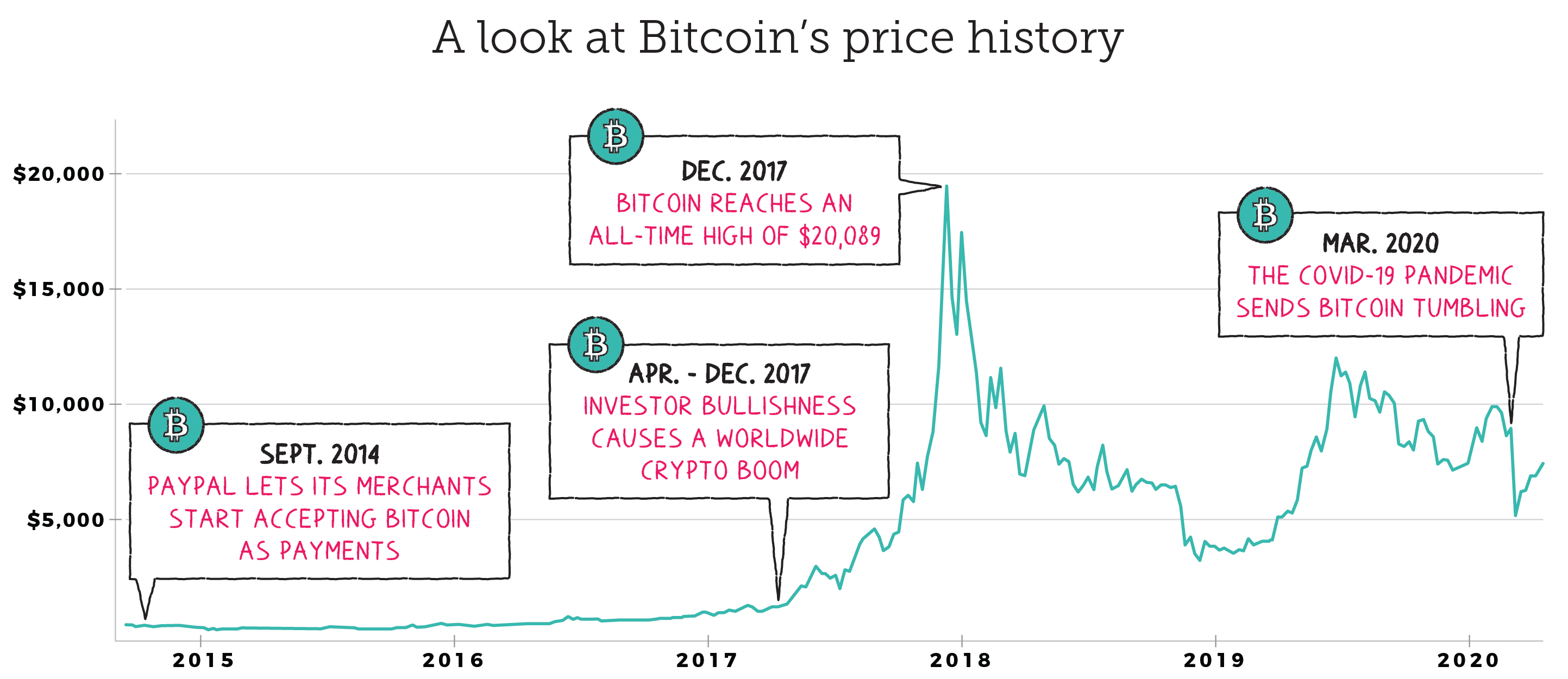

2012–2013: The price of one Bitcoin crossed $100 and then $1,000.

2014–2020: Bitcoin went mainstream. It became an accepted form of payment with PayPal and some other major businesses. By 2019, more than one in twenty Americans owned some.

2021: Bitcoin reached an all-time high of over $68,000 after starting the year out at just under $30,000. El Salvador is the first country to accept Bitcoin as legal tender.

2022: Due to global economic factors, the price of Bitcoin dropped below $18,000.

“Bitcoin will do to banks what email did to the postal industry.“

—Rick Falkvinge

There are three ways to acquire Bitcoin:

- Purchase—You can buy Bitcoin with another currency, such as dollars, just like you can trade dollars for euros or other traditional currencies.

- Receive—You can trade goods or services for Bitcoin.

- Mine—You can become a Bitcoin miner, which is someone who devotes a large amount of computing power to solving complex math problems and gets rewarded in Bitcoin.

“It’s gold for nerds.“

—Stephen Colbert

You can’t put Bitcoin in your pocket or stuff it into a physical wallet. Instead, it lives in a virtual wallet. Inside that wallet is your private key (or keys). With this key, you can use and accept Bitcoin. Every transaction in the Bitcoin network is kept in a public ledger called the Blockchain.

You can keep your Bitcoin key in an online wallet, an app, a hardware or software program, or even on a piece of paper. Many people keep their wallet in multiple places for extra security because if you lose your key your Bitcoin disappears with it. (Although online or app-based wallets can be easiest to use, in those cases a third party holds your key. That’s why many people prefer old-fashioned paper for long-term storage.)

Not all stores accept Bitcoin as payment, but there are some that will—either directly or through a third-party source, such as BitPay or Flexa, including:

- Virgin Galactic (for your next trip into space)

- Microsoft

- Overstock.com

- AT&T

- Twitch

- ExpressVPN

To buy something at another store, you can use a website that will let you convert your Bitcoin into a gift card. There are even Bitcoin ATMs that will turn your coin into cash.

Some people own Bitcoin mainly as an investment in the hope it will keep climbing higher and higher in price over time. Other people use it to make actual day-to-day purchases. But before you open up a digital wallet, there are some trade-offs to consider:

| Pros | Cons |

| Can be used anywhere in the world | Not widely accepted by businesses |

| Anonymous | Anonymity increases potential for illegal use |

| Buy or send without a credit card or bank account | Not FDIC insured |

| Transfer funds without a fee | Volatile price |

| No limit on sending or receiving funds | Disappears if you lose your key, get hacked, or have a computer crash |

Bitcoin may be the most established cryptocurrency, but it’s far from tame. In its short lifetime, its price has gone from a low of less than $0.01 per coin to almost $20,000 before losing more than 80% of its value.

Bitcoin is the world’s first cryptocurrency. You can buy it, mine it, or receive it from someone else. Some people use it to make anonymous purchases online, while others hold it as an investment. Its value can swing wildly, so what you have today could be worth nothing (or millions!) tomorrow.

- That Florida pizza buyer’s Bitcoin would have eventually been worth more than $20 million if he’d held on to them.

- One unlucky man from Wales lost more than $100 million in Bitcoin when he threw away his computer hard drive. The device is now buried in a landfill near his home.

- The Winklevoss twins (of The Social Network fame) reportedly have enough invested in Bitcoin that at one point in time they were Bitcoin billionaires. (That was before the price of Bitcoin took a big fall.)

- Bitcoin is the first and most well-established cryptocurrency. It’s a peer-to-peer currency exchanged anonymously online that relies on encryption and isn’t controlled by any government or bank.

- Although you can now use Bitcoin to pay for goods and services with some major businesses, it’s still not widely accepted, and the price can swing wildly.

- You can acquire Bitcoin by buying, receiving, or mining it.