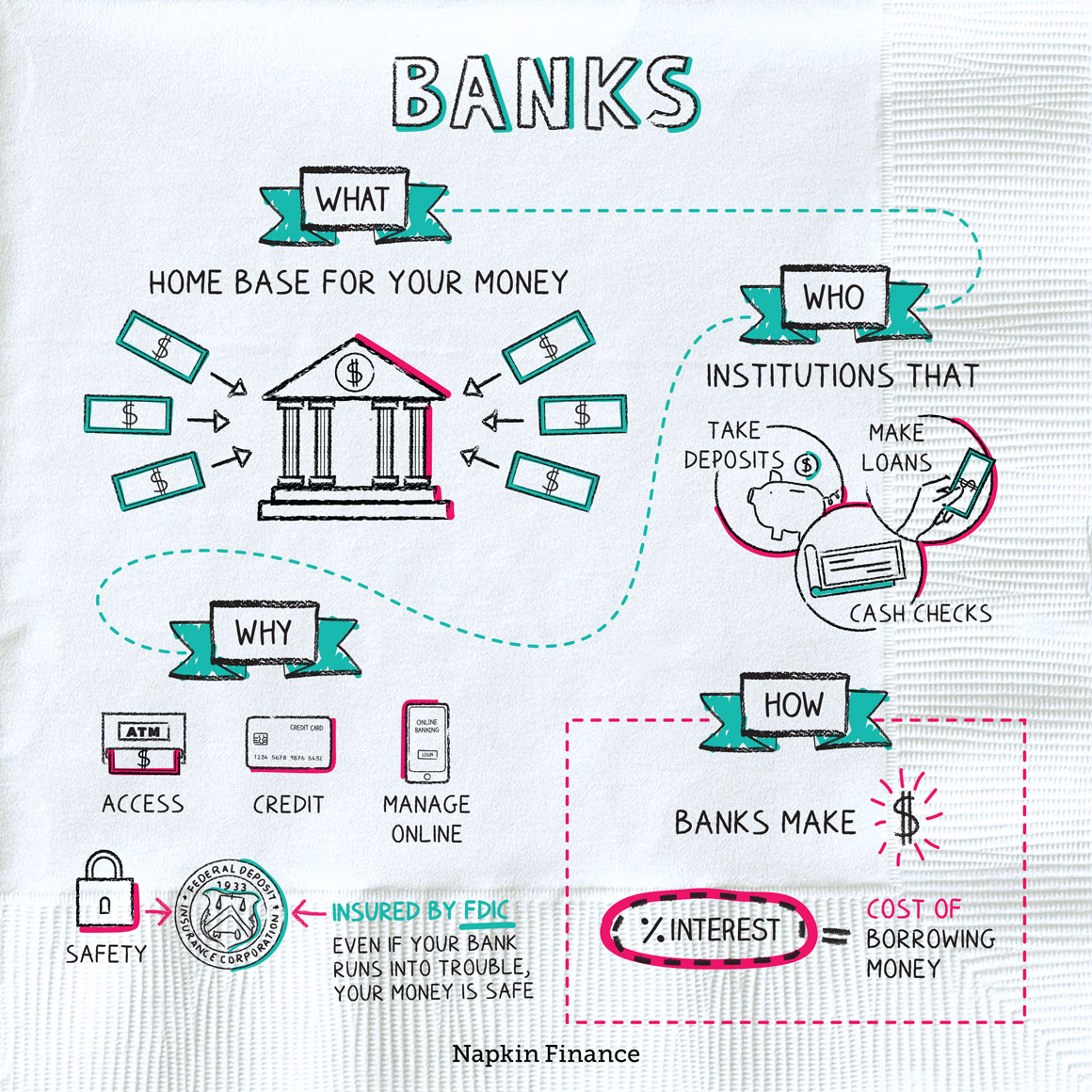

Banks

Bank on It

Banks are institutions that take deposits, cash checks, and make loans. They are essentially home bases for keeping your money safe and making transactions.

Using a bank account or other bank services can give you the advantages of:

- Safety—your money at the bank is typically insured for up to $250,000

- Easy access—deposit and withdraw money conveniently

- Online management—manage your accounts with your bank’s website or app

- Simple transfers—link your account to a payment app and it’s easy to pay back your friend for those concert tickets

- Access to loans—apply for a credit card or mortgage with your bank

The money you deposit at a bank is safe. That’s because the federal government, through the Federal Deposit Insurance Corporation (FDIC), insures bank accounts dollar for dollar for up to a total of $250,000 per person, per institution. So even if your bank goes out of business (which is extremely unlikely) and your money disappears, you’ll be paid back up to that amount.

“A bank is a place that will lend you money if you can prove that you don’t need it.“

—Bob Hope

Banks offer various products and services to their customers, including:

- Checking accounts: A checking account lets you deposit your paycheck or withdraw money easily for short-term spending.

- Savings accounts: Savings accounts are better suited for money you’ll hold at the bank for a longer term. They can protect your money and help you increase your wealth as you earn interest.

- Credit cards: Allow you to purchase everyday items or pay certain bills conveniently using borrowed money. You pay interest on what you borrow and have to make monthly payments to avoid fees.

- Loans: These include mortgages, auto loans, business loans, and personal loans that you pay back in installments over a set period of time.

Depending on the bank, you can access services in person at a branch, over the phone, online, or through an app.

Banks make loans to people and companies and charge interest on those loans (they also make money if you trigger fees on your account, although for most banks that’s not their main source of income).

Because they receive that interest income, banks are generally also able to pay a small amount of interest on money held in savings accounts.

Like a bank, a credit union is a financial institution that provides deposit accounts and lends money. Unlike banks, they’re not-for-profit organizations owned by their members. While they offer most (or all) of the same services as a bank, credit unions typically use profits to fund projects and services that benefit members, such as lower fees or higher interest rates on savings accounts.

Here are the main differences between banks and credit unions:

| Banks | Credit unions | |

| Who owns it? | Shareholders | Members |

| Who can be a customer? | Anyone | Only those who meet membership requirements |

| Typical fees | Many fees; monthly service charges | Lower fees; many free services |

| Are deposits insured? | Yes, through the FDIC | Yes, typically through the National Credit Union Administration (though some are privately insured) |

Some credit unions are tiny, local establishments that serve people who live in a certain town. Others are nationwide. And some are set up only to benefit their employees, such as the Boeing Employees Credit Union. This can make a difference in not only who is eligible but also how accessible bank services are. (For example, a local credit union might not have as many free ATMs as a nationwide one.)

Banks (and credit unions) offer many options to keep your money safe and your financial life on track, such as checking or savings accounts, credit cards, and loans.

- At the Credito Emiliano bank in Italy, you can take out a loan using Parmigiano-Reggiano cheese as collateral.

- Why would you rob a bank for just $1? To go to prison so that you can get health care, according to the North Carolina man and Oregon man who (independently) tried to do just that in 2011 and 2013, respectively.

- Having a bank account can make it easier to manage your money.

- The FDIC insures the money you hold at most banks for up to $250,000, so your money is safe even if your bank goes under.

- Banks usually offer deposit accounts (i.e., checking and savings accounts), credit cards, and loans.

- Banks make money by charging interest on loans.

- If you meet membership requirements, credit unions may help you access lower interest rates and cheaper services.