Futures

Looking Ahead

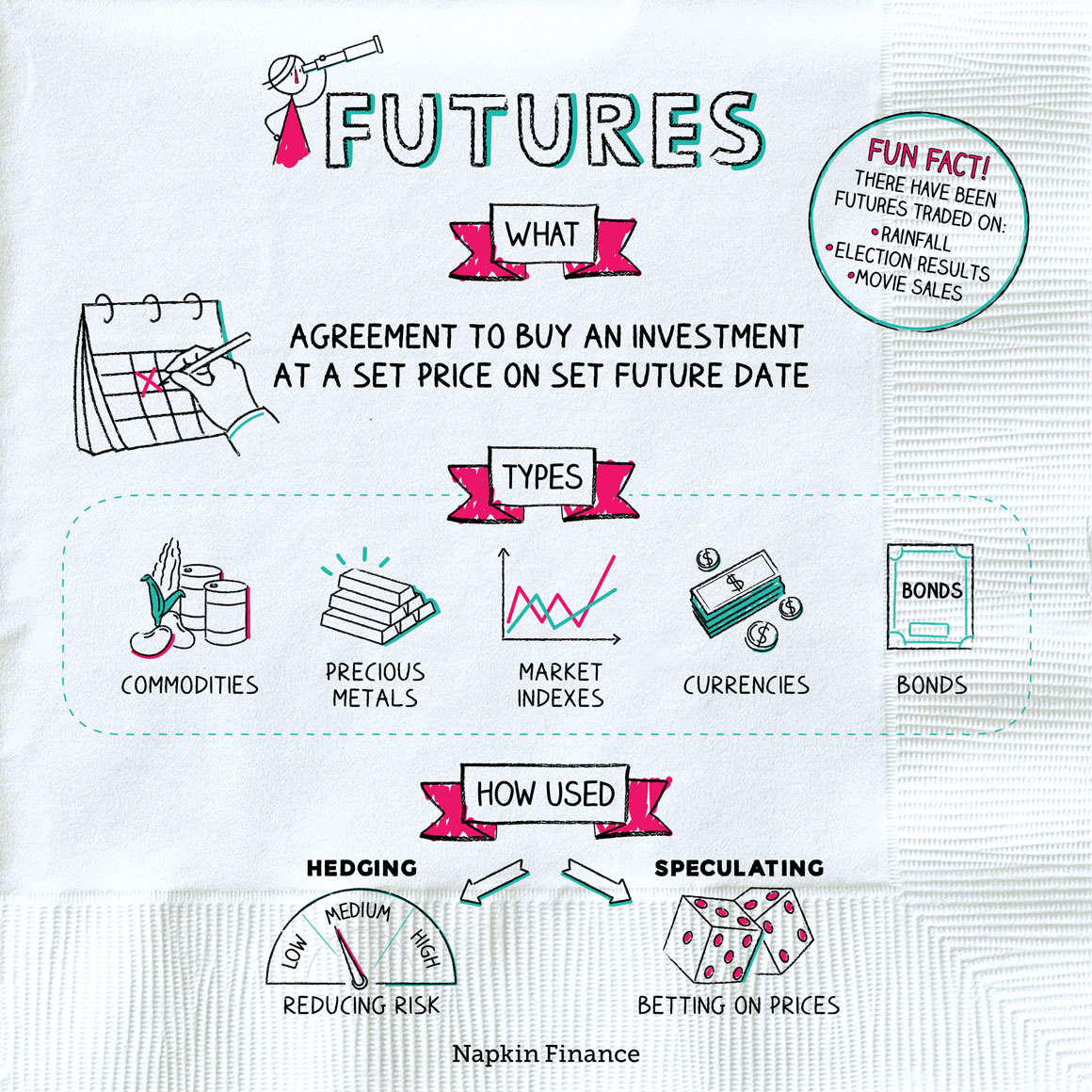

A futures contract is an agreement to buy a specific investment at an agreed-upon price on an agreed-upon future date.

Unlike an option—which gives the buyer a choice of whether or not to actually use the option—a futures contract is an obligation. If you enter into a futures contract, you have to hold up your end of the deal.

Suppose you enter into a futures contract to buy one ounce of gold in three months for $1,500. And suppose that when you enter into the contract gold is trading at $1,400 per ounce.

After you enter the contract, the price of gold will rise or fall from day to day. If the price of gold is higher than $1,500 when the futures contract expires, then you’ve earned a profit. If the price of gold is lower than $1,500 when it expires, then you’ve suffered a loss.

Some futures contracts are made with what’s called “physical delivery,” in which case you would actually receive that ounce of gold at the end of the three months. But often the two sides of the trade instead settle up with cash—in which case you would receive or pay a cash amount equal to your gain (or loss) on the contract at the end of the three months.

Like options, you can buy futures contracts on a range of underlying investments, including:

- Commodities, such as wheat or corn

- Precious metals, such as gold or silver

- Stock market indexes

- Currencies

- Bonds

Two of futures main uses are for:

- Hedging: If you’re a farmer and you know that in six months you’re going to need to sell several tons of corn, then you may buy corn futures today. That way you’re protected if the price of corn takes a sudden plunge.

- Speculating: If you just want to make a bet on whether corn will rise or fall in price, then you’re said to be speculating in the market.

Futures and forwards are highly similar. Both are obligations to exchange something on a future date at an agreed-upon price.

The key difference is that futures are exchange-traded (like stocks), with standardized terms for various contracts, while forwards are custom-negotiated contracts between two parties. Because they’re exchange-traded and settled through a clearinghouse, futures contracts also expose you to less risk that the investor on the other side of your deal will fail to pay up on their side of the deal (this is also called “counterparty risk”).

Futures are agreements, or contracts, to buy a particular investment at a set price on a certain future date. Futures contracts are standardized, exchange-trade contracts. Unlike options, which give the owner a choice of whether or not to buy or sell the underlying security—futures contracts represent obligations.

- There have been futures traded on snow and rainfall amounts, box office ticket sales, and election results.

- Unlike stock trading—which in the U.S. is mainly based in New York—the center of the world of futures trading is Chicago at the Chicago Mercantile Exchange.

- A futures contract is an agreement to buy or sell a specific underlying asset at an agreed-upon price on an agreed-upon future date.

- If you enter into a futures contract to buy an asset in the future, you’ll make money if the underlying asset rises in price above the futures price you’ve agreed to.

- Futures are mainly used for hedging and speculation.