EBITDA

How You Slice It

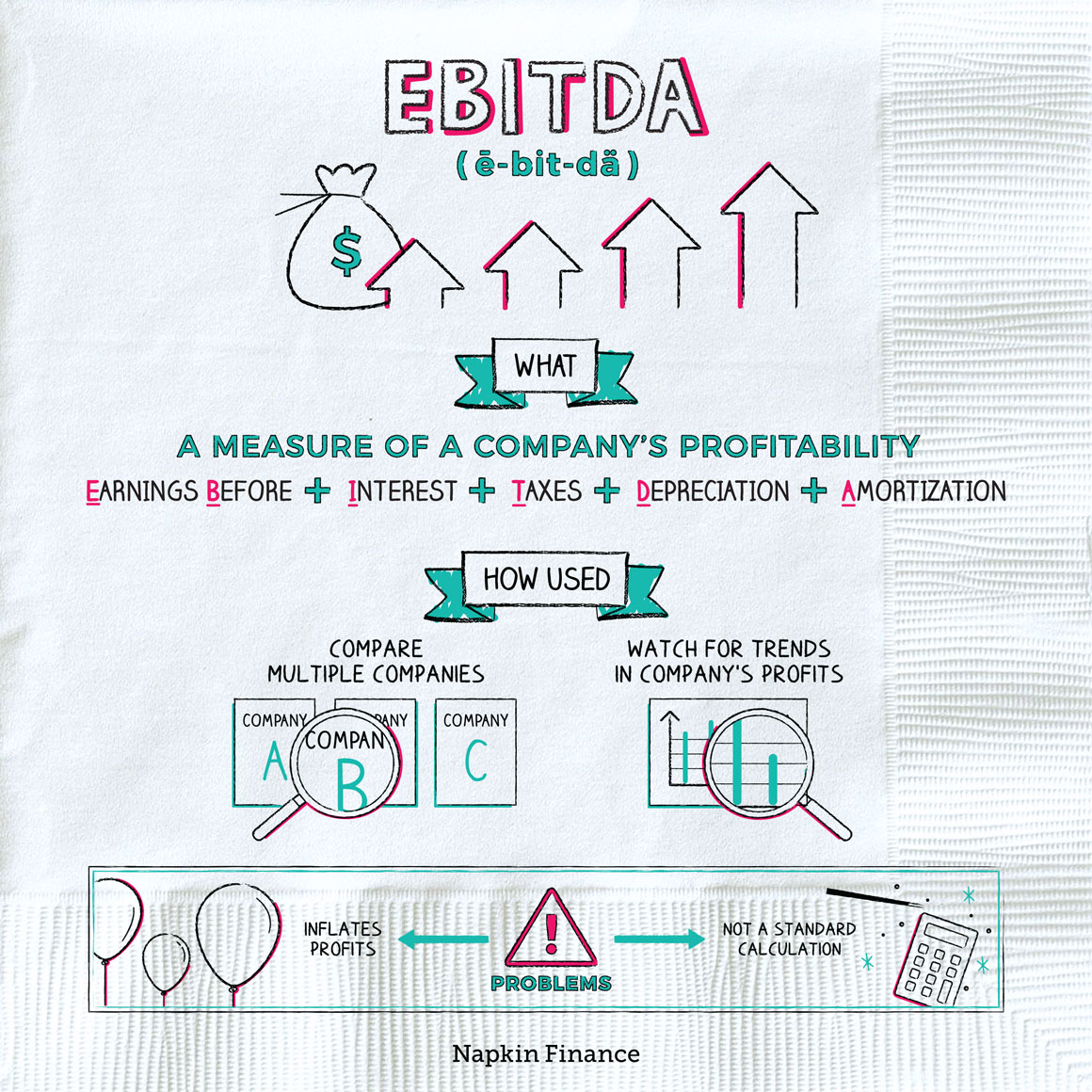

EBITDA (pronounced “ee-bit-tah”) stands for “earnings before interest, taxes, depreciation, and amortization.” It’s one measure of a company’s profits and can be used as an alternative to other measures, such as earning per share.

Investors can use EBITDA to better understand a company’s profitability. Rather than looking at a single EBITDA number on its own, investors typically use it:

- To compare companies with one another

- To see how a particular company’s profits have grown or changed over time

Some investors feel that EBITDA is a more reliable and comparable measure of profitability than traditional measures. That’s because it ignores the effects of certain expenses (namely, depreciation and amortization) that some investors feel can skew a company’s profits.

When companies report their financial results, they have to calculate their numbers according to specific rules that accountants have agreed on (in the U.S., these rules are called “GAAP,” which stands for Generally Accepted Accounting Principles).

EBITDA falls outside these rules (it’s called a “non-GAAP” measure), which means it’s more of a loosey-goosey subjective calculation. So investors typically don’t look only at a company’s EBITDA—they consider it alongside the company’s other numbers too

You can calculate EBITDA with one of the following equations:

| Operating profits (aka EBIT; aka earnings before interest and taxes) + Depreciation + Amortization = EBITDA |

Net income (aka profits) + Interest + Taxes + Depreciation + Amortization = EBITDA |

Profit margin is a way of describing how easily a company makes a profit. If a company keeps $15 in profits for every $100 it sells, then it has a profit margin of 15% (which is a fairly middle-of-the-road margin).

Just as there are different ways of defining “profits,” there are different ways of calculating margin. EBITDA margin is EBITDA divided by total revenue. It shows how a company’s core business-related expenses affect its profit.

The higher the margin, the less risky (and more profitable) the company is financially. There are certain industries that tend to have high or low margins:

- High: Software, technology, and service-based companies, such as law firms

- Low: Brick-and-mortar businesses, such as grocery stores, bookstores, and gas stations; wholesalers of raw materials

Although some investors live for EBITDA, others see it as suspect. Here’s why:

- By adding back in a range of expenses, EBITDA always makes a company look more profitable than it does using standard measures of profitability.

- A positive EBITDA doesn’t always indicate a healthy company because taxes and interest are real expenses a business needs to pay for.

- Because there’s subjectivity involved in calculating EBITDA, it’s often not a standard calculation from one company to the next.

EBITDA is sometimes seen as an accounting trick to make a company look like it’s earning more money than it really is.

EBITDA is an alternative way of gauging a company’s profits. It can help an investor compare many companies without considering certain costs that could skew results. However, EBITDA does not fully account for all the costs associated with running a business and is sometimes viewed as more of an accounting shenanigan than a reliable measure of profitability.

- EBITDA skeptics like to say that it really stands for “Earnings Before I Trick Dumb Auditors.”

- EBITDA was especially popular in the late 1990s before the dot-com bubble burst in 2001. “When will you be EBITDA positive?” was a supposed favorite opening line at Silicon Valley parties at the time.

- EBITDA is an alternative profitability metric used to measure a company’s financial performance.

- By dividing EBITDA by total revenue, you can find the EBITDA margin; the higher the margin, the better.

- The formula has many detractors, who say it gives an incomplete picture of a company’s health and can be misleading to investors.