Mutual Funds

Join Forces

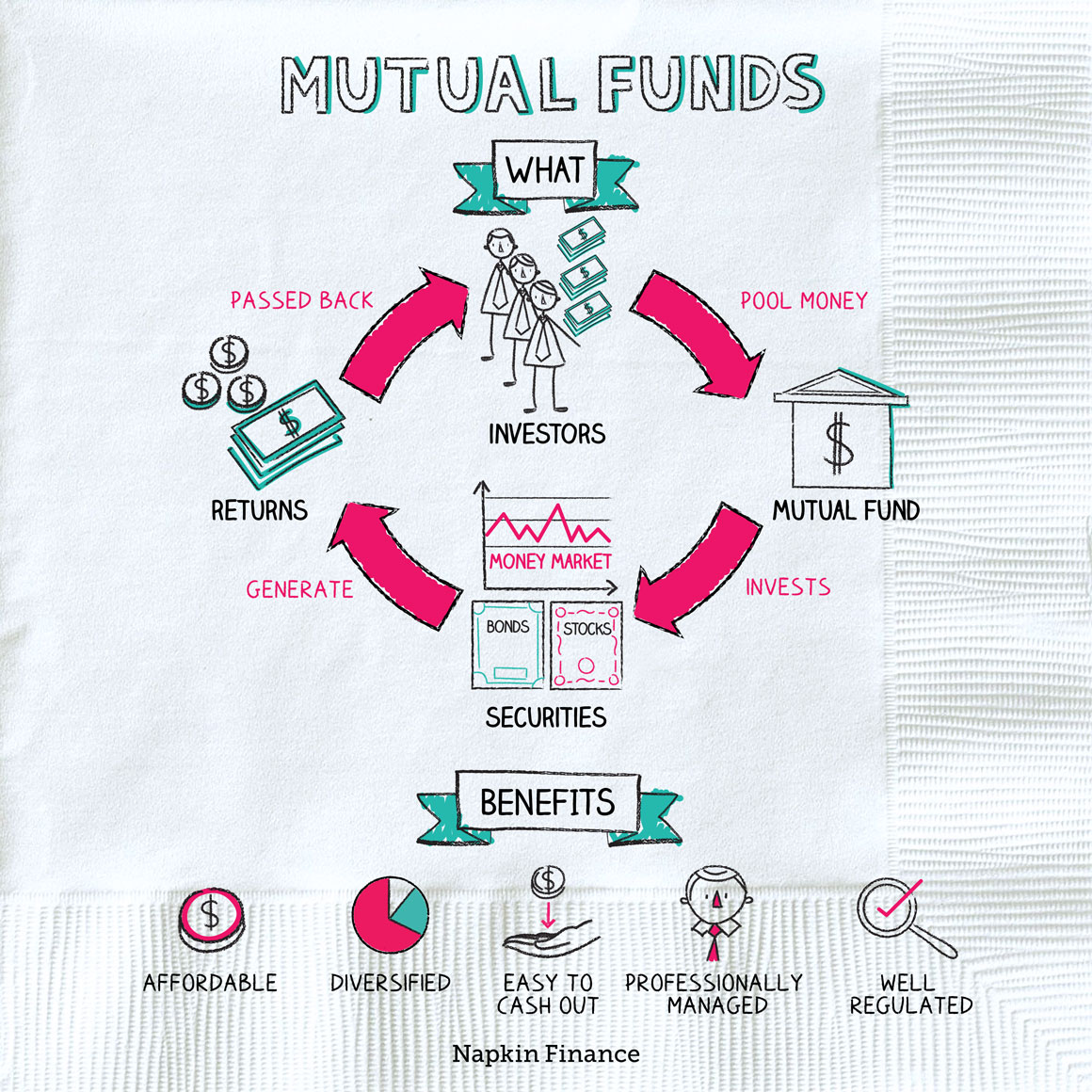

A mutual fund is a professionally managed fund that pools lots of investors’ money in order to buy a basket of investments.

You can think of it this way: Picking your own stocks and bonds is a bit like cooking your own meals—you need to choose good ingredients, use some know-how in putting them together, and make sure that you’re giving yourself a well-balanced diet.

Investing in mutual funds is like hiring an affordable personal chef. Someone else is responsible for your meal planning and for all that legwork. But you still need to make sure you’re being served a healthy diet (and not being overcharged).

Here are the basic mechanics of investing in a mutual fund:

Step 1

Investors buy shares in the mutual fund.

↓

Step 2

The fund pools investors’ money and uses it

to buy a portfolio of investments—typically stocks and bonds.

↓

Step 3

Dividends, interest, and gains are paid back to investors,

who can choose to reinvest them in the fund.

↓

Step 4

Investors can cash out of the mutual fund at any time.

You can invest in mutual funds directly with the company that runs a particular fund, through an online broker, or through a financial advisor. If you have an Individual Retirement Account (IRA) or 401(k), there’s a good chance you already invest in mutual funds.

Mutual funds are a popular investment option because they offer:

- Professional management—By pooling money, funds can afford to hire top-notch managers. Some also have large teams of researchers and analysts.

- Diversification—Many funds own hundreds (or even thousands) of individual securities. Investors can build fully diversified portfolios with just one or two mutual funds.

- Liquidity—Although you can’t trade them as frequently as stocks, you can usually buy or sell fund shares on any day the market’s open.

- Affordability—Many funds let you invest with only a few hundred or thousand dollars to start. Mutual fund fees vary, but most are much cheaper than the typical hedge fund, and the cheapest funds cost only pennies for every $100 you invest.

- Oversight and regulation—Mutual funds must file periodic reports on their investments, report the value of what they own every day, and follow restrictions on what investments they can buy. It would be basically impossible for a mutual fund to pull off a Bernie Madoff–type fraud.

Every investment option has at least a few downsides. When it comes to mutual funds, those include:

- Fees—Even if your fund tanks, you’ll still have to pay management fees. Fee structures vary widely, with some mutual funds also charging sales commissions.

- Control—A professional fund manager takes the burden off you, but it also means that you don’t have control over the manager’s decisions.

And like any investment, with mutual funds, you aren’t guaranteed good returns. You could do all the homework possible in order to pick a good mutual fund and still see its returns tank—because that’s just the way investing works.

There are mutual funds that invest in all kinds of things, including:

- Stock funds—invest in stocks.

- Bond funds—invest in bonds.

- Money-market funds—invest in very safe short-term debt.

- Balanced funds—invest in a mix of stocks and bonds.

- Target-date funds—invest in a fully diversified mix of investments, which becomes more conservative as you near retirement.

Another important distinction to make is between index mutual funds, which only aim to match the market’s returns, and actively managed funds, which try to pick and choose the best investments in order to beat the market.

A mutual fund is an investment option that pools the money of many investors to buy stocks, bonds, and other securities. A mutual fund portfolio is professionally managed, comparatively affordable, and is subject to strong oversight and regulation. Most mutual funds invest in stocks, bonds, or a mix of the two.

- The oldest mutual fund is the MFS Massachusetts Investors Trust fund, which launched in 1924.

- A vigilant numbers geek named Harry Markopolos tried to warn U.S. regulators many times that Bernie Madoff was a fraud, including with a 2005 letter titled “The World’s Largest Hedge Fund is a Fraud.” The regulators didn’t listen, and in 2008 Madoff’s fund collapsed.

- A mutual fund pools investors’ money in order to buy a diversified portfolio of securities.

- The benefits of mutual funds include professional management, easy diversification, comparatively low fees, and strong regulatory oversight.

- The downsides of mutual funds include giving up some control, no performance guarantee, and fees that you must pay even if your fund does not perform well.

- Most mutual funds invest in stocks and bonds.

- How risky a particular fund is or how much it returns will depend on the underlying investments it holds.