Venture Capital

Nothing Ventured, Nothing Gained

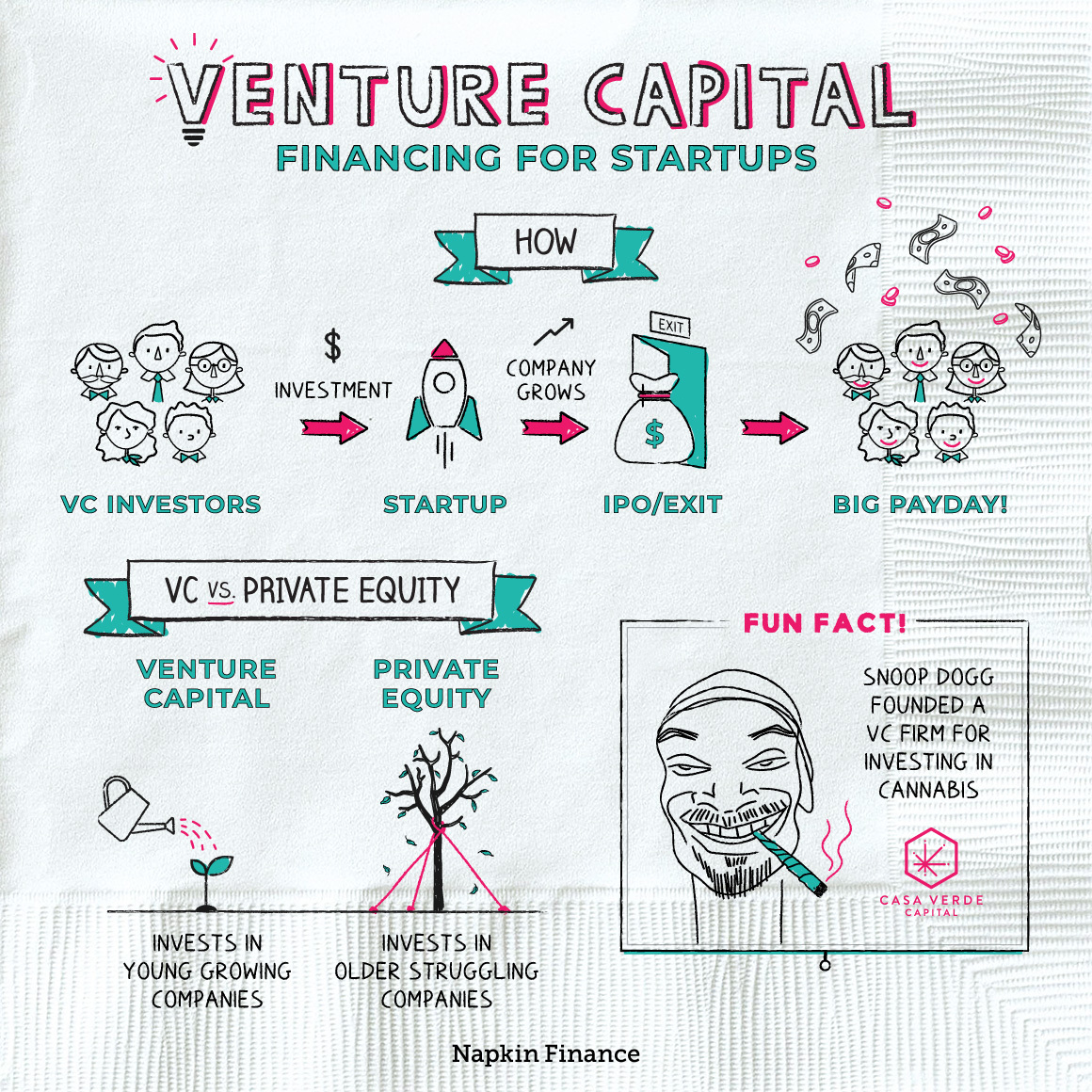

Venture capital (or “VC” for short) is a type of financing for startup companies.

Venture capitalists invest money in young companies they believe have big growth potential. In exchange, the investors receive ownership stakes (i.e., equity), which could be worth a whole lot more down the line if those companies prove to be successful.

Here’s what the typical life cycle of a VC investment looks like:

Startup submits a business plan to VC firm or investor

↓

VC does due diligence on company and business model

↓

If it decides to invest, VC and startup agree to terms of the investment

(like what percent of the company the new VC investors own)

↓

Startup uses this funding to grow its business.

The company (hopefully) takes off!

↓

Other VC investors may also buy into the company

in subsequent “funding rounds”

↓

Eventually, VC investors

cash out of the company through an “exit”

VC investors typically don’t receive a dime back on their investments until they reach an “exit.” That’s the VC investors’ chance to cash out and finally profit from the startup’s growth. Here are the main ways they usually do so:

- Initial public offering (IPO)—When the startup sells shares to the public for the first time. At this point, VC investors can sell their ownership stakes in the stock market.

- Merger or acquisition—If the startup is acquired by or merges with another company, the VC investors will have a chance to trade in their stakes.

- Management buyout—The startup’s executives could offer to buy back the ownership stake held by VC investors.

Finally, while it’s not the exit any VC investor dreams about, there’s always a real possibility that a given startup could fail. If this happens, VC investors often lose their entire investment.

A VC investment always comes with potential risks and rewards for both parties. Here are some of the main ones:

| Pros | Cons | |

| For VC investors |

|

|

| For startups |

|

|

Venture capital is technically a type of private equity. But investors typically refer to them as separate categories due to their different focus and strategies. For example:

- Industry—VC typically focuses on tech. Private equity may include a wider range of industries.

- Company stage—VC focuses on young, fast-growing companies. Private equity targets mature companies that are facing business problems or bankruptcy.

- Size of ownership stake—VC investors usually take on a small stake (think single digits, like 5%). Private equity firms often buy entire companies.

- Strategy—VC investors are more likely to leave companies alone while they grow. Private equity may take over management of a struggling company to try to make it profitable again.

Here are some other points to keep in mind about VC investments:

- There are VC firms—just as with private equity, there are dedicated VC firms that specialize in these investments. Wealthy people can buy into these firms, which may invest in a broad range of startups at once.

- You don’t have to go through a firm—in other cases, an investor may make a VC investment directly (without a VC firm in the middle) by handing a big check over to the startup and receiving an ownership stake.

- It’s typically only for the very wealthy—because of the large investment minimums and long delays before you can get your money back, ordinary investors usually don’t have much of a role in the VC world.

- It can take a lot of swings to get a hit—VC firms may invest in dozens of companies, knowing that most of them will fail. But if one or two out of the bunch become the next Uber or Netflix, the gains can be big enough to more than offset all the losers.

Venture capital is a type of financing in which investors buy directly into a young, fast-growing startup. VC investors then have an ownership stake, which they may sell for a profit if the startup eventually IPOs or gets acquired. For founders and companies, VC funding can provide much-needed cash to fuel growth. For well-heeled investors, it can be a high-risk, high-return investment option.

- In addition to being the startup capital of the world, Silicon Valley is the home base of many of the biggest and best known VC firms.

- VC isn’t just for financier types—plenty of celebrities are active VC investors, too, including Oprah Winfrey, Ashton Kutcher, and Gwyneth Paltrow.

- Snoop Dogg founded his own VC firm, Casa Verde Capital. (It focuses on cannabis investments.)

- Many of the world’s best-known and most successful companies got off the ground thanks to VC funding, including Facebook, Amazon, and Alibaba.

- Venture capital is a direct investment made in a young, fast-growing private company.

- The term can be used to describe investments made by VC firms or those simply made by wealthy individuals who want to get in on the ground floor of a promising company.

- VC investments can take years or even decades to pay off. Investors typically don’t realize any return on their investment until the underlying company goes public or is acquired.

- While VC firms tend to invest in tech startups that have bright futures ahead of them, private equity firms tend to invest in struggling older companies in need of a turnaround.

- VC investments are typically only an option for the most well-heeled of investors.