Interest

Pay Up

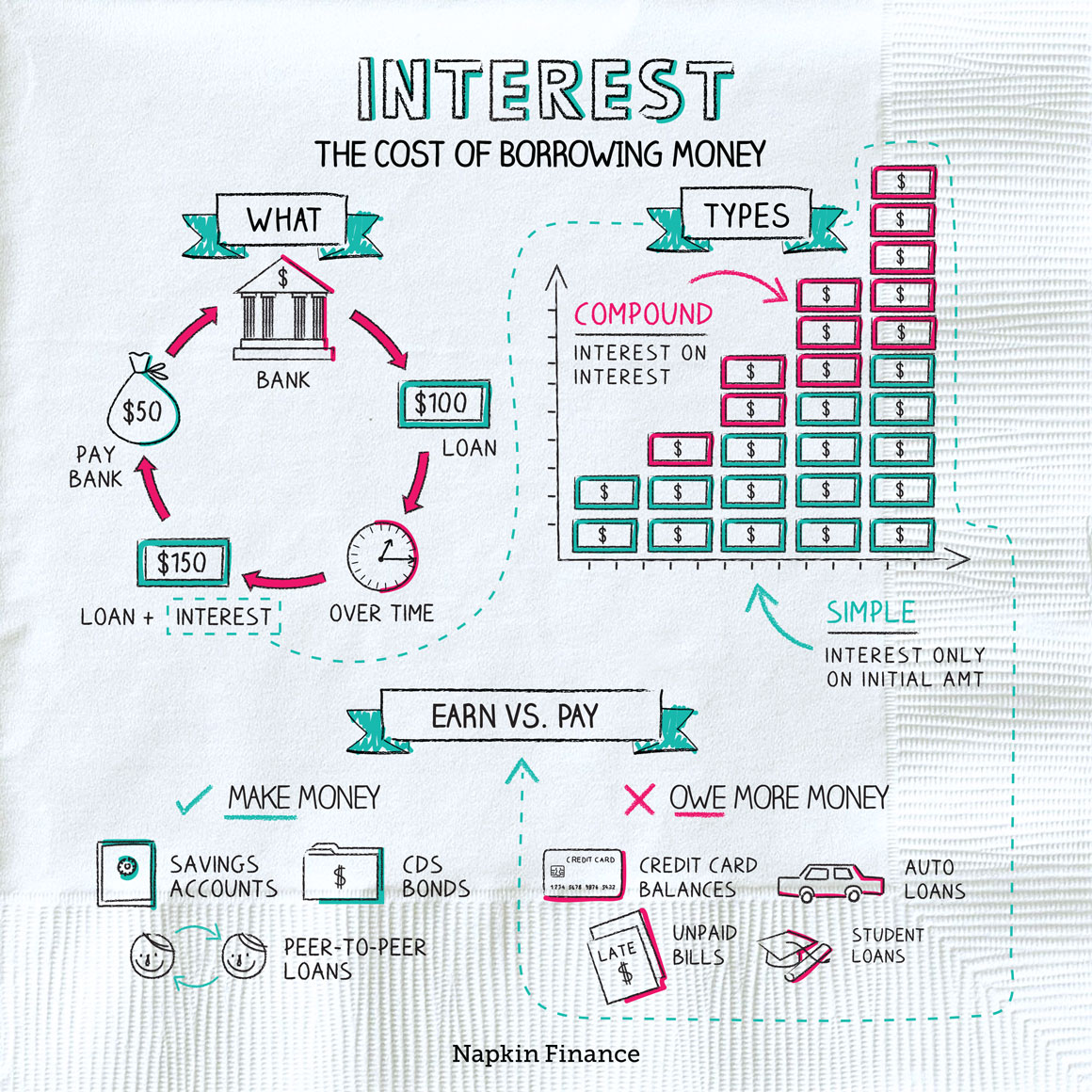

Interest is the cost of borrowing money.

For a borrower, interest is the price of taking on a loan. For a lender, interest is the return earned on making a loan.

Interest is expressed as a rate, such as 5%. How much interest the borrower pays is calculated by multiplying the rate by the amount borrowed and the length of time it takes to pay back the loan. For example, if you borrow $1,000 at a 5% interest rate for one year, you would pay back $1,050.

At different times in your life, you may be on the receiving or paying end of interest.

When you lend or invest money, a higher interest rate is better because it means you earn more. When you borrow money, a lower interest rate is better because it means you pay less.

| You receive interest if: | You pay interest if: |

| You have money in an interest-bearing bank account | You carry a balance on your credit card |

| You own CDs, bonds, or other interest-bearing investments | You borrow money to buy a house, go to college, or buy a car |

| You make a peer-to-peer loan online or a loan with interest to a friend | You leave a bill unpaid and it starts to accrue interest |

“Simple interest” is calculated only on the initial amount borrowed. “Compound interest” is calculated on the borrowed amount plus on any interest you’ve already earned.

When you’re comparing bank accounts or loan offers, you might see interest rates expressed as an “annual percentage rate” (APR) or “annual percentage yield” (APY). The former only expresses simple interest, while the latter reflects compounding.

Interest rates can also be set in two different ways:

- Fixed: Stays the same for the life of the loan

- Variable: Can rise or fall in response to economic conditions and could reset monthly, quarterly, or annually

The bottom line: Interest rates can be surprisingly complicated. Any time you’re comparing rates—whether you’re looking for a low rate to borrow at or a high rate to earn on your money—make sure you’re comparing the same type of rate.

Interest can be your best friend or your worst enemy. Here are some ways you can make it work for you:

- Shop around: Interest rates can vary a lot from bank to bank or lender to lender. Compare rates whether you’re taking out a loan or opening a savings account.

- Reinvest your interest: Leave the interest you earn in your savings account so that you earn interest from that interest.

- Reduce your debt: The longer you carry debt that’s accruing interest, the more you’ll pay in the end. Keep your account balances low (or paid off).

Interest is the cost of borrowing money or the return you earn for lending. There will probably be many different points in your life when you pay or receive interest. Interest may be simple or compounded, and interest rates may be fixed or variable.

- Although it’s rare, interest rates can be negative—with the bank paying you to take out a loan (or charging you to keep your money safe).

- Islamic law prohibits paying or receiving interest. If you open a savings account with a Sharia-compliant bank, you may be offered a “target profit” instead of an interest rate.

- Interest is the cost of borrowing money.

- If you’re borrowing money, interest works against you. If you’re lending money, interest works for you.

- If you’re ever comparing interest rates, make sure you’re comparing the same type of rate.

- Compound interest helps when you’re lending but hurts when you’re carrying a balance.