Investing in Gold

Worth its Weight

Gold is a precious metal that’s used in everything from jewelry and artwork to industrial goods and electronics. It can also be an option for investors looking for an alternative to more traditional investments, like stocks and bonds.

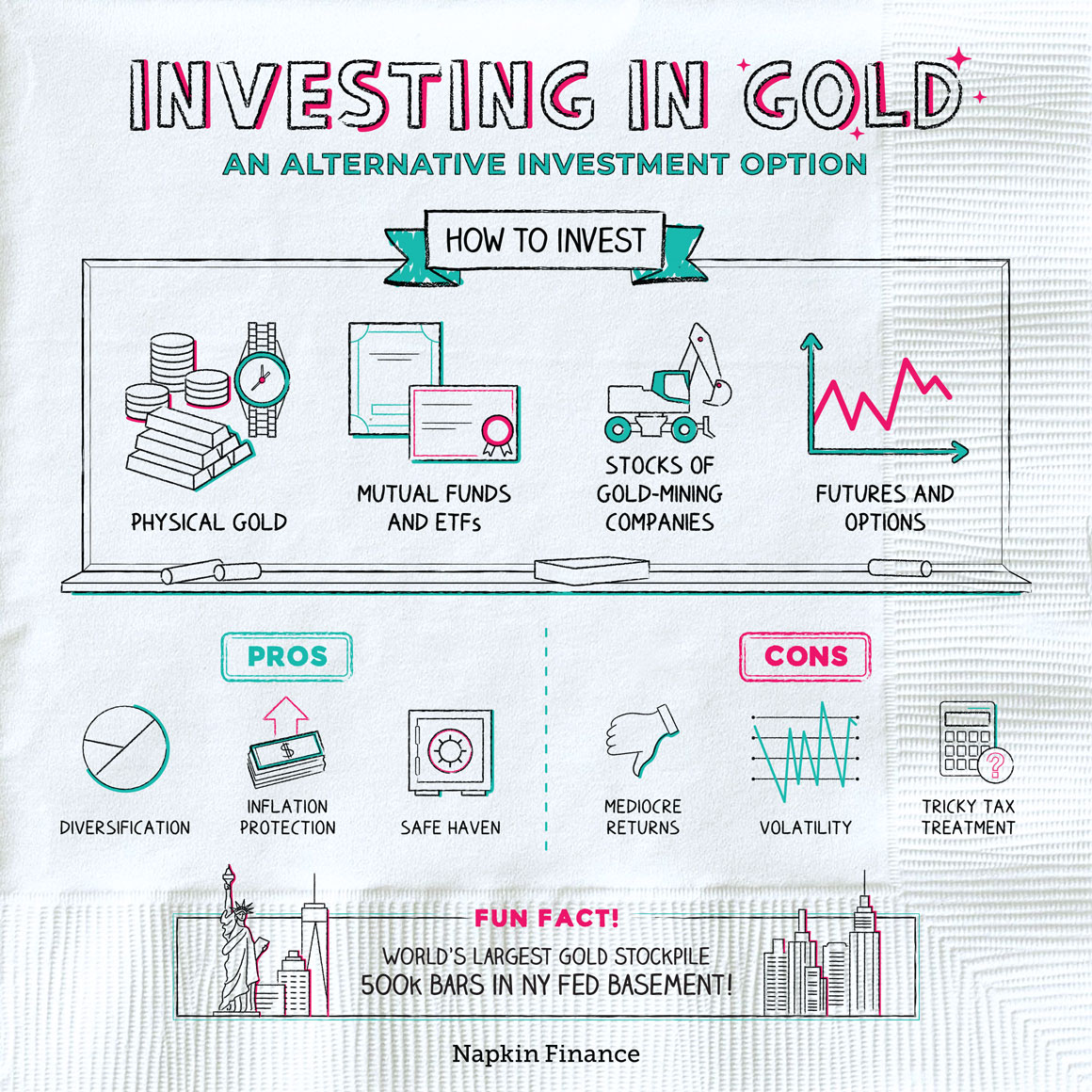

The main reasons investors may consider gold are:

- Diversification—the price of gold doesn’t typically rise and fall along with traditional stocks and bonds.

- Inflation protection—gold prices usually keep up with inflation over time.

- As a safe haven—gold prices often rise when investors fear the economy and stock market may be heading into a tailspin.

Some people also like that gold is a physical object (unlike stocks and bonds) that shouldn’t wear down over time and may still be worth something even if, say, entire governments and currency systems collapse.

There are several ways you can invest in gold:

- Buy physical gold bars (also known as bullion) or coins

- Purchase shares in mutual funds or exchange-traded funds (ETFs) that invest in gold and gold-related assets

- Buy stock in gold mining companies (or invest in mutual funds or ETFs that hold these stocks)

- Invest in gold futures or options

Gold investing is less straightforward than owning vanilla stocks and bonds. Physical bars can be expensive to buy and store, and you may need to insure them. Trading futures and options is risky. And buying shares of mining companies doesn’t give you a direct bet on the price of gold.

In short, any option you choose comes with trade-offs.

Gold can be a controversial investment. Here are some of the disadvantages that skeptics typically point to:

- Mediocre returns—although gold may have a good stretch here or there, over very long periods (i.e., decades), it typically falls way behind stocks and bonds.

- Pays no income—you won’t earn dividends or interest with gold investments.

- Volatile prices—despite being considered a safe haven, gold can take some wild swings in value.

The middle-ground opinion on gold is that it can make sense as a small addition to an otherwise well-rounded portfolio. But you probably don’t want to sink your life savings into that gold ETF just yet.

Physical gold, such as bullion and coins, is considered a “collectible” for tax purposes and so comes with a distinct set of tax rules. If you sell physical gold for a profit, the tax rate you pay may depend on how long you owned it:

- Owned less than one year: You pay your ordinary income tax rate on your profit.

- Owned more than one year: You pay your ordinary income tax rate or 28%, whichever is lower. (These rates are higher than what you would owe for profits on stocks.)

And you never owe taxes on gold that you haven’t yet sold or otherwise transferred—no matter how much it’s risen in value.

Investing in gold—whether in its physical form or through stocks, funds, or derivatives—comes with potential benefits but also trade-offs. While gold can help diversify your portfolio and provide some protection against market swings, it doesn’t provide the same income potential or long-term returns of more mainstream investments.

- The world’s largest known stockpile of gold is the roughly 500,000 gold bars that sit in the basement vaults of the New York Federal Reserve. The Fed only serves as guardian for this gold—it’s owned by the U.S. government, foreign governments, central banks, and international organizations.

- That stockpile weighs more than 6,000 tons. The Fed building can only support its weight because it sits on the bedrock of Manhattan Island.

- The last time Olympic gold medals were made entirely from gold was in 1912. Now, the International Olympic Committee only requires that gold medals contain six grams of gold. The rest is generally made of silver.

- Pure gold is so soft that you can mold it by hand.

- Investors may consider gold as an alternative to mainstream securities, such as stocks and bonds.

- You can invest in gold by buying physical bars or coins, stock in a gold mining or related company, shares of a gold-backed fund, or gold futures and options.

- The benefits of investing in gold can include diversification and inflation protection. Some investors also feel that gold offers safety when markets and economies are in free fall.

- The drawbacks of investing in gold can include volatility and mediocre long-term returns.

- Profits on gold investments may be taxed at higher rates than other investment options.