Bankruptcy

Lose Your Shirt

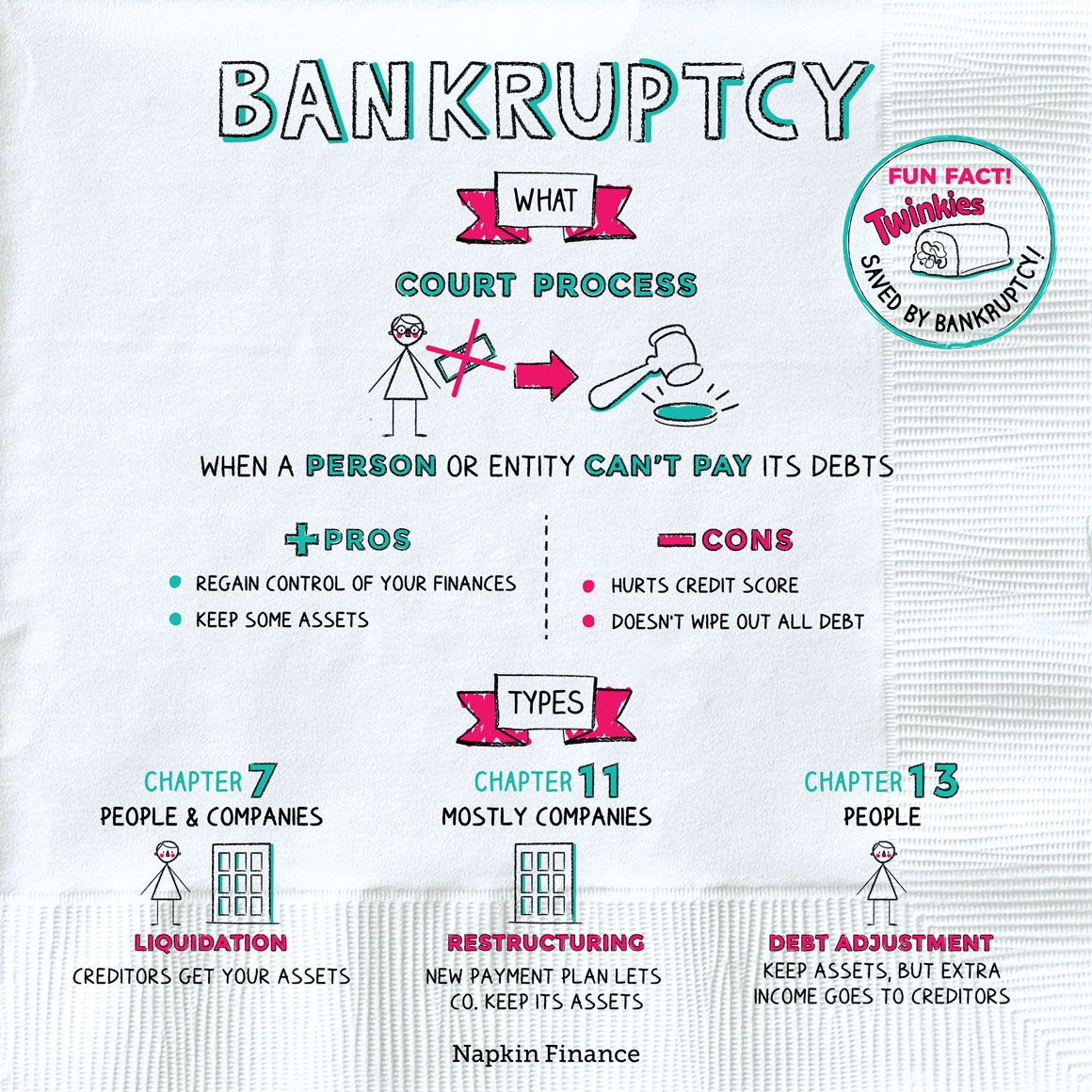

Bankruptcy is the legal process for consumers or businesses to get help with their debt.

Bankruptcy starts when a person or company submits a petition to a court, which reviews their assets and debts. The court can then cancel certain debts or approve a proposed repayment plan.

The debtor (i.e., the person or company who owes money) is usually the one who starts the process, but it can also be forced by lenders in certain situations. That’s called an “involuntary bankruptcy.”

While bankruptcy can give you a second chance at getting your financial house in order, it’s a fairly extreme option and comes with some definite drawbacks.

| Pros | Cons |

| Helps you regain control of your finances | Hurts your credit score (and stays on your credit report for seven to ten years) |

| Could allow you to keep certain assets | Doesn’t eliminate all debt (including some student loans, taxes, and child support) |

| Can put an end to calls from bill collectors | Can make it harder for you to get loans, rent apartments, or access other services in the future |

“Student loan debt will not be discharged in bankruptcy.

It is the Velcro of all debts.“—Suze Orman

There are different types of bankruptcy available, each of which has its own particular rules (their names come from chapters in the U.S. bankruptcy code). The most frequently used options are:

| Name | Who can use | How it works |

| Chapter 7

(aka liquidation) |

Companies and people (who qualify based on income) | This is often the easiest to file, and the process is typically complete within three to six months. The debtor gives up certain assets, and the proceeds are used to pay creditors. State and federal laws dictate which assets you can keep, such as your house, car, clothes, or other personal effects. |

| Chapter 11

(aka reorganization) |

Companies and people (though it’s mainly used by companies, partly because it’s more expensive) | The debtor proposes a plan to repay creditors without giving up its assets. The intent of Chapter 11 is to let financially troubled companies find a way to become profitable again while paying their debt over time. |

| Chapter 13

(aka adjustment of debts) |

Only people with debts below a certain level and with enough income to qualify | A person comes up with a plan to pay all or some debt over the course of three to five years. The debtor can keep their property, but any income above what they need to cover basic expenses usually goes toward their debt. |

Experts recommend that you try all your other options first before filing for bankruptcy. These include:

- Working with your creditors: Your loan servicer, credit card company, or mortgage lender might be willing to work out a new payment plan if you explain your situation.

- Ask for government help: Some states have programs to help you pay specific debts, like your mortgage or utility bill.

- Consolidate your debt: Use a new loan to pay off old debts. While this doesn’t reduce what you owe, it can make your debt more manageable by lowering your monthly payments—either by spreading out your payments over a longer period of time or reducing your interest rate.

- Try credit counseling: An organization (typically a nonprofit) helps you make a plan to get out of debt, consolidate your bills, or improve your money management habits.

“How did you go bankrupt? Two ways. Gradually, then suddenly.“

—Ernest Hemingway

Although people think of bankruptcy as a corporate death rattle, companies often can and do go on to thrive afterward. Here’s how some major companies fared through the process:

Bankruptcy is a legal process for businesses and individuals seeking debt relief. There are various options, and depending on the type, the debtor may be able to cancel certain debts completely or come up with a repayment plan. Bankruptcy has many pros and cons, and while it can help some people rebuild their finances, it can hurt your credit score and might require giving up certain assets.

- Bankruptcy saved the Twinkie: Hostess filed for bankruptcy in 2012 before restructuring and going public.

- At least eight presidents went essentially bankrupt at one point or another, including Abraham Lincoln, Thomas Jefferson, and William Henry Harrison. (Modern bankruptcy laws weren’t passed until 1978, though it was still possible before then for lenders to seize debtors’ assets in court.)

- What’s Chapter 22 bankruptcy? A joke referring to companies that have had to seek Chapter 11 bankruptcy twice—a group that includes Gymboree and Payless.

- Bankruptcy is a formal, court-supervised process to help people and companies who are struggling with their debts.

- Bankruptcy can provide debt relief through a repayment plan or the cancellation of certain types of debt.

- The most common types of bankruptcy are Chapters 7, 11, and 13, and each has different requirements and rules.

- Although bankruptcy can help you get out of debt, it can wreck your credit score and have a lasting impact on your finances.

- Experts recommend you try every other option first before you consider bankruptcy, like debt consolidation, credit counseling, or working with creditors.