Featured Napkin

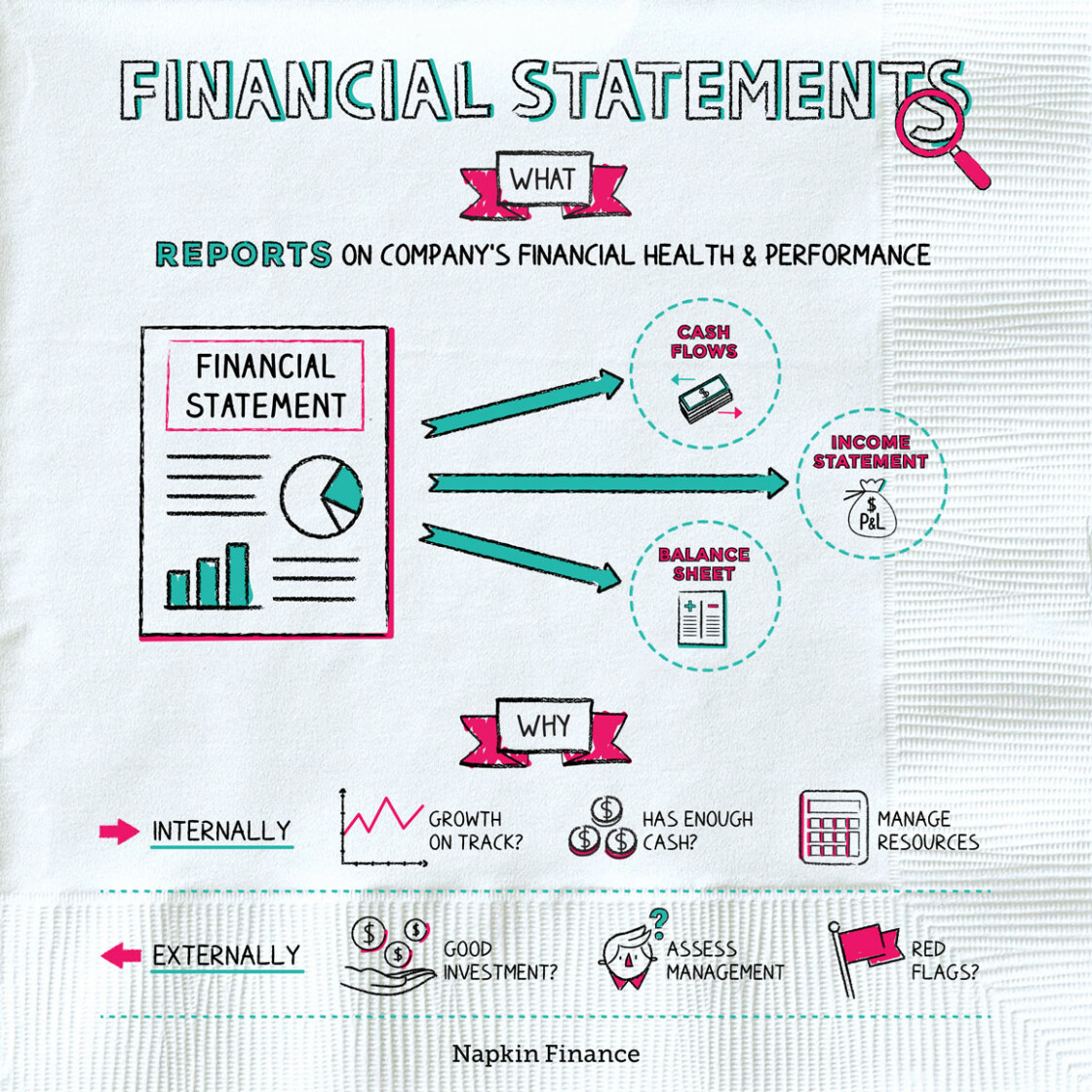

Financial Statements

State of Affairs

Financial statements are reports a company puts together to measure how it’s doing. Companies create their financial statements by condensing large amounts of data into reports. They offer perspective on where a company’s money comes from, how it’s being spent, and whether the company is in good financial health.

Learn moreMore entrepreneurship Napkins...

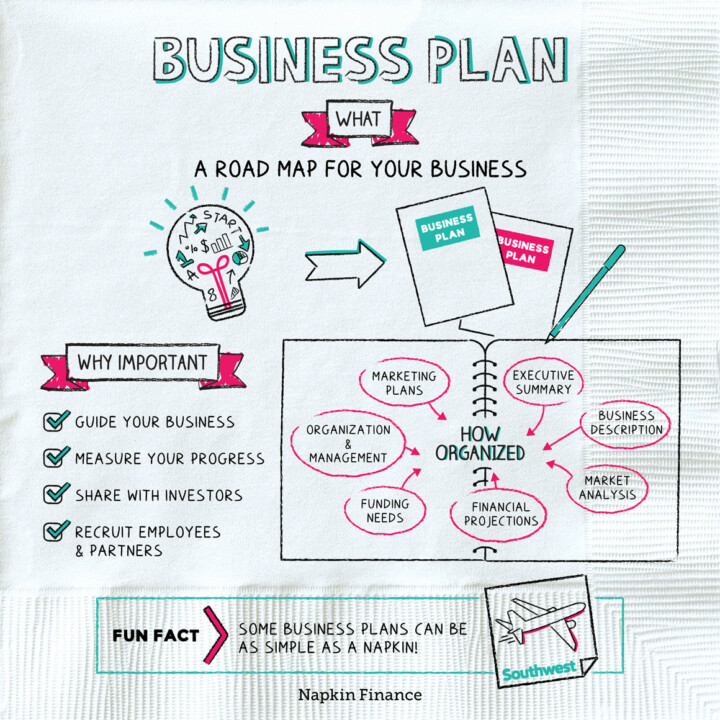

Business Plan

Best-Laid Plans

A business plan is a document that outlines your vision for your business. It describes your big-picture...

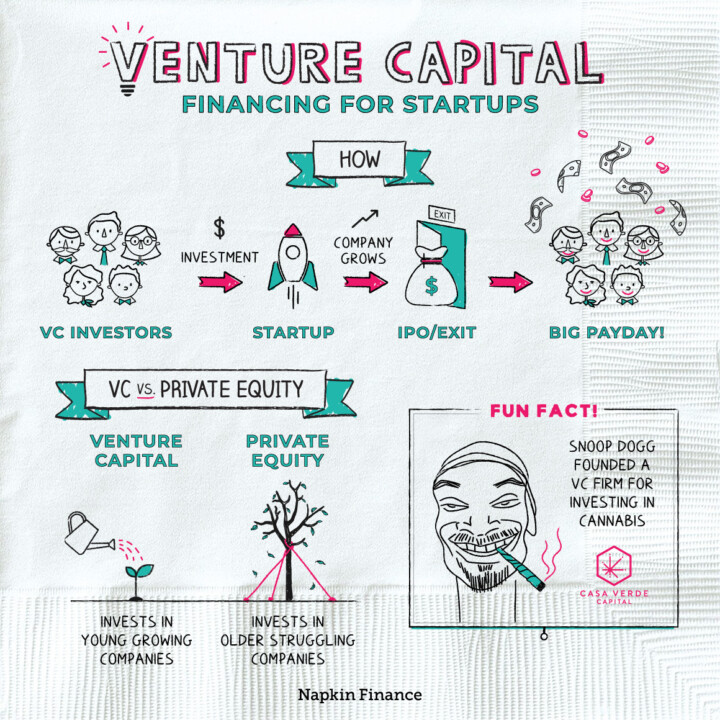

Learn moreVenture Capital

Nothing Ventured, Nothing Gained

Venture capital (or “VC” for short) is a type of financing for startup companies. Venture capitalists invest...

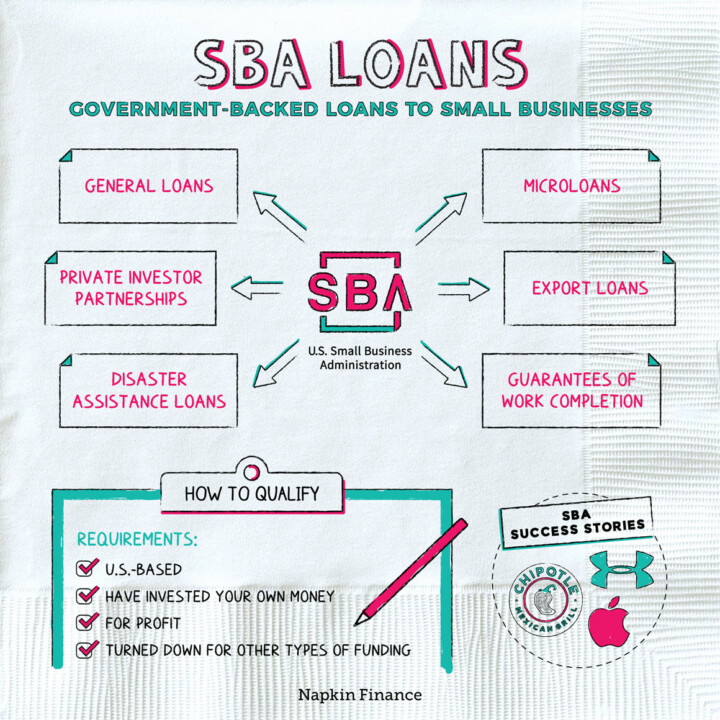

Learn moreSBA Loans

Helping Hand

SBA-guaranteed loans (or just “SBA loans”) are business loans backed by the U.S. Small Business Administration (SBA)....

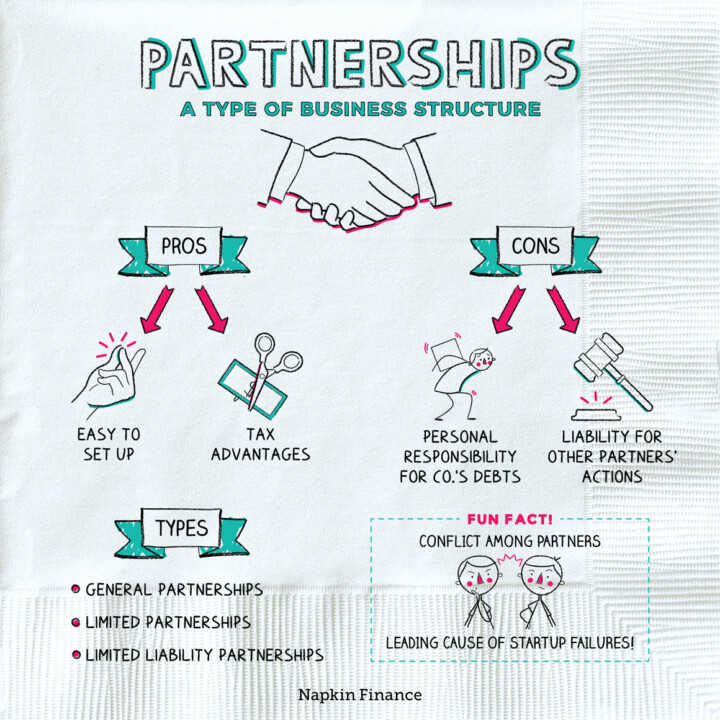

Learn morePartnerships

Passing Through

If you’re starting a business with someone else (or multiple people), the partnership is the most basic...

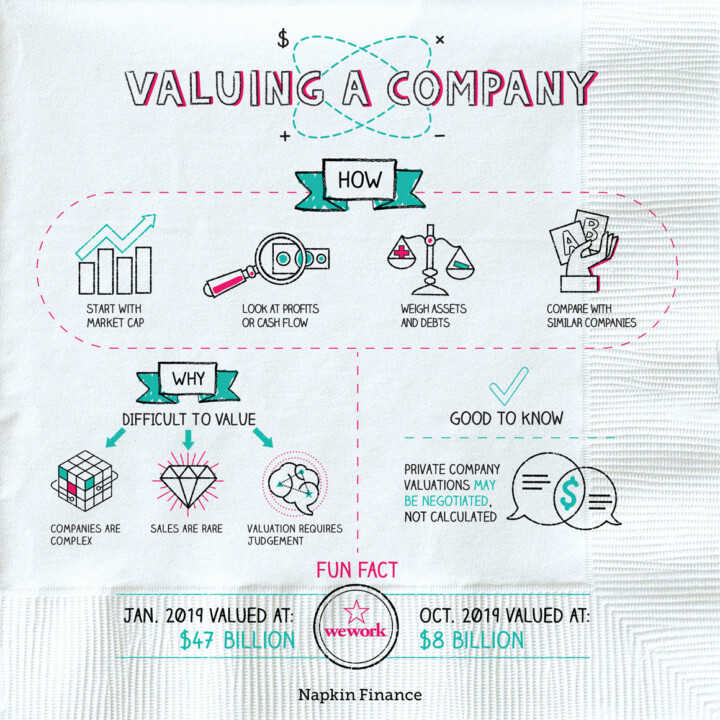

Learn moreValuing a Company

What’s it Worth?

A company’s value is the dollar figure that it might sell for if a person or another...

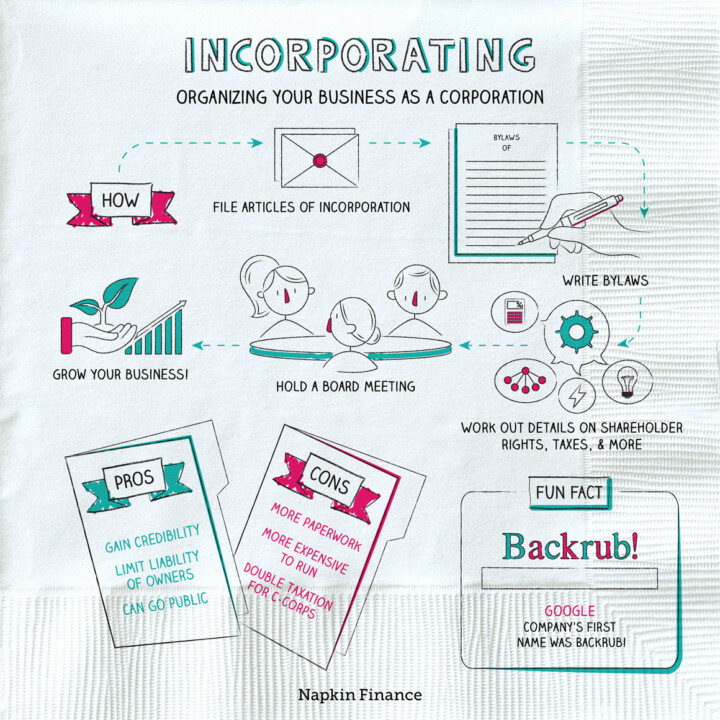

Learn moreIncorporating

Limited Liability

A corporation is one type of formal business structure that entrepreneurs can choose to use when starting...

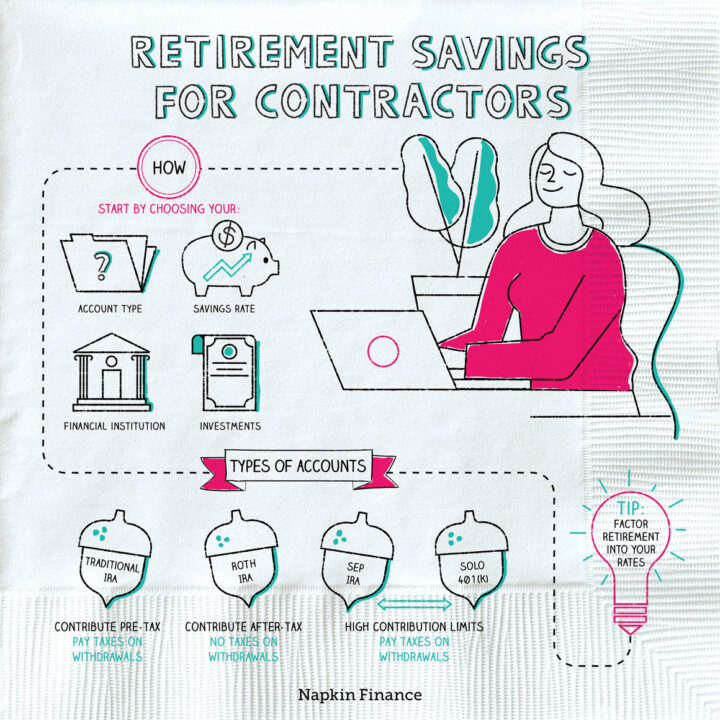

Learn moreRetirement Savings for Contractors

Squirrel Away

If you’re a contractor, saving for retirement can be much more complicated than it is for employees....

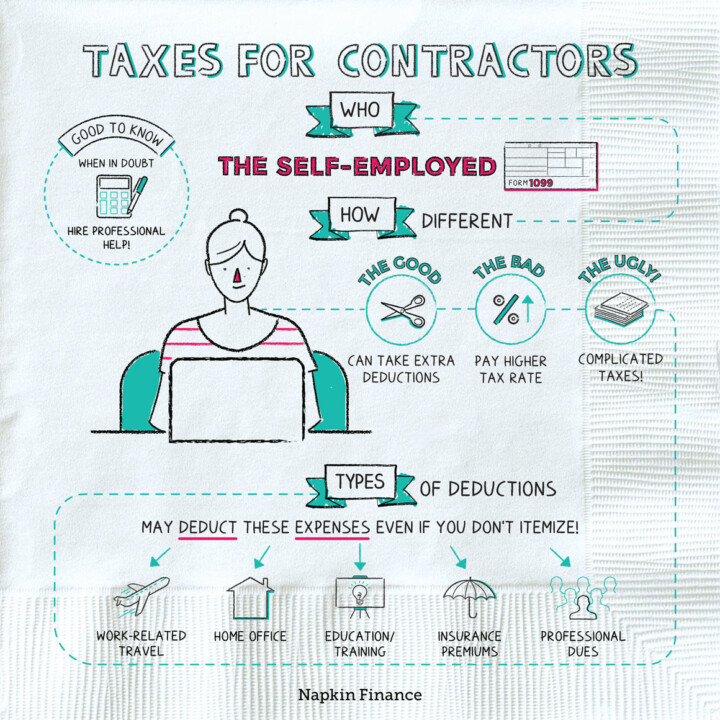

Learn moreTaxes for Contractors

Welcome to the Gig Economy

A contractor, or freelancer, can be anyone who works for clients on a contract basis rather than...

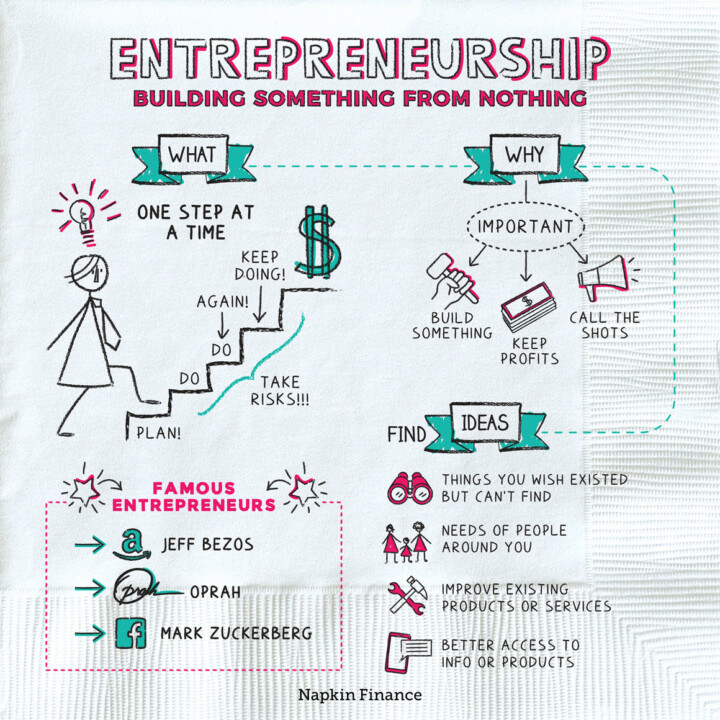

Learn moreEntrepreneurship

Change the World

Entrepreneurship is building a new business from the ground up. It means coming up with an idea...

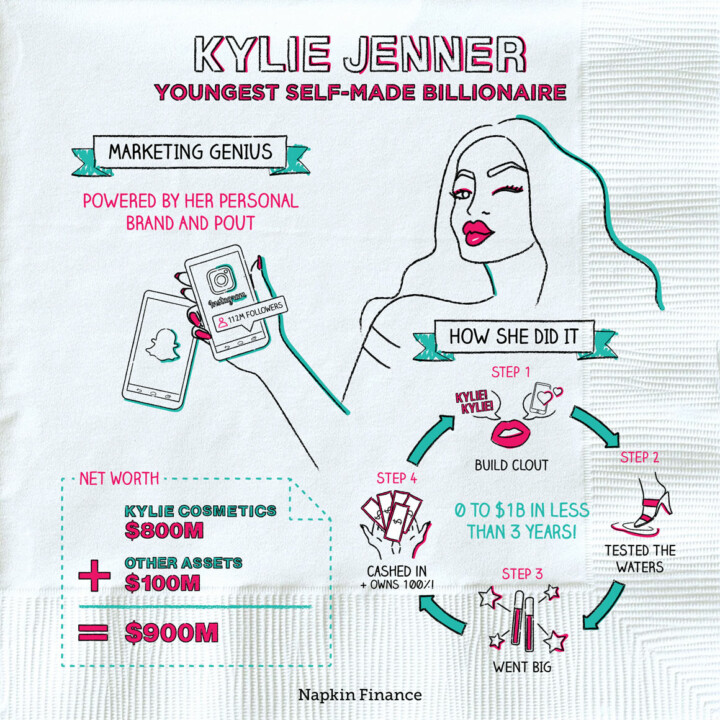

Learn moreKylie Jenner

Lifestyles of the Rich and Famous

When it comes to money moves, Kylie Jenner knows what’s up. A Forbes profile of the youngest...

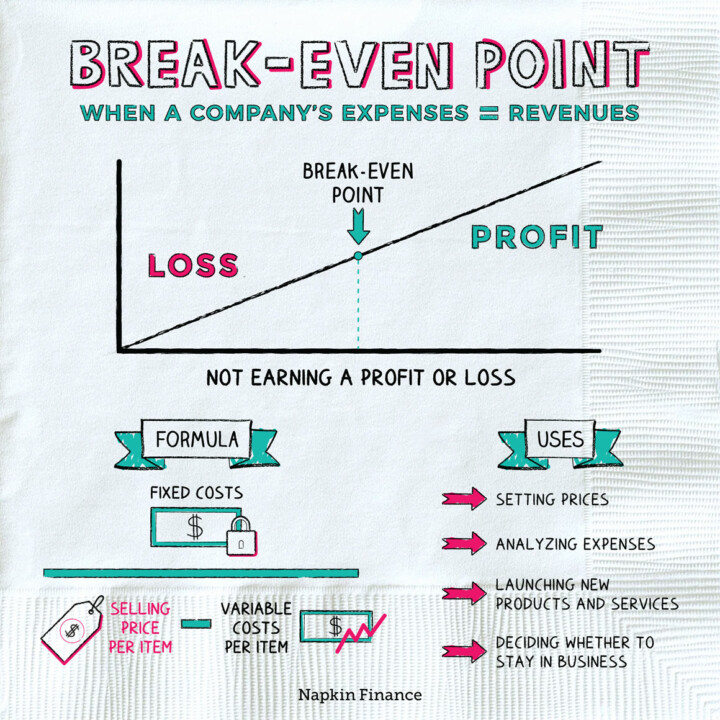

Learn moreBreak-Even Point

Point Break

A company is at its break-even point when its revenue equals its expenses. It is neither making...

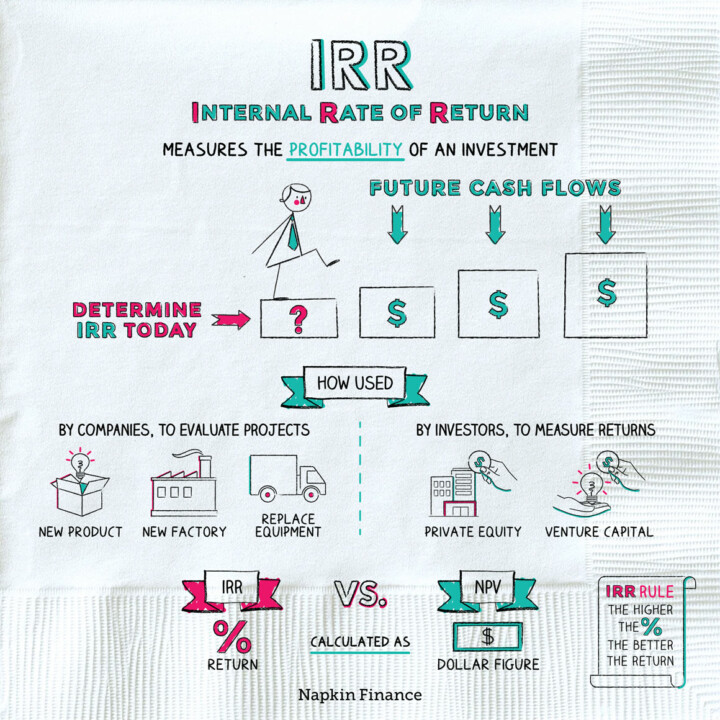

Learn moreIRR

Crunch the Numbers

The internal rate of return, or IRR, is a measure of an investment’s or a project’s profitability....

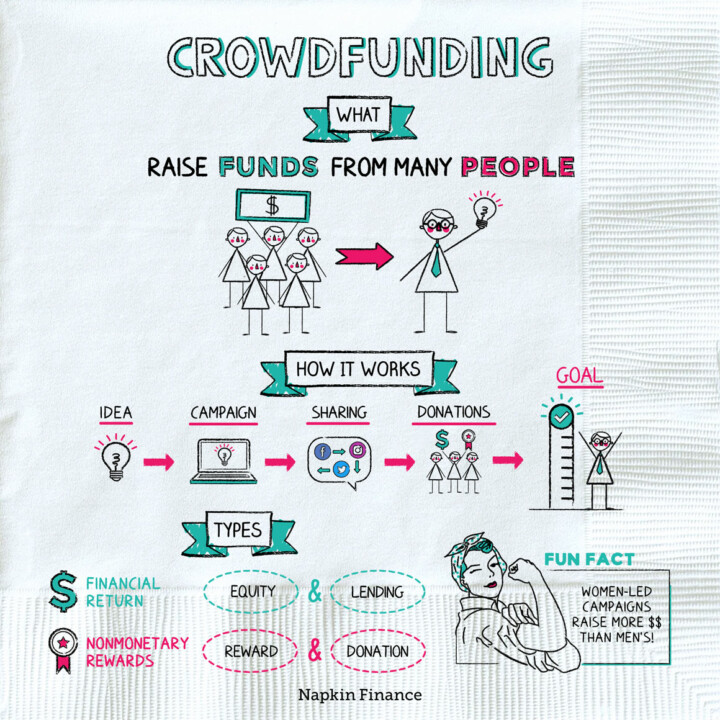

Learn moreCrowdfunding

Pound the Pavement

Crowdfunding is a way to raise money from many people, thanks to the power of the Internet....

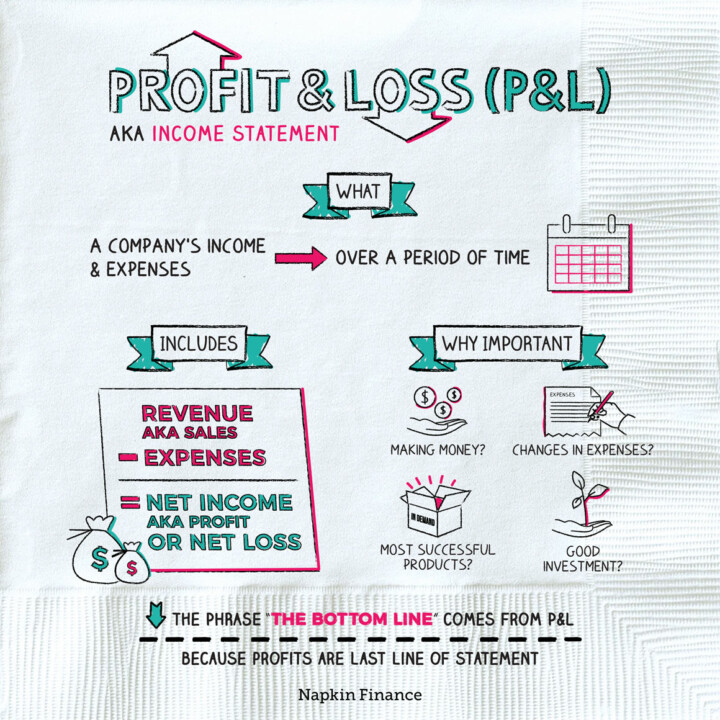

Learn moreProfit and Loss (P&L)

The Bottom Line

A profit and loss statement, or income statement, shows the money a company earned and what it...

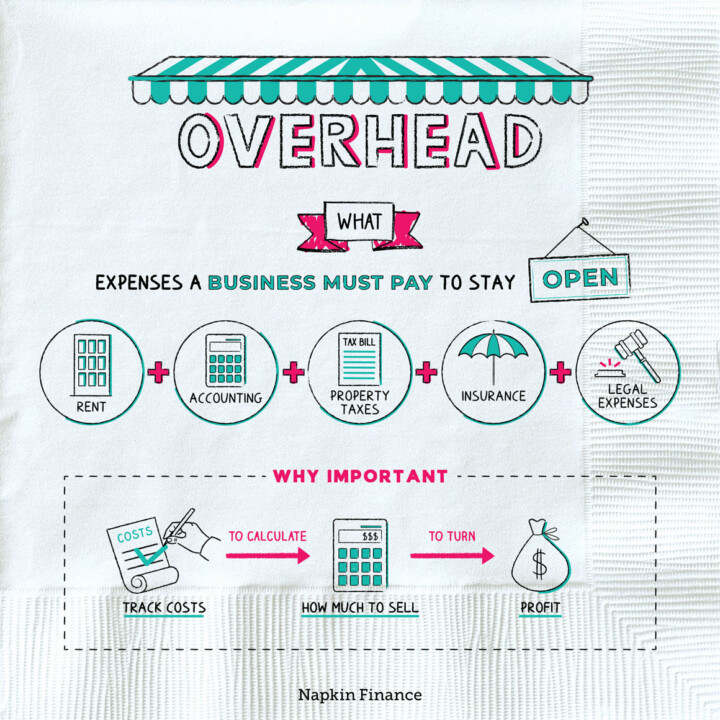

Learn moreOverhead

Keep the Lights On

Overhead refers to the expenses a business must pay just to stay open. Also known as “indirect...

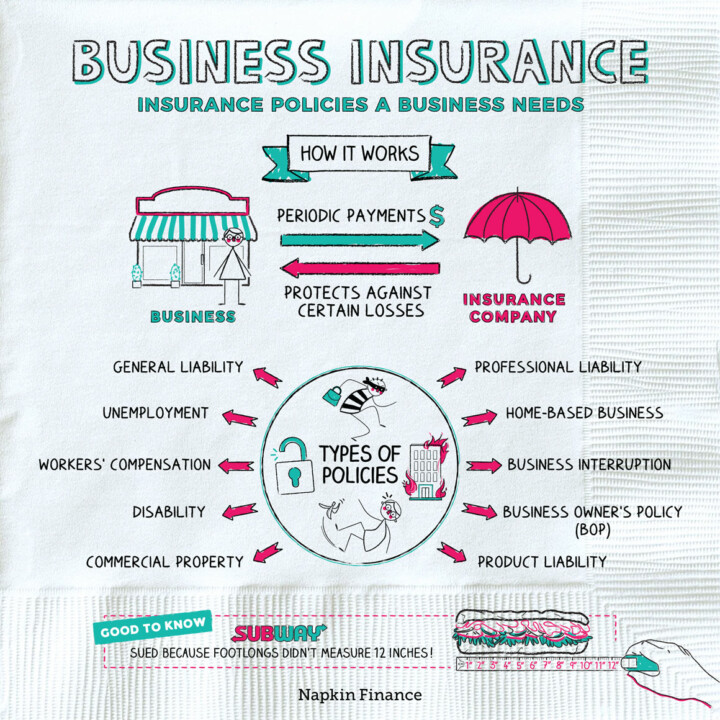

Learn moreBusiness Insurance

Cover Your Bases

A business insurance policy is a contract between an insurance company and a business. In exchange for...

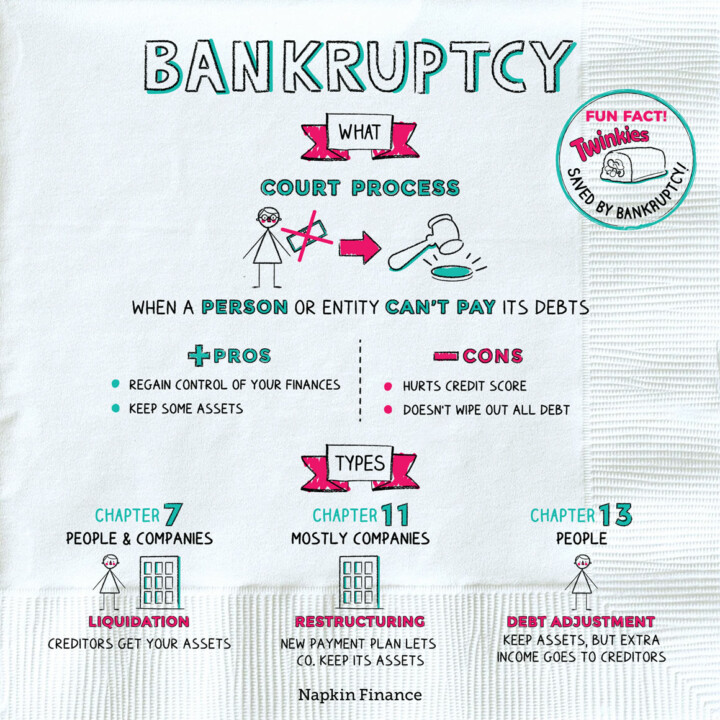

Learn moreBankruptcy

Lose Your Shirt

Bankruptcy is the legal process for consumers or businesses to get help with their debt. Bankruptcy starts...

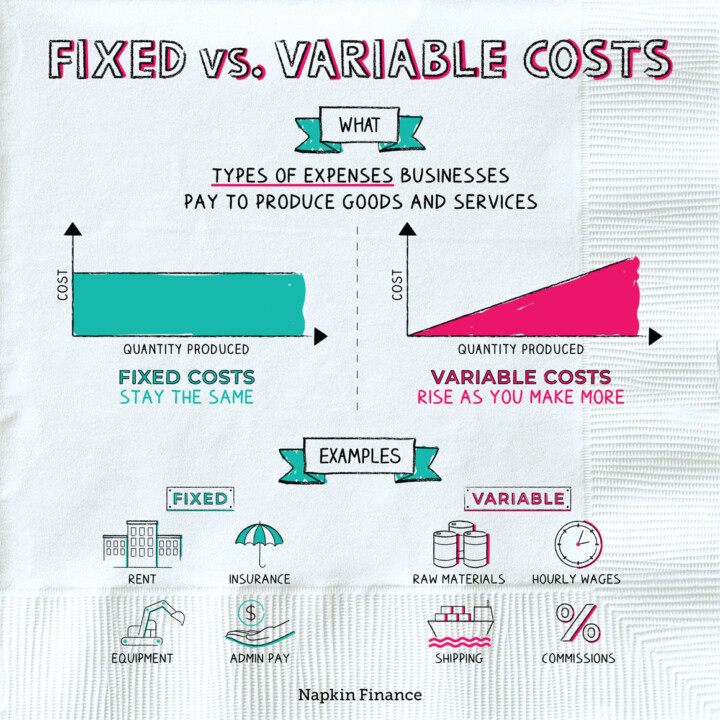

Learn moreFixed vs. Variable Costs

At All Costs

Fixed and variable costs are types of expenses that businesses pay in order to operate.

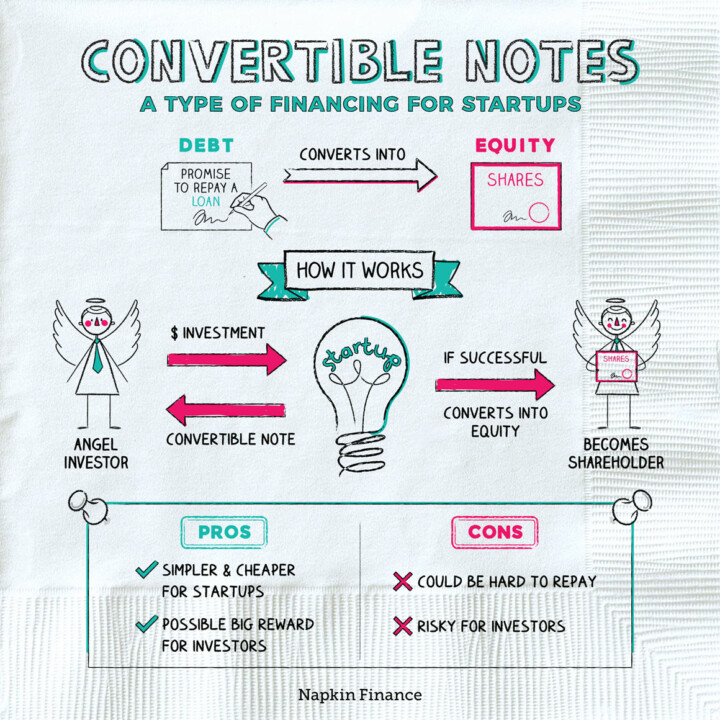

Learn moreConvertible Note

Take Note

A convertible note is a type of short-term loan for a business. However, instead of being repaid...

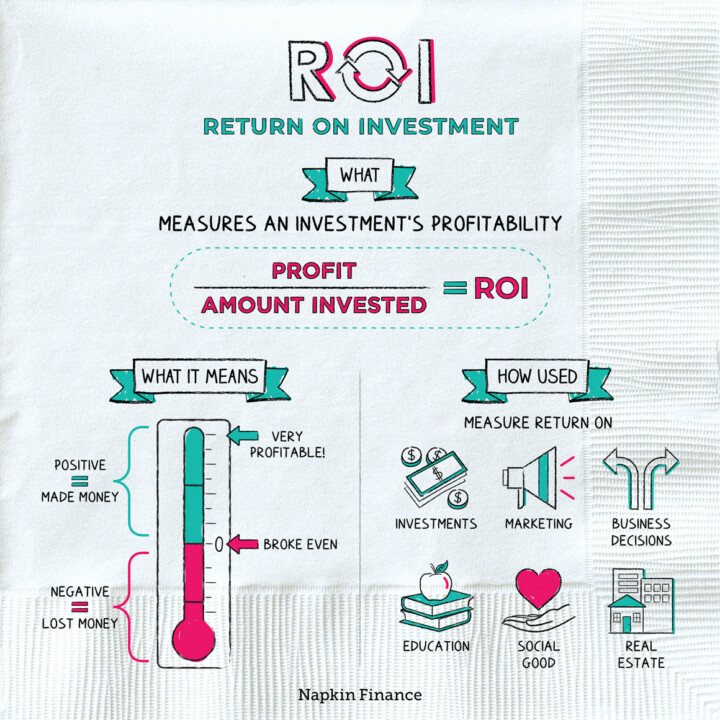

Learn moreROI

Many Happy Returns

Return on investment, or ROI, is a ratio for measuring the profitability of an investment. It puts...

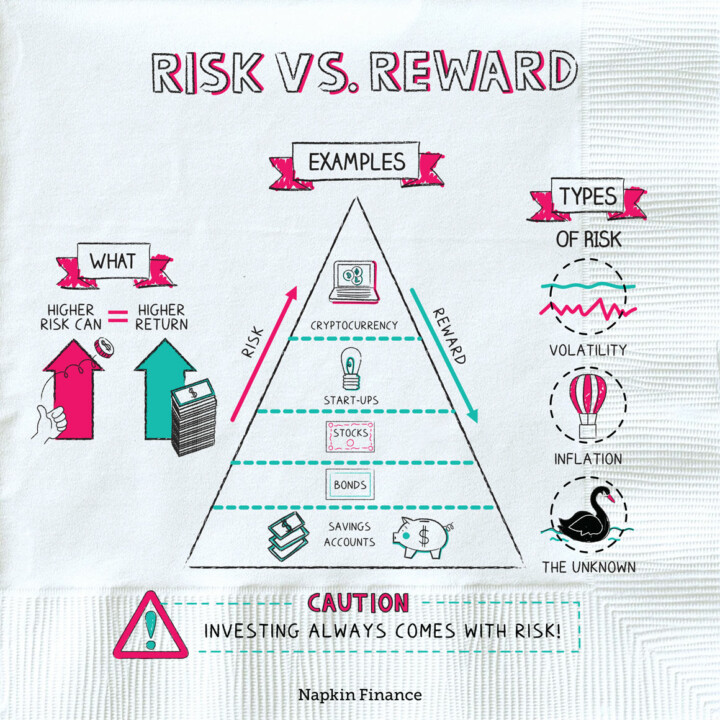

Learn moreRisk vs. Reward

Double Down

All investments come with risk. With financial investments, risk is usually tied to reward. That means investments...

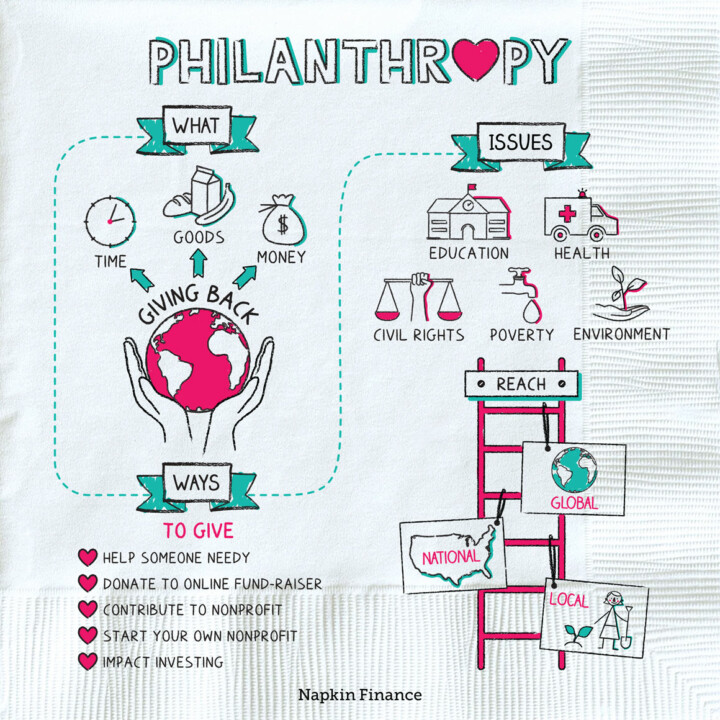

Learn morePhilanthropy

Greater Good

Philanthropy is giving back. It’s paying forward the resources you have—whether your money, or physical goods, or...

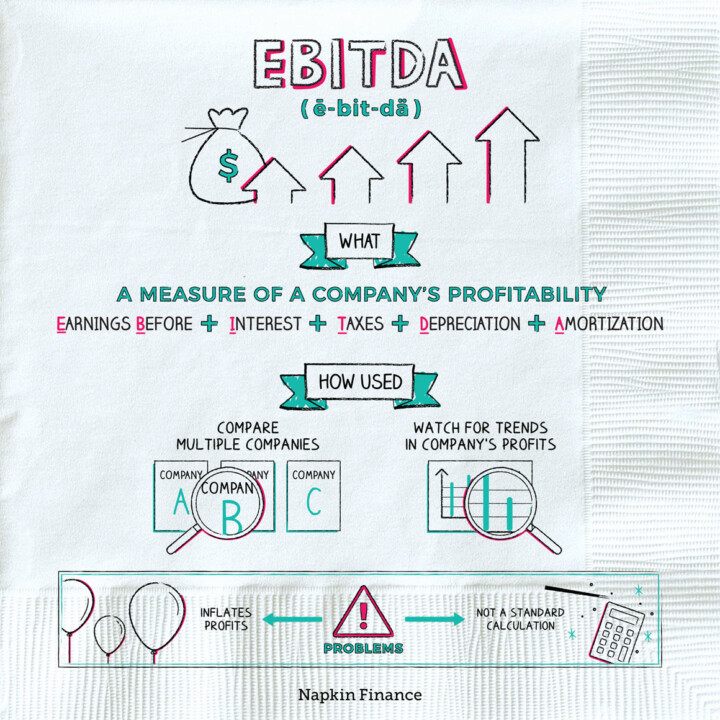

Learn moreEBITDA

How You Slice It

EBITDA (pronounced “ee-bit-tah”) stands for “earnings before interest, taxes, depreciation, and amortization.” It’s one measure of a...

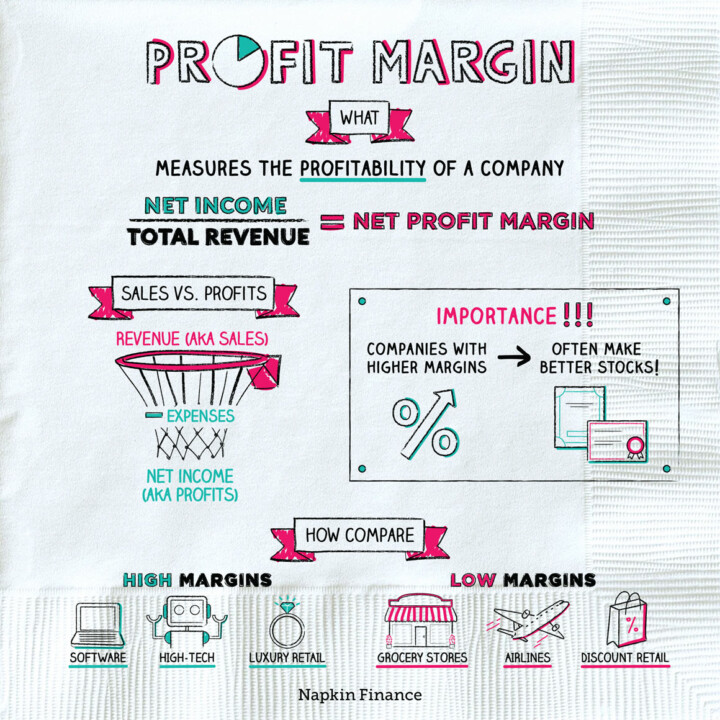

Learn moreProfit Margin

Margin of Error

A company’s profit margin measures the portion of its total sales that it gets to keep as...

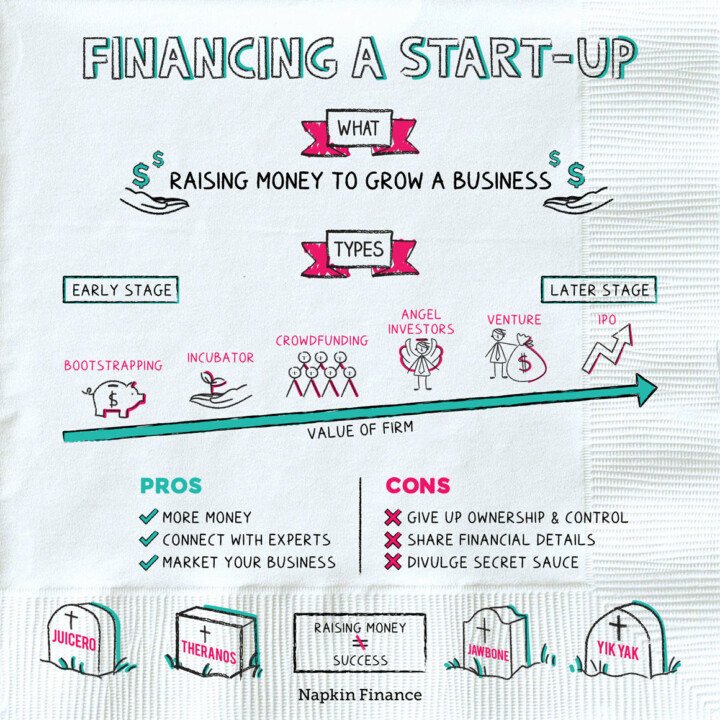

Learn moreFinancing a Start-up

Sink or Swim

If you’re trying to get a start-up off the ground, chances are you’ll need some cash to...

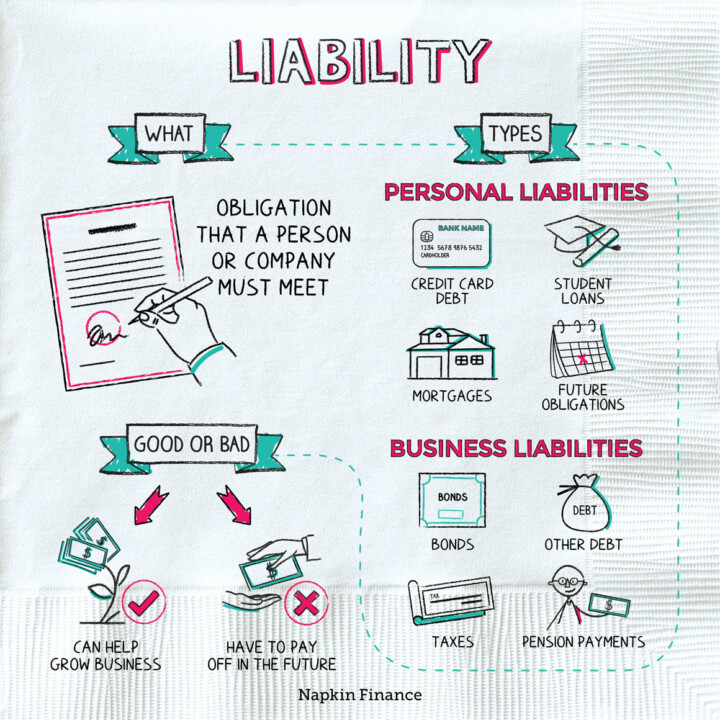

Learn moreLiability

Much Obliged

A liability is something that will require you (or a company) to spend money or resources in...

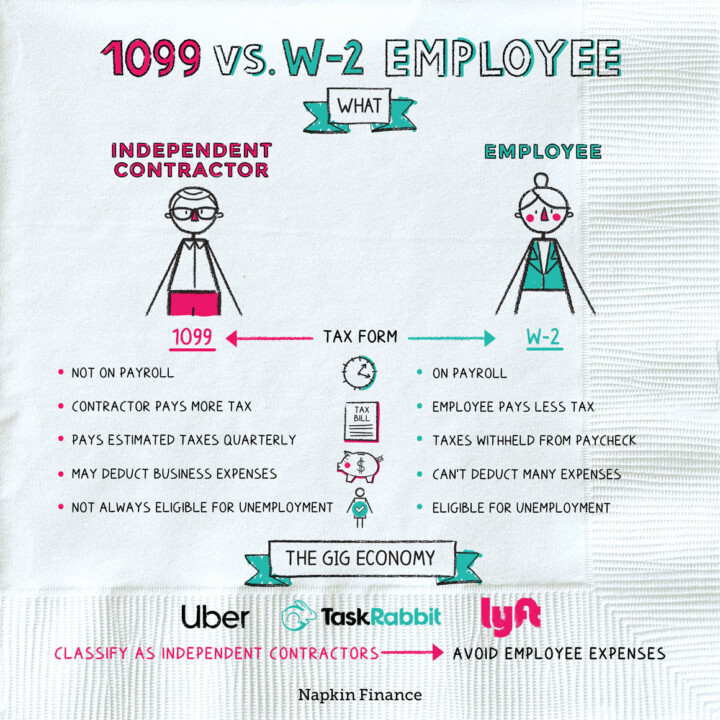

Learn more1099 vs. W-2 Employee

Bring Home the Bacon

1099s and W-2s are both types of tax forms. If you’re a contractor, you should receive one...

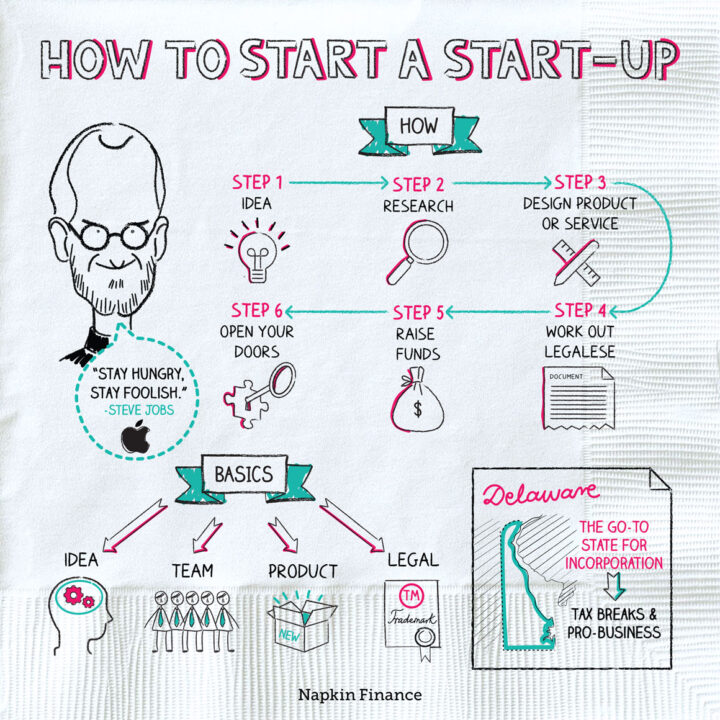

Learn moreHow to Start a Start-up

Go Big or Go Home

Although plenty of start-ups fail, the ones that succeed can do so wildly. Beyond a financial payoff,...

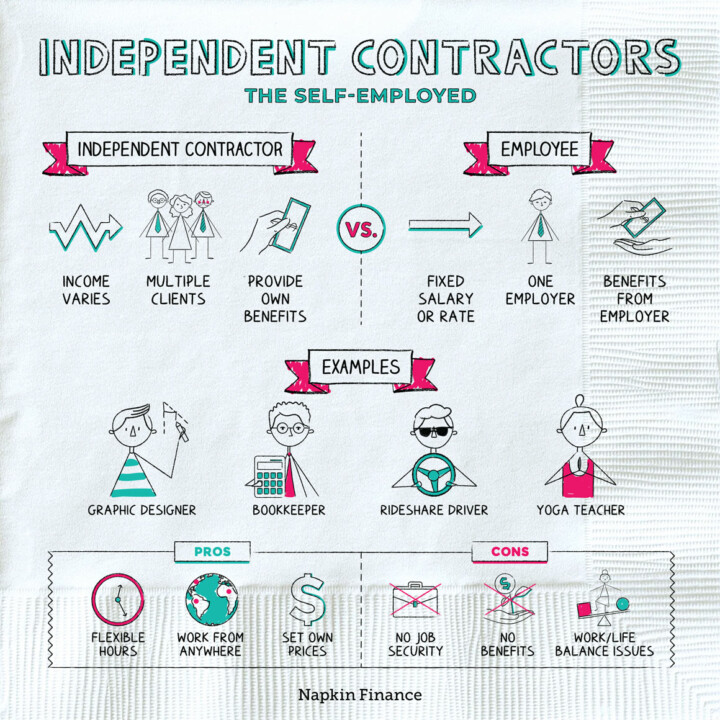

Learn moreIndependent Contractor

Free Agent

An independent contractor is someone who is self-employed and works for clients as a nonemployee. Independent contractors...

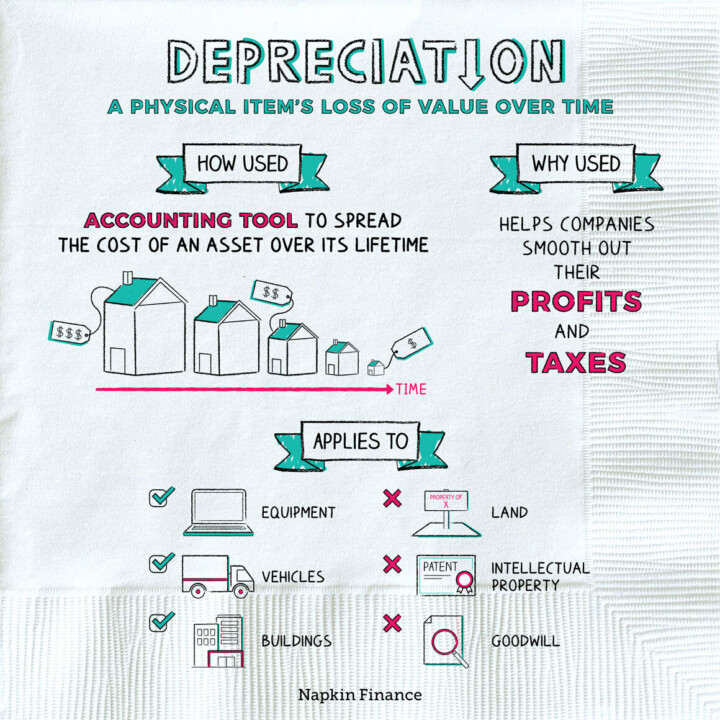

Learn moreDepreciation

Wear and Tear

Depreciation is a physical asset’s loss of value over time. Just as your once new car is...

Learn more