Interest Rate

At Any Rate

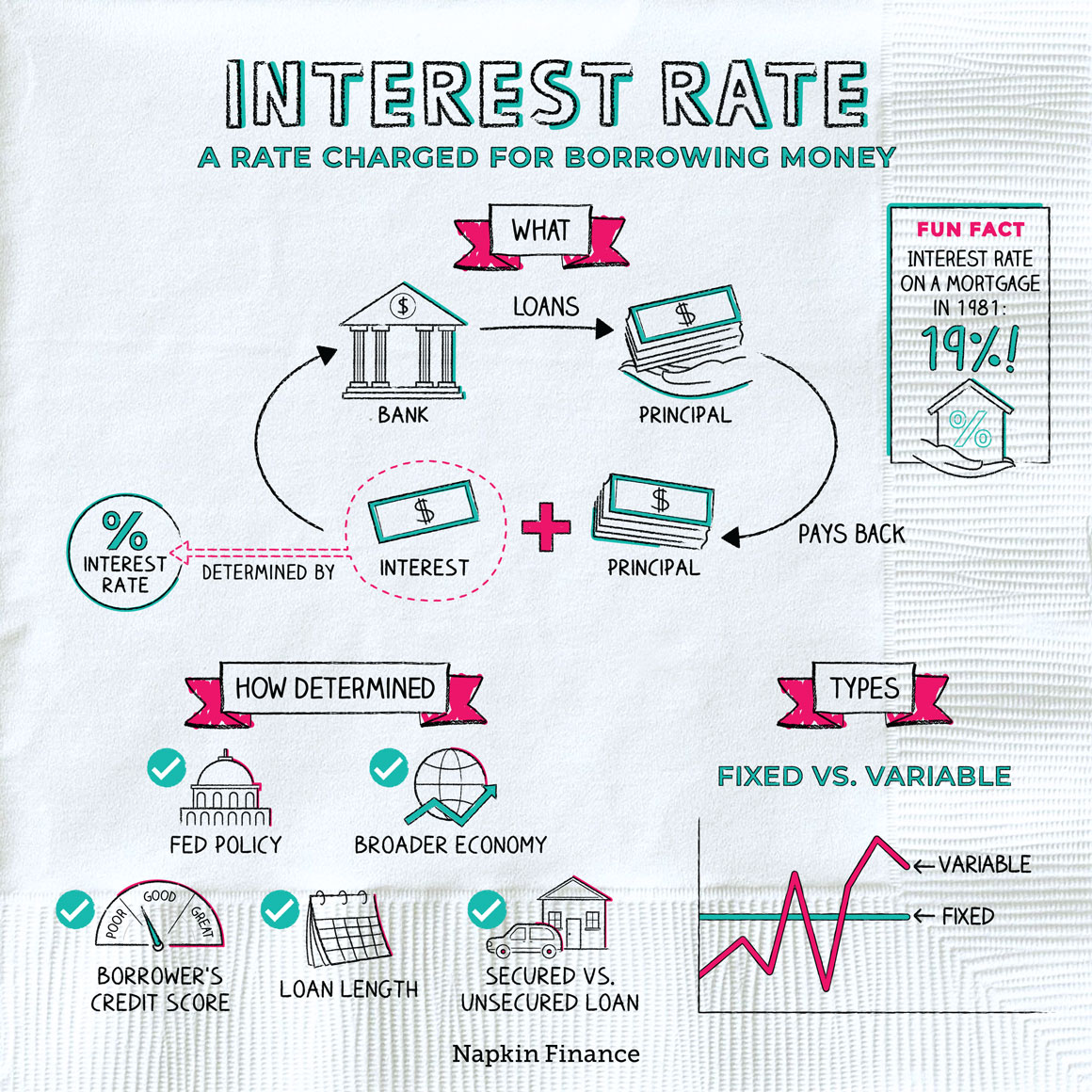

Interest is what a lender charges you to borrow money. It is usually expressed as a percentage of the amount borrowed, known as the interest rate. You might often see this referred to as an annual percentage rate, or APR, which is the interest rate (plus certain fees) you would pay over one year.

When you borrow money, the amount you receive is called the principal. And when you pay back the loan, you repay the principal plus interest. The interest rate determines how much interest you pay.

Borrowing money with higher interest costs more money, while loaning or investing money with higher interest earns more money. That’s why a high interest rate is good for lenders but bad for borrowers.

Lenders typically charge interest rates on any kind of borrowed or owed money, including:

- Mortgages

- Credit cards

- Unpaid bills

- Student loans

- Auto loans

- Home equity loans and other financial products

The Federal Reserve Board of Governors (the Fed), the U.S. central bank, influences interest rates. Its job is to keep inflation and unemployment low. It does this in part by setting a short-term target interest rate based on the strength of the economy:

- High inflation and an overheating economy = Fed sets a higher rate to slow down the economy and regain control

- High unemployment and less spending = Fed sets a lower rate to encourage spending, job creation, and economic growth

Although the Fed doesn’t control the rate you pay on your mortgage or credit card, the rate it sets influences those rates (and all other interest rates throughout the economy). The interest rate you pay on a given loan or financial product is also influenced by:

- The life of the loan: The longer the term, the higher the rate

- Your credit score: The better you’ve done borrowing and repaying in the past, the better your credit and the lower the rate

- Whether the loan is secured or unsecured: Unsecured loans (those that don’t require collateral) tend to have higher rates

- The broader economy: When the economy is doing well, more people have jobs and are able to pay their bills on time. That can mean lenders are more likely to offer loans at good rates and vice versa.

The interest rate you pay when borrowing money might be fixed or variable.

- A fixed rate stays the same for the life of your loan

- A variable rate changes over time as interest rates in the broader economy rise or fall

You might also notice that a single product has many different interest rates attached. For example, when you have a credit card, you might have one interest rate that applies to regular purchases, another if you miss a payment, and yet another if you’re withdrawing money from an ATM.

Your interest rate determines how much you’ll end up paying for something. Let’s say you took out a $200,000 mortgage that you’ll pay back over thirty years. Here’s how the total interest you’ll pay stacks up at different interest rates:

| At a rate of: | You pay total interest of: |

| 4% | $143,739 |

| 6% | $231,676 |

| 10% | $431,852 |

Even a small increase in your interest rate can make a big difference in what you pay over time.

Generally, the best interest rates go to creditworthy borrowers who don’t present much risk to the lender. You can show your worth by:

- Paying all your bills on time

- Maintaining a good credit score

- Minimizing your debt

- Putting up collateral or making a down payment

An interest rate is what you’re charged, expressed as a percentage, to borrow money. When you’re borrowing, a higher rate means you’ll pay more over the life of your loan. When you lend money, a higher interest rate means you’ll earn more. What interest rate you pay on a particular loan can be driven by a range of factors—from your credit score and the type of loan to Federal Reserve policy and the strength of the economy.

- In 1981, you could expect to pay 19% on a 30-year mortgage. That’s because there was runaway inflation in the U.S. at the time, and interest rates tend to rise with inflation.

- Until 1974, women couldn’t get a mortgage or sign up for a credit card without their husband’s or father’s signature.

- An interest rate is the cost of borrowing money expressed as a percentage. The higher the interest rate, the more you’ll pay.

- Interest rates apply to home, car, and student loans as well as credit cards.

- Many factors, including your credit score and the strength of the economy, influence interest rates.

- You can increase your chances of getting a good interest rate if you pay your bills on time, keep your debt low, and have a good credit score.