Blue Chips

Steady Eddy

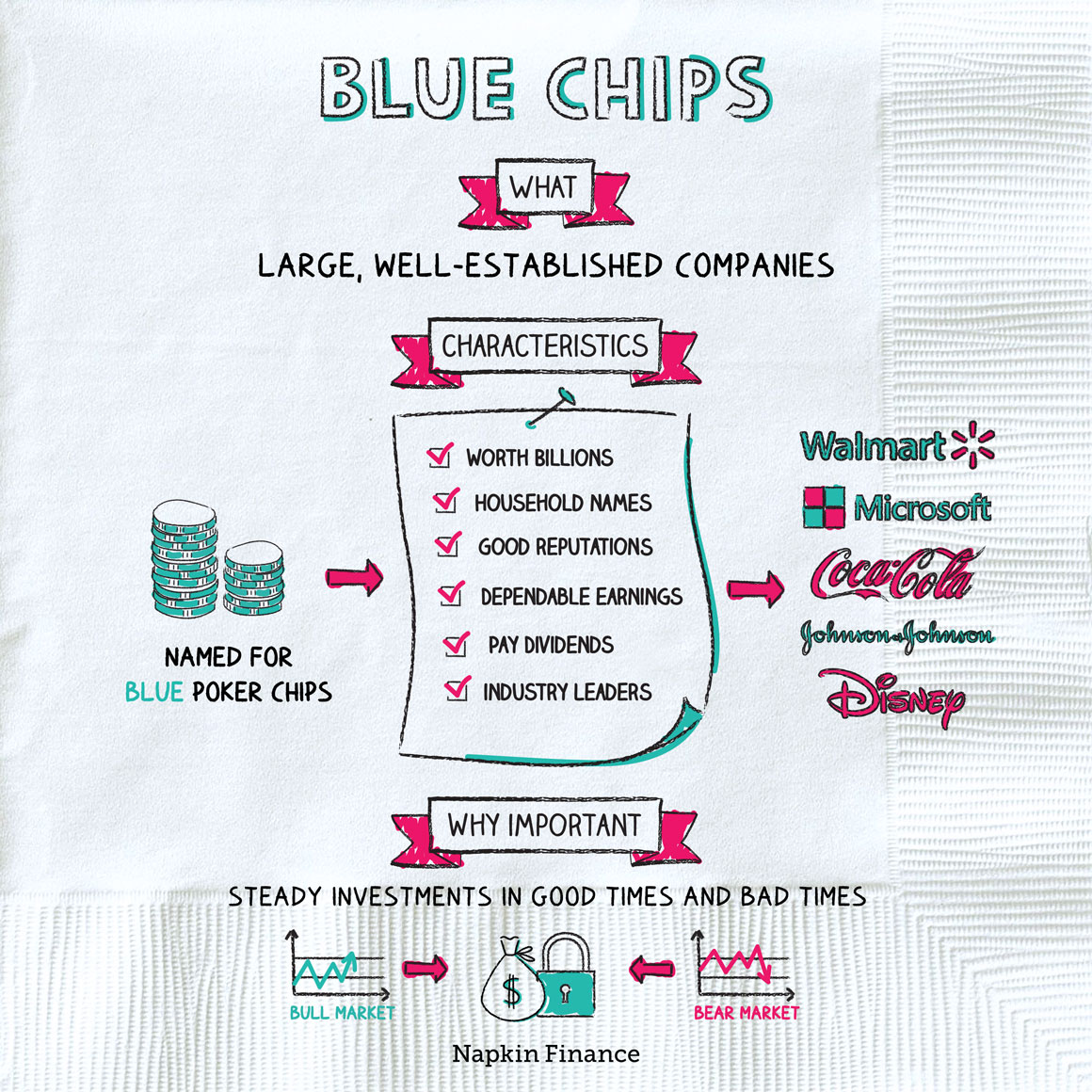

A blue chip is a company that is financially sound and well established.

These companies usually sell well-known, high-quality products and services. They have a record of stability and steady growth and can operate in difficult economic conditions.

The name “blue chip” comes from poker, where blue chips have a higher value than the more commonly used white and red chips. In the stock market, these companies tend to be more expensive investments, but they also produce some of the most reliable returns over time.

There isn’t a standard set of criteria for what makes a company a blue chip, but they usually share many of the following characteristics:

- Value in the billions (often in the tens or hundreds of billions)

- Household name

- Established (i.e., older) company

- Good reputation

- Experienced, respected leadership

- Dependable earnings

- Pay dividends

- Leaders in their industries

“Do you know the only thing that gives me pleasure? It is seeing my dividends coming in.“

—John D. Rockefeller

People usually talk about blue-chip companies in the context of choosing stock investments.

Because they’re typically less volatile than many other stocks, investors may buy blue-chip stocks to provide steady growth or income in their portfolios. These investments are especially popular among risk-averse investors or those nearing retirement because of their reliability.

Investors also tend to favor blue-chip stocks during an economic crisis. That’s because these companies tend to be financially sound (making them less likely to declare bankruptcy) and also because they often sell products that people can’t live without. Even in a downturn, for example, people are still likely to buy diapers from Procter & Gamble or Band-Aids from Johnson & Johnson.

Some examples of blue-chip companies include:

| Company | What they do |

| 3M | Makes various types of sticky tape and Post-it notes |

| Coca-Cola | Makes sodas, juices, and bottled water |

| Disney | Creates movies and runs amusement parks |

| Johnson & Johnson | Makes Band-Aids, toiletries, and treatments, like prescriptions |

| McDonald’s | Runs fast-food restaurants (through franchises) |

| Pfizer | Invents and sells medical drugs |

| Procter & Gamble | Makes toiletries, like toothpaste, and everyday products, like laundry detergent |

| Walmart | Runs discount stores that sell almost everything |

However, investors can (and do) disagree about what exactly makes a blue-chip company and which companies belong on the list.

Some types of industries tend to be more stable, with more blue-chip companies. Those include:

- Consumer staples—Companies that produce products that consumers need (rather than want). Think paper towels, soap, and groceries.

- Healthcare—People still need prescriptions, vaccines, and medical devices even when the economy is in a recession, so the healthcare industry tends to be the home of lots of blue chips.

- Software—People (and companies) tend to be pretty loyal to whatever type of software they’re used to using, which means they may continue to buy that software during good times and bad.

And some industries are naturally less steady, such as high-tech industries and the energy sector. That can mean it’s more rare (though not impossible) to find blue chips in them.

The general rule of thumb is that blue-chip companies perform well over the long term.

They’re usually not investments that will double your money in a few months, but they can provide stability in a diversified portfolio.

That said, no matter their size or strength, these companies can still struggle during an economic downturn or if something changes in their competitive environment. General Motors, for example, went bankrupt during the Great Recession. And Kodak declared bankruptcy in 2012 after years of financial struggles, as consumers switched away from traditional film-based cameras toward digital.

Blue-chip companies are stable, well-established businesses that are often worth tens or hundreds of billions of dollars. Their stocks tend to be popular with investors because they produce steady returns and hold up well during economic crises. These stocks aren’t the most exciting investment, but they can be stable additions to a diversified portfolio.

- Although blue chips have a higher value than some other poker chips, at a standard value of $10, they’re far from the highest. It’s possible to find chips as high as $100,000 in high-stakes gambling rooms (each of which may have an embedded computer chip).

- Dividends are a huge key to blue-chip stocks’ success. Over the long term, reinvested dividends account for some 80% of total stock market returns.

- Think McDonald’s is just a burger company? Think again. A big chunk of its revenue comes from real estate because it’s a landlord for many franchisees.

- Blue-chip companies are usually well-known, established companies that have stable stock performance and can weather economic downturns.

- Blue-chip stocks are a popular investment option for those seeking stability and for those establishing a diversified portfolio.

- These investments are usually not a way to make a quick buck, but they generally show consistent gains over time.

- Although these companies are usually stable, they aren’t always immune to economic conditions, and some can even end up declaring bankruptcy.