Featured Napkin

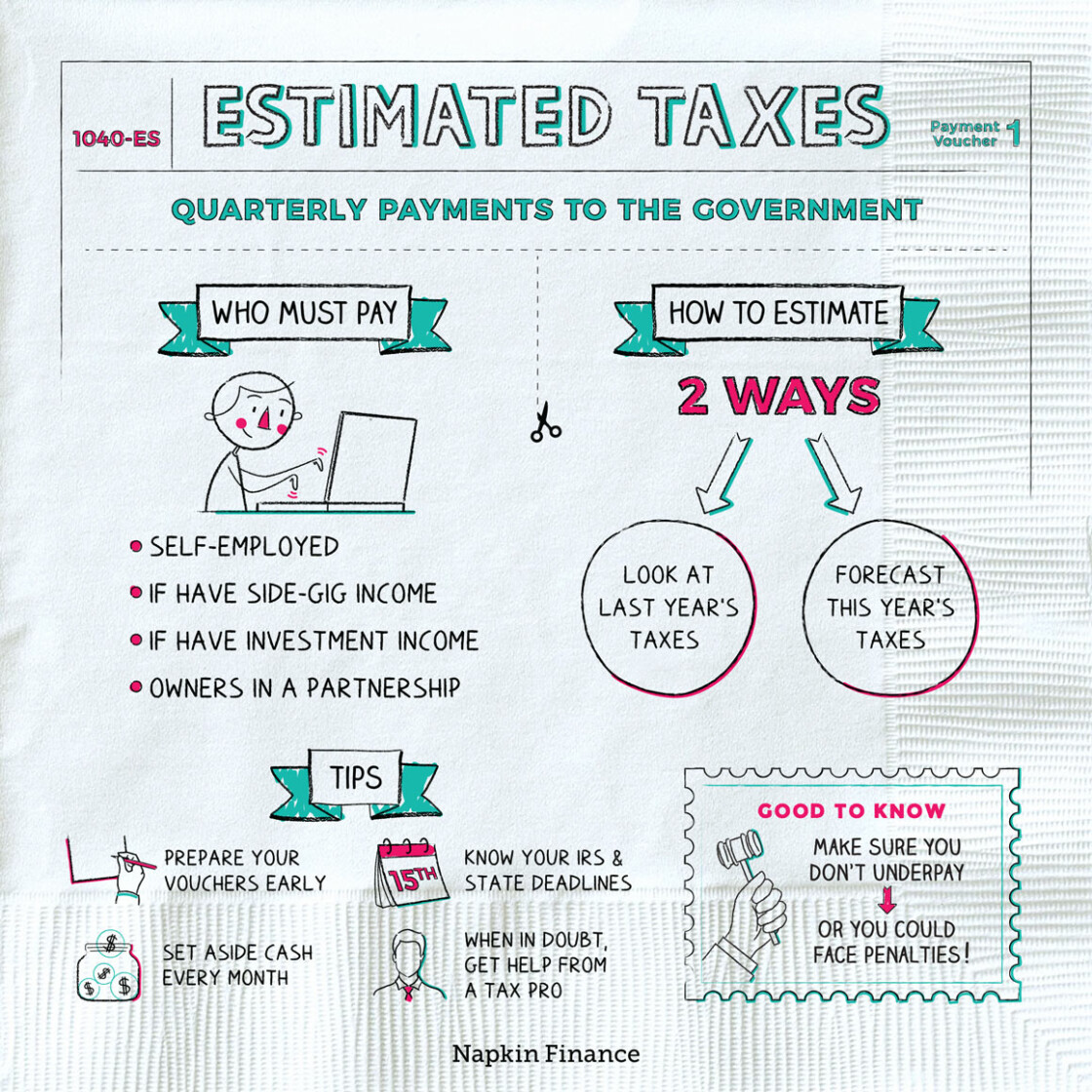

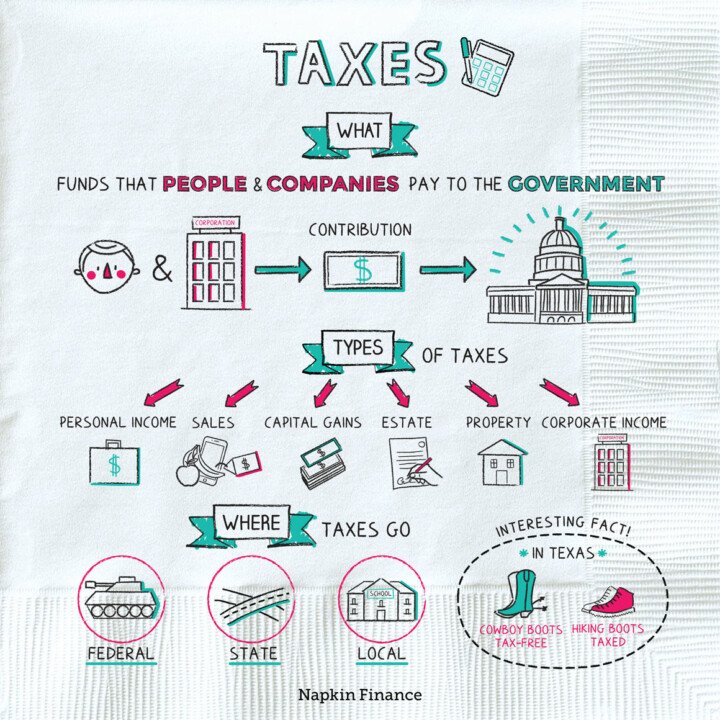

Estimated Taxes

Four Times the Fun

Estimated taxes are payments to the government that some people have to make four times a year. They’re mainly relevant for freelancers and people with nonemployment income.

Learn moreMore taxes Napkins...

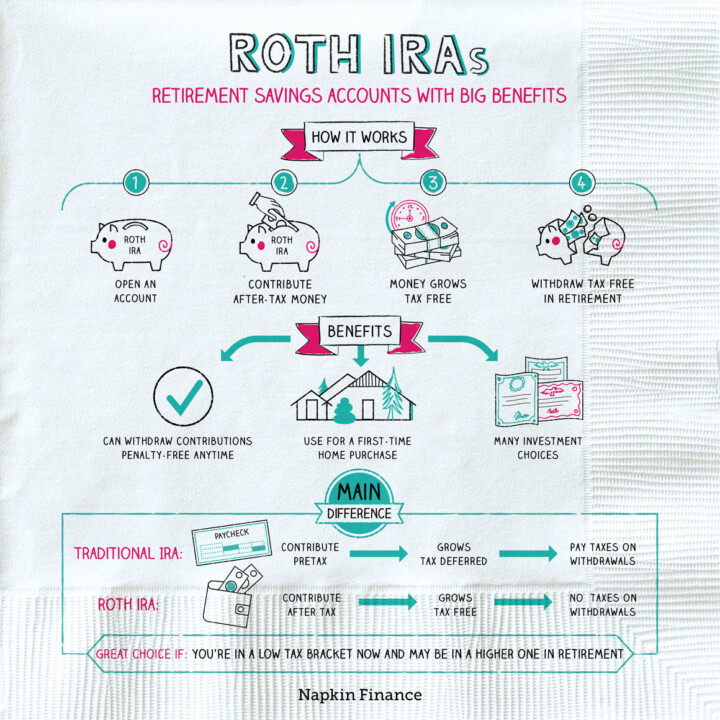

Roth IRAs

Road to Retirement

A Roth IRA, or Individual Retirement Account, is one of the most common types of retirement savings...

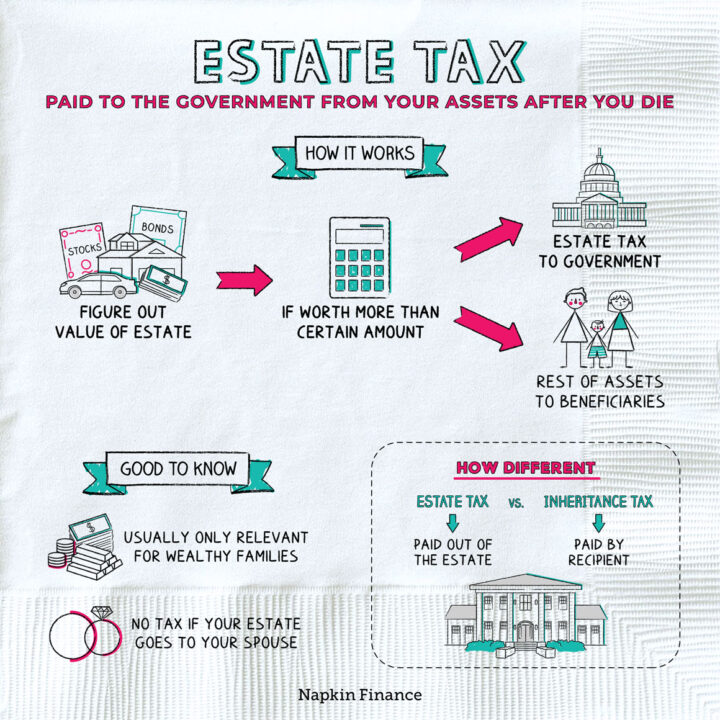

Learn moreEstate Tax

Death and Taxes

An estate tax is an amount that may be paid from your assets to the government after...

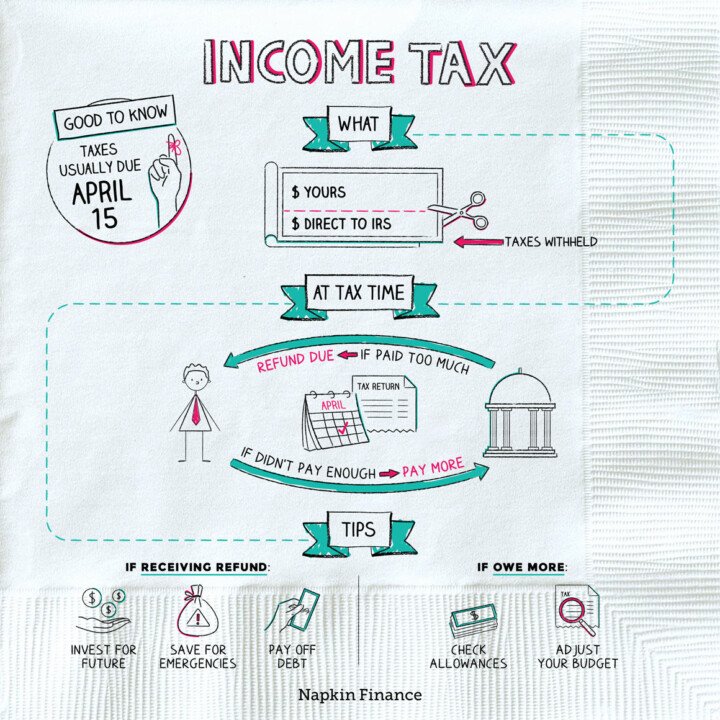

Learn moreIncome Taxes

Pay the Piper

Personal income tax is money the government collects from people based on how much they earned or...

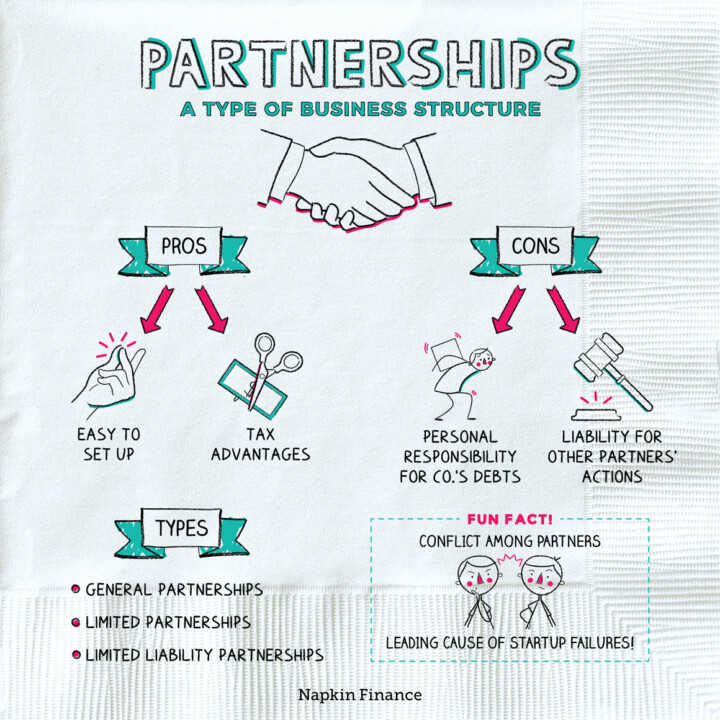

Learn morePartnerships

Passing Through

If you’re starting a business with someone else (or multiple people), the partnership is the most basic...

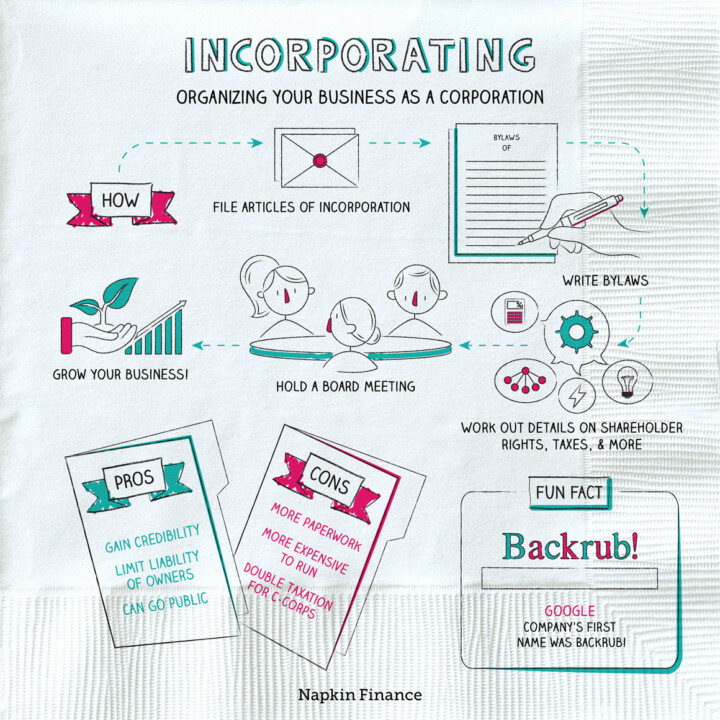

Learn moreIncorporating

Limited Liability

A corporation is one type of formal business structure that entrepreneurs can choose to use when starting...

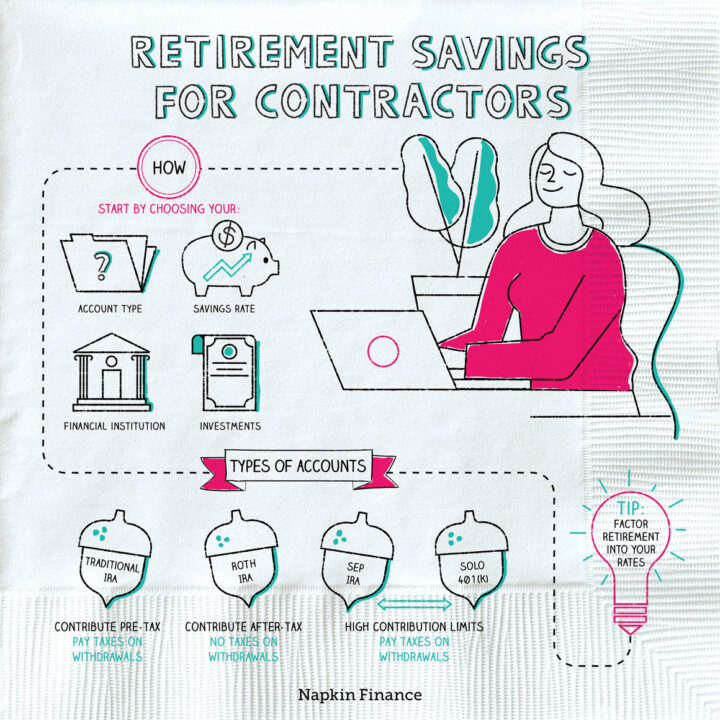

Learn moreRetirement Savings for Contractors

Squirrel Away

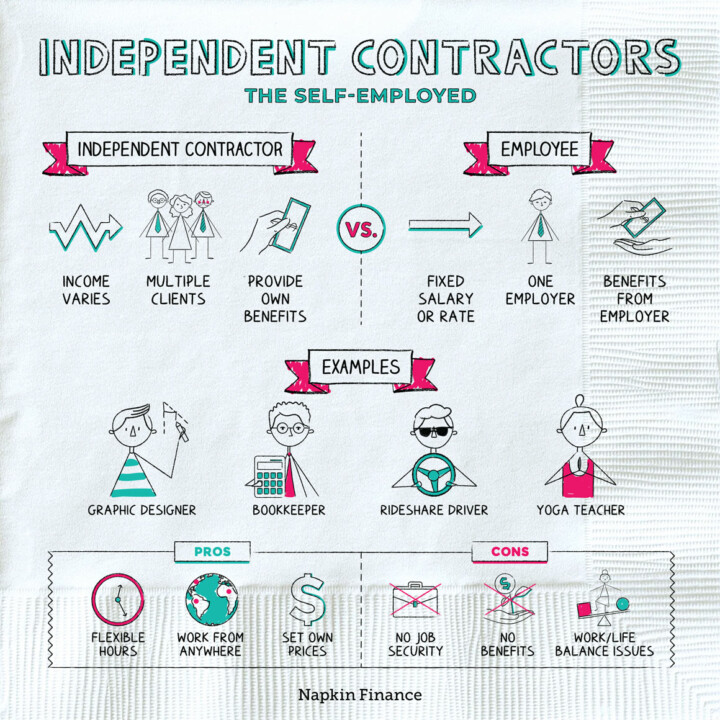

If you’re a contractor, saving for retirement can be much more complicated than it is for employees....

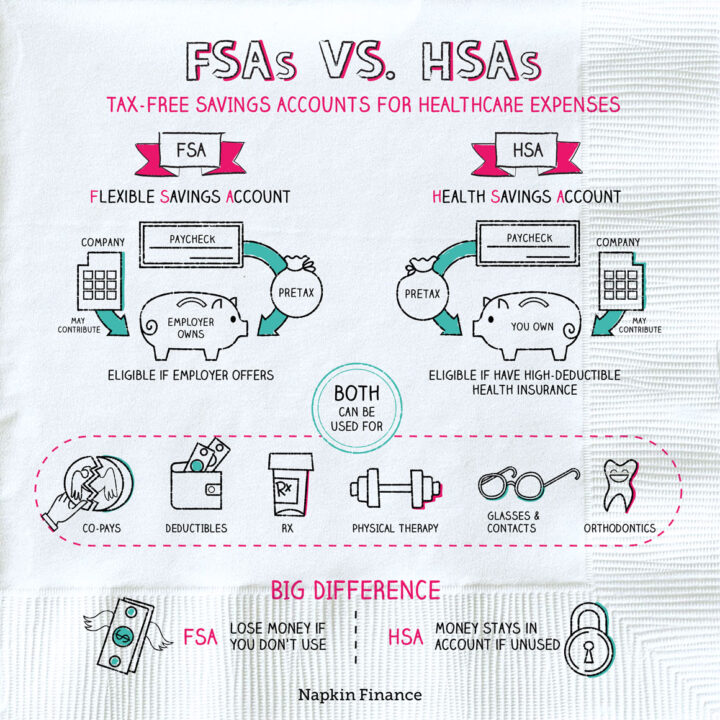

Learn moreFSAs vs. HSAs

Health is Wealth

Health care FSAs and HSAs let you save money for out-of-pocket medical expenses (basically the things your...

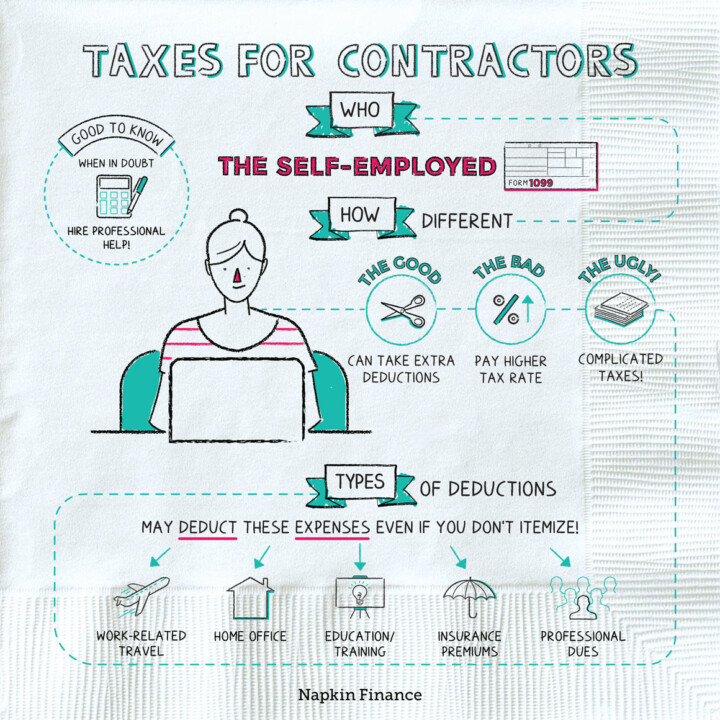

Learn moreTaxes for Contractors

Welcome to the Gig Economy

A contractor, or freelancer, can be anyone who works for clients on a contract basis rather than...

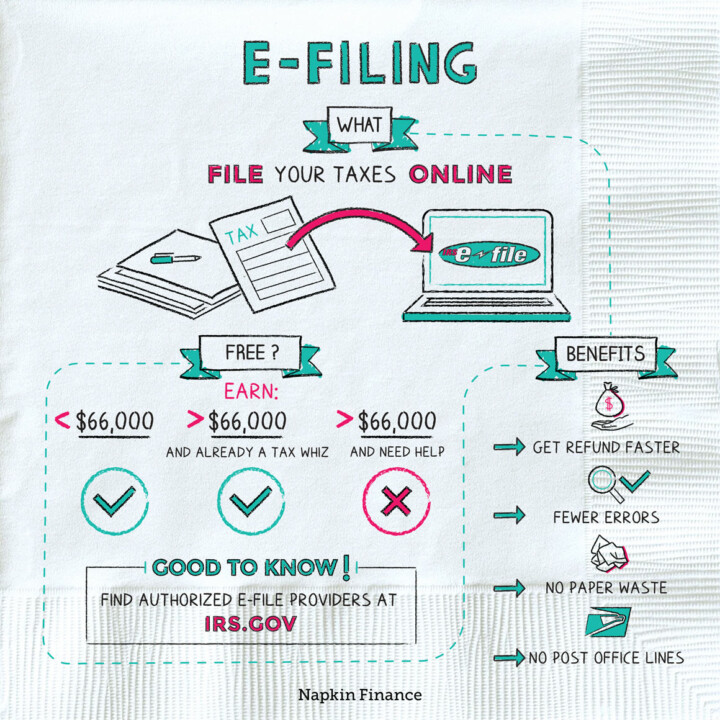

Learn moreE-Filing

Signed, Sealed, Delivered

E-filing means filing your taxes online. You’ll still need all the same documents you’d use to file...

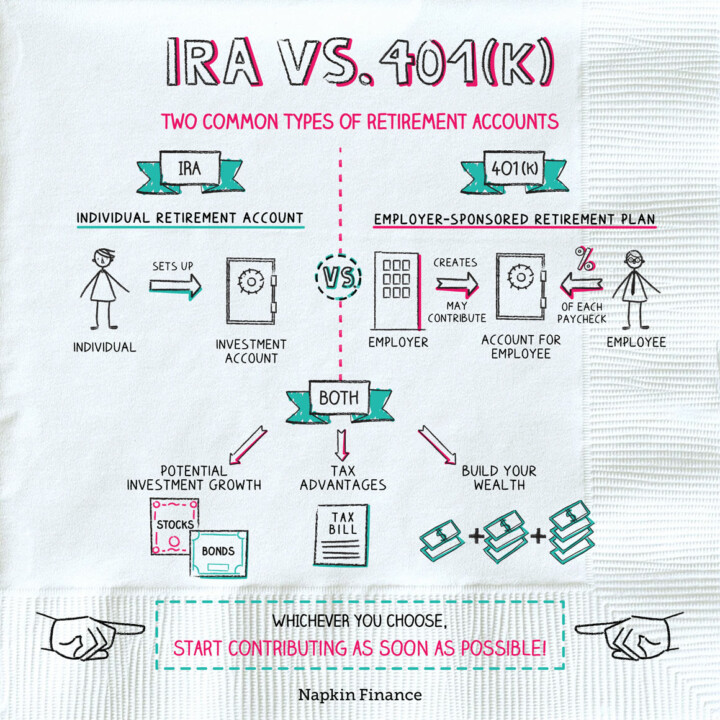

Learn moreIRA vs. 401(k)

Nest Eggs

IRAs and 401(k)s are two popular types of retirement savings accounts. Most people who work in the...

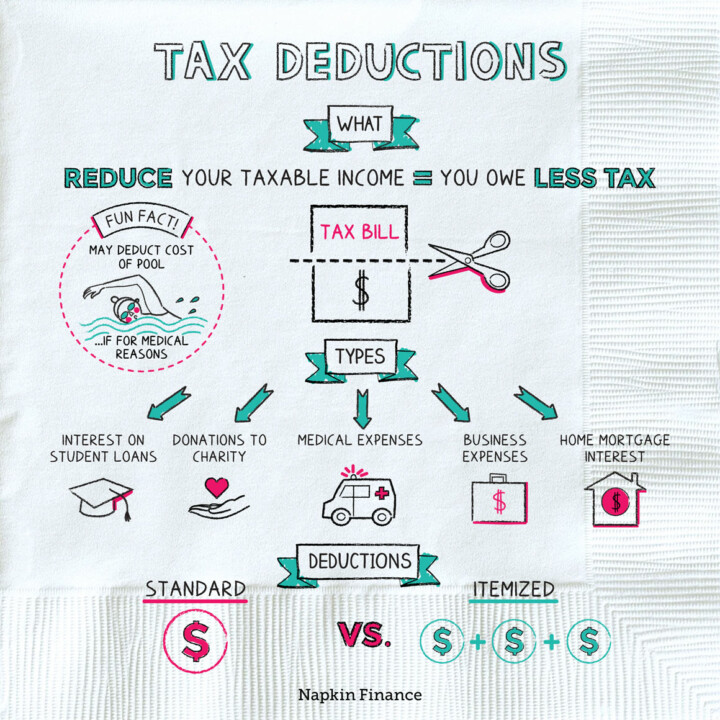

Learn moreTax Deductions

Cut Rate

Tax deductions, such as for donations to charity or interest on student loans, are amounts that you...

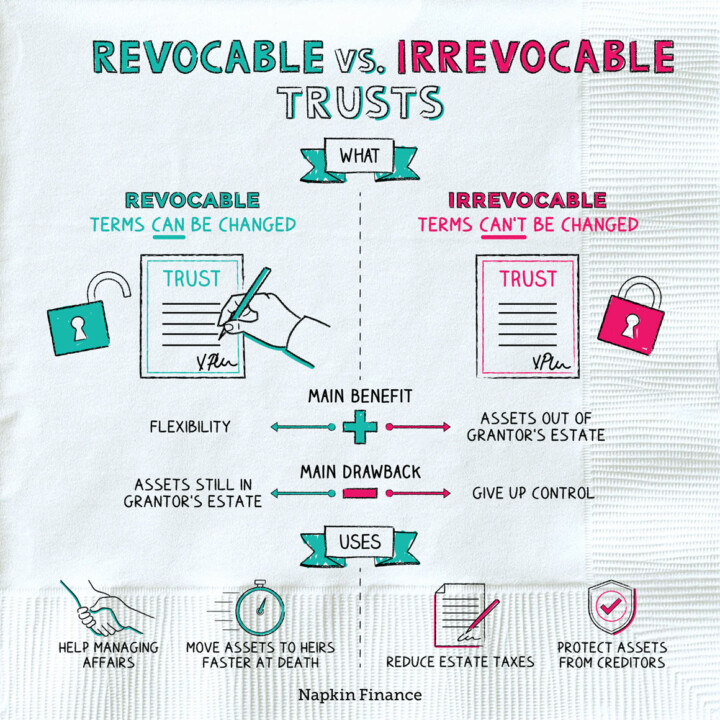

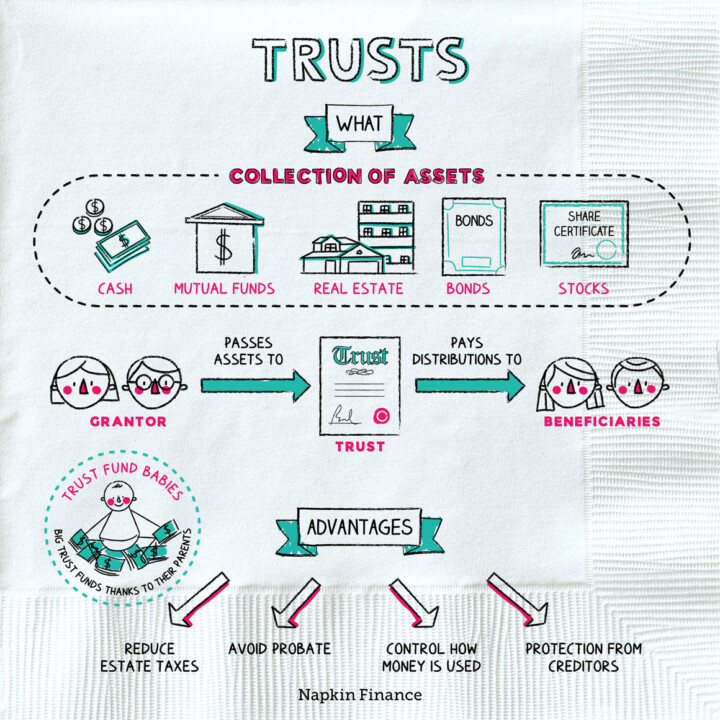

Learn moreRevocable vs. Irrevocable Trusts

In Good Hands

A trust is a legal agreement allowing one person to transfer their assets to someone else via...

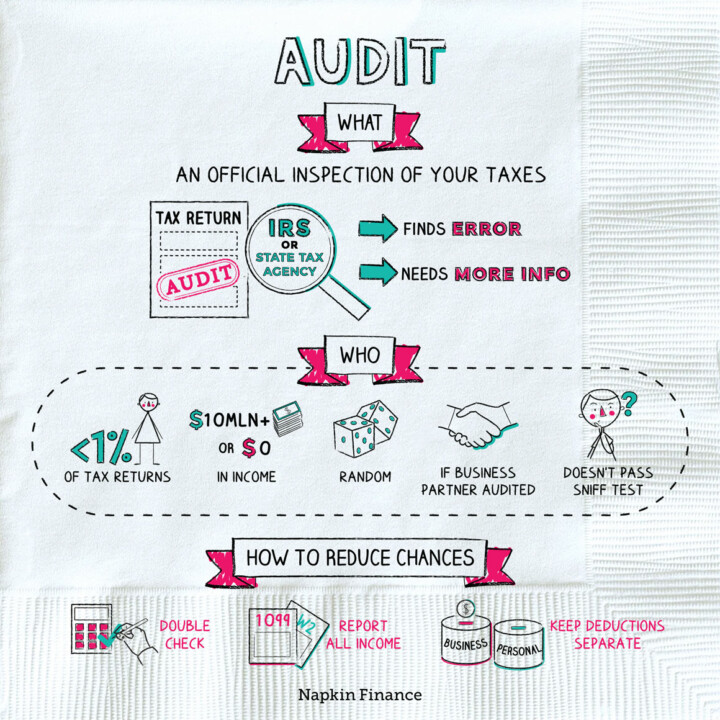

Learn moreAudit

Just Checking In

An audit can refer to any kind of official inspection of financial statements—usually to make sure that...

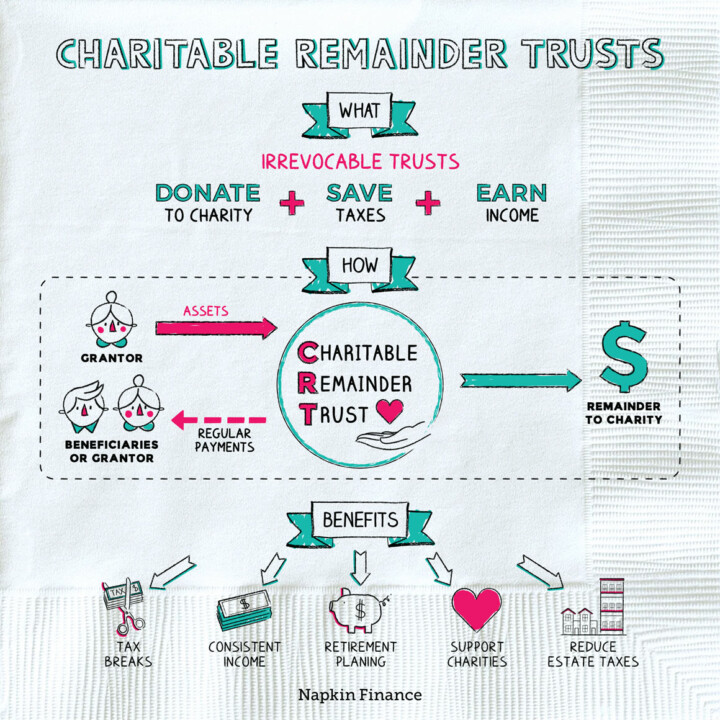

Learn moreCharitable Remainder Trusts

Big Love

A charitable remainder trust is a financial tool that can provide a steady source of income while...

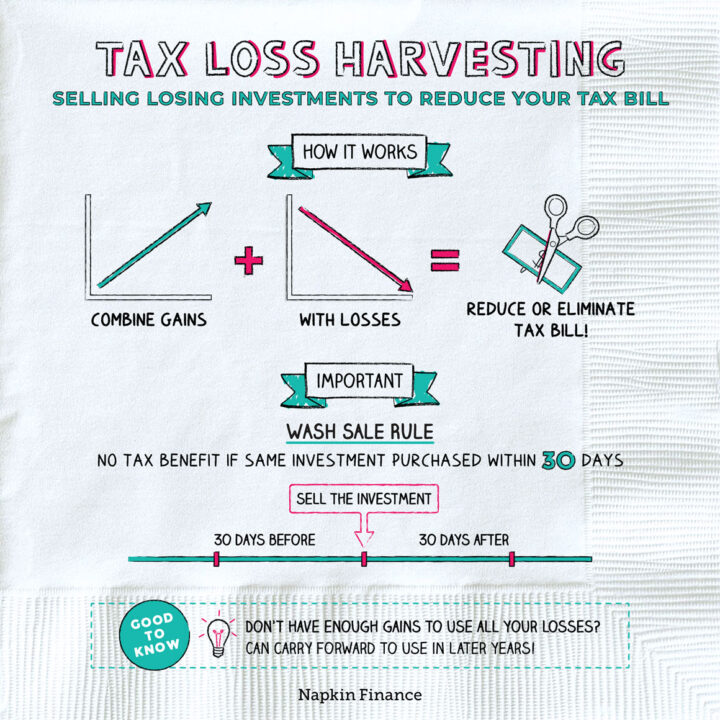

Learn moreTax Loss Harvesting

Cut Your Losses

Tax loss harvesting is a trading strategy investors can use to try to reduce their taxes. It’s...

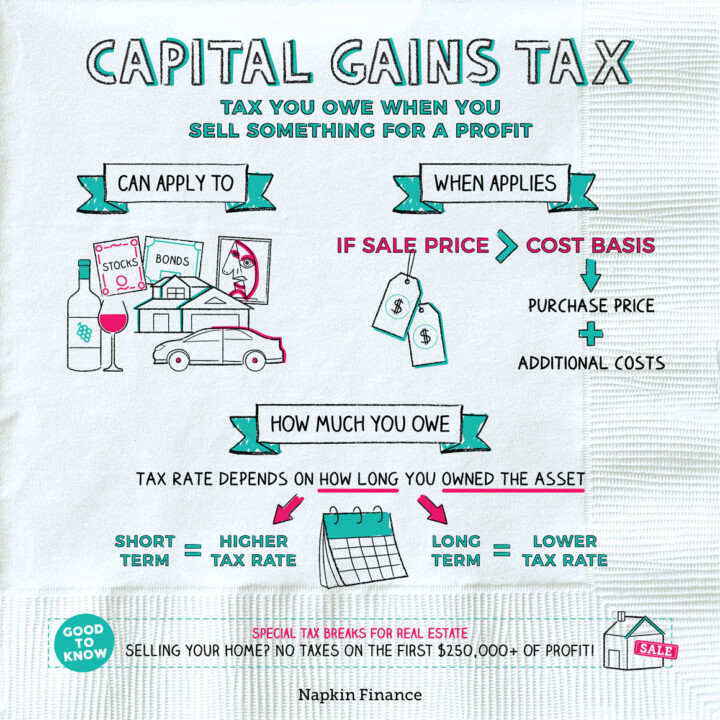

Learn moreCapital Gains Tax

The Taxman Cometh

If something you own goes up in value and you sell it, then you’ve made a profit....

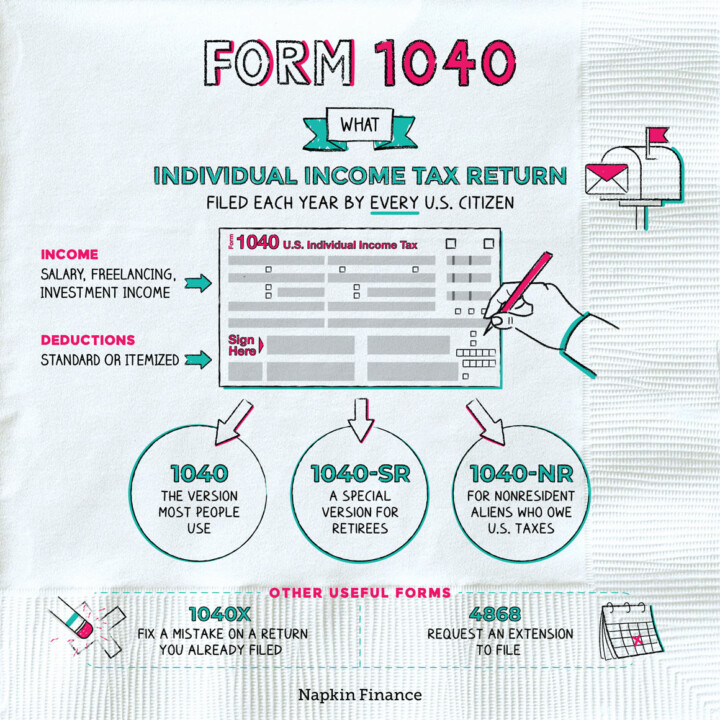

Learn moreTax Form 1040

Any Way, Shape, or Form

The IRS’s Form 1040 is the master form that most people use to file their tax returns...

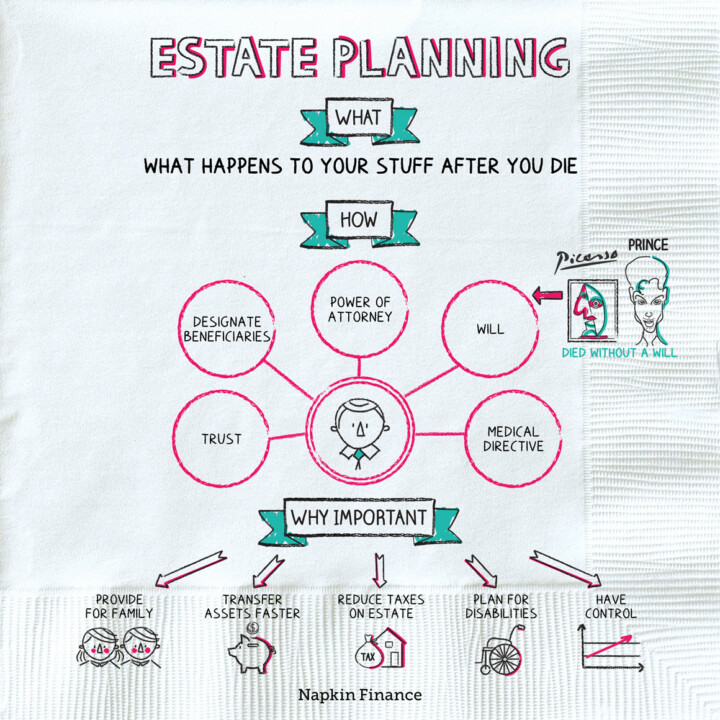

Learn moreEstate Planning

Bite the Dust

Estate planning is the process of figuring out what will happen to your stuff after you die....

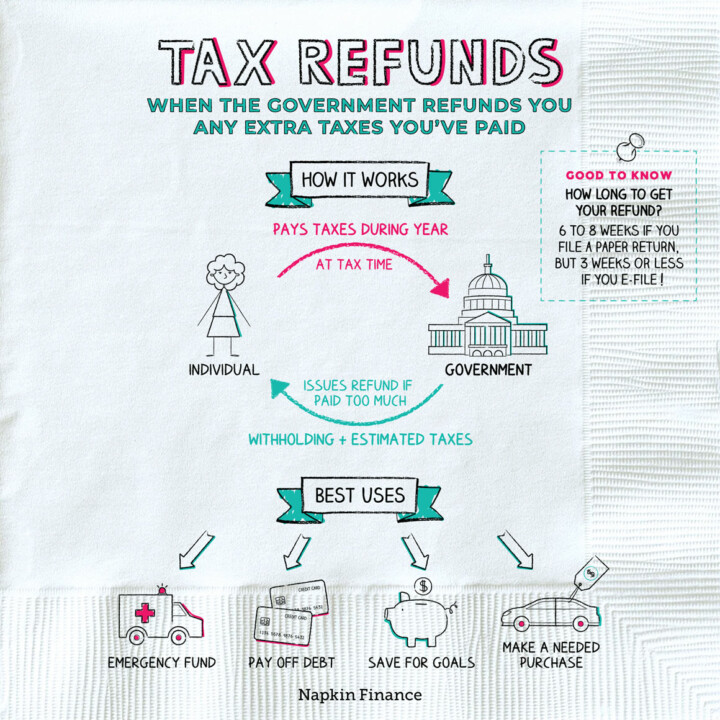

Learn moreTax Refunds

Check’s in the Mail

If you pay more than your fair share in taxes over the course of a year, you’re...

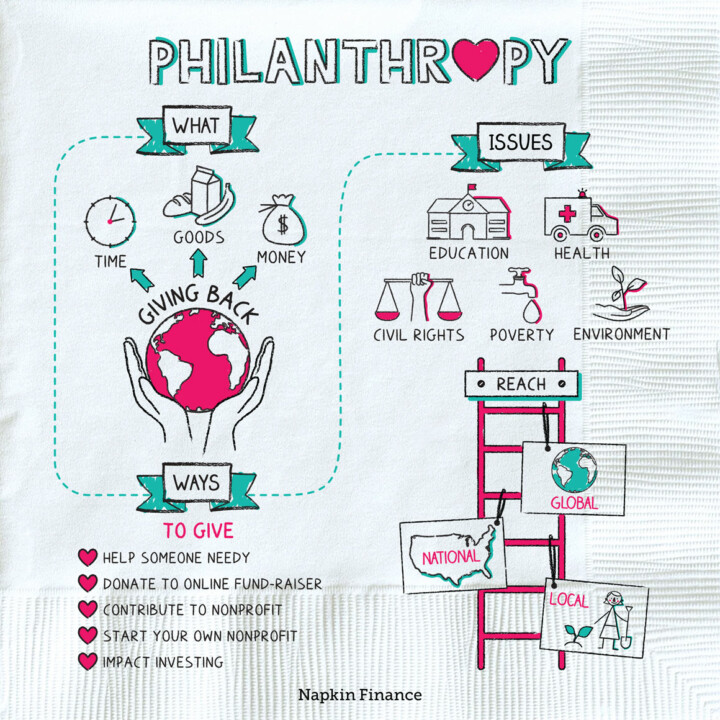

Learn morePhilanthropy

Greater Good

Philanthropy is giving back. It’s paying forward the resources you have—whether your money, or physical goods, or...

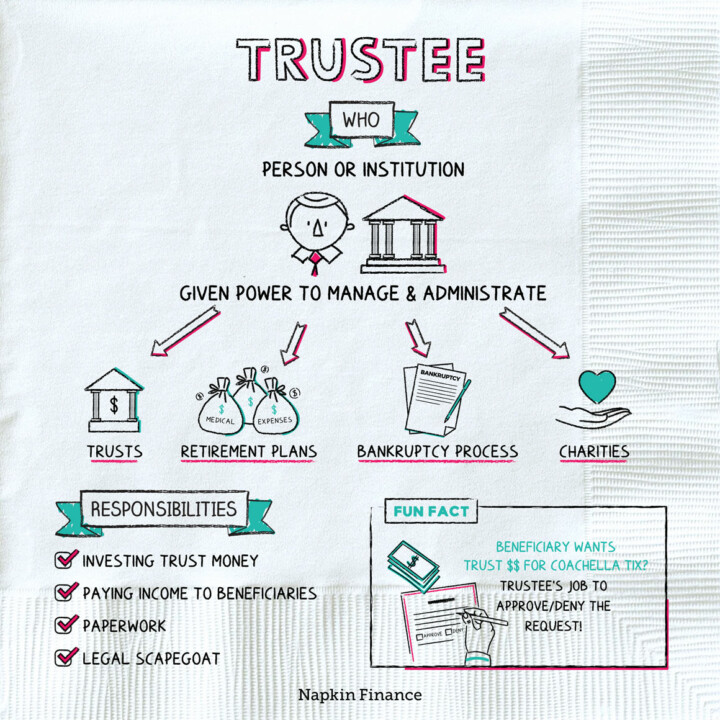

Learn moreTrustee

Handle With Care

A trustee can be an institution or an individual that is given the power to manage and...

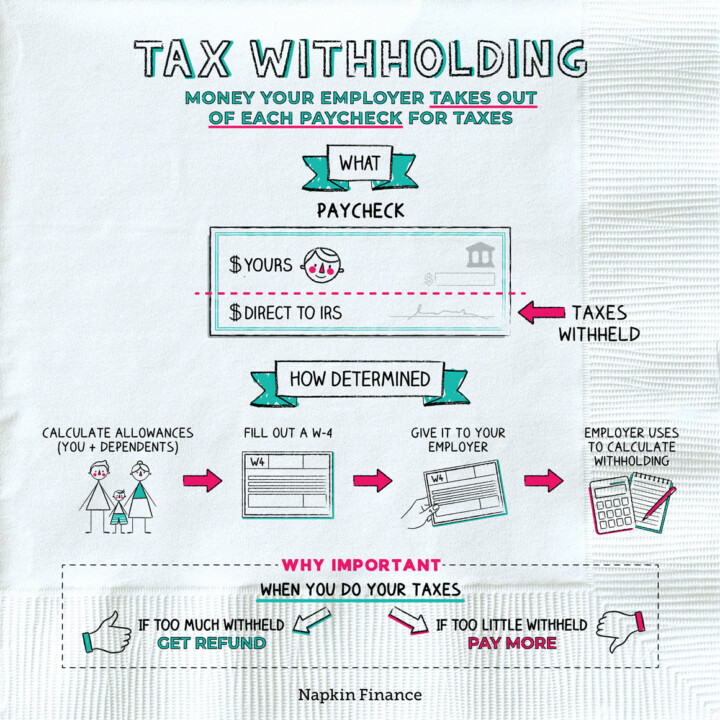

Learn moreTax Withholding

To Have and Withhold

Tax withholding is money your employer takes out of your paycheck each pay period. Your employer then...

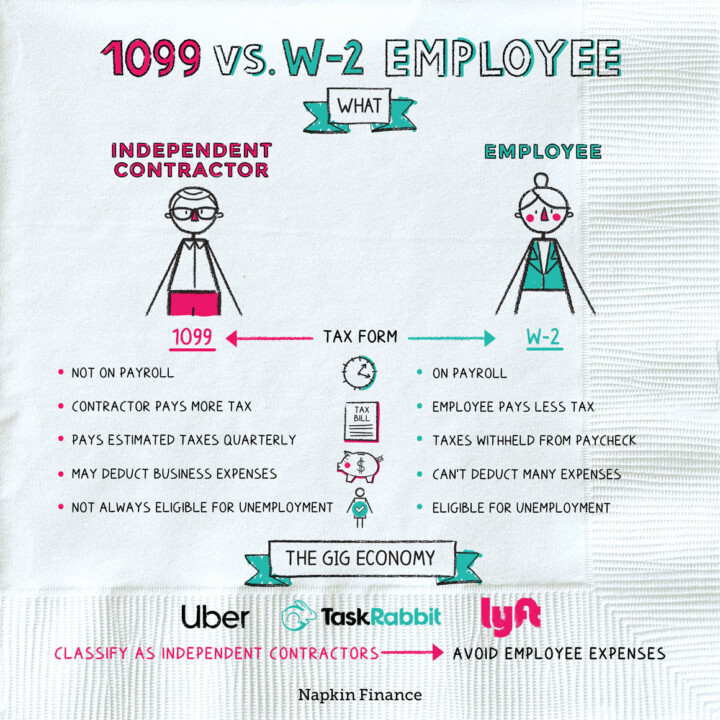

Learn more1099 vs. W-2 Employee

Bring Home the Bacon

1099s and W-2s are both types of tax forms. If you’re a contractor, you should receive one...

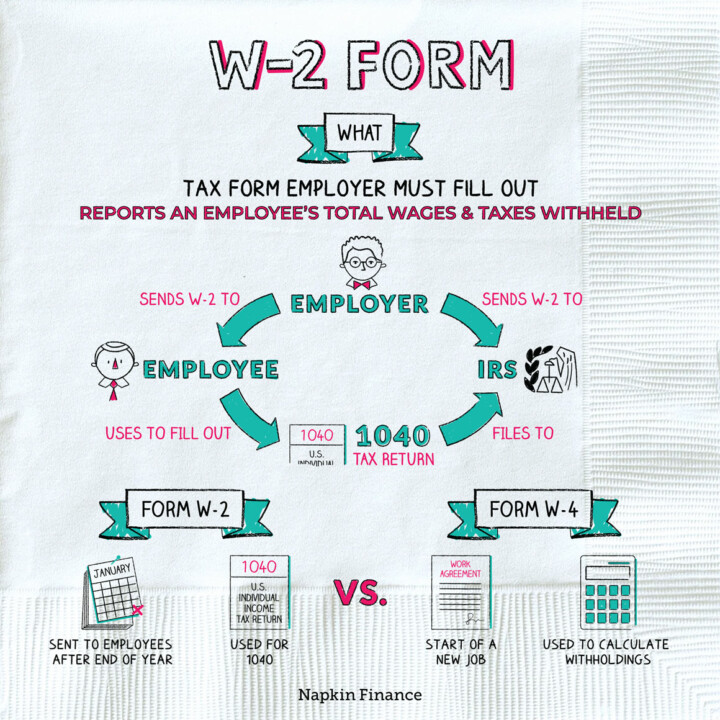

Learn moreForm W-2

Company Man

The W-2 is a tax form your employer must complete at the start of each year to...

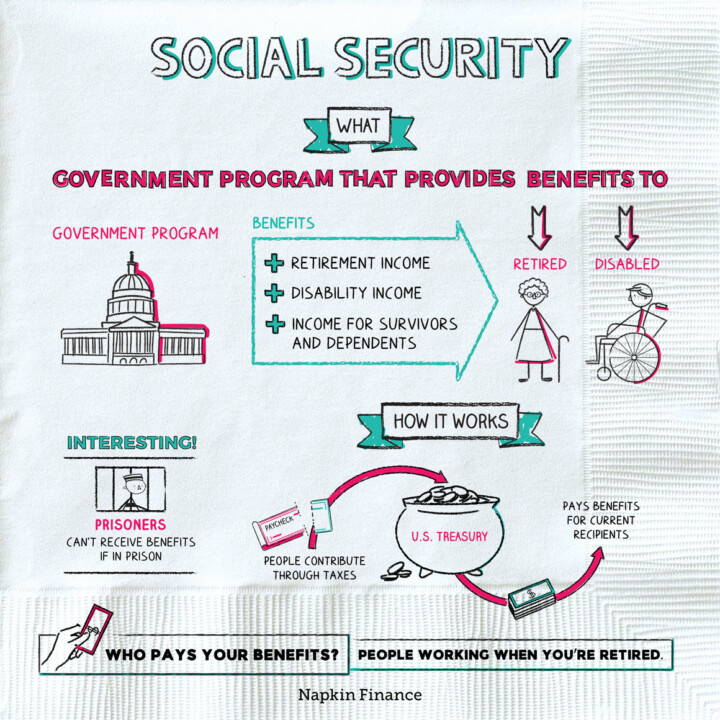

Learn moreSocial Security

Safety Net

Social Security is a government program that takes in taxpayer dollars and pays out benefits to older...

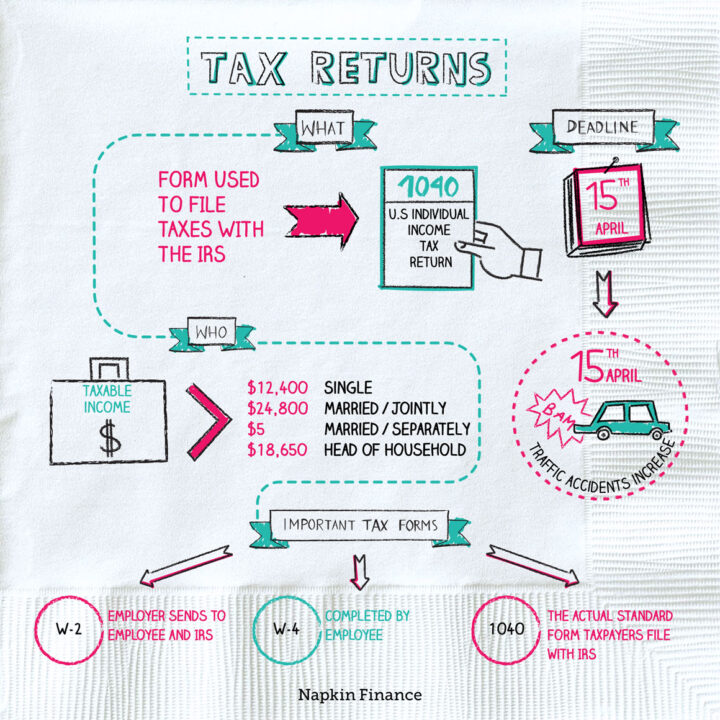

Learn moreTax Returns

Not-So-Happy Returns

Most people pay taxes throughout the year. When you file a tax return, you calculate how much...

Learn moreTrusts

Pennies From Heaven

A trust is a legal document that allows a person (the trustee) to hold the assets of...

Learn moreIndependent Contractor

Free Agent

An independent contractor is someone who is self-employed and works for clients as a nonemployee. Independent contractors...

Learn more