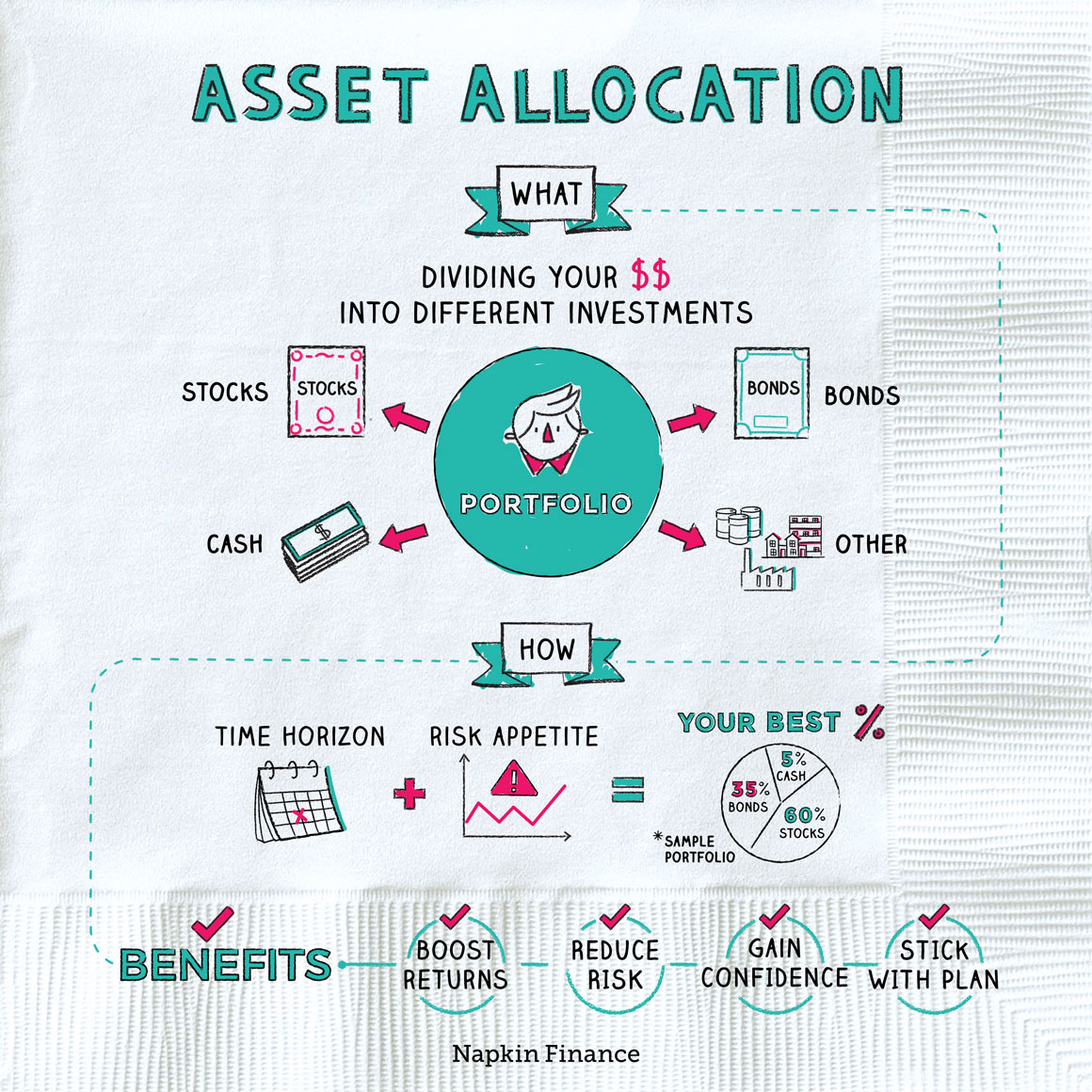

Asset Allocation

Divide and Conquer

“Asset allocation” is a way of describing what you own in percentage terms. If you’ve got $1,000 to your name and it’s all sitting in your checking account, you have a 100% allocation to cash. If you’re worth $10,000 and half of that is in your shoe collection, you have a 50% allocation to shoes (and a 100% commitment to looking fabulous).

When people talk about asset allocation, they’re usually referring to your investment accounts. Holding the right investments in those accounts is important because doing so can help you earn the best return on your money (it lets you turn money into more money), while also avoiding taking on too much risk.

The benefits of a solid asset allocation can include:

- Boosting your returns

- Reducing your portfolio’s risk

- Giving you greater confidence that you hold the right investments

- Making it easier to stick with an investing plan (which also helps your returns)

You can think of different investments and investment mixes as all falling along a spectrum of risk. Riskier investments tend to return more in the long run, but they can also take big price swings in the short run. Safer investments don’t bounce around so much in price, but they also return less.

Two main factors determine your asset allocation: your time horizon and your personal risk appetite.

Time horizon: The longer you have before you’ll need to sell your investments, the more risk you can take on. That’s because with a longer time horizon you can wait for your investments to bounce back if the market does something crazy. If you’re in your 20s and investing for retirement, you can probably take on a lot of risk. (Also, doesn’t “Time Horizon” sound like an awesome action movie? Someone get The Rock on the phone, stat!)

Whether you’re building a riskier or safer portfolio, you’ll use the same main building blocks of stocks, bonds, and cash:

- Stocks—Stock prices can bounce around a lot in the short term, and even stocks of great companies sometimes take a Thelma-and-Louise-style drive off a cliff. In the long run, however, stocks generally offer excellent returns. Of the three main asset classes, stocks are the riskiest but also offer the potential to return the most.

- Cash—Cash is usually considered the safest investment because its price doesn’t change, but it returns almost nothing, so it probably shouldn’t be your main investment.

- Bonds—Bonds are a middle ground between stocks and cash. They can go up and down in price, but not nearly as much as stocks do. They usually return less than stocks but more than cash.

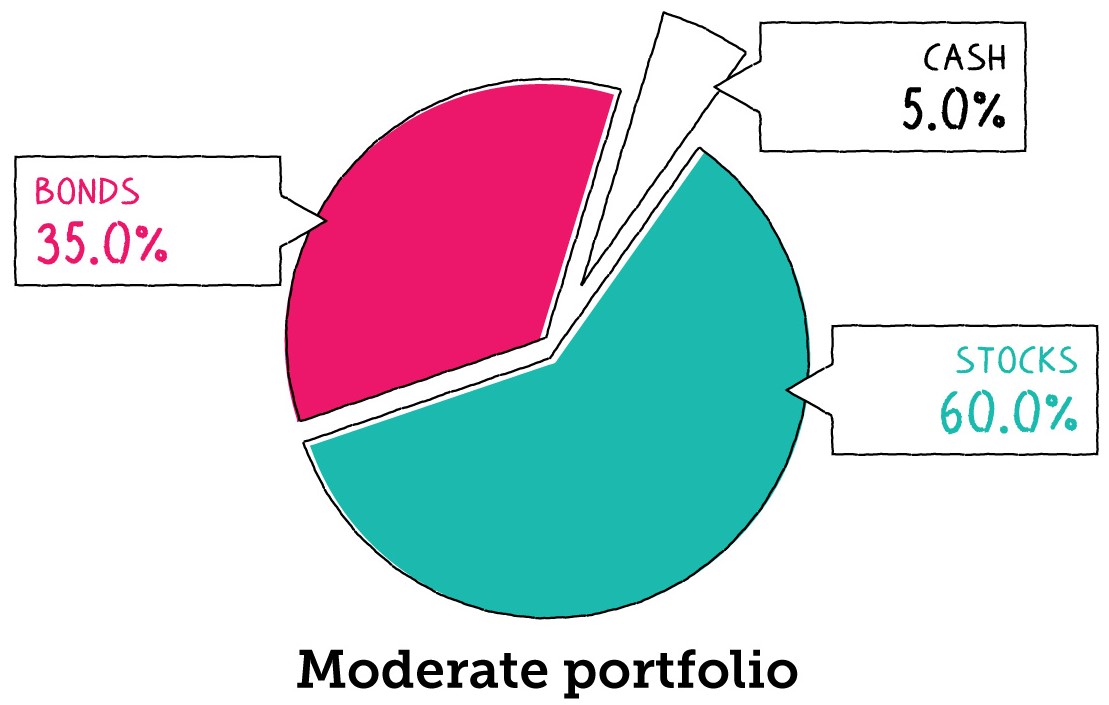

Consider your answers on time horizon and risk appetite, and see where you fall:

| Short time horizon | Long time horizon | |

| Low risk appetite | Conservative | Moderate |

| High risk appetite | Moderate | Aggressive |

Here’s what those categories mean:

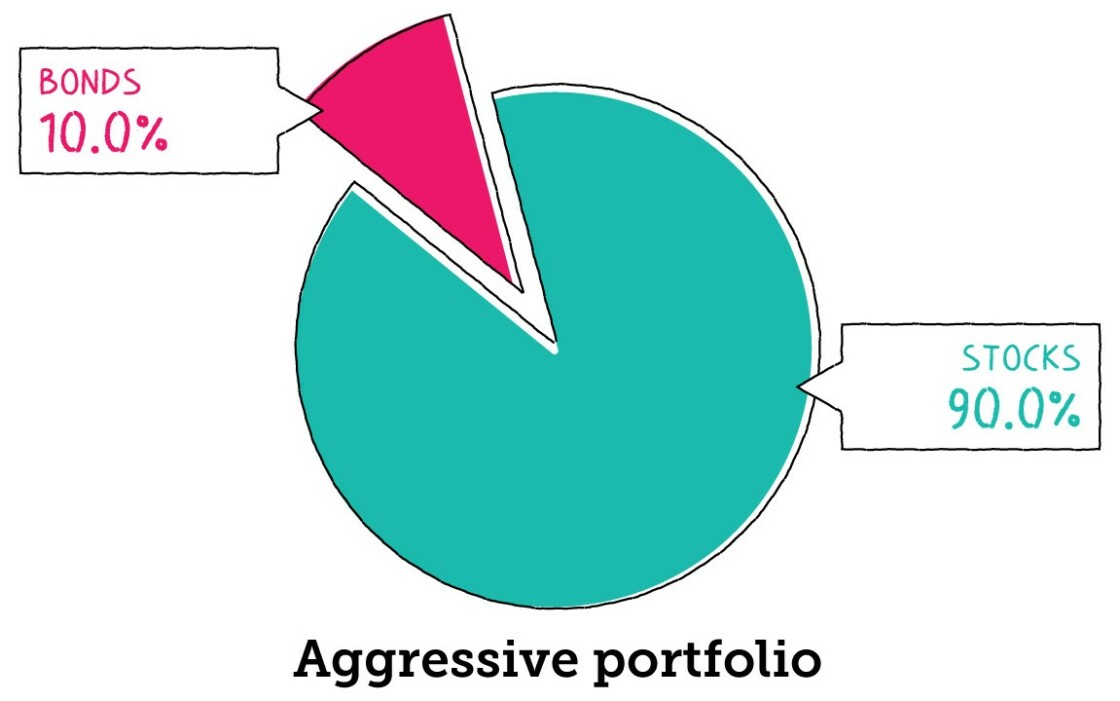

- Aggressive: If you landed in this box, you should probably invest mainly in stocks.

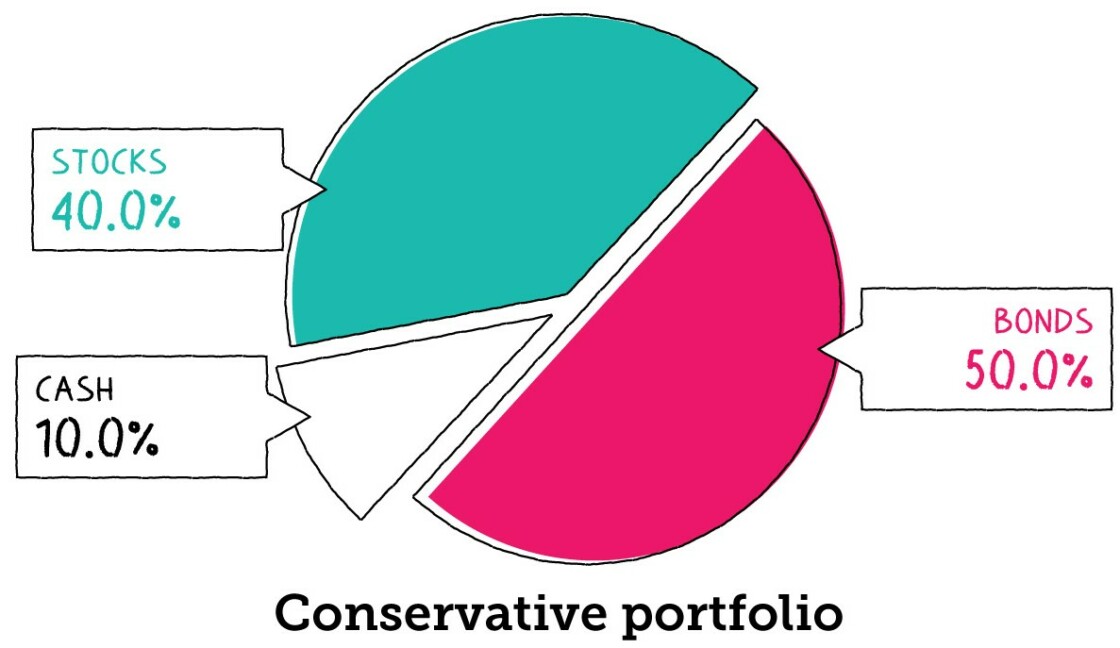

- Conservative: If a conservative asset allocation is right for you, you should probably invest mainly in bonds and cash.

- Moderate: If you landed in one of the moderate boxes, you need an asset allocation that strikes a balance.

Let’s say you’ve decided you should hold 60% of your money in stocks and 40% in bonds. You don’t want to own just one stock or one bond because even companies that look great today may not turn out to be great investments (remember MySpace?).

Your best bet is to hold lots of individual investments so that any bad investments are offset by other great ones. That’s called diversifying. Diversifying can even boost your total return. You can diversify by:

- Holding lots of individual investments, such as many individual stocks and many individual bonds

- Investing in companies from different industries and different countries

- Investing in small and large companies

- Buying a mix of government-issued and corporate-issued bonds

Your asset allocation, meaning how much of your money you place in different types of investments, should be your starting point in investing. With the right asset allocation, you can earn a solid return on your money but also not take on too much risk. There’s no single “best” asset allocation—only one that’s right for you.

- Warren Buffett likes to keep asset allocation simple. He has said that a portfolio with 90% of assets invested in an S&P 500 index fund and 10% invested in Treasury bonds will usually beat the results of high-priced money managers.

- Fine wines have been an excellent investment in recent years, posting as much as 25% annual gains. Cars, stamps and antique furniture have been duds.

- Cryptocurrency—digital tokens, such as Bitcoin, Ethereum and Ripple, is an emerging asset class.

- Until 2011 you could have an asset allocation to pork bellies by investing in the futures market. In 2011 the futures, which were used by the bacon industry, were delisted from the Chicago Mercantile Exchange. (You can still have a delicious allocation to pork bellies, but it may be limited by your fridge space.)

- Your asset allocation describes how you spread your money across different investments.

- The right asset allocation for you depends on your time horizon and risk appetite. With a longer time horizon, you can take on more risk. Your risk appetite describes how much risk you feel comfortable with.

- If a riskier portfolio is right for you, you should probably invest in more stocks. If a safer portfolio is better-suited to your needs, you should generally invest in more bonds and cash.

- Diversifying means spreading your money around with lots of individual investments. It can reduce your portfolio’s risk and boost your overall returns.

- There’s no “best” asset allocation—only the one that’s right for you.