Investing

Piece of the Pie

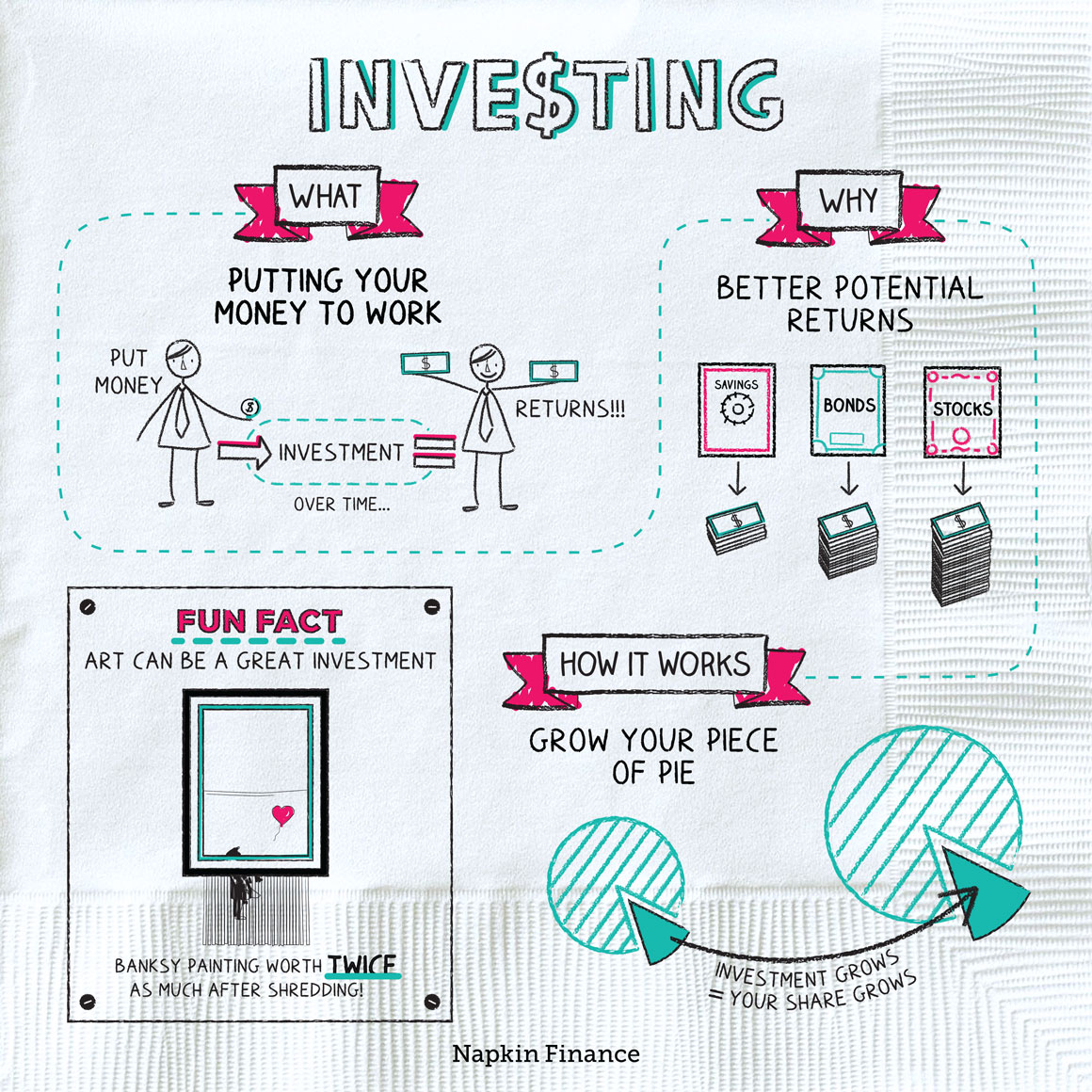

Investing is putting your money to work in the hopes of earning a return.

You probably already invest in all kinds of things. When you invest in your education, the return you’re hoping to earn may be higher future pay or a promising job. When you invest in some designer shoes, you might be hoping to earn a return in compliments or social status.

When it comes to your finances, though, investing means putting your money to work in stocks, bonds, or some other kind of venture in the hopes of earning a profit.

Investing can be a powerful way to grow your wealth because investments such as stocks have historically provided great returns over long periods.

Consider how a $10,000 sum of money would grow if you kept it in a savings account earning 0.1% interest versus if you invested it in U.S. stocks, which have a long-term average annual return rate of 10%.

| Initial investment | Return rate | Invested for | Ending amount | |

| Savings | $10,000 | 0.1%/year | 20 years | $10,202 |

| Stocks | $10,000 | 10%/year | 20 years | $67,275 |

Of course, in the real world, investments can go down as well as up, and they don’t usually deliver smooth returns every year. But in the long run, investing usually grows your money faster than the alternatives.

“How many millionaires do you know who have become wealthy by investing in savings accounts?“

—Robert G. Allen

The stock market generally goes up over the long run because the economy is usually growing—thanks to population growth and to advancements in technology. More people in the world means more people buying things. And technological advancements can improve workers’ productivity and foster new discoveries.

Both of those factors help companies sell more stuff and earn bigger profits over time. Investing lets you get a piece of the pie.

Here’s the basic process:

- Step 1: You invest by buying an ownership stake in a company (such as by buying a stock) or loaning the company money (such as by buying a bond).

- Step 2: The company sells its products and grows.

- Step 3: Your ownership stake is now worth more, so you can sell it for a profit. Or, the company repays the money it borrowed from you with interest.

Among the most common types of investments are:

| Type | What it is |

| Stocks | A tiny piece of ownership in a public company |

| Bonds | An IOU; you lend money to the issuer (such as a corporation or local government), and it pays you back with interest |

| Mutual funds and ETFs | A collection of many different securities (stocks, bonds, etc.) |

If these don’t seem right for you, keep in mind that investing is more than just the stock market. You can invest in real estate, currency, vintage cars, fine art, and more.

There is no one perfect investment choice for everyone. As you evaluate each option, ask yourself:

Investing is the process of committing your money to something in hopes of getting more money in return. Investment options range from stocks and bonds to art and real estate. In the long run, investing usually delivers better returns than a savings account or money stuffed under your mattress. However, all investments come with risk, and there is no guarantee that any will earn you money.

- Art can make a great investment. Banksy’s Girl with Balloon painting reportedly doubled in value after it self-destructed at a Southeby’s auction in 2018.

- You don’t have to start rich to get rich. Warren Buffett’s fortune started with his earnings from his newspaper route. He made his first stock investment at age 11 (it was Cities Service, an oil company that eventually became Citgo).

- Investing is putting your money to work in the hopes of earning a profit or return.

- Putting your money into stocks, bonds, and other investments can provide powerful growth over time.

- Investing works because the economy grows over time, which means companies can sell more stuff and earn bigger profits.

- Consider risk, reward, and your investment goals before picking an investment option.