Options

Coming Attractions

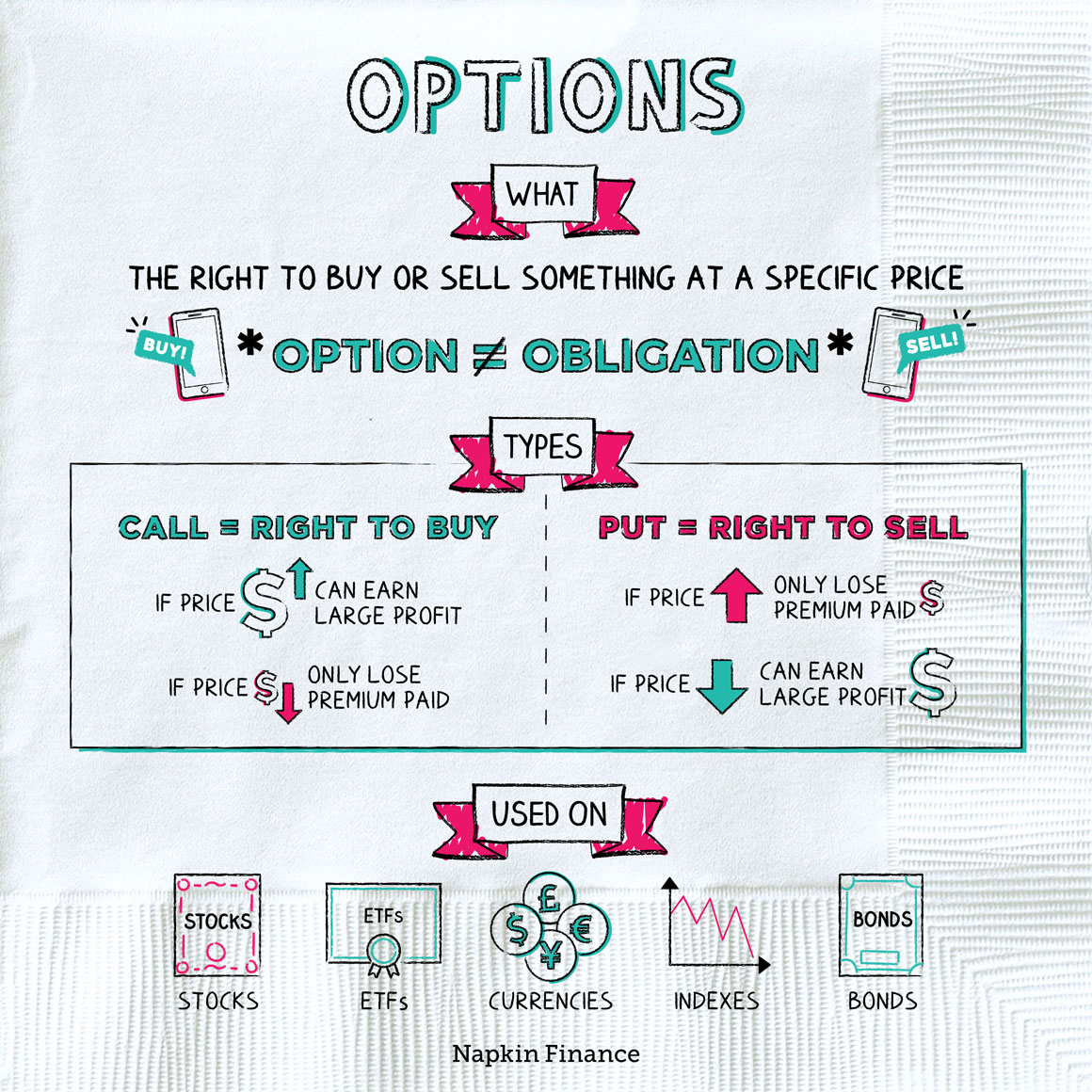

An option is the right, but not obligation, to buy or sell an investment at a specific price.

There are two types of options:

| Type | What it means | When it profits |

| Call | Gives the owner the right to buy an investment at a set price. | If the underlying investment rises in price. |

| Put | Gives the owner the right to sell an investment at a set price. | If the underlying investment falls in price. |

Suppose you buy a call option on Facebook stock when the share price is trading at $150. And suppose that the call option you buy gives you the right to buy the stock for $170. Now, imagine that the stock price either rises or stays flat:

| Stock price rises to $200 | Stock price stays flat at $150 |

|

You exercise your call options, |

Your options aren’t worth anything, |

The mechanics for put options are similar, except in that case your options become valuable if the shares fall in price. Let’s suppose that you already own Facebook shares, but because you’re worried they could fall in price you decide to buy put options that would let you sell for $140 per share. And imagine that the stock price either falls or stays flat at $150:

| Stock price falls to $120 | Stock price stays flat at $150 |

|

You exercise your put options, |

Your options aren’t worth anything, |

Although that’s the basic mechanics if you buy an option (also called going “long”), investors can also sell options (called going “short”). In that case, you make money through the option premiums you receive on each sale.

However, when you sell options, you’re not the one in the driver’s seat. Instead, it’s up to the buyer to decide whether or not they want to exercise an option you’ve sold to them. And if they do, you have an obligation to hold up your end of the deal. That’s why selling options can be risky.

Here are the main parts of any options position:

- Underlying: The investment that the option is on. If you buy a call option on Apple stock, Apple is the underlying.

- Premium: The up-front cost that the option buyer pays to the seller.

- Strike price: The price at which you can buy (with a call) or sell (with a put) the underlying investment.

- Expiration: How long you have left to use the option after which it expires.

- Moneyness: If exercising an option today would earn a profit, it’s said to be “in the money.” Options that would earn a loss are “out of the money.”

You can buy options on many types of underlying assets, including:

- Individual stocks

- Exchange-traded funds (ETFs)

- Currencies

- Stock market indexes

- Bonds

An option is a type of investment that gives the owner the right, but not obligation, to buy or sell a particular investment at a pre-set price. A call is an option to buy an underlying investment—and makes money when the underlying investment rises in price. A put is an option to sell an underlying investment—and makes money when the underlying investment falls in price.

- The lingo of options trades can get pretty kinky. “Collars,” “straddles,” “strangles,” and “spreads” are just a few of the types of trades you can make.

- Although derivatives (such as options) are typically thought of as aggressive investments, they’re often used in conservative investing approaches too—such as by buying puts on the stocks you own to protect against a market drop.

- Options give investors the right (or option) to buy or sell a specific investment at an agreed-upon price.

- There are two types of options: calls and puts. Buying a call means you profit if the underlying investment rises in price, while buying a put earns a profit if the underlying investment falls in price.

- Investors can buy or sell options on a wide range of investments, though they’re most commonly used with stocks.