Liquidity

Cashing Out

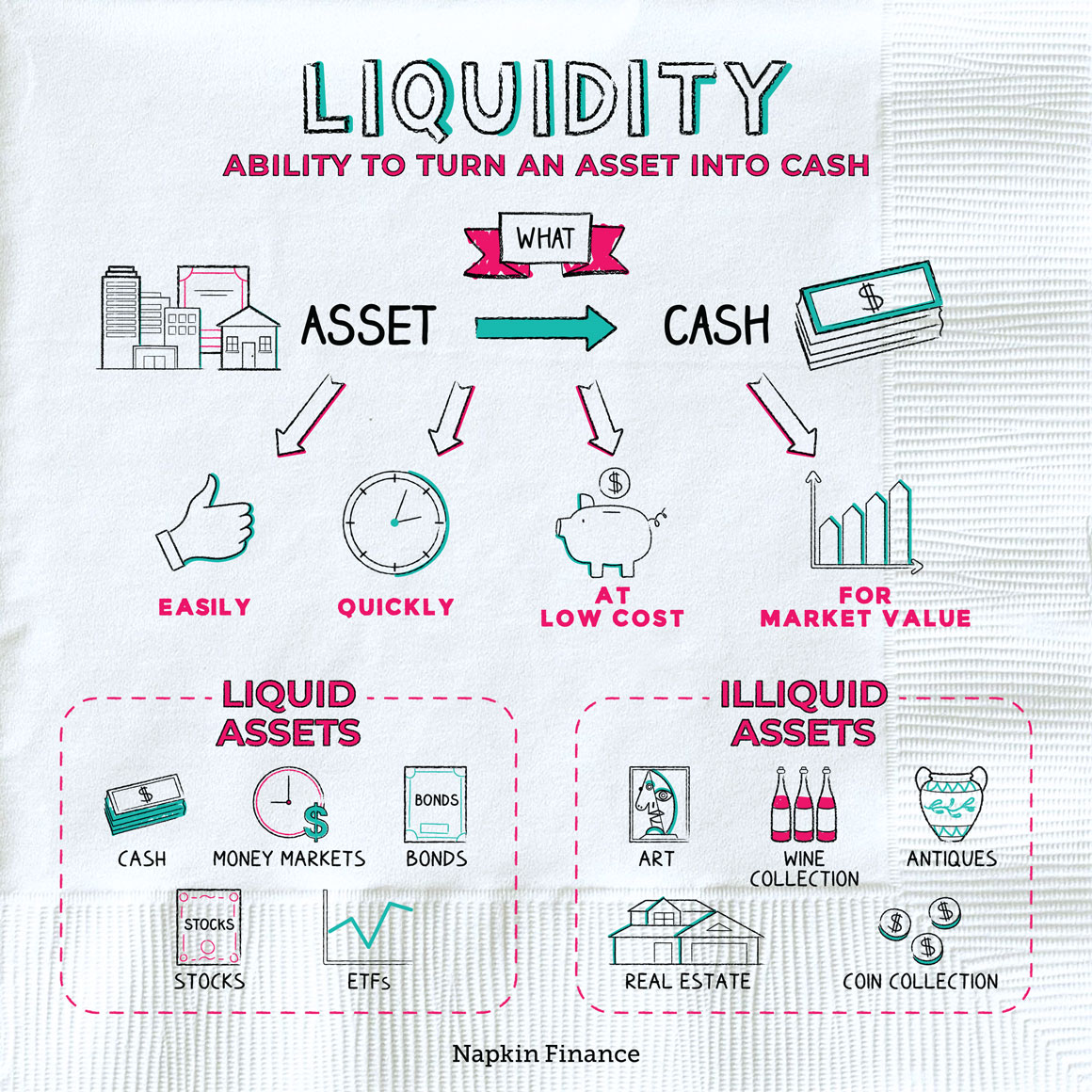

Liquidity refers to how easily you can sell an investment or asset at a fair price.

Assets are liquid if they can be exchanged for cash:

- Easily and quickly

- At little or no transaction cost

- At their fair market values (i.e., without having to entice a buyer with a big discount)

Generally, something is more liquid if:

- Many people would be willing to buy it

- It’s easy to figure out what it’s worth

- It’s easy to transfer ownership from one person to another

- The item or investment is more standardized (i.e., less unique)

A share of Apple stock, for example, is liquid because it’s easy to buy and sell, lots of people would want to own it for the right price, and you can figure out what it’s worth by looking at its current price in the stock market. Plus, the company has billions of shares outstanding, so it’s not unique.

A custom-designed piece of luxury real estate, by contrast, is illiquid because there may only be a few interested buyers, it’s hard to agree on exactly what it’s worth, and the process of transferring it can take a long time.

Cash is the most liquid asset because you can easily turn it into other assets.

So-called “cash equivalent” investments—like money market accounts and funds, savings accounts, and some types of very short-term debt investments—are also extremely liquid. (CDs are slightly less liquid because they tie your money up for a set period of time and charge a penalty if you need to cash out early.)

Other examples of liquid and illiquid assets include:

| Liquid | Illiquid |

| Stocks | Real estate |

| Bonds | Art |

| Mutual funds | Antiques |

| Exchange-traded funds (ETFs) | Collectibles, like coins, stamps, or baseball cards |

While there’s nothing wrong with holding illiquid assets, having at least some liquidity is important both for people and businesses.

- You need some liquid assets for your day-to-day expenses or unexpected bills. If your only asset is a house, it would be hard to sell quickly for a good price to cover a car repair.

- Companies need liquidity to cover short-term expenses and to provide financial stability. If a sudden economic downturn hurts the company’s sales, having enough liquidity on hand can help it make it through the rough patch.

Liquidity describes how quick and easy it is to sell an asset for a fair price. Liquid assets, such as stocks, bonds, and ETFs, are easy to sell. Illiquid assets, including real estate and fine art, are more difficult to turn into cash. Having enough liquid assets is important for both people and companies in order to meet near-term bills and cover any unexpected expenses or financial rough patches.

- Wine is illiquid (as an asset, at least), but that doesn’t stop people from amassing huge collections. One French wine collector built a security system for his 40,000 bottles. He was nevertheless held at gunpoint over 15 cases.

- Baseball cards are a great example of an illiquid asset. Just because you find a good one in your childhood collection doesn’t mean there are plenty of buyers clamoring to get it

- That said, illiquid assets can still be great investments—like if you have one of the 50 Honus Wagner cards from 1909, which set a world record when one sold for $3.12 million.

- Liquidity refers to how quickly and easily you can sell an asset at a fair price.

- Cash is the most liquid asset, but stocks, bonds, mutual funds, and ETFs are usually considered highly liquid. Houses, coin collections, and art are illiquid because it takes time to find a buyer willing to pay a good price.

- While it’s fine to have some illiquid assets, you should balance them out with liquid ones that you can sell if you need quick cash.