Break-Even Point

Point Break

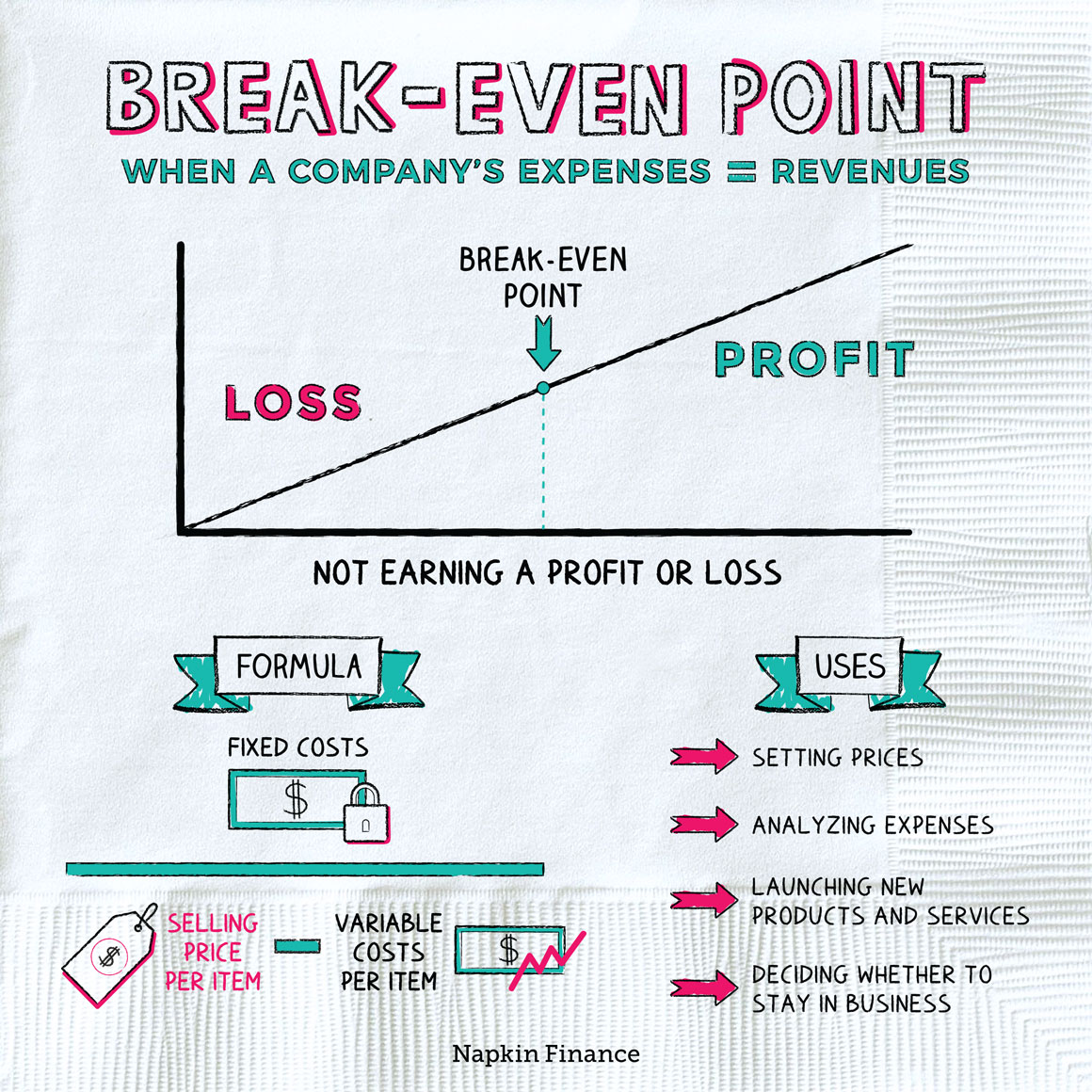

A company is at its break-even point when its revenue equals its expenses. It is neither making nor losing money at this point.

A particular company’s break-even point is usually described in terms of sales—whether as a certain dollar figure in sales it needs to hit or a certain minimum number of items it needs to sell.

Companies use their break-even points to figure out how easy or hard it will be to turn a profit. The lower the break-even point is, the lower a company’s hurdle to becoming financially successful.

A company might also use this number to:

- Set the right price on products and services

- Highlight which expenses are too high and could be reduced

- Decide when to launch a new product or service

- Set long-term goals

Companies can even use their break-even points to decide whether or not to stay in business. If a company is consistently operating below its break-even point, then it may not make sense to keep running the business.

A company’s break-even point is driven by the interplay between its revenues (i.e., all the money it has coming in the door) and its expenses (i.e., all the money it has going out the door).

Expenses come in two main types: fixed and variable costs. A fixed cost is the same whether the business sells one item or 100. A variable cost, on the other hand, changes as the number of items it sells goes up or down.

Here are a few examples:

| Fixed | Variable |

| Rent | Raw materials |

| Administrative wages | Labor wages |

| Advertising | Certain taxes |

To break even, a company has to cover both its fixed and variable costs. How much you need to sell in order to cover your fixed costs is easy to figure out: If you’re a shoe store selling $100 shoes and your rent is $5,000 a month, then you need to sell at least 50 pairs of shoes.

Adding variable costs into the mix is what makes understanding break-even points more complicated because the more you sell (or make), the more your costs go up.

The formula for calculating break-even points factors in both fixed and variable costs:

Total fixed costs

—————————————————————

(Selling price per item – Variable costs per item)

Let’s say you run a pizza shop. Just to keep the doors open each year, you spend $60,000 on fixed costs. Each pizza has a variable cost of $10, and you sell each one for $15. So:

$60,000

————————

($15 – $10)

= 12,000

Just to break even, you need to sell 12,000 pizzas per year. You can also think of the break-even point in terms of dollars of sales. At $15 per pizza, you would break even at $180,000 in annual sales.

Companies, especially new ones, want to keep their break-even points low so that they can make a profit faster.

There are two main ways to do this: cut costs or raise prices. The latter can be hard to do because consumers might not be willing to take a chance on a product that’s too expensive.

There are many ways to reduce expenses, however, including:

- Set up shop somewhere where rent is lower and rent only the space you need

- Choose low-cost suppliers and supplies

- Reduce wages, hours, or total staff

- Consider telework (if possible) to cut the amount of space you need (and utilities!)

- Better target your marketing

- Build partnerships with other small businesses to trade services

As you can imagine, it’s often easier for a virtual, service-based business to turn a profit because it doesn’t have to worry about a storefront or inventory.

A company’s break-even point is when its revenue and expenses are equal. It’s calculated using fixed costs, variable costs, and the sale price of whatever the company makes. Businesses can use their break-even points to figure out when they might turn a profit or to decide if prices or costs should change.

- A lot of businesses go belly up before they ever hit the break-even point. But not Amazon. After its founding in 1995, it didn’t turn an annual profit until 2003.

- Tesla has managed to edge past its break-even point in a few isolated quarters but still hasn’t ever turned an annual profit.

- The break-even point is when a company’s revenues are equal to expenses. At the break-even point, companies are not making or losing money.

- You can describe a company’s break-even point in terms of a certain minimum number of items it needs to sell or as a dollar-value of sales it needs to hit.

- To calculate the break-even point, a company must know its fixed and variable costs plus how much revenue it brings in for every item it sells.

- A financially successful business operates above its break-even point. At that point, it’s turning a profit.