Yield

Make Coin

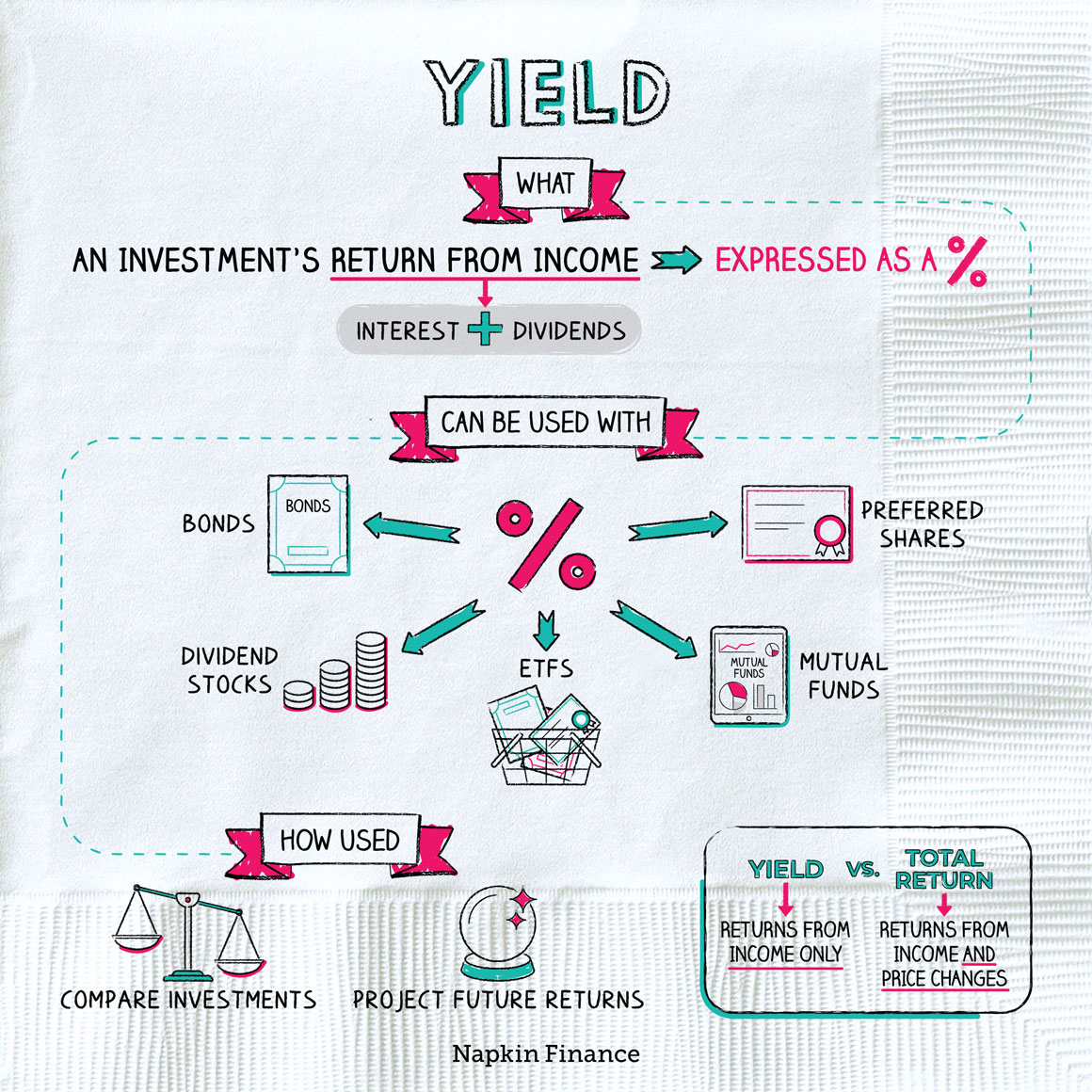

Yield is the earnings generated by an investment over a specific period of time, expressed as a percentage.

Although you can calculate monthly or quarterly yield, most investors look at yield from an annual perspective. At its most basic, you calculate yield by dividing the net return (including interest earned and dividends) by your initial investment.

So, if you invested $10,000 in a software company and earned $300 in interest and dividends for the year, your yield is 3% because:

$300 / $10,000 = 0.03 x 100 = 3%

You can actually calculate yield in many more ways, depending on the investment type and what you’re trying to figure out.

Common yield calculation methods for stocks and bonds include:

| Stocks | Bonds |

| Yield on cost: Based on the original purchase price | Nominal: Based on annual interest and the bond’s face value (not necessarily what you actually paid for the bond) |

| Current yield: Based on the stock’s current market price | Yield to maturity: Total average expected return per year assuming the bond is held to maturity |

You have even more options for calculating yield on your investments, some of which get incredibly complicated by taking compounding into account and assuming that you regularly reinvest the income earned.

Investors rely on yield to make sure they’re putting their money in the best possible investments. They can calculate yield to compare different investment options and decide which will be the most profitable.

A higher yield usually means that an investor can earn more off their investment, while a lower yield probably won’t bring in as much income.

Generally, as risk increases, so does yield. For example, you might not earn too much on a bond issued by the federal government, but there’s also a pretty low risk of default. Same goes for stock from a well-established company (think, McDonald’s or Johnson & Johnson). On the other hand, a tech startup might have a high yield, but there’s also a greater risk that company will fail.

Yield and total return are both expressions of investment income, but they differ slightly:

- Yield includes dividends and interest. Often an investor looking solely at yield will be income focused, with a goal of preserving their initial, principal investment.

- Total return is a more complete picture of investment income. It includes dividends and interest along with capital gains and distributions. An investor focused on growth will likely rely more on total return.

“As I see it, a superior yield at least lets you snack on hors d’oeuvres while waiting for the main meal.“

—John Neff, investment manager

Yield is a measure of how much you can earn from a particular investment. There are many ways to calculate yield, but the most basic is to divide annual return (dividends and interest) by your initial investment. You can use yield to choose between multiple investments, based on how each might perform, but keeping in mind that higher yield investments tend to come with greater risk. Yield is different from total return, the latter of which is a more complete calculation of annual income from a certain investment.

- Stocks listed on the S&P 500 usually have an average yield of between 2% and 4% per year.

- “Junk bonds” have a higher risk of default or other problems, but also come with the potential to net a big profit. The people who trade in them (and sometimes get rich from them) prefer a name with a bit more sophistication: “high-yield bonds.”

- Yield is the amount of income earned (based on dividends and interest) from a particular investment.

- You can calculate yield to figure out which investment choice is best for your goals; usually the riskier the investment, the higher the possible yield.

- While yield can tell you how much you might make in dividends and interest, total return provides a more complete income picture by including capital gains and distributions.