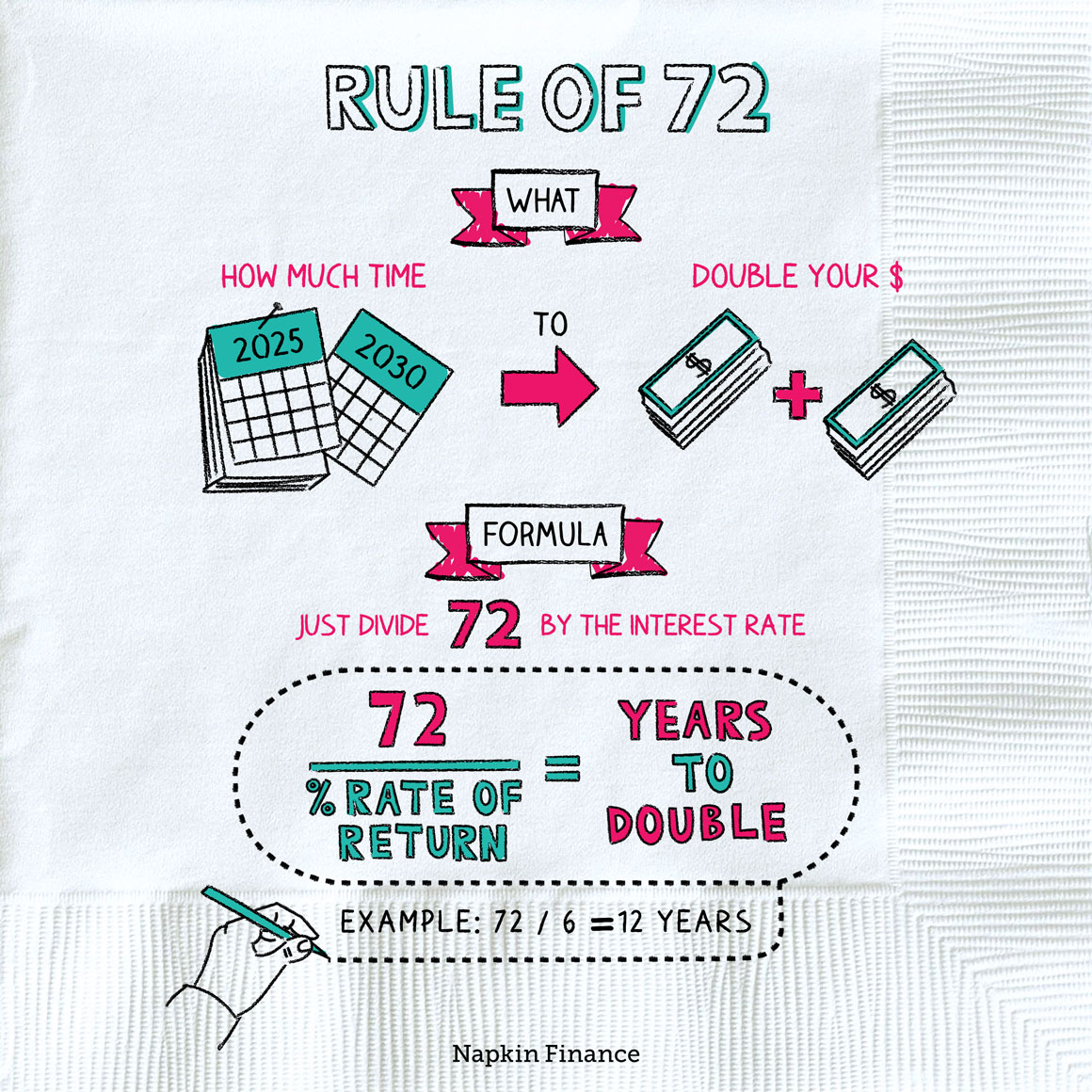

Rule of 72

Crunch the Numbers

The rule of 72 is an easy, back-of-the-napkin way to figure out how long it will take invested money to double given a set interest rate or growth rate.

To use the rule, just divide the number 72 by your annual interest rate.

So, if your money is earning 7% every year, it will double in about:

72 / 7 = 10.3 years

On the other hand, if your money is earning 2% every year, it will double in about:

72 / 2 = 36 years (ouch)

You might use the rule of 72 if you want to:

- Compare investments

- Put investments side by side to figure out which might be best for growing your money.

- Target a rate of return

- If you know when you need your money to double, divide 72 by that number of years to figure out what interest rate you need to reach your goal.

- Evaluate what you’re paying

- Use the rule to calculate how long it will take your money to double for someone else (like your credit card company or mortgage lender) and you’ll understand why lower interest rates matter when you’re footing the bill.

- Understand inflation

- Inflation means your money is worth less in the future than it is today. To figure out when it will be worth half, divide 72 by the expected rate of inflation.

- Estimate other types of growth

- For example, policymakers use population growth estimates when budgeting or planning spending on new infrastructure.

As you learned in elementary school, putting a larger number in the denominator means your result gets smaller. It may not be a shocking revelation, but one of the best ways to help your money double faster (and then double again!) is to seek out a higher rate of return. You can help along your money’s growth by:

- Investing money you won’t need for a long time in stocks. With 10% historical returns, stocks have on average doubled investors’ money about every seven years.

- Avoiding accounts that don’t yield anything. Don’t keep any more cash than you have to in a 0% checking account. Even your emergency fund could live in a high-yield savings account.

- Leaving your money to grow. The rule of 72 assumes compound growth. If you withdraw the money you’ve earned every year and spend it, your money will never double.

The rule of 72 is an easy way to estimate your money’s growth, but it isn’t a precise calculation. The math for working out the exact length of time is quite a bit more complicated (though online calculators can help).

Plus, in the real world, return rates aren’t usually smooth from year to year (or from decade to decade).

The rule of 72 isn’t the only quick calculation you can use for figuring out when your money will double. Some investors actually prefer to divide by 69.3 or 69. While somewhat more accurate, it’s also harder to calculate on the fly (unless you’re a math wiz, in which case, props to you).

You can use the rule of 72 to quickly estimate how long it will take your money to double at a given interest rate or growth rate. It’s useful when comparing investments, interest rates, or the effect of inflation. If you’re looking to double your money, make sure you’re leaving your money alone to grow and choosing investments that provide a solid return potential (given your risk tolerance).

- Although Einstein is often credited with discovering the rule of 72, it was more likely discovered by an Italian mathematician named Luca Pacioli in the late 1400s. Pacioli also invented modern accounting.

- To find out how long it will take your money to triple, divide 114 by your interest rate. And to find out how long it will take to quadruple, use 144.

- The rule of 72 is a quick and easy way to figure out roughly how long it will take your money to double at a given growth rate.

- The rule of 72 can help you compare investments and interest rates and even figure out more wonky things, like how inflation reduces what your money’s worth.

- The rule of 72 is a good approximation but still just an approximation. Running an exact calculation is a bit more complicated, though you may get a slightly better estimate by using 69 or 69.3.

- To help your money double faster, try to seek out higher growth rates, such as by investing in stocks, and make sure you leave your money to grow instead of withdrawing it.