Financial Statements

State of Affairs

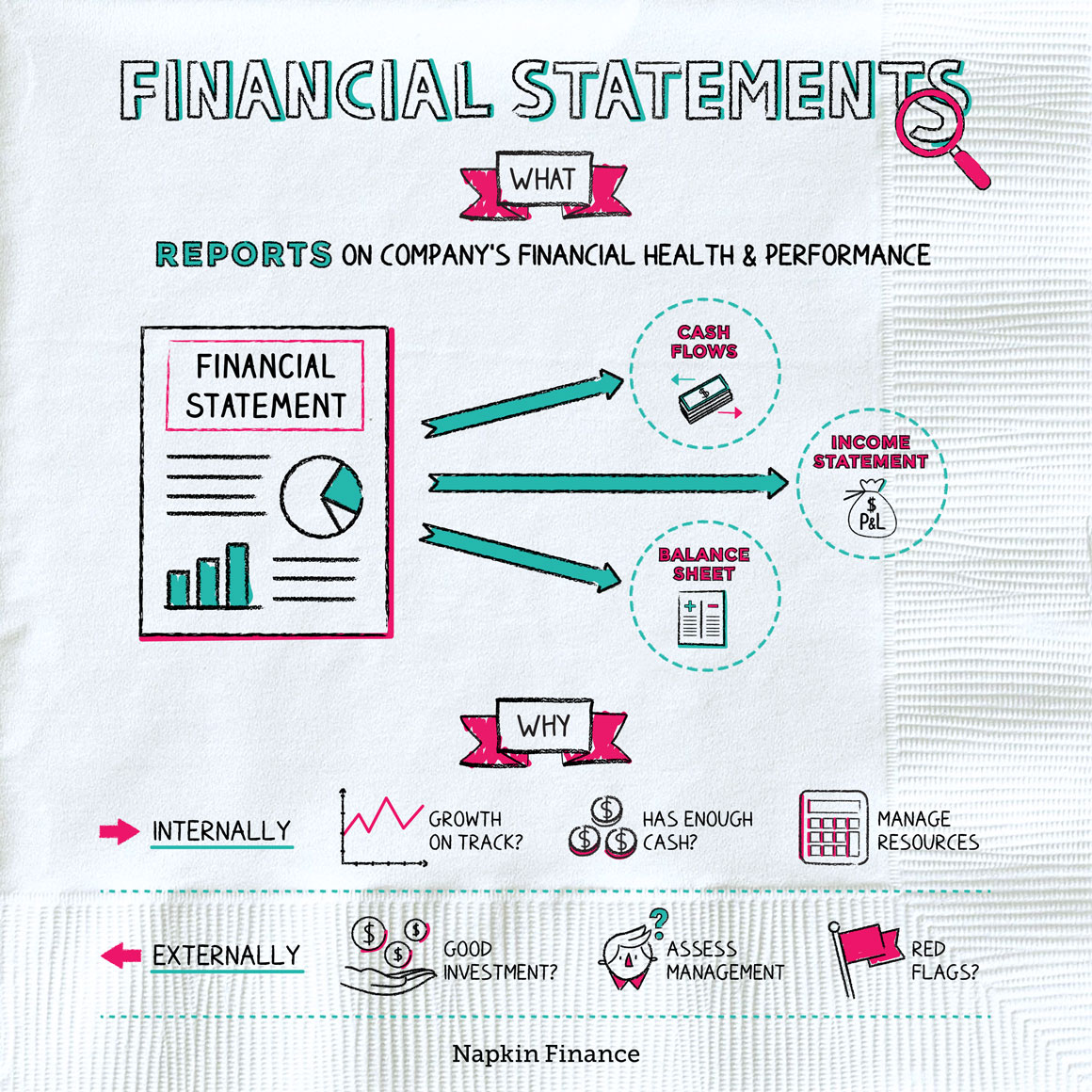

Financial statements are reports a company puts together to measure how it’s doing.

Companies create their financial statements by condensing large amounts of data into reports. They offer perspective on where a company’s money comes from, how it’s being spent, and whether the company is in good financial health.

Financial statements may be put together by:

- Public companies—i.e., companies that are owned by large numbers of investors and have shares that trade on stock exchanges.

- They’re required by law to make their financial statements available to the public, and the statements they produce have to meet certain standards.

- Private companies—often smaller, younger companies or ones that are owned by a family or otherwise aren’t publicly traded.

- They typically only put together statements for their own internal use (or for their investors or lenders to see).

A company typically puts together three main statements:

| What | Shows | Important because |

| Balance sheet | What the company owns and what it owes at a particular point in time. | Can show whether the company has the resources to meet its obligations. |

| Income statement, or “profit and loss” | Sales, expenses, and profits over a specific period of time, such as one year. | Trends in profits are hugely important to outside investors and to the company itself. |

| Statement of cash flows | Cash coming in and cash going out over a specific period of time. | Profits and cash measure different things, but both are important. For example, the cash flow statement shows if customers are paying their bills. |

“I call it the Rule of Three. If you read a company’s financial statements three times, and you still can’t figure out how they make their money, that’s usually for a reason.“

—James Chanon

Financial statements are useful for the company itself because they can show:

- Which parts of the business are thriving and which are struggling

- Whether overall profits are shrinking or growing and by how much

- Whether the company has enough cash to keep running smoothly

- Whether the company’s debt load is reasonable

Outside investors, regulators, and other users also use financial statements to:

- Determine whether to buy a company’s stock and to forecast future profits

- Determine whether a company is likely to be able to pay back a loan

- Try to make sure the company isn’t fudging its accounting or doing anything nefarious

- Figure out whether managers are making good decisions about which parts of the business to invest in

When looking at a company’s financial statements, there are a few things to keep in mind:

- Financial statements can be about as varied as the firms that produce them. There are set accounting standards, but businesses still have a lot of leeway in how they present their numbers.

- Take financial statements with a grain of salt. Some of what’s included is based on the company’s best guess or estimate.

- Financial statements are useful, but they’re just one piece of information. No matter how great a company looks on paper, if it’s shedding staff or its industry is going through a sea change, that could signal trouble.

- Don’t skip the footnotes! Financial statements are full of them, and they provide valuable insight into accounting practices, taxes, and more.

Financial statements are formal reports that a company puts together on its business performance. The main financial statements businesses produce are the balance sheet, income statement, and statement of cash flows. Investors, regulators, and others may use financial statements when deciding whether to invest, when scrutinizing a company for potential wrongdoing, or for other reasons.

- One classic accounting trick is when a company erroneously classifies its routine business expenses as “investments.” Doing so means it doesn’t have to account for the expenses on its income statement, which inflates profits. (We’re looking at you WorldCom.)

- Accountants are in charge of counting ballots for the Oscars (and it was their fault when La La Land was mistakenly announced as the Best Picture winner).

- Financial statements measure a company’s financial performance.

- Public companies generally have to produce more financial statements than private companies, and unlike private companies, they have to make their statements available to the general public.

- The main statements are the balance sheet, the profit and loss statement (aka income statement), and the statement of cash flows.

- Although financial statements provide a wealth of useful information, they’re just one piece of the puzzle when analyzing a company.