ESG Investing

Do the Right Thing

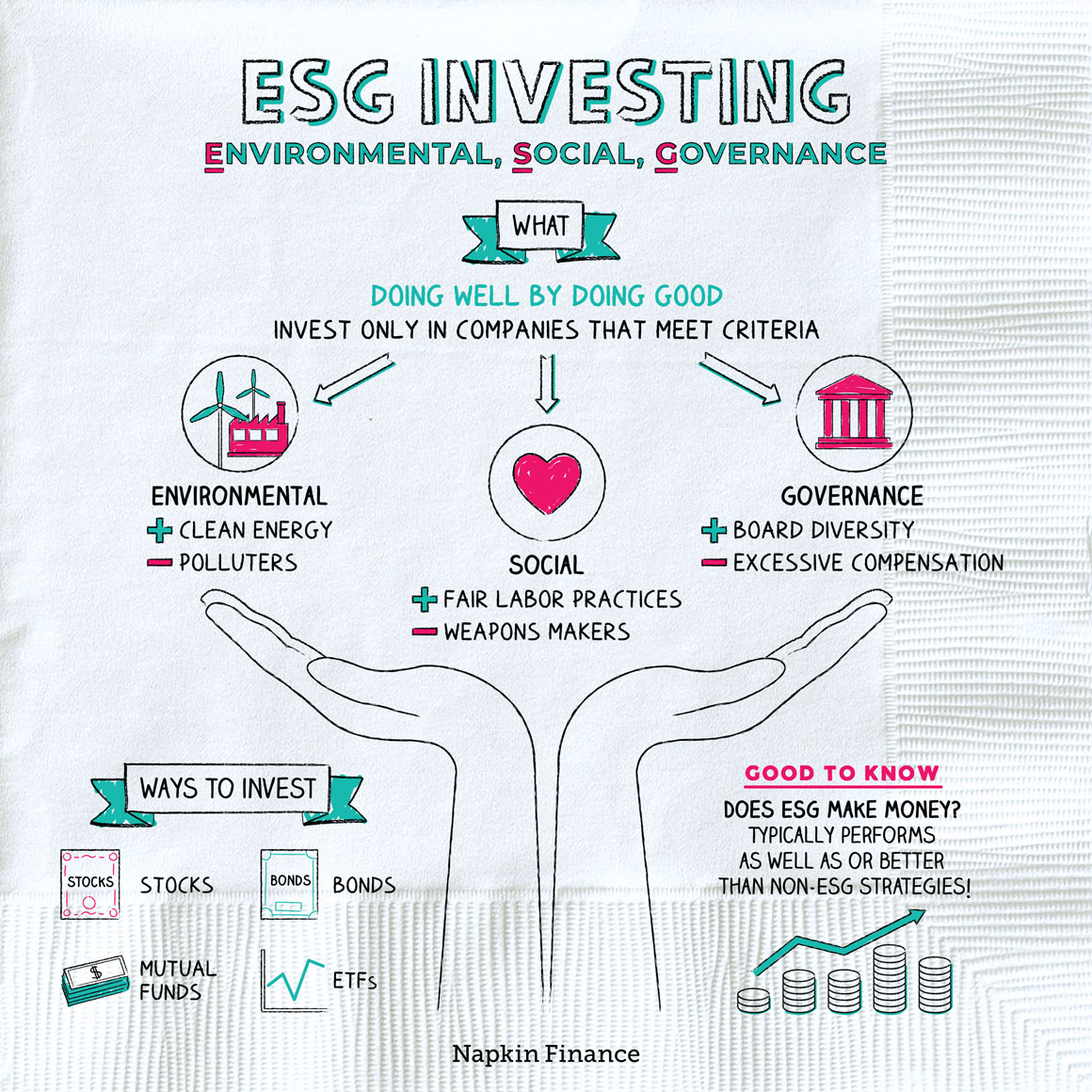

ESG investing means investing in companies that do good (or at least don’t actively do harm).

With ESG investing, investors use various environmental, social, and governance criteria (hence: ESG) to find investments that could have a broader, positive impact on the world.

ESG investors look for companies to invest in by screening for criteria in three categories:

- Environmental

- Investors might look to avoid heavy-polluting industries or aim to proactively invest in clean-energy companies.

- Social

- Investors may avoid investing in companies that manufacture weapons or actively seek out companies with above-average labor standards.

- Governance

- Investors may scrutinize the diversity of a company’s board, the compensation of its executives, or what kinds of rights its shareholders receive.

Investors may apply their chosen set of criteria when deciding which companies’ stocks or bonds to buy.

There are two ways investors may put their ESG criteria into practice:

- Inclusionary approach: Investors look for companies that match a set of positive criteria (like a minimum level of diversity on their board) and then only invest in those companies.

- Exclusionary approach: Investors exclude companies that do business in particular industries, like gun manufacturing or coal companies.

Investors can adopt an ESG strategy by picking individual stocks and bonds themselves or by investing in an ESG fund—whether ETFs or traditional mutual funds.

Here are the basic trade-offs between the two approaches:

| Invest with a fund or ETF | Pick your own stocks and bonds | |

| Pros |

|

|

| Cons |

|

|

The differences boil down to whether you prefer a hands-on or hands-off approach. Investing in individual stocks requires more research than buying a fund, but it may make sense if you’re passionate about a specific cause or criteria.

And although doing your own research on every company’s ESG practices can be a lot of work, there are also research firms that issue reports and ratings specifically on companies’ ESG practices.

Investors often worry that by investing for good they could be giving up the chance to invest for profit. But ESG strategies have historically performed as well as if not better than non-ESG strategies—and without any noticeable differences in risk.

That said, as with any investment approach, experts say it’s important to focus on building a diversified portfolio that includes different asset classes (like stocks and bonds) along with a mix of companies in various industries.

In other words, ESG criteria can be one important factor to consider. But if you’re aiming to make money with your portfolio, you should still weigh traditional investing considerations (like a company’s profitability).

ESG investing lets you try to do good and earn a profit at the same time. It’s a practice of screening potential investments along certain environmental, social, and governance criteria. ESG investment processes are generally either “inclusionary”—meaning they actively seek out companies with best practices—or “exclusionary”—meaning they avoid companies in certain industries or that don’t meet certain practices.

- Actor (and grown-up heartthrob) Leonardo DiCaprio has been an early investor in many environmentally friendly companies, including Beyond Meat, which makes meat “alternatives,” and Diamond Foundry, which manufactures lab-grown diamonds.

- There’s more than $40 trillion invested in ESG-related strategies globally. Those assets have more than tripled in recent years as the strategies have gained in popularity.

- ESG screening isn’t the only way to engage in ethics-driven investing. There are also religion-driven funds, including ones focused on Catholic, Jewish, Islamic, and Protestant values.

- ESG investing can cater to investors who want to “do well by doing good.” It means investing in companies that meet certain environmental, social, and/or governance criteria.

- In addition to focusing on those criteria, ESG investors typically also aim to invest in companies that will deliver a solid return.

- Investors can adopt an ESG approach by screening companies themselves and investing in individual stocks and bonds or by investing in mutual funds or ETFs that have an ESG focus.

- ESG strategies generally perform as well as or better than investment strategies that don’t use ESG criteria.