Target-Date Funds

Bullseye on Retirement

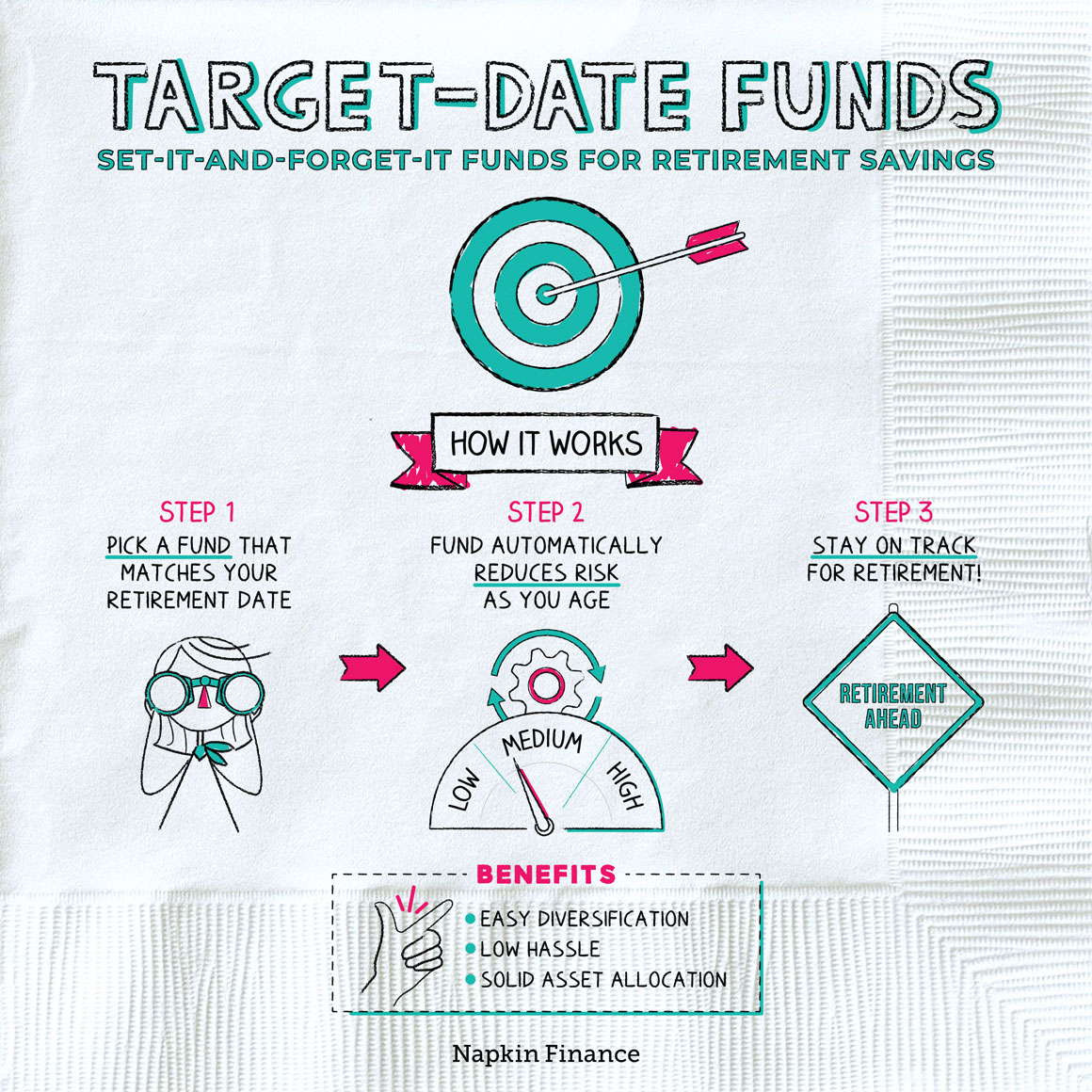

A target-date fund is an investment fund that’s based on your expected retirement date. These mutual funds automatically adjust the mix of stocks, bonds, and other investments they hold as you age.

Target-date funds are common in 401(k) plans and widely available in other types of investment accounts. They can offer an easy one-stop shop option for saving for retirement.

Investing can be overwhelming. Target-date funds aim to make it easier and simpler by handling the work of choosing investments and maintaining a portfolio for you.

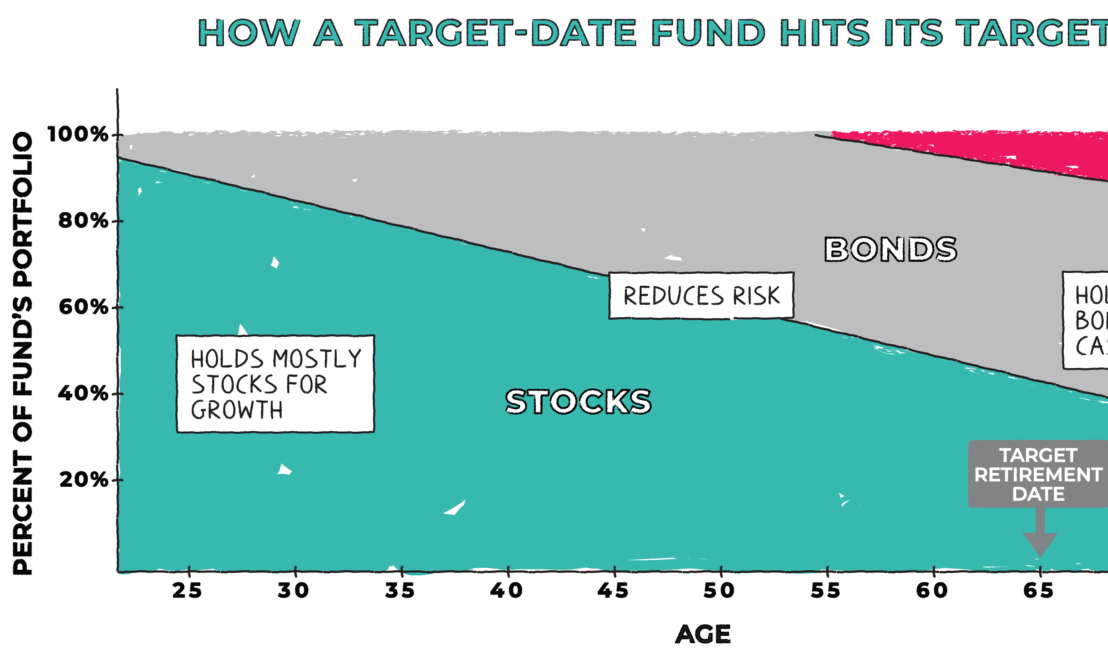

For young investors with a far-off retirement date, the funds typically favor a higher growth strategy by investing primarily in riskier assets, like stocks. As those investors age and their retirement date approaches, a target-date fund will transition to a lower risk strategy by investing more money in safer, lower-returning assets, like bonds and cash.

In each target-date fund, the mix of assets shifts as the target date approaches. Exactly how a particular fund shifts is called its “glide path.” Here’s how that might look:

The exact way the asset allocation changes over time can vary significantly, and you can learn more by reading the nitty-gritty details from the fund provider. It’s important to note that even funds with the same target date could take very different journeys—resulting in different returns or risks.

Target-date funds can be a solid option if you want an easy, low-headache strategy. Here are some of the perks and drawbacks you’ll need to know:

| Pros | Cons |

| Easy way to diversify your portfolio | You don’t get to pick your investments |

| Follow a widely accepted approach to asset allocation | A particular fund may be riskier (or safer) than you prefer |

| Handle rebalancing for you | Some funds have high fees |

| Offer an all-in-one investment option | If you invest everything in one fund, then all your money is tied up in that fund provider |

Target-date funds are a type of mutual fund that invests in other mutual funds—or what’s known as a “fund of funds” in the investing world. But underneath all those layers of funds, here’s what they typically actually own:

- Stocks—A single target-date fund may invest in hundreds (or even thousands) of different companies.

- Bonds—Target-date funds may own a mix of bonds issued by corporations and government entities.

- Cash—Target-date funds typically keep some money in cash or other short-term reserves (and may increase how much they own as they near their targeted date).

- Alternatives—Some but not all target-date funds invest in alternative assets, like real estate or commodity-linked investments.

As the name suggests, target-date funds have an end date in mind: the approximate year when you plan to retire. To make it easy for investors to select a fund, you’ll find a year attached to the name of target-date funds.

For example, if you’re in your 20s, you might invest in a target-date fund with 2060 in the name. (Target-date funds are generally available in five-year increments, so you may end up choosing a fund with an end date that’s slightly before or after your exact planned retirement year.)

In addition to considering the fund’s end date, think about the following before investing or making any changes:

- Goals. Is your goal retirement or something else?

- Asset allocation. Are you comfortable with the fund’s asset allocation over its lifetime?

- Risk. Does the fund match your tolerance for investing risk?

- Fees. How do the fees compare to other target-date funds or to a portfolio of investments you might put together yourself?

- Performance. Does the fund’s returns history look similar to that of other funds with the same target date? If not, why?

- Overlap. How will this fund fit in, or possibly overlap, with other investments in your portfolio?

Target-date funds can be a convenient and low-hassle option for investing for retirement. The funds are designed to age along with you by automatically shifting from a riskier, higher-returning portfolio in your younger years to a safer, lower-returning portfolio as you near your golden years. Their benefits include handling asset allocation, diversification, and rebalancing for you, but it’s important to make sure that this one-size-fits-all approach works for you.

- Almost $1.4 trillion is invested in target-date funds, which have become incredibly popular since they were first introduced in the 1990s.

- Want to make your target-date savings stretch the furthest? Consider retiring in Portugal, which has an ultralow cost of living and offers tax perks for expats.

- You could be invested in a target-date fund without even knowing it. Many 401(k)s will automatically invest your money in a target-date fund based on your age if you don’t choose any investments for yourself.

- Target-date funds can simplify investing for retirement by offering you a one-stop shop for a diversified portfolio.

- These funds are designed to gradually shift from a higher growth approach in your younger years to one that offers more reliable returns as you get closer to your retirement date.

- There are some potential drawbacks to target-date funds because a one-size-fits-all approach based on your age alone may ignore other factors, like your tolerance for risk.

- As you would with any investment, it’s important to carefully consider the fees, track record, and pros and cons of a fund before investing.