Forex

Hard Currency

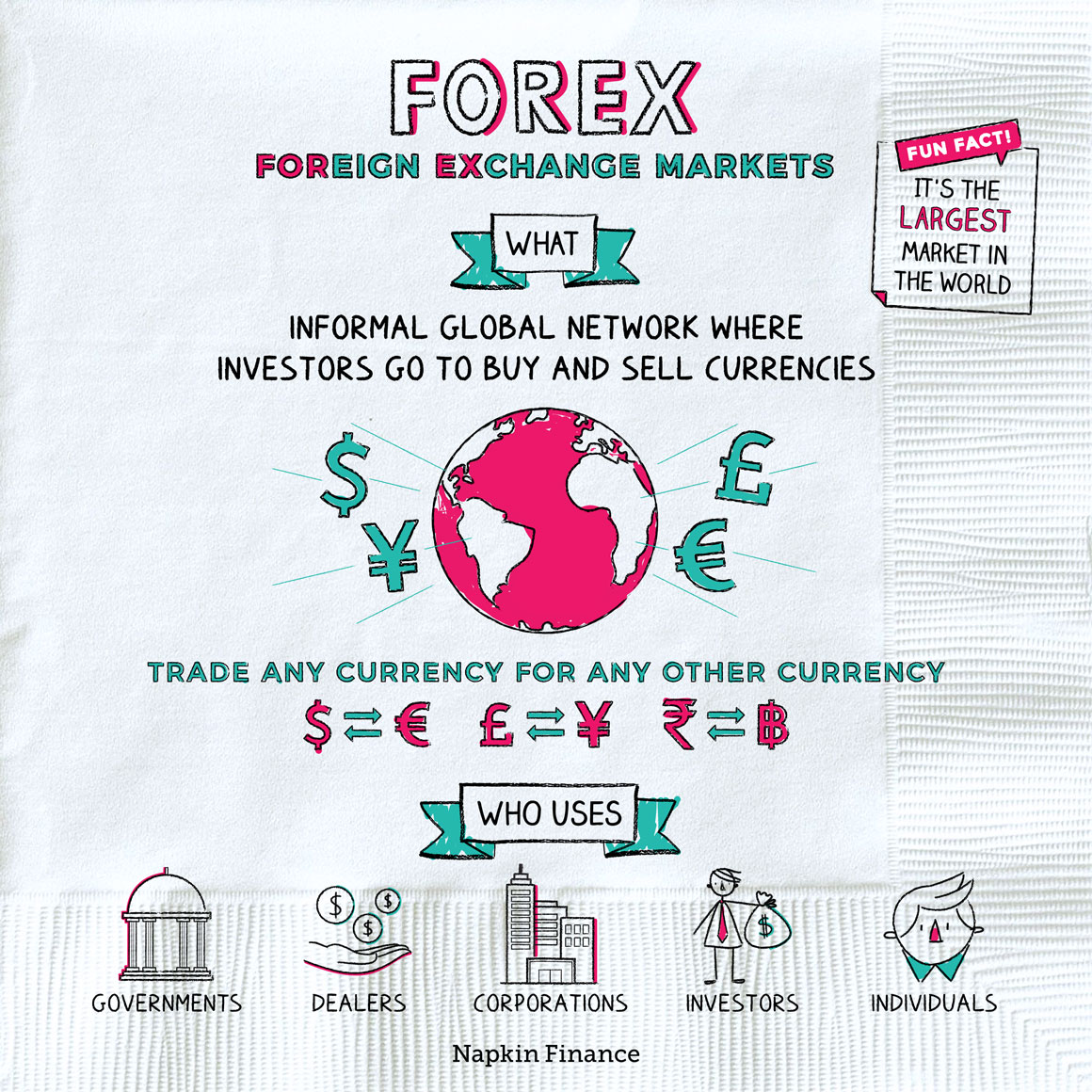

The foreign exchange, or forex, markets are where investors go to buy and sell currencies.

Unlike the stock market, where investors buy and sell investments through an exchange, forex trading is called an “over-the-counter” market. That means it’s made up of an informal network of buyers and sellers, with investors typically making trades through a dealer.

You can essentially trade any currency for any other currency through the forex market by working with a dealer.

To buy or sell one currency, you have to pay or receive a different currency. That’s why currencies are always quoted in terms of pairs. For example, you could buy U.S. dollars and pay for them with Chinese yuan. Or you could buy British pounds and pay for them with euros. Virtually any combination is possible.

A wide range of players trade in the forex market, including:

- Governments

- Central banks or other government entities may trade currencies to try to influence the price of their home country’s currency or to smooth out bumps in its price changes.

- Dealers

- Large financial institutions make currency trades for their clients and may enter into their own trades as well.

- Corporations

- If a company sells goods in the U.S. but is based in Germany, it may need to convert the U.S. dollars it receives into euros. That means going through the forex market.

- Investors

- Large investors and small investors may make bets on currency price movements or may need to exchange currencies in order to make an investment in another country.

- Individuals

- If you go on vacation or a work trip to another country and need to exchange currency when you arrive (or leave), you’re going through the forex market too.

Currency price movements can be driven by:

- Interest rates: Higher interest rates often drive a country’s currency up.

- Inflation: Higher inflation typically makes a currency fall.

- Economic growth: Higher economic growth tends to attract investors into a country, which makes its currency rise.

Here are some phrases you could run into in the forex market:

- Bid: This is the price that a dealer is willing to bid, or pay you, for a given unit of currency.

- Ask: This is the price that a dealer is willing to accept, or receive from you, in exchange for selling you a given unit of currency.

- Spread: Because dealers need to make a profit, the bid price will always be lower than the ask price. That difference is called the spread.

- Spot: The price for an immediate transaction (as opposed to for a transaction on a future date).

- Base currency: The base currency is the denominator in the currency quote. The quote tells you how much it costs to buy or sell one unit of the base currency.

- Price currency: The price currency is the numerator in the currency quote. The quote tells you how many units of the price currency you need to pay or receive in exchange for one unit of the base currency.

For example, a currency quote of €2 / $1 tells you that it costs two euros to purchase one dollar. In that quote, the dollar is the base currency and the euro is the price currency.

The forex market is a global network of currency trading. Unlike stock markets, foreign exchange trading is decentralized, with investors transacting with one another and through dealers. You can trade essentially any currency for any other currency in the forex market.

- With daily trades of more than $5 trillion on average, the global forex market is the largest market in the world—several times larger than the stock market.

- There are 180 different currencies in the world (not counting cryptocurrencies). The newest one is the South Sudanese pound, which came into existence in 2011.

- The forex, or foreign exchange, market describes the informal network of institutions and dealers that facilitate currency trades.

- Currencies are always traded in pairs, with investors swapping one currency for another.

- Governments, corporations, financial institutions, and investors are all major players in the forex market.