Short Selling

The Big Short

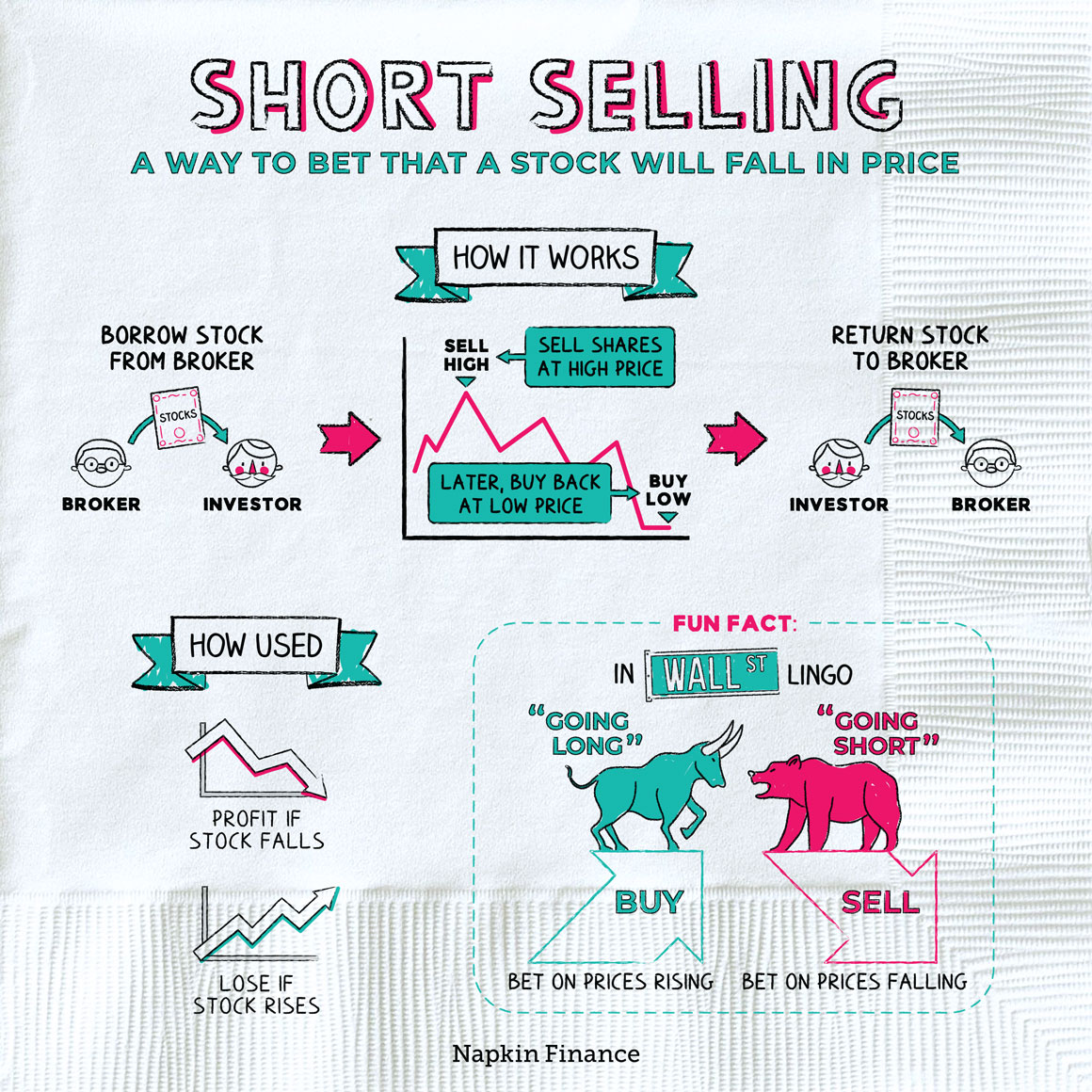

Short selling is a way to bet that a stock will fall in price.

Normally, an investor buys a stock in the hopes that it will rise in price. Short selling (or just “shorting”) lets investors make a bet in the opposite direction.

Instead of buying a stock for a lower price and hoping to sell it later for a higher price, with short selling, investors sell a stock today at a higher price in the hopes of buying it later at a lower price.

To short sell a stock, an investor first must borrow the stock from someone else. Here’s how the entire process typically works:

Identify the stock you want to short

↓

Borrow the shares from a broker or another lender

↓

Sell the shares at the current price

↓

The stock (hopefully) falls in value

↓

Buy back the shares at a price lower than

what you sold them for

↓

Return the borrowed shares to the lender

If the stock price falls between the sale and purchase, the short seller keeps the difference as profit. However, if the stock price rises, the short seller has to pay a higher price to repurchase the stock—meaning they lose money.

Simply buying stocks the vanilla way only lets you bet on prices going in one direction. But knowledgeable investors may also be able to identify companies primed for a fall.

For example, investors can look for:

- Suspicious accounting

- Overly high stock prices

- Lower-than-expected profits

- Owners or other insiders selling off large chunks of stock

- Big customers leaving a company

- Bad press

Of course—like any other investing decision—sometimes you do all your homework, but you’re still wrong. Even the most experienced short sellers can have trouble making the right bets at the right time.

Short selling can be a useful tool in a savvy investor’s toolkit, but it comes with costs too:

| Costs | Benefits |

|

|

When you buy stocks the ordinary way, you can’t lose any more than the amount you’ve invested (because a stock’s value can’t drop below $0).

Short selling is exactly the opposite: There’s an unlimited amount of money you can lose because a stock’s value has no ceiling. And as the borrower, you’re stuck buying back the stock no matter how high (or low) the price.

Because of this, short selling is generally done by only the most experienced investors and involves a massive amount of market know-how. Even among professional investors it’s considered a pretty risky way to invest.

Short selling is a way for investors to make money by betting that a stock’s value will decrease. They can do this by borrowing stock from a broker or other investor, selling it, and then buying it back at a later time (hopefully at a lower price). Short selling is considered to be a risky investing approach because the stock market usually rises over the long term.

- In the world of finance, “going short” stands in contrast to “going long,” which is when you’re betting on prices rising.

- When lots of investors are shorting the same stock, a “short squeeze” can happen. That’s when the stock suddenly starts to rise in price prompting short sellers to cover their losses by buying the stock. But all that buying pressure from the short sellers only pushes the stock higher—compounding their losses.

- Because short sellers essentially bet on companies failing, they’re often not all that popular with CEOs. Or, as Tesla’s Elon Musk has put it, short sellers are “jerks who want us to die.” (The company tends to be a popular target for short sellers.)

- Short selling is a way to bet that a stock will fall in price.

- To sell a stock short, an investor borrows shares from another investor, immediately sells it, and then at a later date buys it back and returns it to the original investor.

- Short selling can be a useful tool that broadens an investor’s universe because it lets them bet on prices going down in addition to going up.

- However, short selling can come with a range of unique costs, including fees and interest paid to borrow shares.

- Even among experienced investors, shorting is considered to be a risky approach.