Featured Napkin

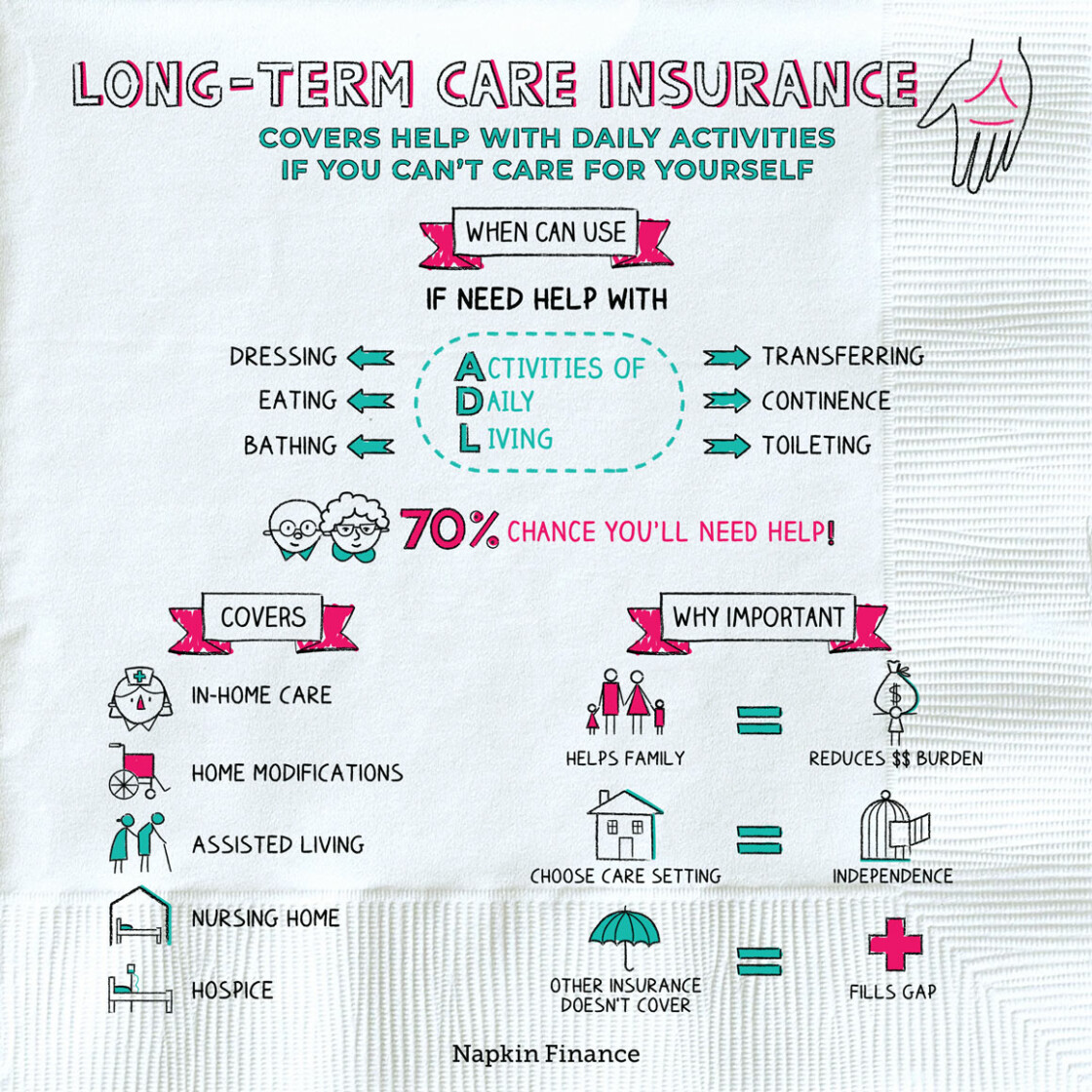

Long Term Care Insurance

Senior Moment

Long-term care insurance is a policy that helps cover the cost of assistance with daily activities if you’re unable to care for yourself. The insurance typically assists those aged 65 and older or who have chronic illnesses or disabilities.

Learn moreMore insurance Napkins...

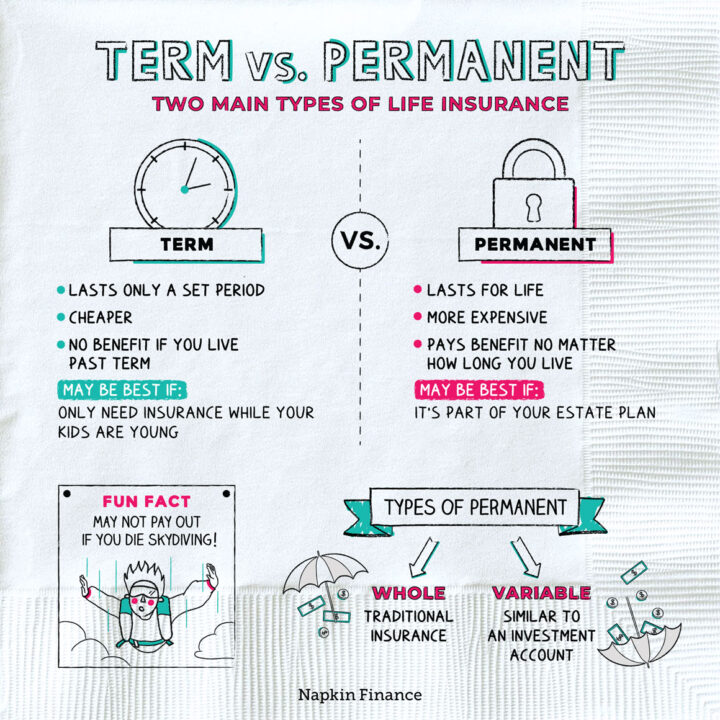

Term vs. Permanent Life Insurance

Life Sentence

Term and permanent policies are the two main types of life insurance. With both types of policies,...

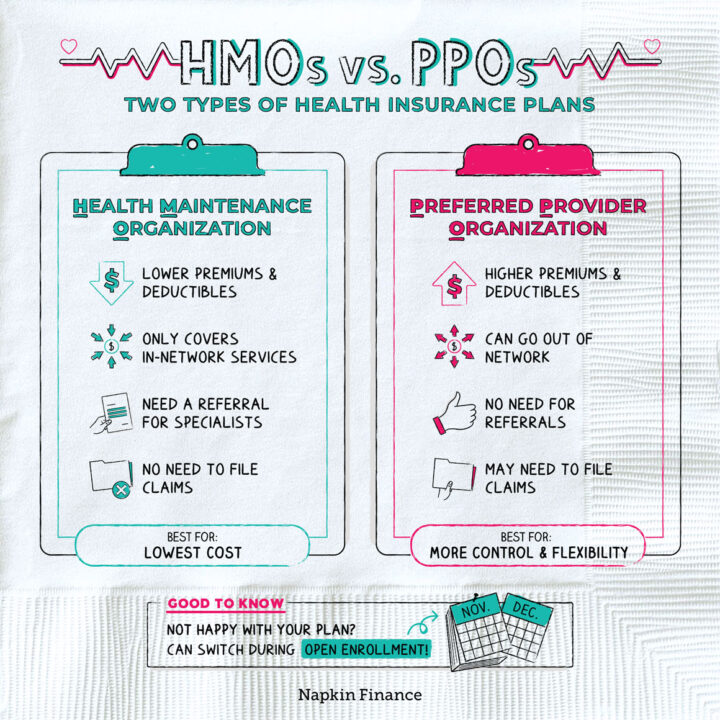

Learn moreHMO vs. PPO

Bill of Health

HMOs and PPOs are two different types of health insurance plans. HMO (or Health Maintenance Organization) plans...

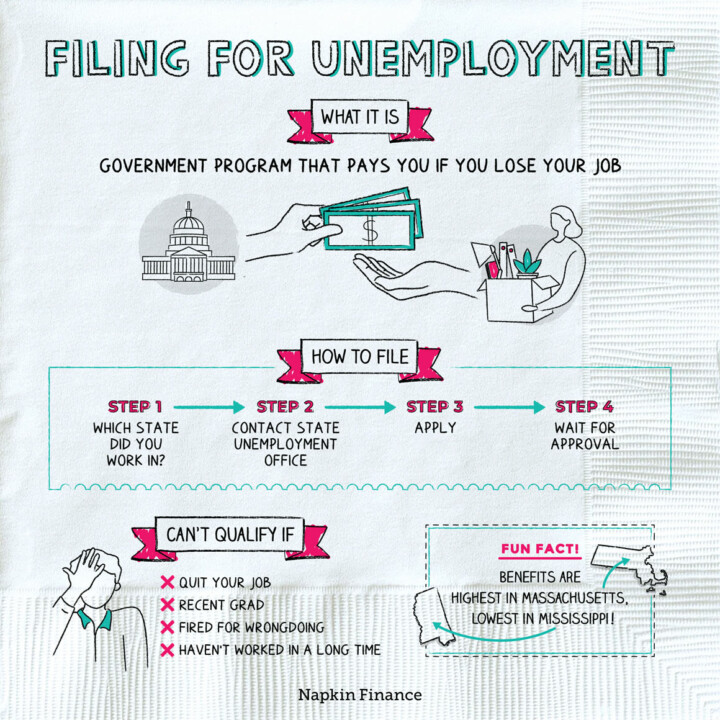

Learn moreFiling for Unemployment

Pink Slip

Unemployment insurance is a government program that gives you money if you lose your job. Sometimes, life...

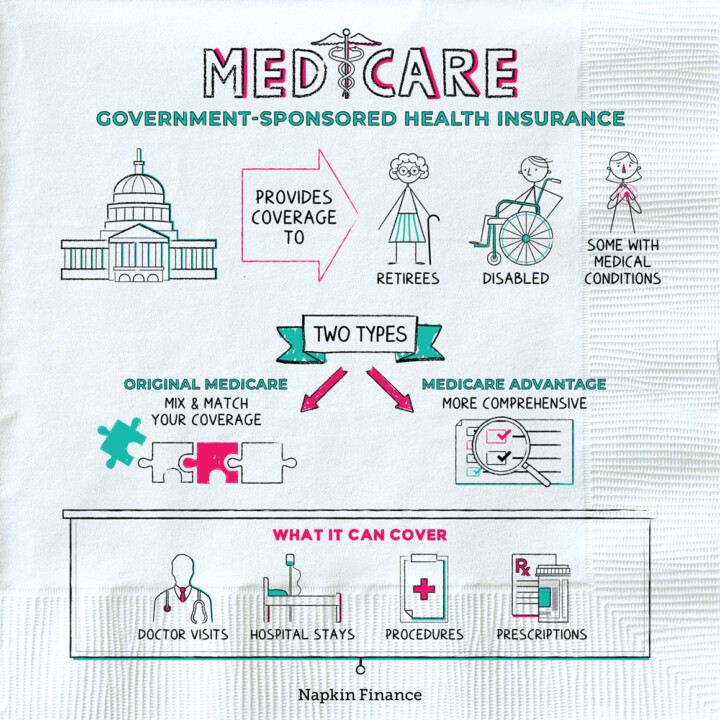

Learn moreMedicare

Free for All

Medicare is a health insurance program for retirees that is sponsored by the federal government. It is...

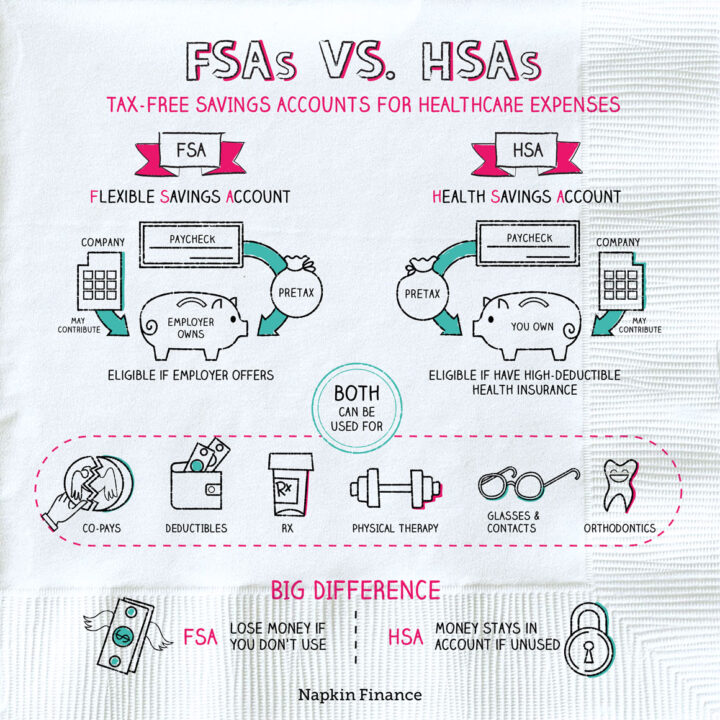

Learn moreFSAs vs. HSAs

Health is Wealth

Health care FSAs and HSAs let you save money for out-of-pocket medical expenses (basically the things your...

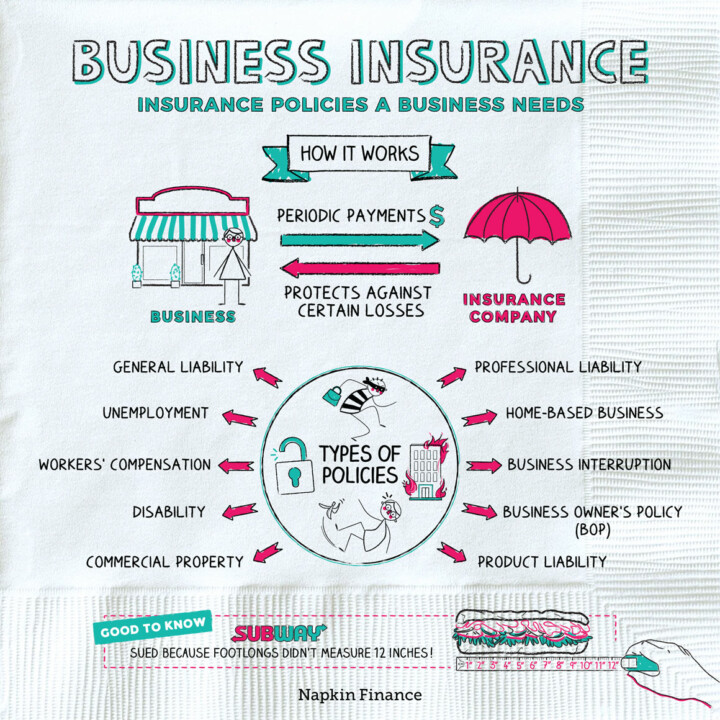

Learn moreBusiness Insurance

Cover Your Bases

A business insurance policy is a contract between an insurance company and a business. In exchange for...

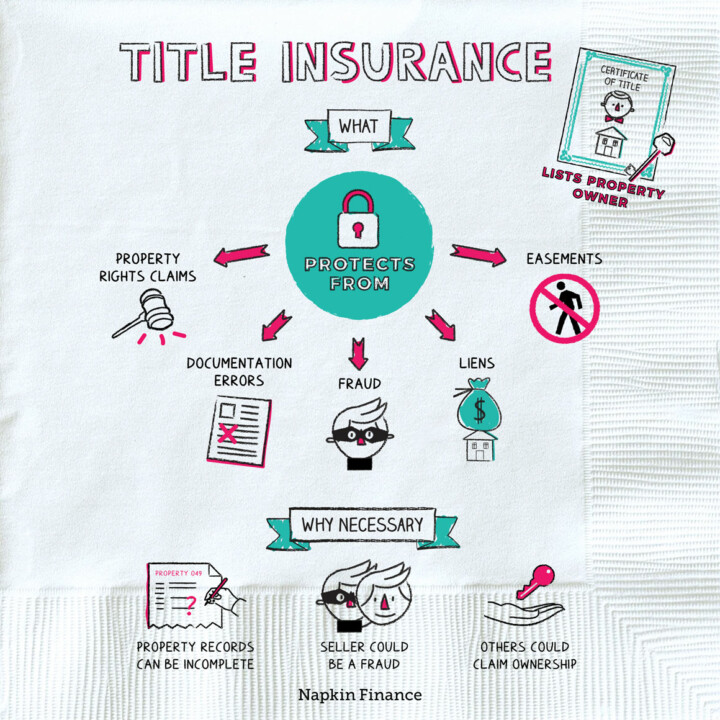

Learn moreTitle Insurance

On the House

A “title” is a document listing the legal owner of a piece of property. Title insurance protects...

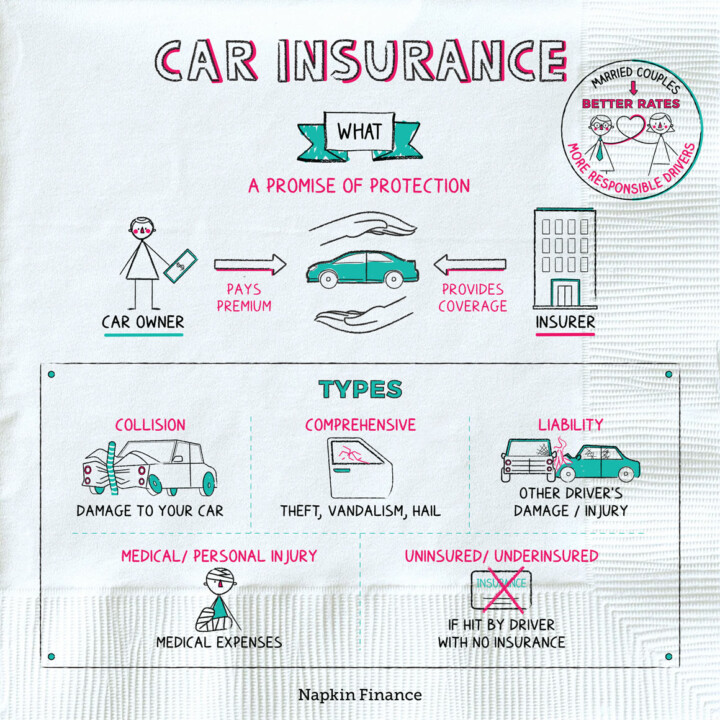

Learn moreCar Insurance

Tighten Your (Seat) Belt

Car insurance is an agreement between you and an insurance provider. In exchange for regular payments from...

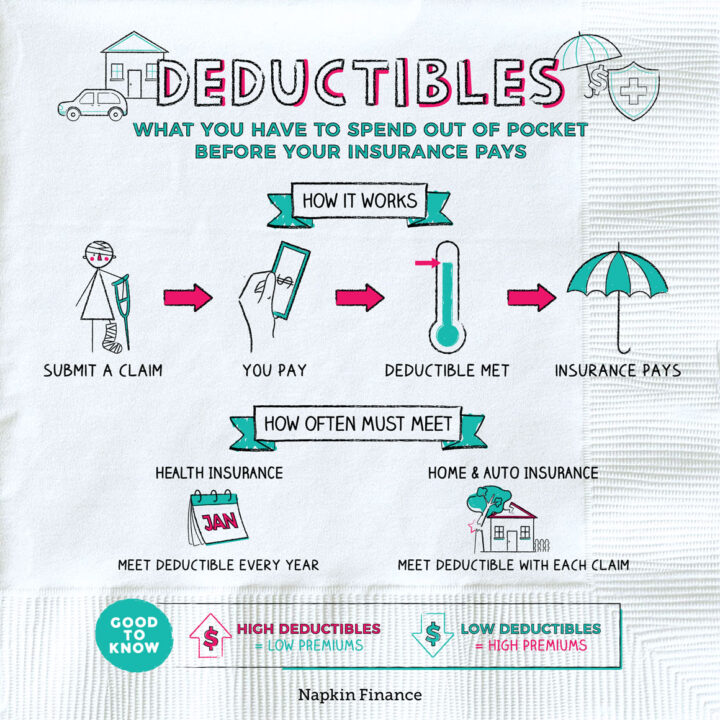

Learn moreDeductibles

Cut Rate

A deductible is the amount of money you must spend out of pocket before your insurance company...

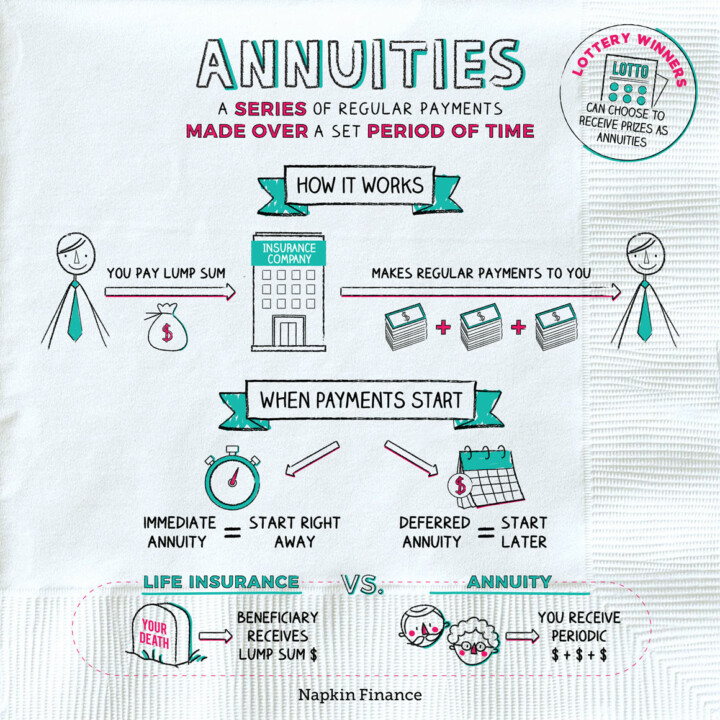

Learn moreAnnuities

Nest Egg

An annuity is a series of regular payments made over a set period of time. Annuities can...

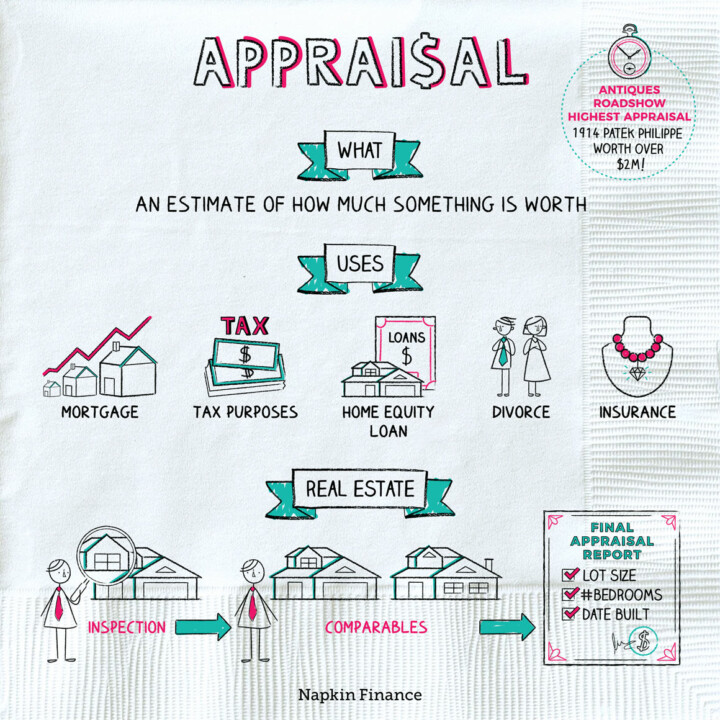

Learn moreAppraisal

For All it’s Worth

An appraisal is an estimate of how much something is worth. People may get appraisals for real...

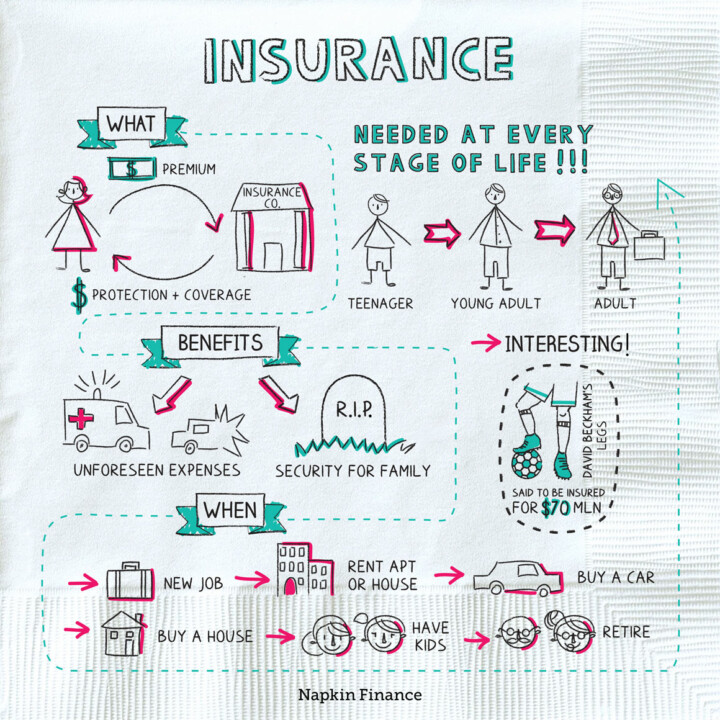

Learn moreInsurance

Cover Your Assets

Insurance is financial protection. Along with your emergency fund, insurance makes up your safety net so that...

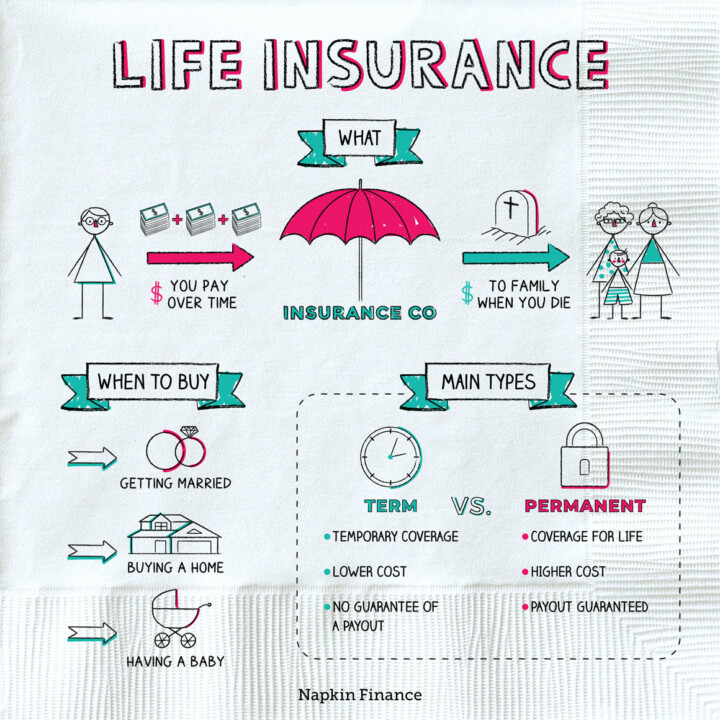

Learn moreLife Insurance

Beyond the Veil

Life insurance is a contract with an insurance company. In exchange for periodic payments, the insurance company...

Learn more