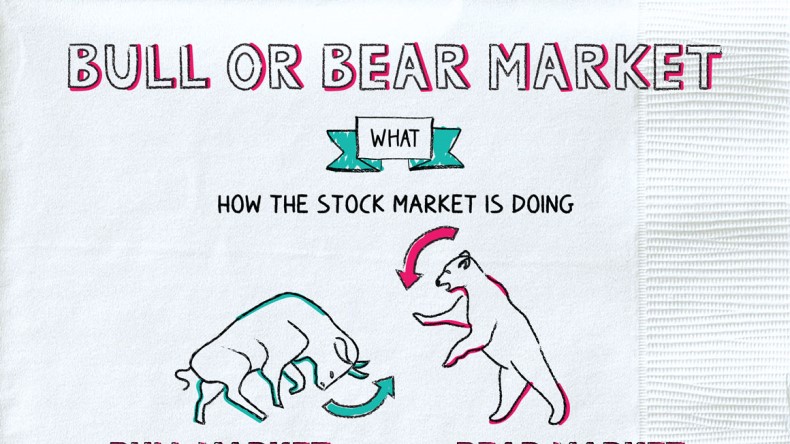

Bull or Bear Market

Into the Wild

Wall Street may be a bit of a rodeo, but there are no literal bulls or bears. Instead, these terms are trader lingo for describing how the stock market is performing.

A bull market is when stocks are generally rising. Bull markets tend to correspond with:

- A growing, or “expanding,” economy

- Falling or stable unemployment

- Rising corporate profits

- Stable or modestly rising inflation

Sometimes, you might also hear that an expert is “bullish” on the market or “bullish” on some particular stock. That just means that person thinks the market or that particular stock is likely to go up.

A bear market is a period when stocks are generally falling—or, more specifically, a time when major stock indexes have fallen at least 20% (a fall of less than that would be called a “correction” but not a bear market). Bear markets tend to correspond with:

- A shrinking, or “contracting,” economy

- Rising unemployment

- Falling corporate profits

- Deflation or unstable inflation

And experts can also be “bearish” on a particular stock or asset class.

Although those definitions make the stock market sound neat and orderly, in the real world, it’s a lot messier. If stocks fall for a few days in a row, it could be the start of a new bear market, or it could just be the market acting weird for a few days—after which it will keep marching up.

Investors waste a lot of energy (and money) trying to guess when a bull market is ending so that they can sell or guess when a bear market is ending so that they can buy. The reality is that no one can predict those turning points consistently. Most investors do a lot better by just holding on through bull and bear markets.

“No price is too low for a bear or too high for a bull.“

—Unknown

It’s hard to know exactly when a bull market ends and a bear market begins, but that doesn’t mean you should shove all your money under a mattress.

Remember this: Even in the worst conceivable bear market, the stock market could only lose 100% of its value. On the other hand, there is no ceiling for a bull market. Stocks can increase indefinitely.

Keeping that in mind, experts generally recommend you invest in a way that makes you comfortable—so that you won’t be tempted to bail on your plan if the market makes a sudden move. Your comfort level with market turbulence is known as your “risk tolerance.” Think of it as the level of uncertainty you can put up with.

In practice, it looks like this:

- If the idea of a bear market coming in and wiping out years of gains makes you feel sick, then conservative investments may be right for you. These include options like cash, money market funds, CDs, and bonds.

- If you can stomach those drops, knowing that a bull market will one day be on the horizon, you can probably take on some additional risk. In that case, you might be able to consider riskier asset classes, like small-cap stocks, investments in emerging markets, or foreign currencies.

You can also use your age to inform your risk tolerance. The closer you get to retirement, the less risky your investments should typically be and vice versa just in case a bear market is around the corner.

“Bull” and “bear” are Wall Street terms used to describe the performance of the stock market. A bull market is when stocks are rising, and a bear market is when stocks are falling. It’s hard to predict when the markets will turn from bull to bear or back again. Your best bet is to invest in stocks in accordance with your risk tolerance and stay the course.

- The average bull market has lasted 6.6 years, with the market returning an average of 339%.

- The average bear market has lasted 1.3 years, with average losses of 36%.

- The terms “bull” and “bear” are used for the way the animals attack: bulls thrust their horns up, while bears swipe their paws down.

- A bull market is a time when stocks are generally rising, and the economy is doing well.

- A bear market is a period when stocks are generally falling, and the economy is doing poorly.

- In a perfect world, you could predict when the market would turn so that you could capture all the gains of bull markets and suffer none of the losses of bear markets. In the real world, the best bet is usually to hold on through ups and downs.